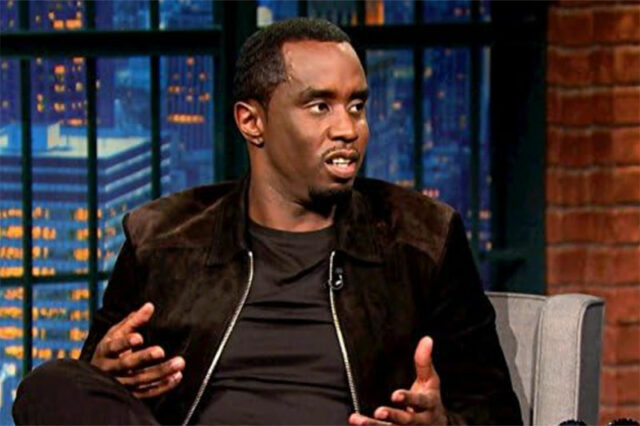

Sean ‘Diddy’ Combs cleared of most serious charges, to remain jailed for now

NEW YORK — Sean “Diddy” Combs will remain behind bars for now, a judge ruled on Wednesday, after the music mogul was cleared of sex trafficking and racketeering charges that could have put him behind bars for life but found guilty of lesser prostitution-related offenses.

In rejecting the defense’s request for bail, US District Judge Arun Subramanian said prosecutors had presented ample evidence at Mr. Combs’ trial that he had committed violent acts and should remain in jail until his sentencing on two counts of transportation to engage in prostitution.

“It is impossible for the defendant to demonstrate by clear and convincing evidence that he poses no danger,” Mr. Subramanian said during a hearing in Manhattan federal court hours after the verdict.

The seven-week trial focused on allegations that Mr. Combs forced two of his former girlfriends to partake in drug-fueled, days-long sexual performances sometimes known as “Freak Offs” with male sex workers in hotel rooms while Mr. Combs watched, masturbated and occasionally filmed.

Both women — the rhythm and blues singer Casandra “Cassie” Ventura, and a woman known in court by the pseudonym Jane — testified that he beat them and threatened to withhold financial support or leak sexually explicit images of them.

As Mr. Subramanian denied bail, Mr. Combs stared straight ahead and one of his family members in the courtroom gallery hung their head.

It was a far cry from the jubilant reaction after the verdict.

“I’m gonna be home soon,” Mr. Combs said then, prompting applause and cheers from his family and supporters. “Thank you, I love you.”

The 12-member jury unanimously acquitted Mr. Combs of racketeering conspiracy and two counts of sex trafficking Ms. Ventura and Jane. The Bad Boy Records founder could have faced life in prison if convicted on those counts.

Mr. Combs, once famed for hosting lavish parties for the cultural elite in luxurious locales like the Hamptons and Saint-Tropez, had pleaded not guilty to all five counts.

The verdict was overall a win for Mr. Combs, a former billionaire known for elevating hip-hop in American culture.

“It’s a great victory for Sean Combs, it’s a great victory for the jury system,” defense lawyer Marc Agnifilo told reporters.

Under federal law, Mr. Combs faces up to 10 years in prison on each of the two prostitution counts. But prosecutors acknowledged in a court filing that federal sentencing guidelines appeared to recommend a sentence of at most 5-1/4 years total, well below the statutory maximum. Mr. Combs’ lawyers argued that two years would be the outer limit.

The judge suggested sentencing Mr. Combs on Oct. 3, but will consider a defense request for an earlier date.

Prosecutors argued Mr. Combs should remain in jail because he remained a danger, pointing to Jane’s trial testimony that he assaulted her in June 2024 while aware he was under investigation.

“He’s an extremely violent man with an extraordinarily dangerous temper who has shown no remorse,” prosecutor Maurene Comey said in court.

ACQUITTAL ON THREE CHARGES

The jury’s acquittal on the most serious charges signaled that the prosecution failed to draw a direct line between Mr. Combs’ abuse of Ms. Ventura and Jane and their participation in the sexual performances.

The defense acknowledged that Mr. Combs engaged in domestic violence, but argued that Ms. Ventura and Jane were strong, independent women who consensually took part in the sexual performances because they wanted to please Mr. Combs.

Sarah Krissoff, a former federal prosecutor in Manhattan, said the jury may have viewed Mr. Combs’ conduct as evidence of toxic romantic relationships, but not sex trafficking.

In a statement after the verdict, Manhattan US Attorney Jay Clayton and Homeland Security Investigations Special Agent in Charge Ricky Patel said sex crimes were “all too present” across society and that Americans wanted it to stop.

Mr. Combs still faces dozens of civil lawsuits accusing him of abuse. Ms. Ventura sued him in November 2023 for sex trafficking, and they settled a day later for $20 million.

Mr. Combs, once feted for turning artists like Notorious B.I.G. and Usher into stars, has denied all wrongdoing.

After the verdict, Ms. Ventura’s lawyer Douglas Wigdor said in a statement that she had “paved the way” for Mr. Combs’ conviction on the prostitution counts. — Reuters