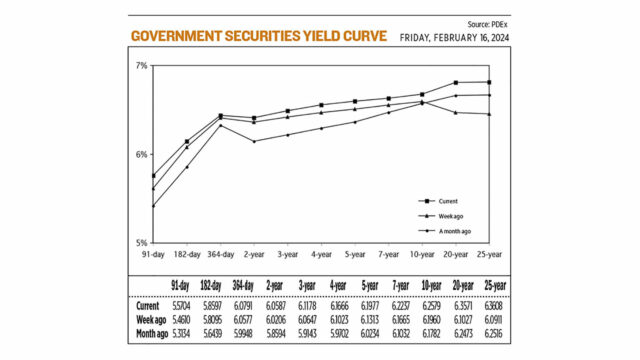

YIELDS on government securities (GS) climbed across the board last week as the Treasury began its retail bond offering and as the market awaited the Bangko Sentral ng Pilipinas’ (BSP) first policy meeting for this year.

GS yields, which move opposite to prices, went up by an average of 9.51 basis points (bps) week on week at the secondary market, based on the PHP Bloomberg Valuation Service Reference Rates as of Feb. 16 published on the Philippine Dealing System’s website.

The short end of the curve rose, with yields on the 91-, 182-, and 364-day Treasury bills (T-bills) increasing by 10.94 bps (to 5.5704%), 5.02 bps (5.8597%), and 2.14 bps (6.0791%), respectively.

At the belly, the rates of the two-, three-, four-, five-, and seven-year Treasury bonds (T-bonds) went up by 3.81 bps (to 6.0587%), 5.31 bps (6.1178%), 6.43 bps (6.1666%), 6.64 bps (6.1977%), and 5.72 bps (6.2237%), respectively.

Lastly, at the long end of the curve, the 10-, 20-, and 25-year papers went up by 6.19 bps, 25.44 bps, and 26.97 bps to yield 6.2579%, 6.3571%, and 6.3608%, respectively.

Total GS volume traded reached P4.24 billion on Friday, below the P11.34 billion on Feb. 8.

“The yield curve steepened during the week as most investors sold positions in the belly to long end following the result of the new five-year retail Treasury bond (RTB) auction,” Alessandra P. Araullo, chief investment officer at ATRAM Trust Corp., said in a text message.

“Players opted to trim some of their positions in the five- to 10-year space given the additional supply brought by the new five-year RTBs. The sell-off in the back end of the curve was also potentially due to investors dialling back their expectations of an earlier rate cut by the BSP,” she said.

The Bureau of the Treasury last week raised an initial P212.719 billion from its auction of RTBs, the third under the Marcos administration and the 30th overall.

Tenders for the five-year RTBs at the rate-setting auction reached P272.708 billion, or more than nine times the P30 billion on offer. The retail bonds fetched a coupon rate of 6.25%.

The public offer period for the RTBs and submission of bond exchange offers began on Tuesday and is scheduled to end on Feb. 23, unless closed earlier by the Treasury. The new retail bonds will be issued and settled on Feb. 28.

“Aside from this, investors were also anticipating the result of the first monetary policy meeting this year of the BSP,” Ms. Araullo said.

“Hawkish statements from the BSP have solidified expectations that local interest rates might remain elevated in the near term, especially on the shorter end of the yield curve,” a bond trader added in an e-mail.

The Monetary Board last week kept the policy rate at a near 17-year high of 6.5% for a third straight meeting, as expected by 15 of 17 analysts in a BusinessWorld poll. Interest rates on the overnight deposit and lending facilities were also left unchanged at 6% and 7%, respectively.

The BSP raised borrowing costs by 450 bps from May 2022 to October 2023.

BSP Senior Assistant Governor Iluminada T. Sicat said there is “scope for a rate cut” this year as soon as they see a sustained inflation downtrend.

“While we see some improvement in headline and core, we still consider taking a more prudent monetary policy stance at this moment,” Ms. Sicat said at a briefing on Thursday.

“We need to maintain our hawkish position but in terms of tone, it’s not as strong as what we had last December. But we continue to be hawkish looking at developments here and abroad,” she added.

GS yields rose after faster-than-expected US consumer inflation, the trader added.

The US consumer price index (CPI) increased 0.3% last month after gaining 0.2% in December, the Labor department’s Bureau of Labor Statistics said, Reuters reported.

In the 12 months through January, the US CPI increased 3.1% after advancing 3.4% in December. Economists polled by Reuters had forecast the CPI would gain 0.2% on the month and rise 2.9% on a year-on-year basis.

For this week, yields may continue to move sideways amid the Treasury’s ongoing RTB offering, Ms. Araullo said.

“With this, we are expecting that yields will trade sideways with an upward bias as investors may continue to sell some of their holdings and use the proceeds to reposition in the new RTBs,” she said.

“Yields might move with an upward bias amid potentially hawkish statements from the minutes of the January US Federal Reserve meeting. However, the upside might be capped by concerns on the global economy after Japan and the UK fell into technical recession,” the bond trader added.

Minutes of the Fed’s Jan. 30-31 meeting will be released on Wednesday. — M.I.U. Catilogo with Reuters