THE GOVERNMENT fully awarded its offer of reissued seven-year Treasury bonds (T-bonds) on Tuesday at higher rates on expectations of a hawkish move from the Bangko Sentral ng Pilipinas (BSP) as June headline inflation was at a near four-year high.

The Bureau of the Treasury (BTr) raised P35 billion as planned from its auction of reissued seven-year securities that have a remaining life of three years and seven months on Tuesday, with total bids reaching P56.236 billion.

Rates awarded ranged from 5.6% to 5.999%, bringing the average rate for the bonds on offer to 5.908%, 117.6 basis points (bps) higher than the 4.732% fetched for the series when it was last offered on Jan. 21, 2020.

The average rate seen for the tenor on Tuesday was also 33.47 bps higher than the 5.5733% quoted for the four-year bonds, the benchmark closest to the remaining life of the papers on offer, at the secondary market before Tuesday’s auction, based on the PHP Bloomberg Valuation Reference Rates published on the Philippine Dealing System’s website.

Meanwhile, it was 55.63 bps lower than the 6.4643% fetched for the seven-year tenor at the secondary market before the auction.

National Treasurer Rosalia V. de Leon said in a Viber message to reporters after the auction that the average rates of the bonds auctioned off on Tuesday were higher than the secondary market level as investors priced in expectations of the BSP turning hawkish as June headline inflation came in slightly higher than consensus.

Asked if the BTr would be willing to award at rates higher than usual if inflation continues to pick up, Ms. De Leon said they would have to adjust during their auctions.

“We will have to calibrate. If cash remains ample and rates exceed our tolerance level, then we will reject. Always a careful balancing act,” she said.

The first trader said they think the BTr was forced to award at a higher rate and was “quite aggressive” as the faster June inflation print caused market players to demand higher yields.

“The bond was trading around 5.75%. So, with the bond maturity [on Monday], there was some hope that the awarded rates will be at the low end of the expected range,” the first trader said, referring to three-year papers worth P103.6 billion that matured on July 4.

The second trader said the auction result was “just as expected,” although the average rate was higher than the last done deal at the secondary market but still in line with their forecast range.

“Of course, we had to consider inflation data in the months to come along with BSP’s monetary tightening path,” the second trader added.

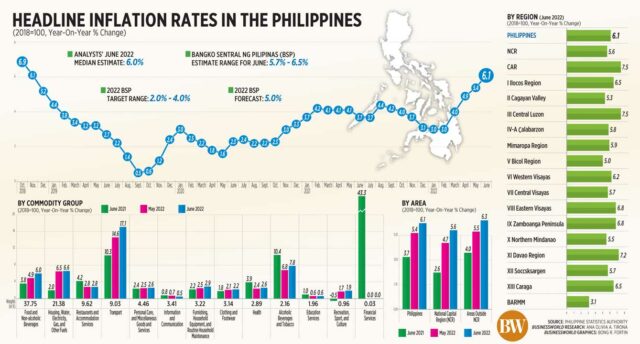

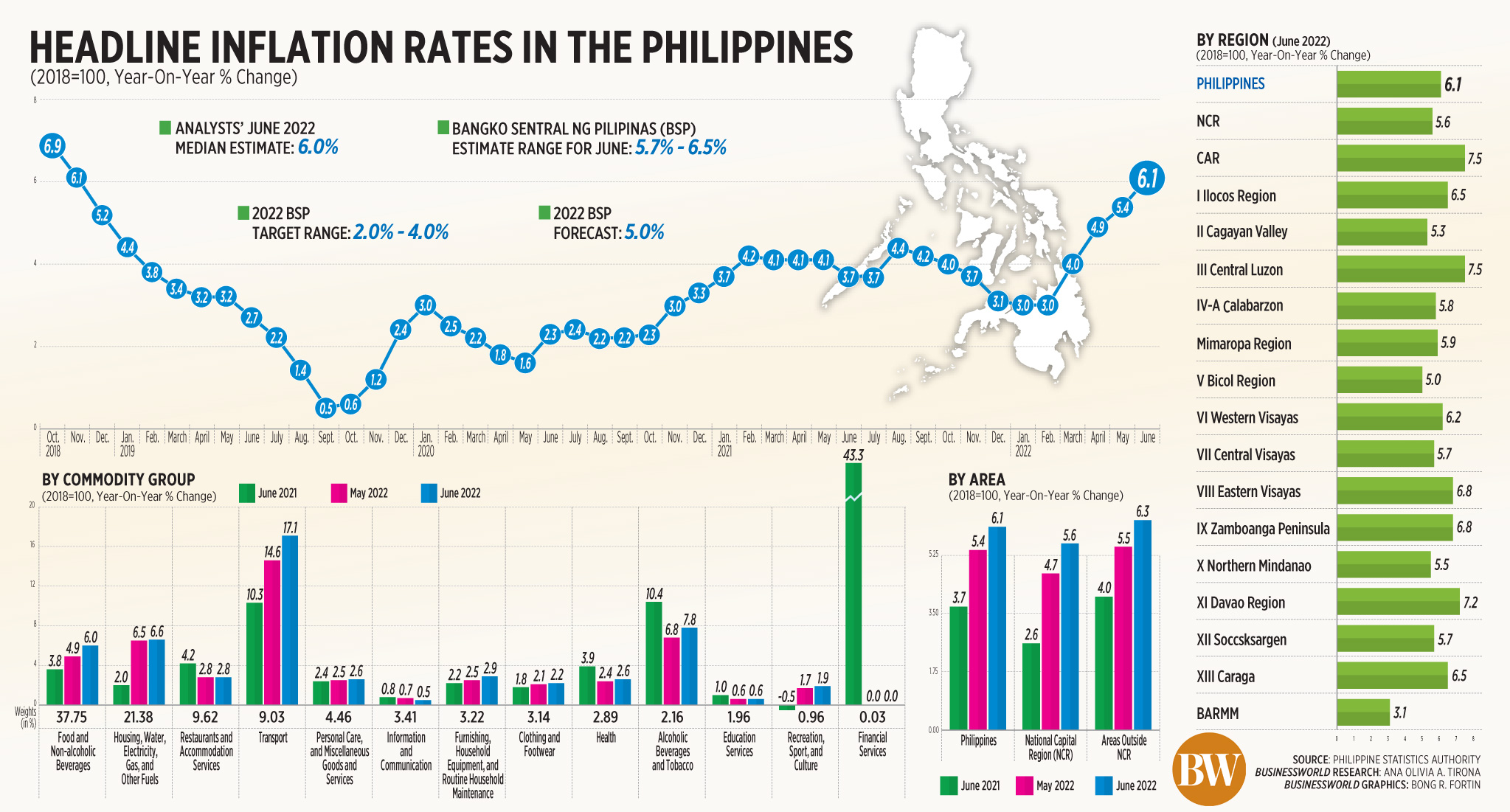

Headline inflation in June surged by 6.1% year on year from 5.4% in May and 4.1% a year ago amid higher food and transport costs, preliminary data from the Philippine Statistics Authority released on Tuesday showed.

This is slightly higher than the 6% median estimate in a BusinessWorld poll conducted last week and marked the third consecutive month that inflation went above the BSP’s 2-4% target for the year. Still, it settled within the 5.7%-6.5% estimate of the central for the month.

The June headline print is a near four-year peak, matching the pace recorded in November 2018 and was the fastest since the 6.9% logged in October 2018.

Year to date, inflation has averaged 4.4%, higher than the 4% seen in the same period a year ago but lower than the central bank’s 5% forecast for the year.

The BSP Monetary Board has raised benchmark interest rates by a total of 50 bps so far this year, via 25-bp hikes at its May 19 and June 23 meetings, bringing the policy rate to 2.5%, to help temper rising prices.

On Tuesday, BSP Governor Felipe M. Medalla said in a Bloomberg Television interview that a hike of at least 25 bps is guaranteed at their Aug. 18 meeting, but he is also open to a bigger increase of up to 50 bps.

He said the central bank may raise rates by “at least 100 bps more” in the rest of its meetings for the year to bring cumulative hikes for 2022 to 150 bps, as the policy rate needs to be higher than the 3% midpoint of their 2-4% inflation target.

Mr. Medalla said the need to normalize its policy settings has become “more urgent” amid supply shocks and developments in advanced economies. This has made the BSP advance the implementation of its exit plan, which was originally planned to begin in the third or fourth quarter, he said.

The Monetary Board has four more meetings scheduled for the year to be held on Aug. 18, Sept. 22, Nov. 17 and Dec. 15.

For July, the BTr wants to raise P200 billion from the domestic market, or P60 billion via Treasury bills and P140 billion from T-bonds.

The government borrows from local and external sources to help fund a budget deficit capped at P1.65 trillion this year, equivalent to 7.6% of gross domestic product. — Diego Gabriel C. Robles