By Keisha B. Ta-asan, Reporter

ANNUAL INFLATION sharply slowed in October after two straight months of acceleration, reflecting easing prices of key food items, the Philippine Statistics Authority (PSA) said on Tuesday.

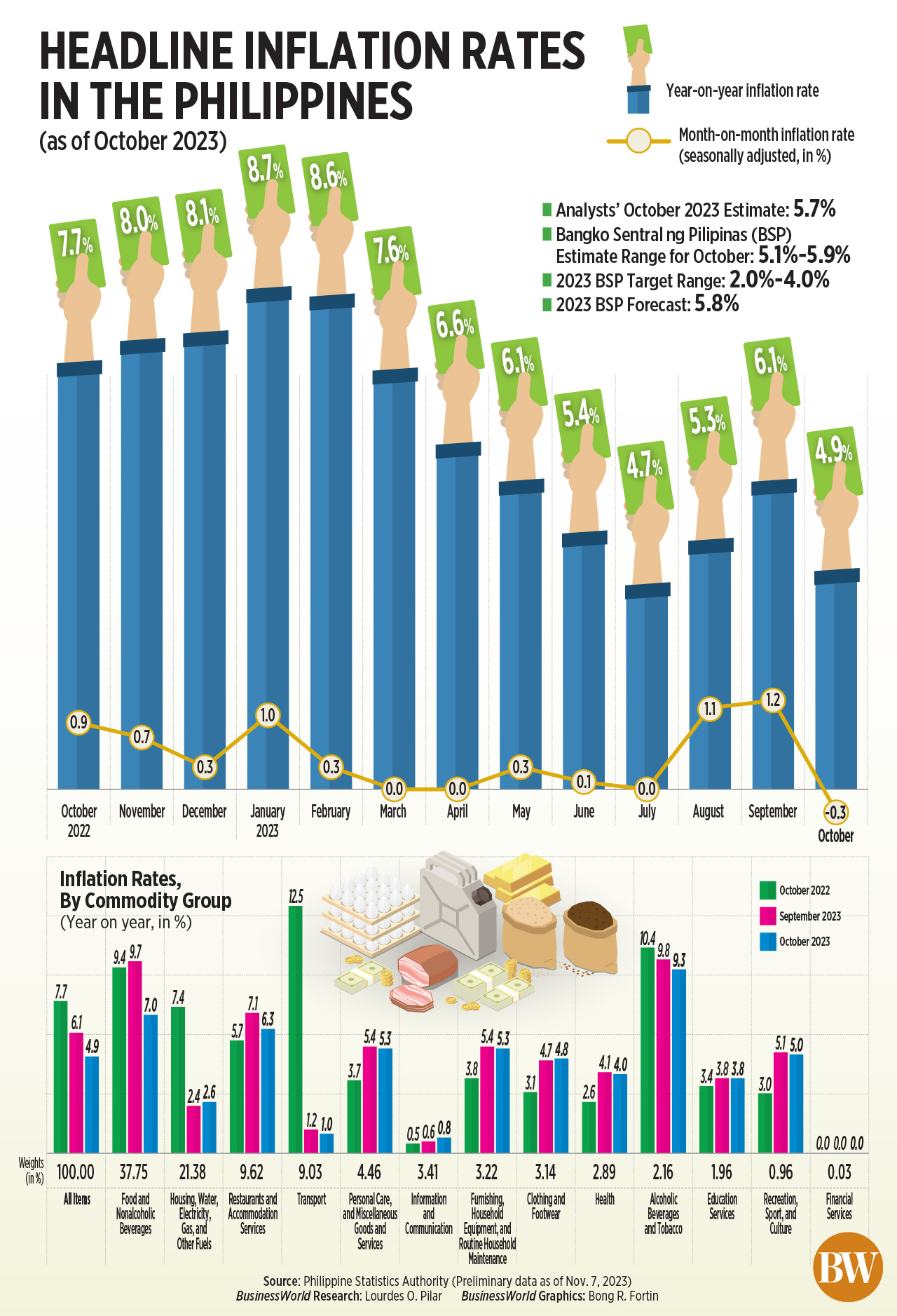

Preliminary data from the PSA showed headline inflation eased to 4.9% in October from 6.1% in September and 7.7% in October 2022.

This was significantly slower than the 5.7% median estimate in a BusinessWorld poll last week. The figure was also below the 5.1-5.9% forecast of the Bangko Sentral ng Pilipinas (BSP) for the month.

The latest inflation print was the slowest pace in three months or since the 4.7% in July. However, October marked the 19th straight month that inflation breached the central bank’s 2-4% target band.

The latest inflation print was the slowest pace in three months or since the 4.7% in July. However, October marked the 19th straight month that inflation breached the central bank’s 2-4% target band.

Stripping out the seasonality effects on prices, the consumer price index (CPI) declined by 0.2% month on month.

For the 10-month period, inflation averaged 6.4%. This is still above the BSP’s 5.8% full-year forecast.

“If we don’t see any shocks, supply shocks, our view is that inflation rate will go down,” National Statistician Claire Dennis S. Mapa said at a briefing on Tuesday.

Core inflation, which excludes food and fuel volatile prices, further slowed to 5.3% in October from 5.9% in September. Year to date, core inflation stood at 7%.

Mr. Mapa said that the sharp slowdown in October inflation reflected easing food prices.

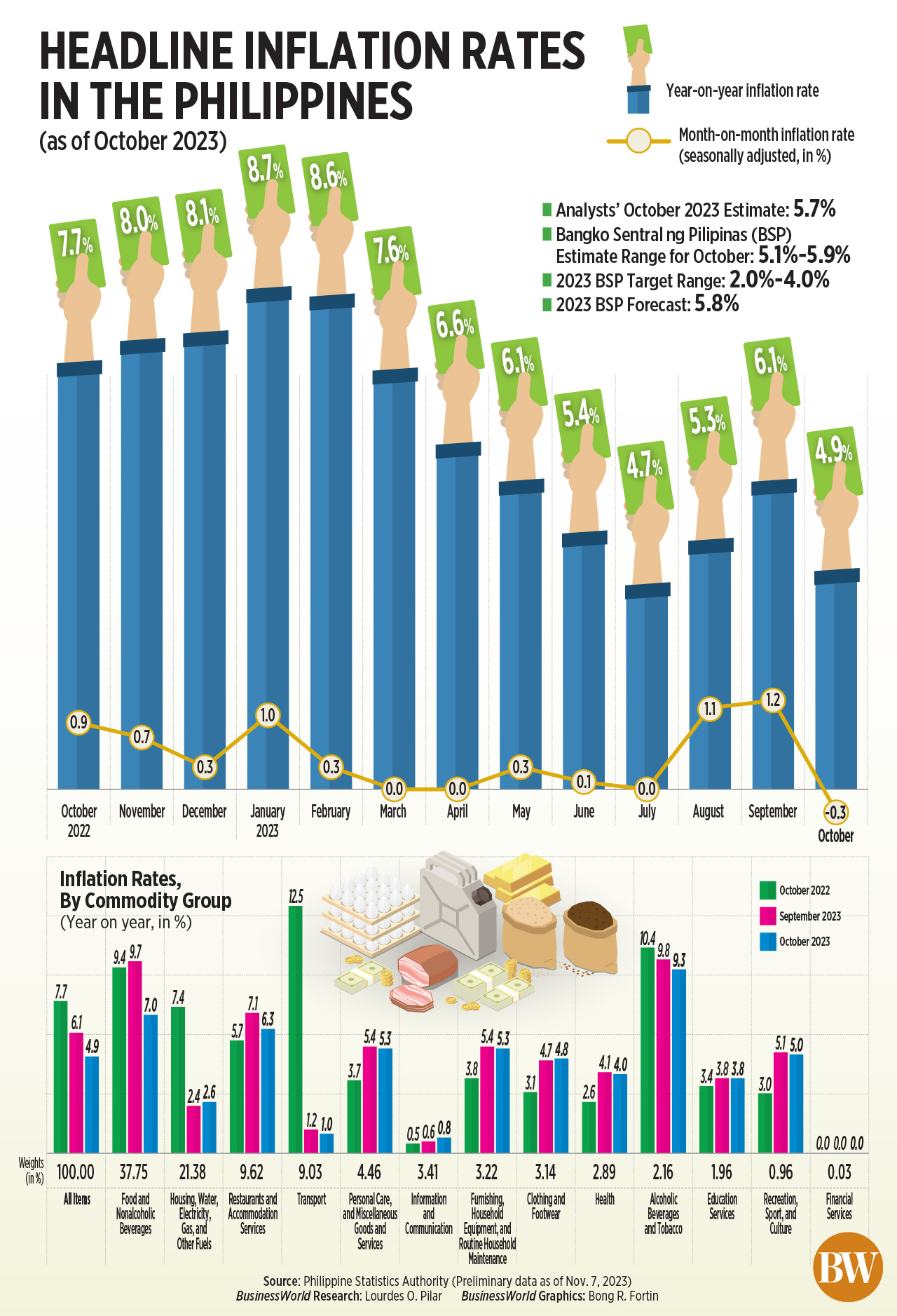

The heavily weighted index for food and non-alcoholic beverages eased to 7% year on year in October from 9.7% in September.

The food-alone index likewise slowed to 7.1% in October from 10% in the previous month. The deceleration in food inflation was mainly due to lower prices of vegetables and rice.

The annual growth of vegetables, tubers, plantains, cooking bananas and pulses slowed to 11.9% from 29.6% in September.

Rice inflation also eased to 13.2% in October from the 14-year high of 17.9% in September.

Mr. Mapa said the average price of regular milled rice last month went down to P45.40 per kilogram from P47.50 in September. The average price of well-milled rice also slid to P51 per kilo in October from an average of P52.70 a month earlier.

However, rice prices remained higher than last year when prices of regular and well-milled rice stood at P39.70 per kilo and P44 per kilo, respectively.

“Rice inflation slowed down following the onset of peak harvest and import arrivals. The stable supply of vegetables as harvest season comes likewise resulted in a slower inflation rate of the commodity,” National Economic and Development Authority (NEDA) Secretary Arsenio M. Balisacan said in a statement.

Also, Mr. Mapa noted food inflation contributed 2.5 percentage points (ppts) to the overall CPI basket.

Inflation of the following commodities also decelerated: fish (5.6% from 6.1%), bread and other cereals (7.4% from 8.1%), sugar (4.9% from 9%), and meat (0.8% from 1.3%).

The inflation rate of restaurants and accommodation services slowed to 6.3% in October from 7.1% in September, which Mr. Mapa said was due to high base effects, lower prices of food items, and easing utility rates.

Transport inflation also slowed to 1% in October from 1.2% a month ago despite the P1 jeepney fare increase. This was due to the lower pump prices during the month.

In October, oil companies slashed pump prices for gasoline by P3.1 per liter, diesel by P0.45 per liter, and kerosene by P4.40 per liter, data from the Energy department showed.

Other commodity groups that reported slower annual increases in October include alcoholic beverages and tobacco (9.3% from 9.8% in September) and furnishings, household equipment and routine household maintenance (5.3% from 5.4%).

Faster inflation was seen in clothing and footwear (4.8% from 4.7%); and housing, water, electricity, gas and other fuels (2.6% from 2.4%).

Meanwhile, inflation in the National Capital Region (NCR) slowed to 4.9% in October from 6.1% in September, while inflation in areas outside Metro Manila eased to 4.9% from 6% in the prior month.

All regions outside NCR also recorded slower inflation rates, except for Region VII (Central Visayas), which posted a higher annual increase of 4.1% in October from 3.8% a month prior.

Meanwhile, the October inflation rate for the bottom 30% of income households slowed to 5.3% from 6.9% in September and 8.9% last year. The 10-month average stood at 7.1%.

THREATS AND RISKS

For PSA’s Mr. Mapa, headline inflation will continue to go down in the coming months barring any supply shocks.

Mr. Balisacan said that even though inflation eased in October, it is still crucial to monitor commodity prices, especially food, transportation, and energy, amid global challenges such as geopolitical uncertainties and the El Niño weather event.

“Moreover, it is important to ensure that the most vulnerable sectors of society are protected and provided assistance, especially while food prices remain high and we expect El Niño to affect local and global food production,” he said.

On the sidelines of the Philippine Economic Society Annual Meeting, Mr. Balisacan said November, December, and January are good months for the agriculture sector, as there are fewer typhoons.

However, demand would be high during the Christmas season, and this may contribute to upward pressures on inflation.

“(Inflation) can probably go (to 2-4%) early next year,” he said. “We are now at 4.9%. If we can get another 1.2-percentage-point reduction, that’s now within the 2-4% band. But still, we want to see progress in the reduction,” Mr. Balisacan said.

In a statement, the Department of Finance (DoF) said the government will continue to implement measures to ensure rice and vegetable inflation will go down for the rest of 2023. This includes the utilization of the Rice Competitiveness Enhancement Fund programs, as well as measures to control nonfood inflation such as demand and supply management for energy and water, careful review of wage and transport fare hikes, and monitoring the suspension of pass-through fees for delivery trucks.

“This ensures the protection of the purchasing power of the most vulnerable families and the continued delivery of essential services such as public transportation and agricultural activities,” Finance Secretary Benjamin E. Diokno said.

BSP PAUSE?

HSBC ASEAN economist Aris Dacanay said inflation will continue to slow in the coming months due to base effects and easing global rice prices.

“Barring any new and unexpected supply shock, we expect the BSP to keep interest rates steady at 6.5% in the upcoming Monetary Board meeting but remain hawkish in tone,” he said in a note.

Last week, the BSP hiked borrowing costs by 25 basis points (bps) in an off-cycle move, bringing the key rate to a fresh 16-year high of 6.5%. The BSP has raised policy rates by 450 bps since May 2022.

The BSP’s next policy-setting meeting is scheduled for Nov. 16.

However, even if inflation returns to the 2-4% target range, headline CPI may rise again, Mr. Dacanay said.

“Our baseline scenario is for inflation to average above 4% in the second quarter of 2024. Triggering the inflation flare up will be the expiration of Executive Order No. 10, an order that temporarily reduces the tariff rates for rice, corn, coal, and pork,” he said.

“We estimate its expiration to add 1.4 ppts to the inflation outlook. Since this is expected, this will likely lead the BSP to keep policy rates high for a prolonged period. We only expect rate cuts to begin in the third quarter of 2024,” he added.

Pantheon Macroeconomics Chief Emerging Asia Economist Miguel Chanco in a note said achieving the 2-4% inflation target band is still doable by the end of the year.

“Not surprisingly from our perspective, today’s report shows a big U-turn in food inflation,” he said. “We expect this U-turn to continue until early next year, particularly with base effects remaining quite favorable.”

Mr. Chanco said the BSP may start cutting policy rates in the first quarter of 2024, with a total of 100-bp worth of easing next year.

The BSP projects the full-year inflation to hit 5.8% for 2023, before slowing to 3.5% in 2024 and 3.4% in 2025. But officials have said they will likely revise their inflation forecasts on Nov. 16. — with inputs from Luisa Maria Jacinta C. Jocson