Mouthwash may cure ‘the clap’

PARIS — In the 19th century, before the advent of antibiotics, Listerine mouthwash was marketed as a cure for gonorrhoea. More than 100 years later, researchers said Tuesday the claim may be true.

A year on, Jeju Air crash report delayed as families question probe’s credibility

SEOUL — A South Korean investigation into the Jeju Air crash that killed 179 people is set to miss a one-year deadline to release a progress report, two officials said, as frustrated relatives of the victims continue to demand answers about what went wrong.

The country’s accident investigation board will not be in a position to release the interim update by the first anniversary on Monday of the worst aircraft accident on South Korean soil, the two board officials said. They declined to be identified due to the sensitivity of the matter.

On December 29, 2024, the Boeing made an emergency belly landing at Muan airport, overshot the runway then slammed into a concrete embankment and erupted into a fireball, killing all but two of the 181 people on board.

The government-led Aviation and Railway Accident Investigation Board said in a preliminary report in January that both of the plane’s engines sustained bird strikes.

The pilots shut off the less-damaged engine after the bird strike, investigators said in a July update that was not released publicly due to objections from victims’ families.

VICTIMS’ FAMILIES FRUSTRATED

Some of the family members said investigators appeared to blame the pilots without exploring other factors, such as the concrete structure beyond the end of the runway that likely made the disaster far more deadly.

“It feels like all kinds of doubts are just growing bigger and bigger. In the meantime, a year has gone by, and it feels like the frustration is only continuing to build,” said Ryu Kum-Ji, a 42-year-old woman who lost both of her parents in the crash.

She joined other family members who shaved their heads and staged a protest in front of a presidential office, calling for an independent and transparent probe.

Missteps by the transport ministry, which oversees the investigation board, could also be a factor in the accident, Ms. Ryu said.

A transport ministry official told bereaved family members this month that it would examine their concerns.

“We take seriously your concerns saying that government’s efforts were not sufficient in the process of (finding the truth),” the second vice minister of the transport ministry said. “The government will stand by the bereaved families and take a closer look.”

South Korea’s parliament will launch an independent probe into the crash on Tuesday.

REPORT DELAYED

Under the UN aviation body’s rules, a final report is expected within a year of an accident, and if that is not possible, an interim statement should be made public on every anniversary detailing the investigation’s progress and any safety issues raised.

But the investigation board is not planning to release an update yet because of pending legislation designed to ensure its independence, said the two officials.

Lawmakers have proposed replacing board members and transferring oversight from the transport ministry to the prime minister’s office.

“We will respect the decision of the newly formed committee regarding the timing of the interim statement’s publication,” said one of the board officials.

South Korea’s anti-corruption body found in a report this week that the concrete embankment at Muan airport violated local and global standards that call for such structures to be “frangible” so they give way in case of impact. That meant it could “cause fatal damage to aircraft and occupants.”

The board had planned public hearings in early December, but delayed them at the request of the victims’ families and lawmakers. Police are also investigating the accident.

“All we want is for authorities to admit they were wrong if they did wrong, and apologize. Apology and a proper disclosure of the truth…that is what we want,” Ms. Ryu said.— Reuters

Judge grants injunction blocking US from detaining British anti-disinformation activist

WASHINGTON — A US judge on Thursday temporarily blocked the Trump administration from detaining British anti-disinformation campaigner Imran Ahmed, after the US permanent resident sued officials over an entry ban for his role in what Washington argues is online censorship.

Washington imposed visa bans on Tuesday on Mr. Ahmed and four Europeans, including French former EU commissioner Thierry Breton. It accuses them of working to censor freedom of speech or unfairly target US tech giants with burdensome regulation. Mr. Ahmed lives in New York and is believed to be the only of the five currently in the country.

The move sparked an outcry from European governments who argue regulations and the work of monitoring groups made the internet safer by highlighting false information and compelling tech giants to do more to tackle illegal content, including hate speech and child sexual abuse material.

For Mr. Ahmed, the 47-year-old CEO of the US-based Center for Countering Digital Hate, it also sparked fears of imminent deportation that would separate him from his wife and child, both US citizens, according to a lawsuit he filed on Wednesday in the Southern District of New York.

Secretary of State Marco Rubio, when announcing the visa restrictions, said he had determined the presence of the five in the United States had potentially serious adverse foreign policy consequences for the United States and they could therefore be deported.

Mr. Ahmed named Mr. Rubio, Homeland Security Secretary Kristi Noem and other Trump officials in his lawsuit, arguing officials were violating his rights to free speech and due process with the threat of deportation.

US District Judge Vernon Broderick issued a temporary restraining order on Thursday, which enjoined officials from arresting, detaining or transferring Mr. Ahmed before he has an opportunity for his case to be heard, and scheduled a conference between the parties for December 29.

Mr. Ahmed, in a statement provided by a representative, praised the US legal system’s checks and balances and said he was proud to call the country his home. “I will not be bullied away from my life’s work of fighting to keep children safe from social media’s harm and stopping antisemitism online,” he said.

In response to questions about the case, a State Department spokesperson said: “The Supreme Court and Congress have repeatedly made clear: the United States is under no obligation to allow foreign aliens to come to our country or reside here.”

The Department of Homeland Security did not respond to a request for comment.

Legal permanent residents, known as green card holders, do not need a visa to remain in the US, but the Trump administration has attempted to deport at least one already this year.

Mahmoud Khalil, detained in March after his prominent involvement in pro-Palestinian protests at Columbia University, was released by a judge who argued punishing someone over a civil immigration matter was unconstitutional.

A US immigration judge in September ordered Mr. Khalil to be deported over claims he omitted information from his green card application, but he appealed that ruling and separate orders blocking his deportation remain in place.— Reuters

Tracing the colorful journey of Ube through the Astoria Culinary Expert Services (Astoria-ACES) farm-to-table initiative

The rich purple hue and naturally sweet, earthy flavor of ube has long been a beloved staple in Filipino desserts. From the classic halaya, lovingly stirred for hours in traditional kitchens, to the modern creations seen in cafés and restaurants, this local delicacy has earned its place as an icon of Filipino culinary artistry. Over the years, this humble root crop has evolved into a versatile ingredient, celebrated both locally and globally.

Recognizing the deep cultural significance and the rising demand for high-quality ube, Astoria Culinary Expert Services (Astoria-ACES) embarked on a visionary farm-to-table initiative. This movement not only aimed to elevate the quality and integrity of ube-based ingredients but also to uplift local farming communities, encourage sustainability, and create new avenues for culinary innovation.

From Harvest to Innovation: Astoria Philippine Ube Powder

As the demand for ube-based products grew due to the crop’s seasonal availability, Astoria-ACES recognized the need for a versatile and shelf-stable ingredient that preserved the authentic taste of real Philippine ube. This became the foundation for developing an innovative product: Astoria Philippine Ube Powder.

As the demand for ube-based products grew due to the crop’s seasonal availability, Astoria-ACES recognized the need for a versatile and shelf-stable ingredient that preserved the authentic taste of real Philippine ube. This became the foundation for developing an innovative product: Astoria Philippine Ube Powder.

Made from 100% real, locally sourced ube, this premium powder was crafted by Astoria’s team of chefs, agricultural specialists, food scientists, and quality control specialists. The meticulous process developed by the team ensures the preservation of ube’s natural flavor, color, and aroma. The result is a highly adaptable ingredient that can be used for baking, cooking, and beverage creation.

Made from 100% real, locally sourced ube, this premium powder was crafted by Astoria’s team of chefs, agricultural specialists, food scientists, and quality control specialists. The meticulous process developed by the team ensures the preservation of ube’s natural flavor, color, and aroma. The result is a highly adaptable ingredient that can be used for baking, cooking, and beverage creation.

Though the Farm-To-Table initiative began as their effort to support the local agricultural industry by sourcing different types of fruits and vegetables directly from farmers across the Philippines, it has provided a sustainable and reliable avenue for farmers to maintain their harvests and remain competitive in a rapidly evolving industry.

New Ube Desserts Crafted

New Ube Desserts Crafted

With the success of the ube powder and its consistent quality, Astoria found themselves an exciting opportunity: to reimagine their dessert offerings and showcase the versatility of this uniquely Filipino ingredient. The result? A vibrant array of new creations that accentuate the beauty of ube in modern and unexpected ways.

From delicate pastries to indulgent cakes, refreshing beverages, and reinvented classics, the culinary teams across Astoria’s properties have embraced ube as a star ingredient. Guests now enjoy desserts that not only satisfy their sweet cravings but also tell a story of heritage, collaboration, and innovation.

1.Ube Crème Brulee Cake

Dig in to every bite of ube chiffon and taste the sweet blend of custard cream, light ube mousse, ube halaya, and caramelized sugar with the Ube Crème Brûlée Cake.

Dig in to every bite of ube chiffon and taste the sweet blend of custard cream, light ube mousse, ube halaya, and caramelized sugar with the Ube Crème Brûlée Cake.

2. Ube Cashew Clusters

To satisfy your sweet tooth, indulge in the crunch of ube cashew clusters while binge-watching your favorite series during your movie marathon nights.

To satisfy your sweet tooth, indulge in the crunch of ube cashew clusters while binge-watching your favorite series during your movie marathon nights.

3. Ube Buko Langka Pie

A typical treat taken home to your family turns into a much more aesthetic and mouthwatering dessert. Enjoy the rich blend of flavors from ube, buko, and langka in pie form. Share a slice or two with family and friends and bond over this melt-in-your-mouth baked goodie.

A typical treat taken home to your family turns into a much more aesthetic and mouthwatering dessert. Enjoy the rich blend of flavors from ube, buko, and langka in pie form. Share a slice or two with family and friends and bond over this melt-in-your-mouth baked goodie.

4. Ube Macapuno Ensaymada

Looking for a snack to pair with your cup of hot coffee or chocolate? Grab an ube macapuno ensaymada. Let this new take on the ever-popular pastry bring you on a brand-new dessert adventure.

Looking for a snack to pair with your cup of hot coffee or chocolate? Grab an ube macapuno ensaymada. Let this new take on the ever-popular pastry bring you on a brand-new dessert adventure.

5. Ube Espasol

Enjoy the nutty taste of ube in this classic sweet and chewy espasol snack that is a local favorite. Be awestruck with the nostalgic taste of this snack and bring it back home to family in the province when you travel for the holidays.

Enjoy the nutty taste of ube in this classic sweet and chewy espasol snack that is a local favorite. Be awestruck with the nostalgic taste of this snack and bring it back home to family in the province when you travel for the holidays.

The journey of ube from the fields to your plates is much more than a supply chain — it is a story of community, culture, and creativity. Through this initiative, Astoria-ACES has strengthened the connection between farmers and consumers, created groundbreaking products like the Astoria Philippine Ube Powder, and inspired a new wave of Filipino desserts.

As this initiative continues to grow, so does a promising future where local ingredients thrive, farmers flourish, and Filipino flavors shine even brighter on the global culinary map. With every spoonful of purple goodness, we celebrate not just a beloved dessert ingredient, but the people and passion behind it.

Interested to try out your culinary skills to create a new version of your favorite desserts? Contact Astoria Culinary Expert Services to purchase your new secret ingredient via:

Mobile: (+63) 998-535-2919

Landline: (+63 2) 8687-1111 locals 8125 and 8172

Email: info.f2t@astoria-aces.com

Spotlight is BusinessWorld’s sponsored section that allows advertisers to amplify their brand and connect with BusinessWorld’s audience by publishing their stories on the BusinessWorld Web site. For more information, send an email to online@bworldonline.com.

Join us on Viber at https://bit.ly/3hv6bLA to get more updates and subscribe to BusinessWorld’s titles and get exclusive content through www.bworld-x.com.

ICI commissioner Rosanna Fajardo resigns

The Independent Commission for Infrastructure (ICI) will lose another commissioner by year-end following the resignation of Rossana A. Fajardo, as the body moves toward winding down its operations, the commission said on Friday.

In a statement, Ms. Fajardo, who also serves as the country managing partner of accounting firm SGV & Co., announced that she has tendered her courtesy resignation, effective Dec. 31, 2025. Her exit follows the recent resignation of fellow commissioner Rogelio “Babes” L. Singson, leaving the ad-hoc body with one remaining commissioner, a special adviser, and its executive director.

The independent commission was established in September under Executive Order No. 94 to investigate multibillion-peso losses from anomalies in government infrastructure and flood-control projects carried out over the past 10 years.

Ms. Fajardo said she has “completed the work” she set out to accomplish, particularly in establishing financial oversight frameworks and supervising evidence-gathering efforts for infrastructure-related probes.

“Since my appointment, I have been committed to advancing the Commission’s objectives, particularly in the areas of financial oversight and infrastructure project investigations,” she said.

She added that investigative and prosecutorial responsibilities are now better handled by permanent institutions such as the Department of Justice and the Office of the Ombudsman.

Ms. Fajardo also pointed to pending legislative measures seeking to create a permanent Independent Commission Against Infrastructure Corruption and an Independent People’s Commission, which she said would have enhanced powers to support prosecutions.

“It has been a profound honor to serve alongside individuals who are deeply committed to transparency and accountability,” she added.

In a separate statement, ICI Chairperson Andres B. Reyes, Jr. said Ms. Fajardo’s resignation comes at a “natural point” in the commission’s lifecycle, as its initial mandate of fact-finding and evidence-gathering nears completion.

“Commissioner Fajardo’s resignation comes at a natural point in the Commission’s work. The ICI was created with a clear, time-bound mandate: to gather evidence, establish facts, and propose corrective measures,” Mr. Reyes said.

“The public can be assured that accountability continues,” he said, adding that the commission is now focused on finalizing its remaining case folders for submission to the Office of the Ombudsman.— Erika Mae P. Sinaking

Ukraine, US negotiators discussed how to bring peace closer, Zelenskiy says

KYIV — Ukrainian President Volodymyr Zelenskiy said on Thursday that he spoke with US President Donald Trump’s special envoy Steve Witkoff and son-in-law Jared Kushner for about an hour on how to end the war with Russia.

“It was a really good conversation: many details, good ideas, that we discussed. There are some new ideas on how to bring the real peace closer, and it concerns formats, meetings, and, certainly, the timeline,” Mr. Zelenskiy said on the Telegram app.

Mr. Trump has been pushing for a deal to end the almost four-year-long war, and in recent weeks peace efforts led by Mr. Witkoff and Mr. Kushner have been slowly inching forward.

Earlier this week,Mr. Zelenskiy presented a 20-point draft peace plan that he described as the main framework for ending the war.

The draft represented a slimmed-down version of an original 28-point plan the US previously discussed with the Russian side that was widely seen as mainly benefiting Moscow as it demanded Kyiv cede territory and put curbs on its army.

However, key territorial questions remain unresolved in the new 20-point draft, Mr. Zelenskiy said, adding that a meeting with Mr. Trump would be required to solve the most sensitive issues.

Kremlin spokesperson Dmitry Peskov said on Thursday that Moscow was analyzing the documents on ending the war which were brought to Moscow by Russia’s special envoy Kirill Dmitriev from the United States.

The White House did not immediately reply to a request for comment.

Mr. Zelenskiy said that Ukraine’s top negotiator Rustem Umerov planned to have one more conversation with the US negotiators later in the day.

“We are truly working 24/7 to bring closer the end of this brutal Russian war against Ukraine and to ensure that all documents and steps are realistic, effective, and reliable,” he said. — Reuters

Trade gap narrows to nine-month low in November

THE PHILIPPINES’ trade deficit in goods narrowed further in November as export growths quickened year on year, the Philippine Statistics Authority (PSA) reported on Friday.

Preliminary data from the PSA showed the country’s trade-in-goods balance — the difference between exports and imports — stood at a shortfall of $3.51 billion in November, 28.8% lower than the revised $4.94-billion gap a year earlier.

Month on month, the trade gap shrank from the revised $4.19-billion deficit in October.

The latest figure was the narrowest trade deficit in nine months or since $2.97-billion imbalance in February.

In the January-to-November period, the trade deficit narrowed to $45.2 billion, down 9.3% from the $50.18-billion gap in the same period last year.

The country’s trade balance has remained in deficit for over a decade or since the $64.95-million surplus recorded in May 2015.

Exports of Philippine-made goods rose by 21.3 % year on year in November to $6.91 billion, faster than the 20.3% increase in October and reversing the 8.6% dip in November 2024.

It was the fastest pace for exports in five months or since the 26.9% growth in June.

However, the November export figure also marked a decrease from last month’s $7.45 billion.

Year to date, exports increased by 14.5% to $77.39 billion.

Meanwhile, merchandise imports in November weakened by 2% year on year, continuing from the revised 3% drop in October and the 3.3% drop a year earlier.

Imports in November totaled $10.42 billion, the lowest in nine months since $9.76 billion in February.

During the January-to-November period, imports rose by 4.1% to $122.59 billion.

The Development Budget Coordination Committee anticipates exports to decline by 2% this year, while imports are expected to grow by 3.5%.

Cid L. Terosa, senior economist at University of Asia and the Pacific, said that greater demand for semiconductors, US tariff exemptions for agricultural products, higher remittances during “ber” months, and effects of “front-loaded” imports helped narrow the trade deficit.

US President Donald J. Trump issued an executive order in November exempting certain food products from increased US tariffs, effective Nov. 13.

The exempted items included bananas, coconuts, coffee, pineapples, and beef.

“Exports of electronic products and semi-conductors can be related to holiday-related spending worldwide,” he said in an email message.

Electronic products continued to be the country’s top export commodity, climbing by 50.6% to $4.19 billion and accounting for more than half of total exports.

Manufactured goods made up the largest portion of total export receipts, up by 29.8% year on year to $5.76 billion in November.

However, exports of mineral products contracted by 42.1% to $325.98 million in November. Petroleum products inched up by 2.6% to $25.95 million.

Sergio R. Ortiz-Luis, Jr., president of the Philippine Exporters Confederation, Inc., said in a phone call interview in Filipino that the narrowing trade deficit could be attributed to the ban on agricultural imports and stronger-than-expected semiconductor exports.

Philippine President Ferdinand R. Marcos, Jr. extended the country’s rice import ban last November — first imposed on Sept. 1 to counter falling palay prices — through yearend last November to help stabilize farmgate prices for unmilled rice.

Additionally, the Department of Agriculture announced that the sugar import ban will be extended until December 2026.

However, Mr. Ortiz-Luis said that export growths were minimal if comparing month-on-month changes as businesses monitored Mr. Trump’s tariff strategy.

“Many buyers from the US are holding back. So, they’re waiting to see what will happen. Fortunately, it came out last month that they won’t be affected that much,” regarding possible tariffs on semiconductors.

Hong Kong was the main destination of Philippine-made goods in November, accounting for 16.9% or $1.17 billion of total export sales. This was followed by the US, with a 16.8% share in total exports or $1.16 billion, Japan with a 12.6% share or $872.12 million, China with a 10.1% share or $698.37 million and the Netherlands with a 4.9% share or $338.18 million.

Union Bank of the Philippines Chief Economist Ruben Carlo O. Asuncion said in an email message that the peso’s slide toward record lows likely affected imports.

“A weaker currency raises the peso cost of imports, discouraging marginal purchases, which aligns with the slight decline in November imports. Conversely, exporters benefit from higher peso-denominated revenues, reinforcing the incentive to ship goods abroad.”

The peso hit what was then a historic low of P59.17 against the US dollar on Nov. 12, according to data from the Bankers Association of the Philippines, before falling further to P59.22 on Dec. 2.

Mr. Asuncion added that the peso’s drop could cause a J-curve effect, widening the trade deficit at first if import volumes stay sticky, but later shrinking over time as pricier imports reduce demand and exporters gain an edge.

Raw materials and intermediate goods, which made up the bulk of the country’s total imports in November, were down by 1.8% to $3.94 billion.

Capital goods imports rose by 7.8% to $3.15 billion in November, while consumer goods fell by 5.6% to $2.22 billion.

Imports of mineral fuels, lubricants and related materials also declined by 18.9% to $1.06 billion.

China continued to be the top source of imports, accounting for 27.8% or $2.9 billion of the total import bill in November.

It was followed by South Korea with a 9.4% share or $978.91 million, Japan with 7.7% or $806.17 million, Indonesia with 7.7% or $805.07 million and the US with 5.8% or $609.62 million.

Looking forward, Mr. Asuncion said that the global semiconductor cycle and China’s demand and supply chain could heavily impact Philippine exports, while peso’s trajectory and BSP’s policy stance will affect import costs and exporter margins.

“Diversifying exports beyond electronics and improving logistics efficiency will be critical to sustaining a healthier trade position.”

Mr. Ortiz-Luis added that domestic corruption controversies could undermine business confidence, eroding buyer trust and affecting trade.

Meanwhile, Mr. Terosa said that geopolitical risks could spur volatility in global markets, leading to oil price instability, supply shortages, and price surges.— Pierce Oel A. Montalvo

Duty Free Philippines bets on airport expansion to lead its next phase of growth

Duty Free Philippines Corp. (DFPC) is opening a new chapter in its modernization drive by strengthening its presence inside the country’s international airports as part of its long-term growth strategy. As part of this shift, DFPC is in discussions regarding the future of its Fiesta Mall lease in Parañaque as it moves toward expanding its presence inside the country’s airports.

The DFPC leadership said the review supports a strategic realignment toward high-traffic travel locations and reflects the corporation’s broader modernization efforts. “We want to grow the footprint of Duty Free and revive its glory days through expansion and new offerings. There is strong potential in what’s coming with these changes,” they said.

Officials explained that the possible transition away from Fiesta Mall is being considered alongside operational realities — including the site’s aging layout and growing maintenance needs — and emphasized that airport-based expansion aligns more closely with global trends in duty-free retail, where digital upgrades and refreshed store formats are now essential.

Parallel to the ongoing transformation at NAIA, DFPC is also upgrading its stores and services as it pushes to remain a world-class, tourism-supporting retailer.

With international arrivals continuing to rise — nearly six million foreign tourists visited the Philippines in 2024 and close to four million more were recorded in the first eight months of 2025 — DFPC said it is scaling up operations to meet growing demand and advance its vision of transforming Duty Free Philippines into a powerhouse destination for travel retail.

As part of their modernization roadmap, DFPC is rolling out major upgrades inside Ninoy Aquino International Airport, with expansion plans under way at both Terminals 1 and 3. At Terminal 3, the corporation is set to scale up its retail area from its current footprint to as much as 6,000 square meters, making it one of the largest duty-free spaces in the airport network and positioning it to better serve the growing volume of international travelers.

The transformation goes beyond square footage. DFPC is also reshaping its retail experience by expanding its lineup of luxury labels, international brands, and emerging names, while opening its outlets to more concessionaires and brand partners. The result is a more dynamic and inclusive product mix — one that ranges from high-end exclusives and global best-sellers to Filipino-made goods and practical pasalubong — giving travelers greater choice without compromising value.

DFPC leadership emphasized that airport-based retail plays a key role in enhancing the country’s tourism ecosystem, helping transform arrival and departure halls, as well as terminals, into more vibrant and service-oriented spaces. “This is not just expansion — it’s transformation,” officials said. “We’re building stores that reflect how Filipino travelers move, shop, and expect service today.”

And for many Filipinos coming home after months or years abroad, Duty Free Philippines has always been more than a store. It is often the first familiar sight upon arrival — a place to pick up chocolates, perfume, or small tokens for loved ones eagerly waiting to welcome them home. As DFPC reinvents itself for a new era of travel, it remains tightly woven into a tradition as old as the balikbayan suitcase: the joy of coming home with something for the ones who matter most.

Spotlight is BusinessWorld’s sponsored section that allows advertisers to amplify their brand and connect with BusinessWorld’s audience by publishing their stories on the BusinessWorld Web site. For more information, send an email to online@bworldonline.com.

Join us on Viber at https://bit.ly/3hv6bLA to get more updates and subscribe to BusinessWorld’s titles and get exclusive content through www.bworld-x.com.

Philippines forecasts 2025 current account deficit at 3.2% of GDP

MANILA – The Philippines’ current account deficit will likely settle at $15.5 billion this year, amounting to 3.2% of GDP, slightly narrower than the previous forecast in October, the central bank said on Friday.

The balance of payments deficit is expected to reach $6.2 billion in 2025, or 1.3% of GDP, the central bank added. The Philippines posted a modest $600 million surplus in 2024.

“This reversal largely reflects a continued current account shortfall arising from a sustained trade-in-goods gap and weaker services receipts,” the Bangko Sentral ng Pilipinas said in a statement.

For 2026, the current account balance is seen at a deficit of $15.3 billion, or 3.0% of GDP, while the balance of payments is expected to record a deficit of $5.9 billion, or 1.2% of GDP.

Foreign exchange reserves are projected to increase to $110 billion by the end of 2026, with growth in remittances remaining at 3.0%.

“Goods trade is expected to remain soft, shaped by weaker global demand, easing commodity prices, and slower domestic growth momentum,” the BSP said. — Reuters

Jair Bolsonaro backs son’s Brazil presidential bid, undergoes hernia surgery

SAO PAULO — Brazil’s former President Jair Bolsonaro endorsed his son Flavio’s 2026 presidential bid on Thursday in a statement from a hospital where he underwent a scheduled hernia operation that doctors said went smoothly.

Supreme Court Justice Alexandre de Moraes authorized Mr. Bolsonaro to leave prison, where he is serving a 27-year sentence for plotting a coup, for the surgery. Police were ordered to stay outside his room where computers and mobile phones were prohibited.

Senator Flavio Bolsonaro, 44, has said he wants to consolidate his father’s conservative legacy at the October 4 vote when he will try to unseat leftist President Luiz Inacio Lula da Silva.

“With the commitment of not allowing the popular will to be silenced, I make the decision to nominate Flavio Bolsonaro as a pre-candidate for the presidency in 2026,” Jair Bolsonaro said in a letter read out by Flavio in front of a hospital in the city of Brasilia where his father was being treated.

The 70-year-old former leader has faced repeated health setbacks since surviving a near-fatal stabbing during the 2018 campaign, undergoing more than half a dozen abdominal surgeries over the years.

Thursday’s operation, which lasted about three hours, was described by his doctor Claudio Birolini as expected and uneventful. Mr. Bolsonaro, who is expected to stay in the hospital for five to seven days, was already in his room and awake, the doctor told reporters.

The former president could also undergo a separate medical procedure targeting his recurring hiccups during his hospital stay, according to Mr. Birolini and doctor Brasil Ramos Caiado. The decision on that may be taken after a reassessment of his medical conditions on Monday, they said.

Deemed a flight risk following his conviction, the ex-president was detained in late November and began serving his 27-year sentence three days later.

Flavio Bolsonaro confirmed this month that his father supports his 2026 presidential bid, unsettling markets that had expected the ex-president to favor a more seasoned contender such as São Paulo Governor Tarcisio de Freitas.

The cancellation of a planned interview on Tuesday, where Jair Bolsonaro was expected to formalize the endorsement, helped the real strengthen nearly 1% against the dollar. — Reuters

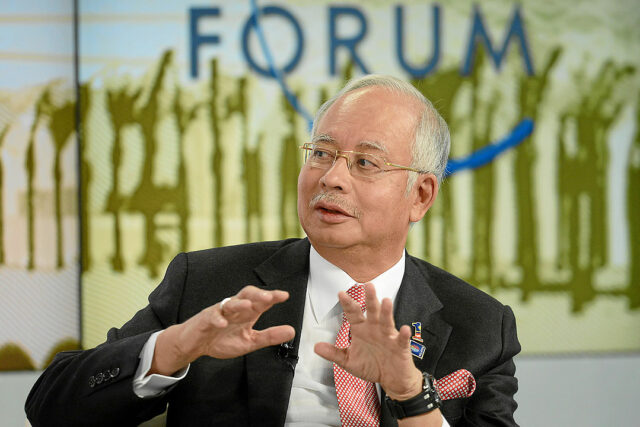

Political stability at stake as Malaysia’s Najib awaits verdict in biggest 1MDB trial

KUALA LUMPUR — Jailed former Malaysian Prime Minister Najib Razak will hear a verdict on Friday in the biggest trial he faces over the multibillion-dollar 1MDB scandal, a ruling that could risk deepening tensions within the administration of current premier Anwar Ibrahim.

Investigators have said about $4.5 billion was allegedly stolen from 1Malaysia Development Berhad, a state fund co-founded by Mr. Razak in 2009, and that more than $1 billion allegedly made its way into his personal bank accounts.

Mr. Razak, 72, last year apologized for mishandling the scandal while in office but he has consistently denied wrongdoing, saying he was misled by 1MDB officials and a fugitive financier, Jho Low, on the source of the funds.

In 2020, Mr. Razak was convicted of graft and money laundering for illegally receiving funds from a 1MDB unit and began a 12-year prison sentence two years later after losing all his appeals. That sentence was later halved by a pardons board chaired by Malaysia’s king, with Mr. Razak due for release in 2028.

A Malaysian high court will decide on Friday whether to convict Mr. Razak of four more charges of corruption and 21 counts of money laundering involving the illegal transfer of about 2.2 billion ringgit ($539 million) from 1MDB.

If found guilty, he could face maximum jail terms of between 15 and 20 years on each charge, as well as a fine of up to five times the value of the alleged misappropriations.

The implementation of the penalties, however, could be stayed pending further appeals.

VERDICTS TEST GOVERNMENT STABILITY

The decision will be closely watched after another court this week dismissed a bid by Mr. Razak to serve the remainder of his sentence under house arrest.

That ruling reignited tensions in Mr. Ibrahim’s ruling administration, which includes Mr. Razak’s party, the United Malays National Organization.

UMNO campaigned against Mr. Ibrahim in a 2022 election but joined his coalition to form a government after the poll ended in a hung parliament.

Several UMNO leaders expressed disappointment with the decision to deny Mr. Razak house arrest, saying it risked diluting the powers of Malaysia’s rulers, while others were angered by social media posts by some members of Mr. Ibrahim’s coalition celebrating the ruling.

Mr. Ibrahim this week called for all parties to handle news of the verdict with patience and wisdom, adding that it was “inappropriate to muddy the atmosphere or add tension” even if there were those who chose not to sympathize with Mr. Razak and his family.

A guilty verdict for Mr. Razak on Friday could strain ties further, with some UMNO leaders already calling for the party to review its pact with Mr. Ibrahim or withdraw from the government altogether. An acquittal, however, may weaken Mr. Ibrahim, who has been under pressure to uphold his credentials as an anti-graft campaigner.

Mr. Ibrahim has been accused by critics of betraying progressive voters and allies after prosecutors dropped some corruption charges against Mr. Razak and other UMNO figures. The premier has repeatedly said he does not interfere in court cases. — Reuters

US launches strike against Islamic State militants in northwest Nigeria

PALM BEACH — The United States carried out a strike against Islamic State militants in northwest Nigeria at the request of Nigeria’s government, US President Donald Trump and the US military said on Thursday, claiming the group had been targeting Christians in the region.

“Tonight, at my direction as Commander in Chief, the United States launched a powerful and deadly strike against ISIS Terrorist Scum in Northwest Nigeria, who have been targeting and viciously killing, primarily, innocent Christians, at levels not seen for many years, and even Centuries!,” Mr. Trump said in a post on Truth Social.

The US military’s Africa Command said the strike was carried out in Sokoto state at the request of the Nigerian authorities and killed multiple ISIS militants.

The strike comes after Mr. Trump in late October began warning that Christianity faces an “existential threat” in Nigeria and threatened to militarily intervene in the West African country over what he says is its failure to stop violence targeting Christian communities.

Reuters reported on Monday the US had been conducting intelligence-gathering flights over large parts of Nigeria since late November.

‘MORE TO COME’

Nigeria’s foreign ministry said the strikes were carried out as part of ongoing security cooperation with the United States, involving intelligence sharing and strategic coordination to target militant groups.

“This has led to precision hits on terrorist targets in Nigeria by air strikes in the North West,” the ministry said in a post on X.

A video posted by the Pentagon showed at least one projectile launched from a warship. A US defense official said the strike targeted multiple militants at known ISIS camps.

US Defense Secretary Pete Hegseth on X thanked the Nigerian government for its support and cooperation and added: “More to come…”

Nigeria’s government has said armed groups target both Muslims and Christians, and US claims that Christians face persecution do not represent the complex security situation and ignore efforts to safeguard religious freedom. But it has agreed to work with the US to bolster its forces against militant groups.

The country’s population is split between Muslims living primarily in the north and Christians in the south.

Police said earlier on Thursday a suspected suicide bomber killed at least five people and injured 35 others in Nigeria’s northeast, another region troubled by Islamist insurgents.

In a Christmas message posted on X earlier, Nigerian President Bola Ahmed Tinubu called for peace in his country, “especially between individuals of differing religious beliefs.”

He also said: “I stand committed to doing everything within my power to enshrine religious freedom in Nigeria and to protect Christians, Muslims, and all Nigerians from violence.”

Mr. Trump issued his statement on the strike on Christmas Day while he was at his Palm Beach, Florida, Mar-a-Lago Club, where he has been spending the holiday. He had no public events during the day and was last seen by the reporters traveling with him on Wednesday night.

The US military last week launched separate large-scale strikes against dozens of Islamic State targets in Syria, after Trump vowed to hit back in the wake of a suspected ISIS attack on US personnel in the country. — Reuters

Business groups bare ‘tax wish list’ for 2026

By Aubrey Rose A. Inosante, Reporter

PHILIPPINE business groups are urging lawmakers to pass a general tax amnesty and review the value‑added tax (VAT) on electricity as part of their tax wish list for 2026.

British Chamber of Commerce Philippines Executive Chair Chris Nelson said the group supports the proposal of Senate Finance Committee Chair Sherwin T. Gatchalian to pass a general tax amnesty.

“This gives the opportunity for those taxpayers who may have unpaid or outstanding liabilities to move forward amicably,” he said during a phone call with BusinessWorld.

The measure is among President Ferdinand R. Marcos, Jr.’s legislative wish list for the 20th Congress. Bills seeking a one‑time general tax amnesty have been filed in both the Senate and the House of Representatives and are still pending at the committee level.

Senate Bill No. 60, filed in July by Mr. Gatchalian, aims to grant a one-time reprieve on unpaid internal revenue taxes for the taxable year 2024 and prior years.

The measure aims to give delinquent taxpayers a “fresh start” while broadening the government’s tax base and strengthening revenue administration.

Mr. Nelson also called for tariff adjustments, particularly a higher minimum access volume (MAV) quota for pork exports to the Philippines, to ease supply shortages and curb inflation.

He said the Philippines’ MAV quota was set in the 1990s for a population of 90 million, though it is now near 120 million, and warned that limits on food imports risk driving prices higher.

The European Chamber of Commerce of the Philippines (ECCP) also pressed lawmakers to fast-track priority measures, including “the passage of a General Tax Amnesty to broaden the tax base and encourage voluntary compliance.”

Executive Secretary Ralph G. Recto earlier said the government is preparing a tax amnesty to address provisions vetoed in 2019, when then-President Rodrigo R. Duterte struck down the general tax amnesty under Republic Act No. 11213 but retained the estate tax amnesty.

The International Monetary Fund has frowned upon the administration’s proposed general tax amnesty, saying that it could lessen regular voluntary tax compliance.

Meanwhile, the ECCP also backed priority bills endorsed by the Legislative-Executive Development Advisory Council, including amendments to the Bank Deposits Secrecy Law and the Anti-Money Laundering Act.

The amendments to the bank secrecy law allow the Bangko Sentral ng Pilipinas to examine the accounts of bank officers and employees involved in illegal financial activities. The House of Representatives has passed the measure on third and final reading.

“Ensuring the full and effective implementation of the CREATE MORE (Corporate Recovery and Tax Incentives for Enterprises to Maximize Opportunities for Reinvigorating the Economy) Act, the Capital Markets Efficiency Promotion Act, and the proposed Mining Fiscal Regime, to provide investors with a stable, predictable, and competitive fiscal framework,” the group said.

The ECCP said investor confidence could be boosted by expanding renewable energy incentives, creating a carbon credit facility, and ensuring a stable mining fiscal regime to position the Philippines in the global critical minerals supply chain.

AMNESTY FOR EXPORTERS

Meanwhile, Philippine Exporters Confederation, Inc. President Sergio R. Ortiz-Luis called for a one-time amnesty for exporters in their cases with the Bureau of Customs.

“What we would like is an amnesty in Customs. Since its establishment, Customs has never had an amnesty unlike the BIR (Bureau of Internal Revenue),” he said in a phone call on Dec. 23.

“This would help clear cases that cannot be prosecuted and allow a one‑time amnesty to clean up records. Otherwise, these cases can be a source of graft,” Mr. Ortiz-Luis said.

He also noted the high electricity and fuel costs in the Philippines, which are significantly higher than those of its neighboring countries.

“Maybe it’s high time to remove taxes (in electricity) so our electricity costs can go down,” Mr. Ortiz-Luis said in Filipino.

Similarly, Philippine Chamber of Commerce and Industry (PCCI) President Enunina V. Mangio is calling for the government to review the VAT on electricity.

“We also recently called for the review of VAT on electricity as this directly affects inflation, household spending, and business costs,” she said in a Viber message.

Finance Undersecretary Karlo Fermin S. Adriano earlier said the government collected around P44 billion to P45 billion in VAT on electricity in 2024.

“For 2026, PCCI’s tax priorities center on measures that lower the cost of doing business, improve predictability, and strengthen our country’s competitiveness in the region,” Ms. Mangio said.

The group said it will continue to monitor legislative developments and, hopefully, will be signed into law as a priority legislative measure by Mr. Marcos.

Meanwhile, the German-Philippine Chamber of Commerce and Industry (GPCCI) said that enhancing and reforming tax administration is crucial, rather than introducing new incentives and laws, and should be among the government’s key priorities to strengthen the country’s investment climate in 2026.

“The necessary laws, circulars, and incentive frameworks are already in place. What investors need most is clarity, predictability, and consistent implementation,” GPCCI President Marie Antoniette E. Mariano said in a statement to BusinessWorld.

Ms. Mariano said reliable application of existing rules significantly improves investor confidence.

The Marcos administration earlier pledged not to introduce new taxes.

DIGITALIZATION

At the same time, business groups are urging for broader government digitalization as persistent delays and uncertainty continue to challenge local and foreign firms.

“Most important is accelerating full digitalization and administrative reforms that make tax compliance easier rather than introducing new revenue-raising measures that could dampen investment sentiment,” Ms. Mangio said.

The ECCP urged the government to accelerate the rollout of e‑invoicing and support the passage of the Digital Payments Act.

She said these are critical to modernizing tax administration, improving compliance, and lowering the cost of doing business.

“We are very much committed to digital transformation. In that respect, we’d like to see how the system can be further digitalized to reduce paperwork and bottlenecks. I think the government has made a commitment,” Mr. Nelson said.

He added that electronic invoicing, one of the initiatives, would capture real‑time transactions and accelerate processes.

GPCCI called for more transparent digitalization, including fewer bureaucratic requirements, faster tax rulings, and quicker dispute resolution.

“Transparent and well-managed tax audits, complemented by efficient dispute resolution mechanisms, benefit the taxpayer and the government alike, play a key role in improving the countries competitiveness,” said Dr. Marian Majer, GPCCI Policy and Advocacy Chairperson.

American Chamber of Commerce in the Philippines Executive Director Ebb Hinchliffe said one of the key priorities would be the fast‑tracking e‑invoicing and digital compliance.

“Support the BIR’s 2024-2028 digital roadmap while ensuring a pragmatic rollout of e‑invoicing,” he said in a Viber message.

CROSS-BORDER SERVICES

The ECCP also reiterated its call to reconsider Revenue Memorandum Circular (RMC) No. 05-2024, which sets out the tax treatment of cross-border services.

“If left unchanged, the issuance could significantly increase compliance costs and discourage cross-border service providers from operating in or expanding into the Philippine market,” it said.

GPCCI raised concerns over cross‑border transactions, citing uncertainties under RMC No. 5‑2024 and backlogs in tax treaty rulings. It urged the government to prioritize clearing the backlog, and provide “clearer guidance on the tax treatment of such transactions to reduce compliance risks for investors.”

The group said resolving these issues would reduce compliance risks and bolster foreign investment.