Mouthwash may cure ‘the clap’

PARIS — In the 19th century, before the advent of antibiotics, Listerine mouthwash was marketed as a cure for gonorrhoea. More than 100 years later, researchers said Tuesday the claim may be true.

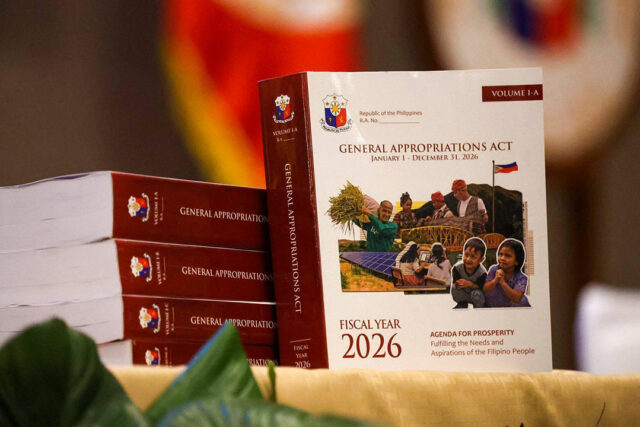

Groups flag P633 billion corruption risk in bicam-approved 2026 budget

Multisectoral groups on Monday raised their recommendations on the P6.793-trillion national budget approved by the bicameral for 2026, following their concerns on the P633 billion worth of projects at risk for corruption and patronage.

“We recommend that the President take action on more than P633 billion worth of projects at risk of corruption and patronage in the bicam version of the budget,” the Roundtable for Inclusive Development (RFID) and People’s Budget Coalition (PBC) said in a joint statement.

Both chambers of Congress separately ratified the bicameral conference committee report on the proposed national budget for 2026 on Monday.

The first recommendation filed by the groups highlights vetoing unprogrammed appropriations, also known as “shadow pork,” worth P243 billion, in addition to removing the P43 billion SAGIP program, which was said to previously used to fund anomalous flood control projects.

The groups defined shadow pork as funds that “sit outside the regular budget framework” and are often used in the previous years in “risky” infrastructure projects due to their minimal transparency or legislative scrutiny upon release.

“Special provisions on unprogrammed appropriations had violated specific provisions in the PDAF ruling of the Supreme Court,” the civil groups said.

“The constitutionality of unprogrammed appropriations itself is an issue, as Congress artificially increases the budget ceiling set by the President, required under the Constitution; it also violates separation of powers and non-delegability of the legislative power of the purse,” they added.

The groups also promoted transforming the patronage-driven assistance or ayuda worth P210 billion into “rights-based and rules-based programs”, in consultation with allied health professionals and social protection experts, along with the P11 billion worth of confidential and intelligence funds (CIF).

According to the groups, soft pork is composed of aid programs at risk of political patronage because it leads citizens to “beg” politicians for assistance.

“Politicians must be excluded from the process of selecting beneficiaries, prevalent under the inhumane and unconstitutional guarantee letter system that encourages post-enactment intervention by legislators in the budget,” they said.

“We are alarmed that the bicameral conference committee nearly tripled soft pork to P210 billion compared to the President’s proposed budget,” they added.

The last recommendation mentioned involved placing the P600 billion-worth of infrastructure projects under a multisectoral citizen monitoring initiative funded by the government or internationally funded independent research programs.

The 2025 national budget faced heightened public scrutiny after several budget allocations and congressional insertions had been discovered, sparking multiple rallies nationwide for transparency and accountability.

“As citizens, we remain committed to working with you to monitor the budget process so that every taxpayer peso benefits our nation,” they said. “Buwis natin ito, budget natin ito [This is our taxes, this is our budget].”— Almira Louise S. Martinez

Canada asks Air India to probe incident of pilot reporting for duty under influence of alcohol, source says

NEW DELHI — Canada’s transport regulator has asked Air India to investigate an incident of a pilot reporting for duty under the influence of alcohol and failing two breathalyzer tests, a person familiar with the matter said.

The tests were conducted by Canadian police at Vancouver International Airport, after the pilot was asked to leave the aircraft, the person said.

The incident was labelled as a “serious matter” by Transport Canada in a letter to Air India and authorities are likely to pursue enforcement action, the person added.

The person requested anonymity as he was not authorized to speak to the media. Transport Canada did not respond to an emailed request for comment outside regular working hours.

In a statement, Air India confirmed the flight from Vancouver to Delhi on December 23 experienced a last-minute delay due to the incident, adding that an alternate pilot was brought in to operate the flight.

“The pilot has been taken off flying duties during the process of enquiry. Air India maintains a zero-tolerance policy towards any violation of applicable rules and regulations,” Air India said.

“Pending the outcome of the investigation, any confirmed violation will attract strict disciplinary action in line with company policy.”

The letter from Transport Canada official Ajit Oommen has asked Air India to provide its findings and details of steps taken to prevent future occurrences by January 26, the person familiar with the matter said.

India has been under intense scrutiny since the June 12 crash of a Boeing Dreamliner killed 260 people. India’s aviation regulator has flagged multiple safety lapses at the airline, which was previously owned by the government until 2022.

Pilots at Air India, owned by Tata Group and Singapore Airlines, have also come under scrutiny. This week, India’s Directorate General of Civil Aviation sent warning notices to four Air India pilots, flagging “serious safety concerns” related to regulatory compliance and flight crew decision-making.

The DGCA said the pilots accepted an aircraft for operation last year despite prior knowledge of “repeated snags” and “existing systems degradations,” according to warning notices dated December 29 seen by Reuters. The aircraft is a Boeing 787 used for long-haul flights, according to Flightradar24.— Reuters

Brazil’s Bolsonaro leaves hospital after surgeries, returns to prison

BRASILIA — Former Brazilian President Jair Bolsonaro was discharged from hospital and taken to prison on Thursday after undergoing medical procedures to treat a hernia and hiccups, according to local media reports.

A Reuters witness saw official vehicles leaving the DF Star hospital early in the evening, where the 70-year-old was hospitalized, and heading to the Federal Police Superintendency in Brasilia, where he is serving a 27-year sentence for plotting a coup after losing the 2022 presidential election.

Earlier in the day, Supreme Court Justice Alexandre de Moraes rejected a request from Mr. Bolsonaro’s lawyers seeking permission for the former president to serve his sentence under “humanitarian house arrest.”

According to the ruling, after receiving the necessary medical clearance, Mr. Bolsonaro should “return to serve his prison sentence … at the Federal Police Superintendency.”

The DF Star hospital and the Federal Police declined to comment.

Mr. Bolsonaro, who was stabbed in the abdomen during a 2018 campaign event, has a history of hospitalizations and surgeries related to the attack.

The former president was admitted to hospital last week for the surgical procedures, authorized by Mr. Moraes following a request from the former president’s lawyers.— Reuters

China taxes condoms, contraceptive drugs in bid to spur birth rate

HONG KONG — China removed a three-decade-old tax exemption on contraceptive drugs and devices from January 1 in new steps to spur a flagging birth rate.

Condoms and contraceptive pills now incur value-added tax of 13%, the standard rate for most consumer goods.

The move comes as Beijing struggles to boost birth rates in the world’s second-largest economy. China’s population fell for a third consecutive year in 2024 and experts have cautioned the downturn will continue.

China exempted childcare subsidies from personal income tax and rolled out an annual childcare subsidy last year, following a series of “fertility-friendly” measures in 2024, such as urging colleges and universities to provide “love education” to portray marriage, love, fertility, and family in a positive light.

Top leaders again pledged last month at the annual Central Economic Work Conference to promote “positive marriage and childbearing attitudes” to stabilize birth rates.

China’s birth rates have been falling for decades as a result of the one-child policy China implemented from 1980 to 2015, and rapid urbanization.

The high cost of childcare and education as well as job uncertainty and a slowing economy have also discouraged many young Chinese from getting married and starting a family.— Reuters

Animal Kingdom Foundation Launches Hard-Hitting “Bugok!” Billboard Calling Out False Cage-Free Claims

Billboards are a common sight along NLEX but as they pass through in Apalit, Pampanga, a peculiar sight will greet them. A chicken with a basket of eggs beside her, staring directly at them from a roadside billboard. As they notice the chicken, they will read the headline that pulls no punches: “Bugok! Stop Lying.”

This new billboard has been unveiled by the Animal Kingdom Foundation (AKF). They are challenging companies that falsely claim to source cage-free eggs while refusing to provide transparency on where those eggs truly come from. Many fail to disclose which farms supply them or whether those farms meet any verifiable animal-welfare standards.

The case of these companies being bugok

In Filipino, bugok means “rotten,” this deliberate wordplay is used by AKF to spotlight the growing problem of greenwashing in the egg industry. There is a blatant dishonesty behind the growing number of companies claiming to use “cage-free” eggs without showing a shred of transparency.

According to AKF, some farmer claims that some of the large buyers are pushing for cage-free sourcing, only to back out when it came to pricing. They are operating in the assumption that the cost of cage-free eggs would be the same with the regular table eggs. This is problematic as the farmers take risks to improve hen welfare, only to be met with their buyers lowballing their prices for their egg produce.

A call for transparency and honest labeling

AKF appeals for verifiable sourcing hence additional message in the billboard “Get your eggs from certified cage-free farms.” Once these companies claim to use eggs sourced from true cage-free farms, it is their responsibility to substantiate these claims.

When companies use cage-free as a marketing badge while failing to support the very people producing them, that’s not just misleading — it’s exploitative. For AKF, this isn’t merely a marketing issue. It is a matter of integrity, consumer protection, and basic accountability. “Filipino consumers deserve honesty,” the organization said. “If a company claims to be cage-free, they must show proof — otherwise, that claim is bugok.”

How cage-free can actually be verified?

Locally, cage-free standards for egg farms are filed under the Philippine National Standards for Cage-Free Egg Production (PNS/BAFS 312:202). While there is no government endorsed cage-free certification scheme yet, AKF operates an independent cage-free auditing

program aligned with the criteria also being used by other countries globally. Farms must meet requirements on space, nesting areas, perches, litter, and hen behavior before receiving certification. A clear way to identify eggs that truly come from cage-free systems is established and are backed by on-site inspections, documentation and recurring audits.

Why cage-free matters?

Cage-free systems encourage hens to roam around and exhibit natural behaviors as opposed to the conventional cages where they spend their entire lives in cramped spaces. Cage-free egg production entails a meaningful step toward a more humane egg production.

The “Bugok!” billboard is AKF’s latest effort to educate the public and pressure companies to adopt real, verifiable animal-welfare policies. By placing the message along one of the country’s busiest expressways, the organization hopes to spark conversation on false advertising on humane sourcing of eggs.

Spotlight is BusinessWorld’s sponsored section that allows advertisers to amplify their brand and connect with BusinessWorld’s audience by publishing their stories on the BusinessWorld Web site. For more information, send an email to online@bworldonline.com.

Join us on Viber at https://bit.ly/3hv6bLA to get more updates and subscribe to BusinessWorld’s titles and get exclusive content through www.bworld-x.com.

Philippine PMI rebounds in December

By Aubrey Rose A. Inosante, Reporter

Philippine factory activity improved in December, rebounding from the slump in November amid a rise in new orders and softer decline in production.

S&P Global Philippines Manufacturing Purchasing Managers’ Index (PMI) expanded to 50.2 in December, a turnaround from November’s 47.4 which was the “strongest deterioration” in over four years.

The headline PMI is a composite indicator of manufacturing performance. A PMI reading below 50 shows a deterioration in operating conditions, while a reading above 50 denotes better operating conditions from the preceding month.

December saw the highest PMI in four months or since the 50.8 reading in August.

In a report on Friday, S&P Global said the local manufacturing sector closed the fourth quarter showing early signs of recovery, marking a slight improvement after months of “solid deterioration.”

“New order volumes rose for the first time in four months, which helped partly ease the ongoing downturn in production,” Maryam Baluch, economist at S&P Global Market Intelligence, said.

S&P Global said the rise in new orders in December snapped the three-month contraction, but the pace of increase remains modest.

However, overseas demand worsened in December, with fewer new export orders weighed the rise in overall sales.

“While the modest rise in new orders led to a softer fall in production levels, it was unable to reverse the downturn. Output fell moderately in December,” it said.

S&P Global said the drop in output led to four consecutive months of decline, the longest since 2021.

Meanwhile, the higher intake in new orders led manufacturing firms to raise their purchasing activity, the first time in three months and at the fastest pace since August.

“Fuelled by this positive direction, companies increased their purchasing activity for the first time since September, while the labor market showed signs of stabilizing,” Ms. Baluch said.

This allowed firms to better manage their inventory levels.

“After a sharp depletion in November, holdings of pre-production items were unchanged in December. Additionally, stocks of finished goods rose following a strong decline in November. Firms reportedly built up post-production inventories in anticipation of future demand,” S&P Global said.

According to the report, manufacturers reduced staffing for the second consecutive month, but at a weaker rate than in November.

“Some firms reduced workforce numbers in response to declining production requirements, but others increased staffing levels amid greater new order inflows and anticipations of improving demand conditions in the coming months,” S&P Global said.

Operating expenses slightly increased in December, driven by higher material prices that raised input costs. This is the weakest rate of inflation in the current 19‑month period of rising costs.

“Meanwhile, the pace of output price inflation accelerated from November, as many firms indicated they passed higher raw material costs on to customers,” it said.

At the same time, firms also reported longer input lead times in December, reversing the gains from November, due to port congestion and bad weather.

“With new orders rising while both production and employment remained in contraction, companies experienced a higher volume of requests for goods than they could fulfill. Consequently, backlogs of work increased further in December,” S&P Global said.

Despite this, manufacturers anticipate output to pick up over the next 12 months, along with upcoming projects, the launch of new product lines, and business expansion plans.

However, S&P Global noted that overall sentiment fell from November’s recent 12-month high.

“That said, the improvement was tepid across the sector, and its sustainability will largely depend on whether demand can be maintained and further bolstered, bringing growth back to production,” Ms. Baluch said.

She noted the sector faces headwinds from “sharply declining export market conditions, which are limiting the potential for broader expansion.”

“Consequently, at present, the manufacturing sector’s growth is primarily being driven by domestic demand, with external markets offering little support,” Ms. Baluch added.

Starlink plans to lower satellite orbit to enhance safety in 2026

STARLINK will begin a reconfiguration of its satellite constellation by lowering all of its satellites orbiting at around 550 kilometers (342 miles) to 480 kilometers (298 miles) over the course of 2026, Michael Nicolls, SpaceX’s vice president of Starlink engineering, said on Thursday.

The company is looking to increase space safety by lowering the satellites’ orbit.

This comes after Starlink said in December that one of its satellites experienced an anomaly in space, creating a “small” amount of debris and cutting off communications with the spacecraft at 418 km in altitude, a rare kinetic accident in orbit for the satellite internet giant.

The company had said the satellite, one of nearly 10,000 in space for its broadband internet network, quickly fell four kilometers in altitude, suggesting some kind of explosion occurred on board.

“Lowering the satellites results in condensing Starlink orbits, and will increase space safety in several ways,” Mr. Nicolls said in a post on social media platform X, adding “the number of debris objects and planned satellite constellations is significantly lower below 500 km, reducing the aggregate likelihood of collision.”

The number of spacecraft in Earth’s orbit has jumped sharply in recent years as companies and countries race to deploy tens of thousands of satellites for internet constellations and other space-based services such as communications and Earth imagery.

SpaceX, long known for its rocket launch business, has become the world’s largest satellite operator through Starlink, a network of nearly 10,000 satellites beaming broadband internet to consumers, governments, and enterprise customers.— Reuters

Several reported killed in Iran protests over economic hardships

DUBAI — Several people were killed during unrest in Iran, Iranian media and rights groups said on Thursday, as the biggest protests to hit the Islamic Republic for three years over worsening economic conditions sparked violence in several provinces.

The semi-official Fars news agency reported that three protesters were killed and 17 were injured during an attack on a police station in Iran’s western province of Lorestan.

“The rioters entered the police headquarters around 1800 (local time) on Thursday … they clashed with police forces and set fire to several police cars,” Fars reported.

Earlier, Fars and rights group Hengaw reported deaths in Lordegan city in the country’s Charmahal and Bakhtiari province. Authorities confirmed one death in the western city of Kuhdasht, and Hengaw reported another death in the central province of Isfahan.

The clashes between protesters and security forces mark a significant escalation in the unrest that has spread across the country since shopkeepers began protesting on Sunday over the government’s handling of a sharp currency slide and rapidly rising prices.

VIOLENCE REPORTED IN SEVERAL CITIES

Fars reported that two people had been killed in Lordegan in clashes between security services and what it called armed protesters. It earlier said several had died. Hengaw said several people had been killed and wounded there by security forces.

The Revolutionary Guards said one member of its affiliated Basij volunteer paramilitary unit had been killed in Kuhdasht and another 13 wounded, blaming demonstrators who it accused of taking advantage of the protests.

Hengaw said that the man, named by the Guards as Amirhossam Khodayari Fard, had been protesting and was killed by security forces.

Hengaw also reported that a protester was shot dead on Wednesday in Isfahan province in central Iran.

Reuters could not immediately verify any of those reports.

Protests also took place on Thursday in Marvdasht in the southern Fars province, the activist news site HRANA reported. Hengaw said demonstrators had been detained on Wednesday in the western provinces of Kermanshah, Khuzestan and Hamedan.

CRITICAL MOMENT FOR CLERICAL RULERS

Iran’s clerical rulers are grappling with Western sanctions that have battered an economy already reeling from more than 40% inflation, compounded by Israeli and US airstrikes in June targeting the country’s nuclear and ballistic missile infrastructure and military leadership.

Tehran has responded to the protests with an offer of dialogue alongside its security response.

Government spokesperson Fatemeh Mohajerani said on Thursday that the authorities would hold a direct dialogue with representatives of trades unions and merchants, but without giving details.

The Basij is a volunteer paramilitary force loyal to Supreme Leader Ayatollah Ali Khamenei. It is affiliated with the Islamic Revolutionary Guards Corps, which on Thursday accused those involved in the unrest in Kuhdasht of “taking advantage of the atmosphere of popular protests.”

GOVERNMENT SHUTDOWN

Merchants, shop owners and students in a number of Iranian universities have been demonstrating for days and closing major bazaars. The government shut down much of the country on Wednesday by declaring a holiday due to cold weather.

Authorities have in recent years quashed protests over issues ranging from high prices, droughts, women’s rights and political freedoms, often with tough security measures and extensive arrests.

Iran’s economy has been struggling for years, chiefly because of US and Western sanctions over Tehran’s nuclear program. Regional tensions led to a 12-day air war with Israel in June, further straining the country’s finances.

The Iranian rial lost around half its value against the dollar in 2025, with official inflation reaching 42.5% in December.— Reuters

China’s Xi to host South Korea’s Lee in New Year amid Japan tensions

SEOUL/BEIJING — Chinese President Xi Jinping will host South Korean President Lee Jae Myung on a state visit starting on Sunday, signaling Beijing’s intent to strengthen ties with Seoul amidst strained relations with Japan over Taiwan.

The visit marks the second meeting between Mr. Xi and Mr. Lee in just two months, an unusually short interval that signals China’s keen interest in reinforcing ties with Seoul and boosting economic collaboration and tourism, analysts say.

Relations between China and Japan are at their chilliest point in years after Japanese Prime Minister Sanae Takaichi suggested in November a hypothetical Chinese attack on Taiwan could trigger a military response from Tokyo.

Mr. Xi’s invitation to Mr. Lee for a state visit from Sunday is a calculated move aimed at deepening bilateral relations especially before the South Korean leader visits Japan, analysts say.

“China wants to emphasize South Korea’s importance slightly more than before,” said Kang Jun-young, professor of political economics at Hankuk University of Foreign Studies.

“China appears to have strategically decided that it would be better to have (Lee) visit China before South Korea holds a summit with Japan again,” he added.

The Lee administration has said it aims to “restore” ties with Beijing, acknowledging China is South Korea’s largest trading partner.

The pivot follows the two countries’ strained relations under Mr. Lee’s predecessor Yoon Suk Yeol, due to his closer alignment with Washington and Tokyo, as well as criticism of China’s handling of Taiwan.

Now, South Korea is trying to maintain balance but leaning towards cooperation with China to avoid being forced into any troubles that would threaten the Asian industrial powerhouse.

Mr. Lee said in December he wouldn’t take sides in the diplomatic dispute between China and Japan.

US ALLIANCE AND NORTH KOREA

Still, China and South Korea face complex issues as China challenges the US, South Korea’s major ally in the region, and as nuclear-armed North Korea remains unpredictable.

China is North Korea’s major ally and economic lifeline.

Shin Beom-chul, a former South Korean vice defense minister and a senior research fellow at the Sejong Institute, said Mr. Xi and Mr. Lee might discuss some contentious issues such as efforts to modernize the South Korea- US alliance that apparently aim to curb China’s dominance.

Currently, about 28,500 US troops are based in South Korea to counter any threat from North Korea.

US officials have signaled a plan to make those US forces more flexible to respond to other threats, such as defending Taiwan and checking China’s growing military reach.

“Korea is not simply responding to threats on the peninsula,” General Xavier Brunson, commander of US Forces Korea, said at a forum on Dec. 29. “Korea sits at the crossroads of broader regional dynamics that shape the balance of power across Northeast Asia.” he said.

Mr. Lee’s agenda with Mr. Xi includes persuading China to facilitate dialogue with North Korea, experts said.

North Korea has dismissed Mr. Lee’s outreach, labelling him a “hypocrite” and “confrontational maniac”.

Meanwhile, China and North Korea have been seeking closer coordination as North Korean leader Kim Jong Un stood shoulder to shoulder with Mr. Xi in September at a big military parade.

TECH, SUPPLY CHAINS AND K-POP

Mr. Lee’s visit to Beijing is expected to address cooperation in areas including critical minerals, supply chain and green industries, his office said earlier.

Seoul sources nearly half of its supply of rare earth minerals, critical to semiconductor manufacturing, come from China. Beijing also accounts for a third of Seoul’s annual chip exports, the largest market by far.

Last month, South Korean Industry Minister Kim Jung-kwan and Chinese Commerce Minister Wang Wentao agreed to work towards stable rare earth supplies, the South Korean industry ministry said.

The visit may also foster partnerships on artificial intelligence and advanced technologies, experts said.

China’s Huawei Technologies plans to roll out the Ascend 950 AI chips in South Korea next year, aiming to provide an alternative to Nvidia for Korean firms, Huawei’s South Korea CEO Balian Wang told a press conference last month.

Mr. Wang mentioned ongoing discussions with potential customers, without naming those clients.

Huawei did not address questions from Reuters about Mr. Wang’s comments.

Another issue at stake is Beijing’s effective ban on K-pop content since around the 2017 deployment of a US-led missile defense system in South Korea.

The chief executive of SM Entertainment, a leading K-pop agency will join Mr. Lee’s business delegation, according to local media.— Reuters

Dozens killed, 100 injured in fire at Swiss ski resort bar

CRANS-MONTANA — Around 40 people were killed and 115 injured when a fire ripped through a crowded bar during a New Year’s Eve party in the upscale Swiss ski resort of Crans-Montana, officials said on Thursday.

Police said the fire broke out at 1:30 a.m. (0030 GMT) as revelers were celebrating in a bar called Le Constellation in the resort in southwestern Switzerland, which locals said was popular with teenagers.

Swiss President Guy Parmelin described the disaster as “one of the worst tragedies our country has ever known” and said most of the dead were young people.

The cause of the blaze, which was initially reported as an explosion, remained unclear but authorities said the fire appeared to be an accident rather than an attack.

Authorities warned that naming the victims or establishing a definitive death toll would take time because many of the bodies were badly burned. Experts were using dental and DNA records to try to identify the dead.

SCENES OF PANIC

Video footage verified by Reuters showed fire spreading from the building, and witnesses described scenes of panic and confusion as people rushed to get out.

“There were people screaming, and then people lying on the ground, probably dead,” said 21-year-old Samuel Rapp, who saw the aftermath of the fire. “They had jackets over their faces.”

The head of the local canton’s police, Frederic Gisler, said around 40 people were presumed to be dead and 115 were injured, most of them seriously. He said it was too early to give details on the identity of the dead and injured but Italian authorities said 6 Italians were still missing and 13 in hospital.

Two young French women who said they were in the bar told France’s BFM TV that they saw the fire start in the basement section of the club after a bottle containing “birthday candles” was held up too close to the wooden ceiling.

“The fire spread across the ceiling super quickly,” one of the two women, who identified themselves as Emma and Albane, told BFM TV. The pair said they were able to climb a narrow staircase to the ground floor and escape the building. Minutes later, the fire had reached the ground floor too, they said.

BFM showed video of a waitress carrying a champagne bottle with a lit “fountain candle” through the bar, one of many in Crans-Montana, a fashionable ski center with an array of boutiques, luxury hotels, and restaurants. But the footage did not show the fire breaking out.

Local prosecutor Beatrice Pilloud said an investigation had been opened into the blaze at the bar, which Swiss company records showed was owned by a French couple, but she said it was too early to comment on any possible safety failures.

“There are still many circumstances to be clarified… The most likely scenario at present is that a widespread fire caused an explosion,” she told a press conference.

VICTIMS FROM SEVERAL COUNTRIES

Witnesses said many of those celebrating in the bar appeared to be from different countries. Foreign governments were calling around to establish whether their nationals were among the victims but were facing a lengthy process because the severity of the burns had rendered identification challenging, one European official said.

“We met the families this afternoon and it’s terrible because to be in front of them with all their fear and apprehension and terrible anxiety and we don’t have all the answers. And we won’t have them straight away because identifying them will take time. It’s a terrible situation on the ground. Unimaginable,” Mathias Reynard, president of the Valais cantonal government, told Reuters, his voice breaking.

Eight French people were missing, the French foreign ministry said, adding that it could not rule out that French nationals were among the dead.

French President Emmanuel Macron spoke to his Swiss counterpart to offer assistance. Three survivors of the fire have been moved to French hospitals and further transfers were under way, the ministry added.

Italy’s ambassador to Switzerland, Gian Lorenzo Cornado, told Sky TG24 that local authorities had told him the fire was started by someone letting off a firework inside the bar.

Witnesses described injured being treated in improvised triage centers set up in a nearby bar and in a branch of UBS bank and said many suffered after coming out of the heat of the bar into the freezing night air.

“And then it was just ambulances coming back and forth as much as possible,” said Dominic Dubois, who witnessed the frantic scenes as the bodies were brought out.

Video footage showed lines of ambulances queuing and helicopters landing to take victims to nearby hospitals and specialist burn units in other Swiss cities, including Lausanne and Zurich. Switzerland’s neighbors, France, Germany and Italy, also offered to treat victims in their own centers.

On Thursday morning, footage from the street outside showed the area cordoned off, with forensic tents behind white screens set up in front of the bar.

Hundreds of people paid their respects to the victims at the top of the road in front of the scene on Thursday evening. Dozens left flowers or lit candles on a makeshift altar in front of the police cordon as a large crowd stood in silence in the frosty night.

Crans-Montana is due to host next year’s Alpine World Ski Championships. Swiss officials said the fire was unprecedented in Switzerland.

“What was meant to be a moment of joy turned, on the first day of the year in Crans-Montana, into mourning that touches the entire country and far beyond,” Mr. Parmelin said on the social media platform X.— Reuters

NG borrowings surge in November

By Aubrey Rose A. Inosante, Reporter

THE NATIONAL Government’s (NG) gross borrowings surged in November amid a sharp rise in domestic and foreign borrowings, the Bureau of the Treasury (BTr) said.

Latest data from the Treasury showed that total gross borrowings jumped by 74.55% to P113.53 billion from P65.05 billion in the same month a year ago.

Month on month, gross borrowings rose by 29.3% from P87.81 billion in October.

Domestic borrowings increased by 59.57% to P78 billion in November from P48.88 billion in the same month last year. This accounted for the bulk or 68.7% of the total gross borrowings in November.

Domestic borrowings were mainly composed of P70 billion in fixed-rate Treasury bonds (T-bonds) and P8 billion in Treasury bills (T-bills).

On the other hand, external borrowings, which mainly consisted of project loans, jumped by 119.81% to P35.53 billion in November from P16.17 billion in the previous year.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said the higher gross borrowings in November were due to the need to plug the budget deficit.

“This could be attributed to the continued NG budget deficit that needs to be financed by NG borrowings/debt, despite lower maturing government bonds in the fourth quarter,” he said in a Viber message.

In the first 11 months of the year, NG’s gross borrowings inched up by 4.07% to P2.6 trillion from P2.49 trillion a year ago.

The 11-month tally made up around 99.85% of the revised P2.6-trillion financing program for 2025.

As of end-November, domestic borrowings made up 81.32% of the total.

Domestic debt went up by 10.42% to P2.11 trillion in the period ending November from P1.91 trillion a year ago.

This accounted for 99.98% of the P2.112-trillion domestic borrowing program for the year.

Domestic debt was composed of P1.19 trillion in fixed-rate T-bonds, P425.61 billion in retail T-bonds, P300 billion fixed-rate Treasury notes, and P192.2 billion in T-bills.

Meanwhile, gross external borrowings stood at P484.89 billion as of end-November, 16.75% down from P582.41 billion a year ago.

This accounted for 99.33% of the P488.174-billion external borrowing program this year.

Broken down, foreign debt included P201.35 billion in program loans, P191.97 billion in global bonds, and P91.57 billion in project loans.

The end‑November external debt reflected the $3.3-billion global bond issuance completed in late January and settled in February.

Mr. Ricafort said there is a seasonal increase in the budget deficit towards the end of the year, which would require more borrowings to finance the widening budget deficit.

The budget deficit shrank by 26.02% year on year to P157.6 billion in November, but still pushed the fiscal gap to P1.26 trillion in the 11-month period.

This represented 80.92% of the revised full-year target of P1.56 trillion for 2025.

White corn gives Cagayan farmers a lifeline after years of debt and flood losses

By Vonn Andrei E. Villamiel

CAGAYAN — For decades, Crecencia B. Garan planted yellow corn in the river plains of Alcala, Cagayan — only to watch most of her earnings circle back to the middlemen who financed her inputs.

Each planting season left the 67-year-old Filipino deeper in debt, and each flood that swept through her low-lying community wiped out whatever gains remained.

“For yellow corn, we shoulder all the expenses, and we often borrow from middlemen,” she told reporters invited by the Agriculture department to Alcala on Dec. 5 in Filipino. “What we earn just ends up being used to pay our debts.”

Today, Ms. Garan says she is finally making money from the same land. She is part of a small but rising group of farmers shifting to white corn, a variety long grown for household consumption but now fetching higher prices and attracting steadier buyers as Alcala tries to rewire its corn economy.

Today, Ms. Garan says she is finally making money from the same land. She is part of a small but rising group of farmers shifting to white corn, a variety long grown for household consumption but now fetching higher prices and attracting steadier buyers as Alcala tries to rewire its corn economy.

While yellow corn is a feed and industrial crop, white corn is eaten directly and draws higher farmgate prices — P35 to P45 per kilo, roughly double the P18 farmers usually get for yellow corn.

Grown alongside the yellow variety, white corn has become a crucial second stream of income that helps farmers absorb losses from the more volatile yellow corn market.

Input access has also changed the equation. Seeds, fertilizer and pesticides are provided by government programs pushing white corn planting, while Alcala’s municipal processing hub buys the harvest and channels it to institutional buyers.

“Because of white corn, we earn more because of higher prices,” Ms. Garan said. “Farmers also receive free fertilizer and insecticide, and we can borrow tractors and rotavators.”

Alcala’s farmers have long depended on yellow corn, grown across more than 4,200 hectares and sold to livestock growers and feed millers across Cagayan Valley.

That model began to crack after Typhoon Ulysses struck in 2020, sending floodwaters across the province and destroying about P52 million worth of crops and livestock in Alcala alone.

Municipal agriculturist Vincent C. Espejo said years of heavy herbicide use in yellow corn areas contributed to vegetation loss and soil runoff, worsening the impact of flooding.

Local officials began looking for crops that required fewer chemicals and encouraged more manual weeding — conditions that pointed them to white corn.

“We have about 4,200 hectares planted to yellow corn, and almost all of them use herbicide,” Mr. Espejo said in Filipino. “The local government decided to adopt white corn because it does not use herbicide.”

Today, about 100 hectares in Alcala are planted with white corn, producing roughly 170 metric tons per cycle.

The changes required deliberate intervention. During the first harvests, the town government had to buy white corn because there were no buyers yet.

“We bought it at P25 per kilo and sold it at P20 per kilo,” Mr. Espejo said. “The LGU (local government unit) would incur losses, and that was not sustainable.”

That experience led to the creation of the Alcala Product Center, which now buys white corn, processes part of it, and connects farmers to institutional buyers.

One of them is snack maker Nacho King, which buys at P45 per kilo and has a monthly requirement of up to 10 metric tons, according to Alcala’s agriculture office.

‘BIG BROTHER’

The center’s purchases reach about 30 metric tons per cropping cycle. Roughly 3 tons are turned into corn-based products — noodles, coffee, corn bits and corn rice — sold in groceries, trade fairs and pasalubong stores, reaching markets as far as Manila and Palawan.

The Alcala Fine Producers Cooperative, which manages the center, uses what it calls a “big-brother, small-brother” setup to support growers.

“We are the big brother, and they are the small brother,” cooperative manager Jennifer M. Pagaduan told reporters in Filipino. “We help them process and market their products. They no longer need to find buyers themselves.”

For farmers like Belly A. Duruin, president of the White Corn Growers Association, the mix of input assistance, equipment access and market guarantees has transformed their outlook.

“This is a big help to us farmers,” she said in Filipino. “Because of growing white corn, our income increased. We no longer suffer losses.”

Still, expansion remains slow. Of Alcala’s more than 4,000 hectares of corn land, only around 100 hectares have shifted to white corn. Habits, market familiarity, and yield differences continue to anchor farmers to yellow corn.

“White corn is more labor intensive,” Mr. Espejo separately told BusinessWorld. “Unlike yellow corn, which only needs to be sprayed with herbicide, white corn requires manual weeding.”

White corn yields about 2 metric tons per hectare, less than half the 5 tons typical for yellow corn. And although white corn commands higher prices, its market is smaller. Yellow corn remains easier to sell — traders and livestock growers will pick it up directly from farms.

The processing center has also reached its limits. Drying equipment is scarce, and the town still lacks a proper warehouse for bigger volumes.

Despite the constraints, Alcala sees momentum turning. As more buyers explore white corn for snacks and other food products, farmers are finding demand that did not exist just a few years ago.

“When demand for white corn increases, production will also increase. Before, buyers could only find yellow corn, but now producers are available,” Mr. Espejo said.

The local government aims to expand white corn planting to 20% of Alcala’s corn land — around 800 hectares — within five years.

The expectation is that demand for locally grown white corn will continue rising as processors and food manufacturers search for unique ingredients and as consumers explore alternatives to traditional staples.

For now, farmers like Ms. Garan say white corn has already changed their lives. After decades of borrowing from middlemen, she says she no longer ends each harvest season in debt.

“We no longer suffer losses. We earn more now.”