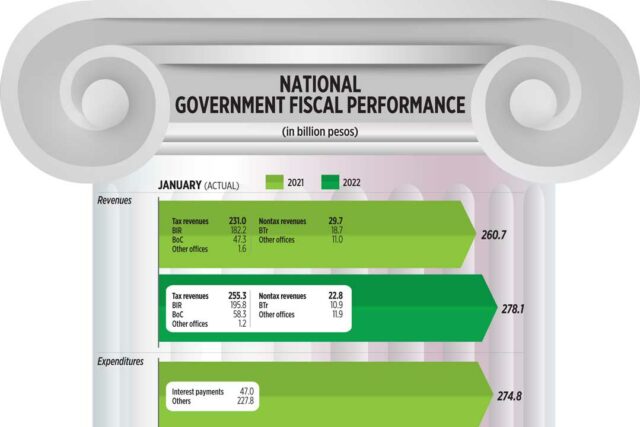

National government fiscal performance

THE National Government’s budget deficit widened to P23.4 billion in January, as spending increased due to the release of tax allotments to local government units (LGUs). Read the full story.

Peso strengthens versus dollar as Russia-Ukraine talks show progress

THE PESO strengthened versus the greenback on Thursday amid some progress in diplomatic talks between Russia and Ukraine.

The local unit closed at P52.14 per dollar on Thursday, stronger by 17 centavos from its P52.31 finish on Wednesday, data from the Bankers Association of the Philippines showed.

The peso opened Thursday’s session at P52.18 a dollar. Its weakest showing was at P52.22, while its intraday best was at P52.10 against the greenback.

Dollars traded declined to $998.2 million on Thursday from $1.046 billion on Wednesday.

A trader said the peso’s appreciation was supported by positive market sentiment as they welcomed progress in the ongoing talks between Moscow and Kyiv.

Ukrainian President Volodymyr Zelensky said their negotiations have become more realistic since the war started three weeks ago, Reuters reported.

Meanwhile, Russian President Vladimir Putin said they are ready to discuss a neutral status with Ukraine.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort in a Viber message said relatively lower oil prices also brought relief to investors and caused the peso to appreciate.

The peace talks between Moscow and Kyiv caused some decline in global oil prices. Brent declined by $1.89 or 1.9% to settle at $98.02 per barrel on Wednesday, while the US West Texas Intermediate crude was down by $1.40 or 1.5% at $95.04.

The dollar index, which tracks the currency against six major peers, was slightly weaker at 98.476 after declining 0.47% on Wednesday.

For Friday, Mr. Ricafort gave a forecast range of P52.05 to P52.25, while the trader expects the local unit to move within P52.10 to P52.25 per dollar. — L.W.T. Noble with Reuters

Shares extend climb on positive economic outlook

STOCKS went up on Thursday as the government said they remain bullish that they can reach this year’s economic growth goal despite the inflation risks caused by the Russia-Ukraine war and following the US Federal Reserve’s rate hike.

The benchmark Philippine Stock Exchange index (PSEi) climbed by 96 points or 1.36% to close at 7,122.45 on Thursday, while the broader all shares went up by 46.28 points or 1.24% to 3,759.96.

“[T]he National Economic and Development Authority (NEDA) said the country is still on track to reach its economic growth target this year despite the impact of Russia’s invasion of Ukraine on prices,” Regina Capital Development Corp. Head of Sales Luis A. Limlingan said in a Viber message.

“Philippines shares continued to rebound after the Fed raised its benchmark interest rates by 0.25% for the first time since 2018. The central bank hinted at six more rate hikes this year as it forecasted a consensus funds rate of 1.9% by end of year,” Mr. Limlingan added.

The NEDA is confident the Philippines could still reach its economic growth target this year, despite the impact of Russia’s invasion of Ukraine on prices, Socioeconomic Planning Secretary Karl Kendrick T. Chua said at a Tuesday briefing.

Meanwhile, the Fed on Wednesday raised interest rates for the first time since 2018 and laid out an aggressive plan to push borrowing costs to restrictive levels next year in a pivot from battling the coronavirus pandemic to countering the economic risks posed by excessive inflation and the war in Ukraine, Reuters reported.

The US central bank’s Federal Open Market Committee kicked off the move to tighten monetary policy with a quarter-percentage-point increase in the target federal funds rate, lifting that key benchmark from the current near-zero level in a step that will ripple through a variety of other rates charged to consumers and businesses.

“[The PSEi] was up most likely due to strong performance of the US market last night and Asian markets today. Also, commodity prices are correcting after climbing significantly last week,” COL Financial Group First Vice-President April Lynn C. Lee-Tan said in a Viber message on Thursday.

Majority of the PSE’s sectoral indices ended in the green except for mining and oil, which fell by 157.19 points or 1.30% to 11,916.61.

Meanwhile, financials climbed 55.01 points or 3.39% to 1,677.86; services rose by 34.93 points or 1.90% to 1,870.38; property increased by 43.67 points or 1.31% to 3,369.19; holding firms improved by 43.10 points or 0.63% to 6,809.39; and industrials gained 49.99 points or 0.52% to 9,647.92.

Value turnover decreased to P7.50 billion with 1.43 billion shares changing hands from the P7.76 billion with 1.32 billion issues seen the previous trading day.

Advancers outnumbered decliners, 123 versus 62, while 49 names closed unchanged.

Net foreign buying increased to P158.04 million on Thursday from P23.87 million on Wednesday. — L.M.J.C. Jocson with Reuters

DoF, NEDA object to single national minimum wage

THE Department of Finance (DoF) and National Economic and Development Authority (NEDA) on Thursday turned down the proposal to institutionalize uniform wage across regions since it will worsen inequality.

“As I mentioned earlier, the DoF will still submit our official position on the proposed measure,” DoF Legislative Liaison Specialist Jeanne S. Guinto said in a livestreamed hearing of the House Committee on Labor and Employment. “We just (want) to initially manifest that we pose an objection to the proposed measures as this may cause high inflation on top of the ongoing fuel crisis.

“We also have concerns on some of the provisions of the bill like aligning the minimum wage of those in the provinces with that in the city. We think that it may not be an effective measure as the cost of living in the provinces is different from that of the city,” she added.

NEDA Director Reynaldo R. Cancio said the economic planning agency supports raising wages but opposes a uniform national minimum wage, which it said will drive away businesses.

“We share the objective of raising the living standards for workers and their families, but we are unable to support proposals to have a uniform minimum wage across regions as this erode the ability of other regions to attract industries and enterprises and worsen the inequality across regions,” Mr. Cancio said.

He also expressed support for maintaining the tripartite wage mechanism to set each region’s minimum wage. — Jaspearl Emerald G. Tan

DTI says few manufacturers are seeking higher prices; SRP adjustment under study

ONLY limited numbers of manufacturers are seeking permission to raise prices of basic goods, the Department of Trade and Industry (DTI) said, with adjustments to the suggested retail price (SRP) list under consideration.

Trade Assistant Secretary Ann Claire C. Cabochan said in a Laging Handa briefing on Thursday that the department is weighing the impact on the broader economy before acting.

“Pinag-aaralan natin, kasi kapag nagbibigay tayo ng SRP bulletin na may price adjustment, alam naman natin ’yung magiging epekto din niyan kasi tataas pa ’yung presyo (It’s being studied, because if we allow an SRP adjustment, we all know that the impact would be higher prices)” Ms. Cabochan said.

“Hindi naman lahat ay humihingi din ng increase as of this time, may ilan-ilan po. Titignan natin kung justified ’yung increase (Not all are asking to increase prices — it’s only a limited number. We will see if the reason for their requests is justified) and if it is, then that is the time (the) DTI will make adjustments,” she added.

The SRP list was last updated by the DTI on Jan. 27, with 73 out of 216 stock keeping units authorized to raise prices due to the higher production costs.

The Philippine Amalgamated Supermarkets Association has estimated that the prices of basic necessities have increased by 3% to 6% while non-essential items have seen their prices increase between 8% and 15% in reaction to rising fuel prices.

Ms. Cabochan said that the DTI sees no reason to order a price freeze with commodity prices rising due to the Russian invasion of Ukraine.

She said Republic Act No. 7581 or the Price Act authorizes a price freeze after the declaration of a state of emergency.

“As of this time and sinabi na ito ni (Trade) Secretary Ramon M. Lopez, na hindi pa natin nakikita ’yung (Secretary Lopez has said that he does not as yet see) circumstances that will give rise to a declaration of state of emergency,” Ms. Cabochan said.

“Under a price freeze, the affected products are only basic necessities listed in the Price Act. The price freeze does not include prime commodities,” Ms. Cabochan added.

According to the DTI website, basic necessities include rice, corn, cooking oil, fresh milk, fresh eggs, and fresh fruit. These products will be covered by any price freeze.

Prime commodities include flour, onion, garlic, processed and canned pork, processed and canned beef and poultry meat, and fertilizer.

Since the beginning of 2022, the prices of gasoline, diesel, and kerosene have increased by P20.35 per liter, P30.65 per liter, and P24.90 per liter, respectively. — Revin Mikhael D. Ochave

Hog, rice industries say lowered tariffs produced no benefits, cut gov’t revenue

PORK PRODUCERS and rice farmers said lower tariffs for pork and rice failed to benefit consumers and producers, with retail prices remaining high.

“What we have heard from the National Economic and Development Authority (NEDA) is that lowering the tariff will benefit consumers. What we observed is that consumers didn’t benefit from it at all. There really are no savings. Our request is to help protect local producers. Imported manufactured goods competing with locally produced goods should, by law, face higher tariffs,” National Federation of Hog Farmers, Inc. President Chester Warren Y. Tan said at a virtual hearing called by the Tariff Commission.

The government sought to liberalize imports of these commodities via lower tariffs in response to an inflation crisis in 2021.

In May 2021, President Rodrigo R. Duterte signed Executive Order (EO) No. 134 and 135, lowering the tariffs on pork and rice imports from non-ASEAN countries from 50% to 35%.

A previous inflation crisis in 2018 led to the initial liberalization of the rice market, via the passage of the Rice Tariffication Law, or Republic Act 11203, the next year.

Mr. Tan said the hog sector would prefer to revert to the original tariff scheme.

Samahang Industriya ng Agrikultura Chairman Rosendo O. So said that the current tariff arrangement has caused the government to forego revenue it would have earned under the old tariff scheme.

“If the tariff of pork was not lower, the government should have collected around P22 billion on the imports of 2021. Because of the lowering of tariffs, we only collected around P10 billion. The government lost around P12 billion… Lowering tariffs did not help improve the retail price,” he added.

“Hog farmers… had to stop repopulation efforts (because of the imports). We are already telling the government, if there are many imports incoming, you will lose hog raisers,” he added.

The hog industry is still seeking to bounce back from the African Swine Fever outbreak, which thinned the Philippine herd and caused many growers to exit the business.

Federation of Free Farmers (FFF) National Manager Raul Q. Montemayor said that the reduction in tariffs on rice imports from non-ASEAN countries had no impact on overall prices and also resulted in foregone tariff revenue that could have been used to help rice farmers.

“There was no increase in rice supply from non-ASEAN sources despite cost advantages of some non-ASEAN exporters. There was a large number of supplier countries, but volumes were negligible,” he said.

“We hope the tariff outside ASEAN be made higher… Imports are not the solution, local produce is more dependable if only the government supported it,” Mr. So added.

In a statement, the FFF said that imports from non-ASEAN sources amounted to only 1.78% of total imports in 2021, down from 2.36% in the previous year, even though rice from India and Pakistan are competitive against their ASEAN counterparts.

“At the same time, importers opted to bring in expensive grades of rice instead of the regular rice commonly purchased by poor consumers. As what happened with the Rice Tariffication Law or RTL, the benefits of lower tariffs were captured either by importers or rich consumers,” the FFF added.

Mr. Montemayor urged the government to return the tariff to 50% and focus efforts on supporting farmers.

“We should encourage local production and incentivize farmers through input support and assurance of stable prices. We should also intensify the accumulation of buffer stocks,” he added.

NEDA told the commission that lower tariffs were intended to increase supply and bring down prices.

“There are several objectives that went into this. One is to increase supply, which we achieved. We really expected to bring down prices, but true enough, it did not happen. But what did happen, which is very crucial, is the stabilization of prices. If we did not have this additional supply, we may have had rocketing prices, in those periods where production was still not coming out. The inflation rate of meat has really come down,” NEDA Undersecretary Mercedita A. Sombilla said.

“When we are able to contain the rise of inflation, that affects the purchasing power of consumers, and that alone helps them. We shouldn’t say that consumers did not benefit from this. They probably did not benefit much from lowering meat prices, but they benefitted from preventing inflation rates going up,” she added.

The Tariff Commission is hearing a proposal to extend the effectivity of the EO beyond its scheduled expiry on May 15, 2022. — Luisa Maria Jacinta C. Jocson

No SDGs expected to be met by 2030 in Southeast Asia

SOUTHEAST ASIA is behind the pace in meeting any of the 17 sustainable development goals (SDGs) by 2030, according to the United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP).

“Southeast Asia is not on track to achieve any of the 17 Goals by 2030, given the current pace of progress by countries in the subregion,” UNESCAP said in a report released on Thursday.

According to UNESCAP, slow progress has been noted in SDG 4, or educational quality, adding that there are signs of regression in inequality indices and low proficiency in reading and mathematics among young students.

“Cambodia, Indonesia, the Philippines, and Thailand recorded less than 50% of lower secondary students achieving minimum reading and mathematics proficiency for both sexes,” the report found.

However, UNESCAP said there has been some progress in Southeast Asia in SDGs related to poverty (SDG 1); industry, innovation, and infrastructure (SDG 9); and life on land (SDG 15).

“The subregion remains on track to eradicate poverty for individuals living below international and national poverty lines, including in Indonesia and the Philippines, which have the highest prevalence of poverty in the subregion with 5 to 6% of the population living below $1.90 a day,” UNESCAP said.

“Factors negatively affecting the progress of SDG 1 are losses due to natural disasters and the continued lack of government spending on basic services (education and health),” it added.

The report also found a lack of progress in SDG 8 or decent work and economic growth, and SDG 17 or partnership for the goals.

“Relatively stable rates of gross domestic product (GDP) growth and increased economic activity contributed to progress towards decent work and economic growth (Goal 8). However, regression in improving efficiency in use of natural resources (material footprint and domestic material consumption) as well as a lack of progress towards compliance with labor rights have undermined overall progress,” UNESCAP said.

“Partnership for the goals (Goal 17) also showed little progress in the subregion because most governments’ revenue fell below 30% of GDP and technical cooperation for official development assistance was significantly reduced,” it added.

Meanwhile, UNESCAP said Southeast Asia is regressing on five SDGs — SDG 6 or clean water and sanitation, SDG 11 or sustainable cities and communities, SDG 12 or responsible consumption and production, SDG 13 or climate action, and SDG 14 or life below water.

The report found that increased greenhouse gases emissions and casualties from various disasters affected the region’s efforts towards achieving SDG 13, while responsible consumption and production was affected by increased material consumption and material footprint, setting back efforts to achieve SDG 12.

“A reverse trend in clean water and sanitation (Goal 6) occurred owing to increased water stress and the inability of countries to protect and restore water-related ecosystems. Sustainable cities and communities (Goal 11) was greatly affected by road traffic deaths and human and economic loss from disasters,” the report said.

“Southeast Asia needs to accelerate progress or reverse current trends in Goals 4, 6, 8, 11, 12, 13, 14, 16 and 17 if the subregion is to meet the 2030 deadline. The trends in these goals must be reversed if the subregion is to make sufficient improvement towards achieving the SDGs by 2030,” it added. — Revin Mikhael D. Ochave

ADB sees stronger RCEP income effect vs TPP

THE Regional Comprehensive Economic Partnership (RCEP) is likely to have greater impact on incomes than the Trans-Pacific Partnership (TPP), the Asian Development Bank (ADB) said.

In a study, the ADB found that RCEP implementation adds $263 billion to global income, based on 2030 baseline projections, Cyn-Young Park, ADB director for Regional Cooperation and Integration, Economic Research and Regional Cooperation Department said in a webinar on Thursday.

The RCEP is a trade deal involving Australia, China, Japan, South Korea, New Zealand and the 10 members of the Association of Southeast Asian Nations (ASEAN). It has been in force in 11 countries since Jan. 1.

Meanwhile, the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) is expected to add $188 billion.

“The income gains (for RCEP) are somewhat greater than those from the CPTPP,” she said.

The CPTPP is a trade deal among Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, and Vietnam.

“In terms of export effects, the patterns are quite similar to income effects,” Ms. Park said.

RCEP adds $496 billion to world exports, while the CPTPP adds $312 billion.

President Rodrigo R. Duterte ratified RCEP on Sept. 2, 2021. The Senate failed to give its concurrence before it adjourned on Feb. 3 for the election break.

Groups such as the Federation of Free Farmers have said that safeguards for the agriculture sector need to be in place before the Philippines signs on to the deal.

Trade Assistant Secretary Allan B. Gepty has said that delayed participation in the RCEP will send the “wrong signal” to investors and put Philippine businesses at a disadvantage in the region. — Jenina P. Ibañez

Energy efficiency companies want their projects to qualify under BOT law

ENERGY efficiency entities have asked the Public-Private Partnership (PPP) Center to include energy efficiency and conservation (EE&C) investments to the list of qualified projects under the Republic Act 6957 or the Build-Operate-Transfer (BOT) Law, in order to facilitate the industry’s access to private-sector financing.

“It is clear that the (revised implementing rules and regulations) of the BOT Law should qualify energy efficiency and conservation projects. We therefore seek explicit inclusion of ‘energy efficiency and conservation’ among the listed eligible types of projects,” Philippine Energy Efficiency Alliance President Alexander D. Ablaza said in a comment submitted to the PPP on Wednesday.

Mr. Ablaza also noted that while section 2.2 of the IRR mentions climate change mitigation, there is a need to mention explicitly ‘energy efficiency and conservation’ projects because climate change mitigation may not be the only purpose or intent of such project.”

“If energy efficiency projects become eligible for PPP transactions under the amended BOT law, through an expanded IRR, government entities may be able to implement energy efficiency projects without allocating taxpayer funding or general appropriations,” he said in a Viber message.

The alliance also sought the synchronization of Government Energy Management Program Guidelines with the BOT IRR’s detailed guidelines for the approval of projects as EE&C projects which are smaller in size, uncomplicated in scope, possessing low to zero negative impacts, which would allow such projects to access a simplified, fast-track project approval process with the corresponding endorsement of the Department of Energy through its Energy Utilization Management Bureau, it said.

The PPP Center is currently soliciting comment on proposed amendments to the IRR of the BOT Law. — Marielle C. Lucenio

Customs plans extended payment hours to facilitate release of goods

THE Bureau of Customs (BoC) plans to roll out a day-and-night payment system for exporters to speed up the release of goods currently being delayed by the limited hours of Customs operations.

The current payment system is only open from 8 a.m. to 5 p.m. daily, Customs Commissioner Rey Leonardo Guerrero said in a webinar on Thursday.

“We’re working with the Philippine clearing house center for us to be able to come up with an upgraded version of this payment system… which will allow 24/7 payment for these shipments, or particularly exports.”

Mr. Guerrero said exporters can also open a pre-payment account for their shipments.

Meanwhile, Mr. Guerrero also addressed corruption allegations at his bureau.

Most presidential candidates at a televised debate held by CNN Philippines last month indicated that they would investigate the Bureau of Customs for corruption if they won the presidency.

“That was really a sad awakening for us because all the while we were confident that we were doing our best to address all of these issues,” Mr. Guerrero said. “The bad impression that the bureau has acquired over many decades of neglect cannot be erased in just two or three years. This is something we have to work on.”

The bureau reported that it transferred 721 of its employees to other offices and ports last year following an anti-corruption campaign.

Customs dismissed three employees and suspended 17 over the course of the year. Another 19 were relieved from their posts but remain in active service.

“We tried our best to investigate and follow up the prosecution of those found involved in malpractice or in graft and corruption. However, the decision, the outcome of the cases, is actually outside the jurisdiction of the Bureau of Customs. This is a concern that we have raised with the agencies concerned,” Mr. Guerrero said.

The Philippines fell two spots to 117th place out of 180 countries and territories in the 2021 Corruption Perceptions Index.

Transparency International gave the Philippines a score of 33 out of 100, which is based on perceived levels of public sector corruption, a “historic low” for the country. — Jenina P. Ibañez

Travel reopening points to greater use of digital payment products — Visa

THE reopening of borders promises greater use of digital payment systems, according to the Visa 2021 Global Travel Intentions study.

Visa said in a statement that 63% of Filipinos who intend to travel plan to resort to digital payments due to safety concerns and comfort with the up-and-coming payment channels.

Some (34%) expressed a preference for mobile payment systems while traveling, with credit cards cited by 24% and debit cards by 31%.

The study also found interest in travel insurance products that protects them from COVID-19-related risks including the cost of medication and treatment (59%), quarantine charges (52%) and hospitalization (41%).

“These findings reflect the changing outlook Filipinos have on traveling as the coronavirus disease 2019 (COVID-19) situation evolves. We have seen a rebound in travel in many parts of the world as borders open, and Filipinos are optimistic about traveling again,” Visa Country Manager for the Philippines and Guam Dan Wolbert said.

“Similar to other markets, Filipino travelers are conscious about following safety protocols and also want to feel that they have sufficient access to health protection… while they are abroad,” he added.

More than half (56%) of respondents in the Philippines are interested in international leisure travel in a travel bubble setup.

Preferred destinations were the US, Japan, Hong Kong, Canada, and Thailand. Other destinations generating interest are South Korea, Australia, and Dubai.

Key considerations cited by those intending to travel are free COVID-19 tests (57%), access to hospital care (51%), and flexibility in changing travel plans (37%).

“As we see the number of COVID-19 cases trending downwards in the Philippines and the government’s decision to start opening our borders, we share the optimism of Filipinos that the road to recovery is beginning,” Mr. Wolbert said. — Luz Wendy T. Noble