Mouthwash may cure ‘the clap’

PARIS — In the 19th century, before the advent of antibiotics, Listerine mouthwash was marketed as a cure for gonorrhoea. More than 100 years later, researchers said Tuesday the claim may be true.

‘February cut on the table,’ says BSP governor Remolona

FURTHER MONETARY POLICY easing might come as early as the Monetary Board’s first meeting for 2026 amid subdued inflation and dismal economic growth last year, the Bangko Sentral ng Pilipinas (BSP) said.

Asked about the likelihood of a February cut, BSP Governor Eli M. Remolona, Jr. said: “(It’s) on the table. Unlikely pero puwede naman (but we could deliver it).”

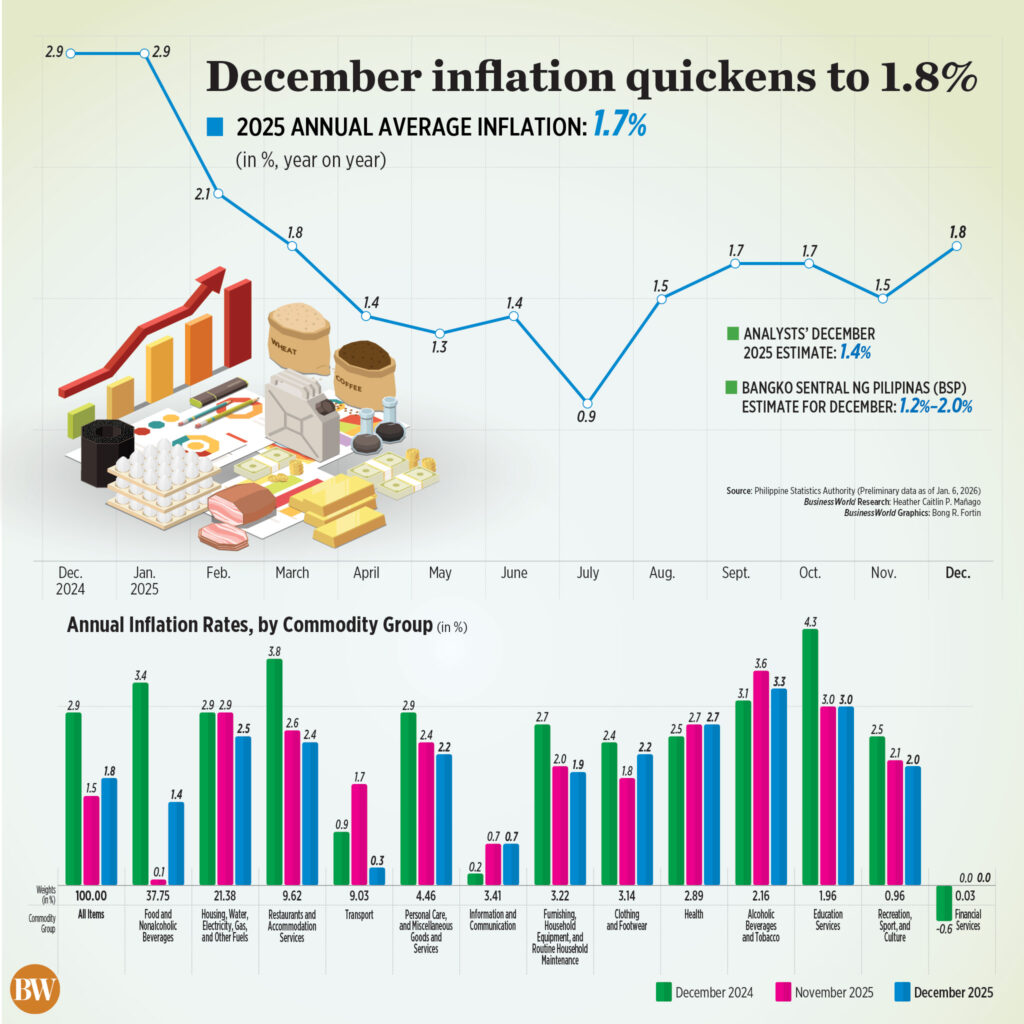

Mr. Remolona said that the latest December inflation print of 1.8% is a “reasonably low rate,” even as it quickened from 1.5% in November. Year on year, it slowed from 2.9% in December 2024.

Philippine economic growth in 2025 also likely fell below the government’s target, he added.

“I can say that we’re very close to where we want to be in terms of policy,” he told journalists in Mandaluyong City. “There’s a chance that we may cut some more, and there’s also a chance that we may not move at all. But there’s not a lot of probability that we will raise in 2026.”

The Monetary Board ended last year with a fifth straight 25-basis-point (bp) cut at its Dec. 11 meeting, bringing the key policy rate to its lowest in over three years at 4.5%.

It has so far delivered 200 bps in total cuts since it began its easing cycle in August 2024.

The central bank chief said the country’s gross domestic product (GDP) may have expanded by 4.6% last year as the flood control corruption scandal continued to drag consumer and investor confidence.

This would be below the government’s 5.5%-6.5% target for the year and also lower than the Development Budget Coordination Committee’s (DBCC) latest projection of 4.8%-5%.

“There was a loss of confidence of investors. So, investments came down. Consumption also came down,” Mr. Remolona said.

“When you realize that your taxes are not really going into infrastructure spending, masakit ’yon eh (that’s painful)… It’s more painful when you know it’s going to the wrong guys. So, that has a big effect,” he added.

In the third quarter, GDP growth slumped to an over four-year low of 4% amid allegations that Public Works officials, lawmakers and private contractors received kickbacks from anomalous flood control projects.

Economic managers have since conceded that the economy likely failed to meet the government’s growth target for 2025.

Meanwhile, the BSP has repeatedly said following its December meeting that further easing is now limited and would depend on economic developments in the country.

Mr. Remolona said they may only deliver two 25-bp cuts if growth slows to below 5% this year due to weak demand.

“If we cut two more times, medyo ibig sabihin nu’n, things are worse than we thought (that might mean that things are worse than we thought). So, that would require a bad surprise in the data,” Mr. Remolona said.

“If growth is much slower than we anticipated. We’re saying that for 2026, growth will be 5.4%. If it goes below 5%, then there’s ground for one more cut beyond the 25 bps,” he added.

For 2026, the central bank sees GDP growth averaging 5.4%, noting that the economy will likely remain sluggish in the first half before picking up in the second half.

“Mahaba pala ’tong impact eh ’yung loss of confidence (The impact of the loss of confidence may be prolonged)… it will continue through the first half of 2026,” Mr. Remolona said, noting that a 5.4% growth is “not bad” considering the flood control scandal.

The DBCC on Monday revised its growth target for this year to 5-6% from the 6-7% goal previously.

Economic growth may further improve to 6.2% in 2027, the BSP chief added, settling near the upper bound of the administration’s 5.5%-6.5% revised goal.

The Monetary Board is set to have its first policy meeting this year on Feb. 19. — Katherine K. Chan

Inflation eases to 1.7% in 2025, slowest in 9 years

By Katherine K. Chan, Reporter

HIGHER FOOD PRICES during the holiday season lifted inflation to 1.8% in December, although the full-year average eased to 1.7% — the slowest in nearly a decade, the Philippine Statistics Authority (PSA) reported on Tuesday.

PSA data showed that last month’s consumer price index (CPI) quickened to 1.8% from 1.5% in November. Year on year, it slowed from 2.9% in December 2024.

December saw the fastest inflation since February or when inflation stood at 2.1%, but matched the 1.8% in March.

The latest CPI fell within the central bank’s 1.2-2% forecast for the month, but above the 1.4% median estimate in a BusinessWorld poll of 14 analysts conducted last week.

December marked the tenth consecutive month that inflation undershot the Bangko Sentral ng Pilipinas’ (BSP) 2-4% target.

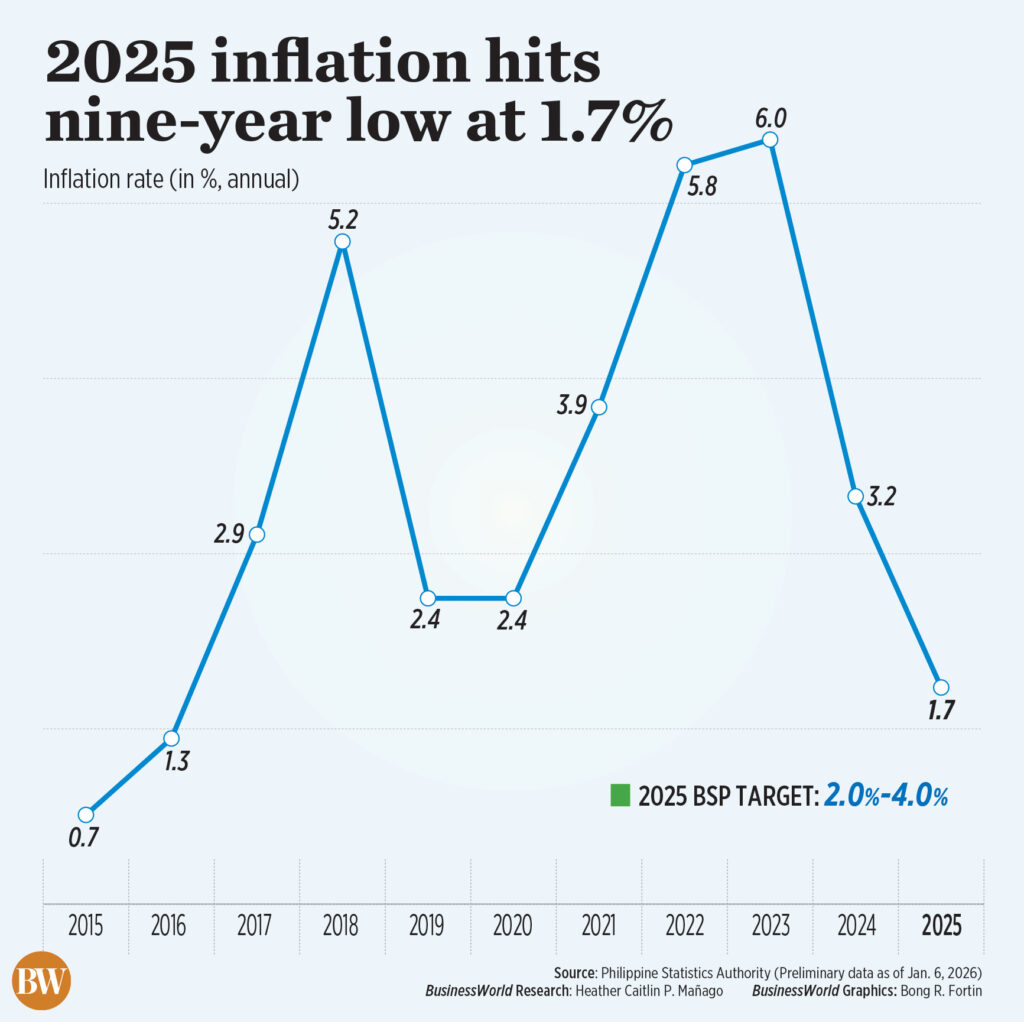

The December print brought average inflation to 1.7% in 2025, easing from 3.2% in 2024. This was the slowest rate in nine years or since the 1.3% clip in 2016. It was also a tad above the central bank’s 1.6% estimate for the year.

“The major reason (for faster inflation) is really food, nonalcoholic beverages, particularly vegetables,” National Statistician Claire Dennis S. Mapa told a press briefing on Tuesday.

“(Prices of) vegetables and flour products rose. These are what we used for consumption in December, part of the holiday effect,” he added in mixed English and Filipino.

Inflation for the heavily weighted food and nonalcoholic beverages index accelerated to 1.4% from 0.1% in November amid faster price increases in cereals, cereal products, vegetables, tubers, fish and fruits.

According to Mr. Mapa, onion prices surged by 79% in December, followed by broad beans which rose by 41%, eggplants by 29.4%, okra by 28%, string beans by 24%, and tomatoes by 20.1%.

He also attributed the costlier vegetables last month to weather disruptions in November.

In November, Typhoon Kalmaegi (local name: Tino) battered parts of the country, leaving the local agricultural sector with about P2.5 billion in losses.

Rice deflation eased to -12.3% in December from -15.4% in the previous month. This was the slowest decline in rice prices in eight months or since -10.9% in April.

In mid-December, the average price of regular milled rice declined by 14.05% year on year to P42.10 per kilo from P48.98 per kilo previously, based on PSA data. Well-milled rice likewise fell by 9.9% year on year to P49.53 per kilo, while special rice fell by an annual 7.17% to P58.91 per kilo.

The National Government extended the suspension of regular and well-milled rice imports until end-2025.

CHEAPER ELECTRICITY, FUEL

Meanwhile, lower electricity and fuel prices during the month offered some relief, with inflation for housing, water, electricity, gas and other fuels slowing to 2.5% from 2.9% in November.

In December, the Manila Electric Co. (Meralco) lowered electricity rates by P0.3557 per kilowatt-hour (kWh) to P13.1145 per kWh from P13.4702 per kWh in November. This was equivalent to a P71 decrease in the monthly electricity bills of households consuming an average of 200 kWh.

Pump price adjustments in December recorded a net increase of P0.80 per liter for gasoline. However, prices of diesel saw a net decrease of P3.80 per liter, while kerosene posted a net decrease of P4.40 per liter.

PSA’s Mr. Mapa noted that the holiday-driven pressures may signal that the inflation spike in December was seasonal and temporary, adding that he hopes “prices will go back down in January.”

“Despite global headwinds and domestic challenges, the Philippine economy has remained resilient against inflationary pressures due to the government’s timely and targeted interventions,” Economy Secretary Arsenio M. Balisacan said in a statement.

Finance Secretary Frederick D. Go said the Department of Finance is focused on implementing “necessary measures to keep inflation manageable and ensure that Filipino families are protected from price shocks.”

Meanwhile, PSA data also showed that core inflation, which excludes volatile prices of food and fuel, steadied month on month at 2.4% in December, but eased from 2.8% in the same month in 2024.

In 2025, core inflation averaged 2.4%, easing from 3% in 2024.

Inflation in the National Capital Region (NCR) cooled to 2.3% in December from 2.8% in November and 3.1% in the same month a year ago. This brought full-year inflation in NCR to 2.4% in 2025 from 2.6% in 2024.

Outside NCR, inflation picked up to 1.7% from 1.2% in November but eased from 2.9% in December 2024, bringing the full-year average to 1.5%.

Central Visayas saw the highest inflation rate at 3.8%, while the Bangsamoro Autonomous Region in Muslim Mindanao recorded a -1% deflation.

On the other hand, inflation for the bottom 30% of income households stood at 1.1% in December, reversing the -0.2% in November but slowed from 2.5% in December 2024.

In 2025, inflation for the bottom 30% averaged 0.3%, easing from 4.9% in the previous year.

FURTHER EASING

Meanwhile, the central bank noted that the December clip supported its benign inflation outlook for 2025 and the next two years.

“(The) 1.8% is a welcome number. It’s a reasonably low inflation rate,” BSP Governor Eli M. Remolona, Jr. told reporters during an event in Mandaluyong City on Tuesday.

Amid this, Mr. Remolona left the door open for another 25-basis-point (bp) reduction to the key policy rate in February, noting that economic data falling below their expectations may warrant further cuts.

“On balance, the Monetary Board views the monetary policy easing cycle as nearing its end,” the BSP said. “Any further easing is likely to be limited and guided by incoming data.”

The central bank has so far lowered borrowing costs by a total of 200 bps since August 2024, bringing the benchmark interest rate to an over three-year low of 4.5%.

For 2026, the BSP sees inflation accelerating to 3.2%, before cooling to 3% in 2027.

Chinabank Research projects faster inflation this year due to a low base effect from the 2025 as well as potential upticks in food and energy prices amid weather disruptions and geopolitical tensions.

“This 2026, we expect inflation to edge higher to around the midpoint of the target range, partly due to base effects from last year’s low readings,” it said in a commentary. “Still, barring new shocks, price pressures are projected to remain manageable moving forward.”

Chinabank Research said this gives the BSP room to trim its key rates this year to spur the economy.

Meanwhile, Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said headline inflation will likely stay below target until February before rising to 2-3% by March.

“(This) could still justify future local policy rate cut/s that would match future Fed rate cuts in 2026, (which) could realistically happen in the latter part of 2026, as early as June 2026, based on the latest Fed Funds Futures,” he added.

Factory output grows at slowest pace in 7 months

MANUFACTURING OUTPUT growth fell to a seven‑month low in November, weighed down by weak domestic consumption and sluggish export demand.

Preliminary results of the Philippine Statistics Authority’s (PSA) latest Monthly Integrated Survey of Selected Industries showed factory output, as measured by the volume of production index, fell by 1.5% year on year in November, a reversal from the revised 1% growth in October.

Year on year, the decline slowed from the 4.5% drop in November 2024.

The November reading was the slowest output growth in seven months or since the 2.4% decline in April 2025.

On a monthly basis, November’s output contracted by 2.8%, reversing the 5% growth in October. Stripping out seasonality factors, it slipped by 3.5%.

Year to date, factory output fell by 0.1%, a reversal from the 0.7% growth in the same period in 2024.

PSA data showed the November manufacturing performance was mainly due to the slower month-on-month growth in food products (4.2% in November from 8.1% in October); and the decline in coke and refined petroleum products (-11.4% from -2.7%); and beverages (-2.8% from 4.9% growth).

“Manufacturing output contracted by 1.5% in November, reflecting a sharper deterioration in operating conditions as the Philippines Manufacturing Purchasing Managers’ Index (PMI) fell to 47.4 from 50.1, driven by weak domestic and export demand and typhoon‑related production disruptions,” Union Bank of the Philippines Chief Economist Ruben Carlo O. Asuncion said in an e-mail.

S&P Global PMI fell to over a four-year low of 47.4 in November, a reversal from the 50.1 in October.

“Beyond these, we continue to monitor declining export orders, softer purchasing activity, thinning inventories, and early signs of labor shedding — signals consistent with a sector adjusting to both global headwinds and domestic supply constraints,” added Mr. Asuncion.

Nicholas Antonio T. Mapa, chief economist at Metropolitan Bank & Trust Co., said the manufacturing performance reflected the slowdown in economic activity in the third quarter.

“In particular, softer household consumption may have weighed on volume of production,” he said in an e-mail.

In the third quarter, GDP grew by 4%, the slowest in over four years. This brought the nine-month average growth to 5%, below the government’s 5.5%-6.5% target.

Philippine Chamber of Commerce and Industry Chairman Sergio R. Ortiz-Luis, Jr. said that the decline in November came after most orders were frontloaded in the first nine months of 2025.

“Actually, both local and export production were fast-tracked in the first three quarters of the year… There was front-loading for year-end deliveries. So, production tapered down in the fourth quarter,” said Mr. Luis-Ortiz in mixed English and Tagalog in a phone call.

Capital utilization averaged 77.4% in November, slightly lower than October’s 77.6%. All sectors have reached an average capacity utilization rate of more than 60% during the month.

Going forward, Mr. Asuncion anticipates a “modest” improvement in December and “gradual” recovery through 2026.

“Our view is that while November’s slump reflects temporary disruptions and cyclical demand softness, forward sentiment remains constructive. Manufacturers posted their strongest optimism since November 2024, and with domestic demand expected to firm up alongside an eventual BSP (Bangko Sentral ng Pilipinas) easing cycle… consistent with medium‑term projections that see manufacturing output trending higher toward 2026,” said Mr. Asuncion.

Mr. Mapa said a gradual recovering in manufacturing is likely as “inventories decline and demand returns over the next few months.”

“Manufacturing looks like to grow especially in export, but not as fast as we would like to, it will continue to grow but still we are left behind by our neighbors due to weak demand,” said Mr. Ortiz-Luis. — Lourdes O. Pilar

ADB expects PHL household spending to improve in 2026

By Aubrey Rose A. Inosante, Reporter

THE ASIAN Development Bank (ADB) said household consumption in the Philippines is likely to rebound in 2026 on the back of easing inflation and interest rates, after a corruption scandal and adverse weather dampened spending in recent months.

However, analysts warned that depending on tax relief to spur consumption could undermine fiscal consolidation efforts.

ADB Country Director for the Philippines Andrew Jeffries said household final consumption expenditure, which accounts for over 70% of the economy, is expected to “strengthen in 2026 amid low inflation and accommodative monetary policy.”

“More broadly, policies need to focus on raising incomes and reducing vulnerability,” he said in an e-mailed statement to BusinessWorld.

Mr. Jeffries said these measures should include expanding higher‑quality employment, boosting productivity through skills upgrading, and targeted social protection for vulnerable households.

This comes as private consumption growth moderated in the third quarter of 2025, particularly discretionary spending on recreation, hotels and restaurants, partly due to weather‑related disruptions, he said.

Data from the Philippine Statistics Authority (PSA) showed household final consumption expenditure slowed to 4.1% in the third quarter from 5.2% a year ago.

This was the slowest since the 4.8% contraction in the first quarter of 2021. Excluding pandemic years, it was the slowest growth in private spending since the 2.6% increase in the third quarter of 2010.

The PSA will release the fourth-quarter and annual 2025 preliminary gross domestic product (GDP) data, including household consumption, on Jan. 29.

Despite the slower growth in the third quarter, the ADB said spending on essentials, particularly food, remained resilient, supported by low inflation.

Inflation picked up to 1.8% in December from 1.5% in November. This brought the average to 1.7% in 2025.

For 2026, the central bank sees inflation accelerating to 3.2%, but still within the 2-4% target band.

The Bangko Sentral ng Pilipinas (BSP) has so far delivered a total of 200 bps in cuts since August 2024, after it lowered its policy rate by 25 bps to an over three-year low of 4.5% at its Dec. 11 meeting, amid subdued inflation and sluggish growth.

The Monetary Board is scheduled to hold six regular policy meetings in 2026, with the first one set on Feb. 19.

TAX RELIEF?

To spur household demand and ease public concerns over flood control issues, a lawmaker had proposed giving tax relief to Filipinos, but analysts were divided, saying the measure could lift spending but risk undermining fiscal consolidation.

Senator Erwin T. Tulfo filed a bill in the Senate in October to provide a one-time, one-month income tax holiday for individual taxpayers receiving compensation income, effective on the first payroll month immediately following the bill’s approval.

Senate Bill No. 1446, or the One-Month Tax Holiday bill, remains pending at the committee level.

“A tax relief will only delay fiscal consolidation,” Foundation for Economic Freedom President Calixto V. Chikiamco told BusinessWorld on Tuesday.

The Marcos administration aims to bring the deficit down to P1.56 trillion, or 5.5% of GDP, in 2025, and eventually to P1.55 trillion, or 4.3% of GDP, in 2028.

Mr. Chikiamco noted that many factors influence consumer spending, such as unemployment, inflation, and wage growth.

“Depreciation of the peso will increase OFW (overseas Filipino worker) incomes and spur consumer spending without decreasing government revenues,” he added.

The peso has breached the P59-a-dollar mark several times since November and sank to a record low of P59.22 on Dec. 9.

Meanwhile, Jonathan L. Ravelas, a senior adviser at Reyes Tacandong & Co., argued that tax relief can boost private consumption, but the program has to be “smart and targeted.”

“Tax relief can help revive spending, especially after a year of high prices and tight budgets,” he said.

“Focus on essentials like VAT (value-added tax) breaks on food and utilities, and give relief to lower- and middle-income families who are more likely to spend,” Mr. Ravelas added.

However, he said tax relief must be “time-bound,” and paired with job creation and price stability, so people feel confident to open their wallets.

“The problem on spending is due to the uncertain environment due to ‘floodgate,’ the government should fix its trust issues so confidence will come back,” Mr. Ravelas said, referring to the flood control mess.

Meanwhile, the ADB’s Mr. Jeffries said improving VAT efficiency and sustaining gains in tax administration through digitalization are key to raising government revenue.

“The proposed tax on single-use plastic bags is a notable measure, serving both revenue and environmental objectives by helping address plastic and solid-waste challenges,” he said.

BIR Commissioner Charlito Martin R. Mendoza earlier said the proposed tax measure is projected to generate between P6 billion and P10 billion annually, “depending on the rate and coverage.”

“Beyond taxation, sustained improvements in expenditure efficiency and public financial management are crucial, particularly to strengthen investment planning, project execution, and governance,” Mr. Jeffries said.

Jollibee plans US listing for global business; stock surges

JOLLIBEE FOODS CORP. on Tuesday said it plans to spin off its international business and list it on a US stock exchange by late 2027 as the Philippine fast-food group plots its global expansion.

Its stock jumped the most in more than five years after the announcement.

Jollibee, which increasingly is taking aim at global fast-food giants such as McDonald’s and Yum! Brands, Inc. from Los Angeles to Ho Chi Minh City, said it has hired international and local advisers to work on the spinoff and potential US listing.

Jollibee Foods Corp. International would include all of the company’s businesses outside its home market, the company said in a disclosure to the Philippine Stock Exchange, where its Philippine operations will remain listed.

Jollibee shares — after a one-hour trading halt — rose as much as 11.56%, the most since October 2020.

“Built on a capital-light model with significant whitespace for expansion, it is positioned to operate in markets that support companies pursuing international scale, innovation, and long-term global growth,” the company said.

“The transaction is intended to be executed in late 2027, subject to prevailing market conditions, completion of appropriate diligence and securing all required regulatory and legal approvals across relevant jurisdictions,” it added.

Establishing two listed businesses is meant to sharpen the strategic focus of each company and enhance the “clarity of each equity story,” Jollibee said.

The spinoff would let investors value the “stable, cash-generative Philippine business separately from the higher-growth but more volatile international operations,” COL Financial Group analyst Rachelle Biacora said in a note.

However, the company’s domestic unit might have a lower market value, which could affect its weighting in some stock indexes, she added.

Jollibee shareholders would receive a number of shares in the international business equal to their company holdings at the time of the listing, the company said.

Jollibee’s restructuring and spinoff of foreign operations is a novel way for a Philippine blue chip to list those units, allowing eligible shareholders “to capture the complete economics of the move,” Juan Paolo E. Colet, managing director at China Bank Capital Corp., said in a Viber message.

He added that spinning off and listing Jollibee Foods Corp. International would unlock full value in Jollibee’s international operations, with Jollibee Foods Corp. likely to see investor buzz over the international company’s valuation speculation.

“Jollibee Foods Corp. International will be seen as having a comparatively higher growth potential given the sheer size of the global consumer space, but that also comes with the associated higher risk of breaking into new markets,” Mr. Colet said.

“Meantime, Jollibee Foods Corp. will become a pure play on the Philippine food-service market where there is still room to refresh and grow a predominantly mature brand portfolio,” he added.

The food giant owns several brands, including its iconic Jollibee chain known for its sweet-style spaghetti and crispy fried chicken.

Jollibee is building its international profile, striking 27 cross-border deals worth about $1.1 billion since 2000, according to data compiled by Bloomberg. That includes US brands such as Smashburger and Coffee Bean and Tea Leaf, which Jollibee struggled to turn around, and recently, South Korea’s Compose Coffee.

The group had 10,304 stores as of September, 6,859 of which were located overseas across over 30 countries, including China, Canada and Vietnam. International business generated about 43% of Jollibee’s P224.2-billion ($3.8 billion) revenue from January to September. — Alexandria Grace C. Magno with Bloomberg News

Meralco 2025 energy sales decline by 0.65%

MANILA ELECTRIC CO.’s (Meralco) energy sales volume declined last year due to soft demand in residential and commercial segments, a company executive said.

Indicative figures showed energy sales within Meralco’s franchise area fell 0.65% to 53,257 gigawatt-hours (GWh) in 2025 from 53,606 GWh in 2024, Meralco Senior Vice-President and Chief Revenue Officer Ferdinand O. Geluz said in a Viber message.

Residential and commercial sales dropped 2% and 0.5%, respectively, while the industrial segment grew by 1%.

Meralco has yet to consolidate figures from Clark Electric Distribution Corp. and other distribution utilities. Clark Electric, 65% owned by Meralco, serves the Clark Special Economic Zone.

This year, the power distributor is targeting 3% growth in energy sales, supported by higher customer connections and normalizing temperatures.

The distribution business contributed 55% of Meralco’s consolidated net income in the first nine months of 2025, which rose 14% to P40 billion. The company remains confident of meeting its full-year core profit guidance of P50 billion.

“Based on the growth of our power generation and steady performance of our core distribution in the past nine months, we stay positive we will achieve our full-year core profit guidance of P50 billion,” Meralco Chairman Manuel V. Pangilinan told a briefing in October.

Shares of Meralco gained 1.37% to close at P593 each on the local bourse on Tuesday.

Beacon Electric Asset Holdings, Inc., Meralco’s controlling stakeholder, is partly owned by PLDT Inc. Hastings Holdings, Inc., a unit of the PLDT Beneficial Trust Fund subsidiary MediaQuest Holdings, Inc., has an interest in BusinessWorld through the Philippine Star Group. — S.J. Talavera

ACEN powers Schneider Cavite plants with RE

AMERICAN POWER CONVERSION CORP. (APC), a flagship brand of French company Schneider Electric SE, has tapped the retail electricity supply unit of Ayala-led ACEN Corp. to power its manufacturing facilities in Cavite using renewable energy (RE).

In a statement on Tuesday, ACEN said APC and Schneider Electric entered into an RE supply agreement with ACEN RES under the government’s Green Energy Option Program, which allows electricity end-users with an average monthly demand of at least 100 kilowatts to choose renewable energy as their power source.

The agreement covers five facilities in Cavite, which are mainly engaged in semiconductor manufacturing. These sites began operating on renewable energy in December and include both office and production locations.

“This collaboration sets in motion our transition to 100% renewable energy at the Cavite Smart Factory — a bold stride in our journey toward net zero,” Antonio Cheng, Jr., plant director for the Cavite Cluster at Schneider Electric Philippines, Inc., said in the statement.

He added that the Cavite facility is set to become the first plant inside a government economic zone in Luzon, and the first Schneider Electric factory in East Asia, to run entirely on renewable energy.

ACEN President and Chief Executive Officer Eric T. Francia said the partnership shows how big industrial players could advance the country’s energy transition. ACEN RES accounts for 57% of the Green Energy Option Program market and obtains power from the company’s solar, wind and geothermal assets.

ACEN has about 7 gigawatts of attributable renewable energy capacity and has completed its shift away from conventional power generation.

The company earlier said it had transitioned its entire generation portfolio to renewable energy after divesting its conventional power assets. — Sheldeen Joy Talavera

RLX, SPX Philippines sign leasing deal

ROBINSONS LOGISTIX & Industrials, Inc. (RLX) said it has signed its second warehouse leasing agreement with SPX Philippines, Inc., the logistics partner of e-commerce platform Shopee, Inc., as both companies seek to expand their distribution network across Luzon.

“RLX’s modern facilities in strategic locations like Calamba support our continued growth as we serve customers nationwide through our multi-partner logistics network,” SPX Philippines head Martin N. Yu said in a statement on Tuesday.

The deal expands the companies’ partnership, which began with the opening of SPX’s biggest sorting center within RLX’s property in Calamba, Laguna in 2024. The facility serves customers in the National Capital Region, South Luzon, the Visayas and Mindanao.

The renewed partnership aligns with both companies’ push to improve speed, efficiency and reliability in the domestic logistics sector.

“It also reinforces RLX’s position as a leading provider of future-ready, scalable logistics solutions built on innovation and operational excellence,” RLX said.

SPX offers services such as pick-up, drop-off, cash-on-delivery and register-as-a-service point, and operates across Southeast Asia, Taiwan and Brazil. SPX Express Philippines is a unit of Singapore-based Sea Group.

“Our collaboration with SPX Philippines highlights RLX’s commitment to delivering Grade A logistics facilities that help partners scale and grow,” RLX Senior Vice-President and Business Unit General Manager Cora Ang Ley said.

RLX, the industrial and logistics arm of Robinsons Land Corp. (RLC), operates 13 facilities across Calamba, Laguna; Sucat and Muntinlupa City; Pampanga; and Rizal. Its warehouses feature modern specifications and flexible layouts.

RLX posted a 2% increase in nine-month revenue to P661 million. Parent firm RLC reported a 19% rise in attributable net income to P3.3 billion for the period.

Shares of RLC rose 1.1% or 18 centavos to close at P16.58 on the Philippine Stock Exchange. — Beatriz Marie D. Cruz

Updates to REIT rules, rate cuts may attract listings, says ICCP

THE Securities and Exchange Commission’s (SEC) proposed updates to real estate investment trust (REIT) rules, alongside possible interest rate cuts by the central bank, could encourage more REIT listings, the Investment & Capital Corporation of the Philippines (ICCP) said.

“If interest rates come down, that would be good for REITs because issuers would be more encouraged to come to market as they would not have to offer very high dividend yields,” ICCP President and Chief Operating Officer Jesus Mariano P. Ocampo said in a statement on Tuesday. “REITs are a dividend story at the end of the day.”

Under the updated REIT rules, the SEC has expanded the definition of income-generating assets to include sectors such as power, infrastructure and telecommunications.

The rules, which took effect this month, also extend sponsors’ reinvestment deadlines and strengthen disclosure and governance requirements.

Mr. Ocampo said the changes could attract billion-peso REIT offerings from tollway operators, water concessionaires, fiber optic network providers, cell tower operators and data-center developers.

He added that the timing of the regulatory changes aligns with a more accommodative monetary environment.

The Bangko Sentral ng Pilipinas (BSP) has cut interest rates by 200 basis points since August 2024.

BSP Governor Eli M. Remolona, Jr. has said another rate cut remains possible at the central bank’s February policy meeting, citing subdued inflation and weak economic growth last year.

The central bank ended 2025 with an additional 25-basis-point cut on Dec. 11, bringing the key policy rate to 4.5%, the lowest in more than three years.

Mr. Ocampo cited the surge in REIT activity from 2020 to 2021, noting that low interest rates during that period helped spur listings.

As rates decline, pressure on issuers to offer elevated dividend yields eases, making public listings a more viable and attractive capital-raising option, he said.

However, Mr. Ocampo said actual listings would still depend on issuer readiness, asset valuation and broader market conditions.

ICCP is a medium-sized group with businesses spanning investment banking, venture capital, industrial-estate development and township development.

The Philippines has eight listed REITs — AREIT, DDMP REIT, Inc., Filinvest REIT Corp., RL Commercial REIT, Inc., MREIT, Inc., VistaREIT, Inc., Citicore Energy REIT Corp. and Premier Island Power REIT Corp. — Beatriz Marie D. Cruz

Civic mindedness is a must to fight corruption

(Part 1)

Filipinos of all social levels are strongly demanding that corrupt officials from the Government — especially from the Senate, the House, the departments of Public Works and Highways (DPWH) and of Health (DoH), and the Bureau of Internal Revenue (BIR) — are actually sent to jail, together with private contractors and other business people involved in the flood control scandal that exploded before Christmas of 2025. They are disappointed that only “small fry” are actually being imprisoned.

Our efforts to minimize corruption in both the public and private sectors (after all, “it takes two to tango”) will not prosper unless we strengthen our weak institutions that directly address the problem of corruption. At this time, the highest priority should be assigned to the passage of four pending bills addressing the challenge of eliminating or at least reducing corruption. They are the Anti-Dynasty Bill, the Independent People’s Commission (IPC) Act, the Party-List System Reform Act, and the Citizens Access and Disclosure of Expenditures and National Accountability Act. President Ferdinand Marcos, Jr. has given his full support to the passage of these legislative measures.

The appropriate strong institutions are necessary for any socio-economic reform, as is very well documented with strong empirical evidence in the book Why Nations Fail by James Robinson and Daron Acemoglu, winners of the Nobel Prize in Economics. For example, the Philippine inflation rate is at a record low of below 3% today because of the expert management of the best Central Bank in the ASEAN. Institution building has also been evident in the former NEDA (the National Economic and Development Authority, now the Department of Planning, Economy, and Development), the departments of Trade and Industry, of Agriculture, Foresty and Fisheries, of Finance (with the exception of the still corrupt BIR), and the Department of Environment and Natural Resources. Much still has to be done to get rid of corruption and inefficiency in the DPWH, which is at the center of the ongoing corruption scandal, the Department of Education, and the DoH.

Strong institutions, however, can only do so much if they have no support from the majority of the population. Unfortunately, most Filipinos lack the virtue of civic mindedness, the concern for the common good of the entire society. The loyalty and the love for others stops with most of us at the level of the extended family system. We are still mostly a feudal society inherited from our pre-colonial era. Each of us still belongs to a “family dynasty” which is what the extended family system boils down to. It is telling that the ongoing attempts to pass a bill that will ban political dynasties are being stalled by the difficulty of determining the degree of consanguinity at which an individual should be banned from running for an elective position at the same time and same political constituency as a relative.

To understand better the type of concern for the common good or the love we call “patriotism,” let us review the classic definition of the different types of love (or seeking the good of another) as defined in the classic book of British writer C.S. Lewis entitled The Four Loves.

Borrowing from the Greek philosophers of ancient times, C.S. Lewis suggested that there are four loves: storge in Greek (affection in English); philia (friend); eros (romantic); and agape (charity or divine love).

The most common and natural form of love (which is always the attraction of the human will to an object perceived as good) is affection. It is the most natural and common love. There is no effort of the will involved here; it is instinctive, such as the love of parents for their children. It is warm, familiar, and humble. It often grows quietly from daily life and shared experiences. As a rule, Filipinos are known to be affectionate people even to strangers. That is why our call center agents in the BPO-IT industry are highly appreciated, because of the affectionate manner that they deal with their customers. The same can be said of Filipinos or Filipinas who work here or abroad in the hospitality industry or in the nursing and caregiving profession.

Then there is the love of friendship (philia in Greek or amistitia in Latin). This is the love that exists between two individuals, regardless of gender, who share common interests, values, or pursuits. It is based on mutual respect and companionship and is considered by C.S. Lewis as a most rewarding form of love.

Some of the most outstanding forms of friendship in the Philippines is the bond that ties individuals who shared the same educational experiences in grade school or high school and are in touch with one another for the rest of their lives — even if they reside in different countries. Especially among middle class women, it is common for them to celebrate the 50th anniversary of their graduation from high school or college.

Fortunately, this form of human is still deeply entrenched in Filipino society, in contrast with some other societies in the West where the bond of friendship among individuals has weakened to the extent that, especially among the youth, lonesomeness or loneliness has become a sort of a social disease. This trend has been abetted by the advent of Artificial Intelligence in which applications like ChatGPT have taken the place of real human friends. The breakdown of the family in some developed societies has also led to the declining role of friendship in human fulfillment since it is in the family that the bond of friendship is first developed.

As any human relationship, friendship has both its positive and negative features. Among the strengths of friendship are its being built on shared truth, values, and purpose. It is, in this most elementary form of human relations, where the individual is nurtured in virtue, honesty, and intellectual growth. Friendship is freely given, not compelled by nature. That is why, in some relationships, friends are treasured more than blood relatives.

There are, however, some perils in the love called friendship. It can become exclusivist or elitist, fostering group pride or moral blind spots. Friends in exclusive fraternities, especially among the economic elite, may foster group pride or moral blind spots. They may reinforce each other’s errors. There should be efforts to prevent bonds of friendship from being used for conspiratory loyalty, especially among soldiers.

C.S. Lewis notes that friendship groups can become dangerous when they see themselves as morally superior.

(To be continued.)

Bernardo M. Villegas has a Ph.D. in Economics from Harvard, is professor emeritus at the University of Asia and the Pacific, and a visiting professor at the IESE Business School in Barcelona, Spain. He was a member of the 1986 Constitutional Commission.

Artistic experimentation focus of brand-new Rift Gallery

A PATCHWORK banner representing generations of women, paintings that stitch together memory and trauma, and sculptures and video works depicting ecological crises are just some of the pieces on view at the newly opened Rift Gallery, located along EDSA.

Titled rift / making through the cracks, the gallery’s inaugural exhibit features works by Laura Abejo, Aiess Alonso, Nathalie Dagmang, Carla Gamalinda, Nicolei Buendia Gupit, Solana Lim Perez, and Kestrel Reyes.

They can be found on the second floor of the historic V.V. Soliven Building, one of the first structures built along EDSA, just a few steps away from the Santolan-Annapolis MRT station. Those who regularly traverse the capital’s expansive avenue may find it strange to finally enter an old building that they usually ignore, but the works of art that await in the quaint gallery space are worth it.

Carla Gamalinda’s banner Open City greets guests with a large sign made of stitched-together fabric of various colors. According to the artist, she put it together from pieces in her grandmother’s wardrobe, using her great-grandmother’s 1920s sewing machine left in their ancestral home.

Ms. Gamalinda explained that she had to “relearn how to use the old machine,” which required help from her mother. This means the work involves four generations of women, reflecting a politics of care.

“I cut up the fabric and stitched together a process of destruction and reconstruction,” she said in her artist’s statement. “When you study the stitches, you can see my learning curve: some of them are shabby while some show that I have gotten a grip on the machine already.”

The banner becoming the sort of centerpiece of Rift Gallery’s first show was very important, according to Carissa Pobre, one of the gallery’s owners and the curator of the exhibit.

“A few months ago, we put together a call for different artists who might want to join our inaugural exhibition, with a prompt centered on the concept of ‘a rift,’” she told BusinessWorld during a visit in December.

“I started to notice that it was women artists who were gravitating towards the concept, which was interesting. The show ended up showcasing seven women artists, and I felt the urgency of how each of them reflected back something in the political and ecological climate at the end of the year,” Ms. Pobre added.

Another approach to the concept is a documentation of personal feelings of crisis through mixed-media paintings. Laura Abejo’s Safety Breach, for example, involves threads sewn into the canvas, to separate different images of places and people.

Ms. Abejo said in her artist’s statement that the technique is “a metaphor for making amends even when there are things unheard and words unsaid.

“Despite the rift, we try to hold it all together and set boundaries,” she explained. “The rift can be felt in the patches cut out and mended from the canvas, as well as the patches that don’t fix anything. They just obscure the layer underneath. I wanted to emulate the feeling of uncertainty and tension we’re experiencing these days in light of recent events.”

A similar effect occurs in Solana Lim Perez’s smaller paintings, Awakenings and A Landscape of Tidings, which are collages of watercolor and pen and ink. For her, they are a record of “memory-hallucinations as paintings,” which became an anchor point for the artist’s personal shifts in identity at an uncertain time in her life.

ARTISTIC EXPLORATION

As the curator, Ms. Pobre told BusinessWorld that the gallery prioritizes younger artists and artists who might not be welcomed by a conservative art market.

“We’re hoping to build a culture that’s based on artistic exploration and cultural education,” she said. This will include events held at the space, such as film screenings, workshops, bazaars, book launches, and live music performances.

The exhibit’s launch on Dec. 14 saw people come together to watch Habitat, a short film by Aiess Alonso, which depicts the struggle of fishermen in the aftermath of Typhoon Yolanda. Her video work is also projected on the wall in a corner of the gallery.

“It’s just so strange that the issues of climate emergency and flooding, which she had done in the wake of Yolanda thereabouts, are still very relevant issues today,” said Ms. Pobre.

The other work being projected in the video installation corner is Nicolei Buendia Gupit’s video which contains voiceover anecdotes of people from a community concerned about water sanitation.

“I explore ecological and geographical rifts as sites of time-space rupture shaped by the intertwined forces of climate change and global capitalism. These ruptures create fault lines in histories and environments, disrupting the lives of coastal, migrant, and diasporic communities,” Ms. Gupit said in her statement.

In front of the wall where the videos are projected are sculptures of water jugs strewn across the floor. What makes them unique are how they are covered with news print that references climate issues.

“Recognizing climate change as the defining crisis of our era, I focus on recording narratives from the ground, stories from frontline communities whose knowledge and lived experiences challenge dominant understandings of our climate,” she added.

Nathalie Dagmang’s paper collages, inspired by her ethnographic research on soil in riverside farms, as well as Kestrel Reyes’ paintings, inspired by tectonic surfaces, atmospheric patterns, and cellular networks that she studies as a chemical engineer, also present unique approaches to the “rift” concept.

Ms. Pobre pointed out that the gallery, even in its construction, is meant to be a contrast to traditional art spaces. Instead of a white cube, it is a gray cube, harkening to a brutalist, industrial feel.

Even its location is meant to be “a fissure within the capital’s corridors of power: proximate to the EDSA Shrine, Camps Crame and Aguinaldo, and mall-ified mausoleums of surplus, all of which scaffold hegemonic lifeways in the mega-urban sprawl,” says the gallery’s manifesto which can be found on its walls.

It maintains that to rift is “to break away in perspective, discourse, movement, or form, so as to make space for experimentation,” and “to break free from the prestige-driven onus of the mainstream cultural establishment.”

“We thought about what kind of identity we wanted a new gallery in the city to be,” Ms. Pobre said. “We’re ending 2025 in a really strange time where the rift is literally what we’re in, and we don’t know how or we’re thinking of ways to create while we’re in this.”

The exhibit rift / making through the cracks is on view until Feb. 1 at the Rift Gallery, located at the second floor of 2112 V.V. Soliven Building, EDSA, San Juan City. — Brontë H. Lacsamana

Gov’t fully awards dual-tranche T-bond offering

THE GOVERNMENT made a full award of the dual-tranche Treasury bonds (T-bonds) it offered on Tuesday at mixed rates as players moved to buy securities at the start of the year.

The Bureau of the Treasury (BTr) raised a combined P50 billion as planned via its dual-tenor T-bond sale as total bids reached P124.747 billion, or more than double the amount placed on the auction block.

Broken down, the Treasury borrowed P20 billion via the reissued seven-year bonds, with total bids reaching P52.082 billion or more than double the amount on offer.

This brought the total outstanding volume for the bond series to P295.6 billion, the BTr said in a statement.

The bonds, which have a remaining life of two years and seven months, were awarded at an average rate of 5.467%. Accepted yields ranged from 5.375% to 5.489%.

The average rate of the reissued papers fell by 31.2 basis points (bps) from the 5.779% fetched for the series’ last award on April 19, 2022, but was 171.7 bps above the 3.75% coupon for the issue.

This was 1.5 bps higher than the 5.452% fetched for the same bond series but 4.9 bps below than the 5.516% quoted for the three-year bond, the benchmark tenor closest to the remaining life of the papers on offer, at the secondary market before Tuesday’s auction, based on PHP Bloomberg Valuation Service (BVAL) Reference Rates data provided by the BTr.

Meanwhile, the government raised P30 billion from the reissued 10-year T-bonds, with total bids for the tenor reaching P72.665 billion or over twice the auction volume.

This brought the total outstanding volume for the bond series to P522.6 billion.

The reissued papers, which have a remaining life of nine years and three months, were awarded at an average rate of 5.985%, with tenders awarded carrying yields from 5.973% to 5.99%.

The 10-year bond’s average rate rose by 10.9 bps from the 5.876% fetched for the series’ last award on Dec. 2, but was 39 bps below the 6.375% coupon for the issue.

This was also 0.3 bp below the 5.988% seen for the same bond series and 7.3 bps lower than the 6.058% quoted for the 10-year debt at the secondary market before Tuesday’s auction, PHP BVAL Reference Rates data showed.

The government fully awarded its T-bond offer as it saw strong demand as players are loading up their portfolios, and with rates fetched near secondary market levels, a trader said in a phone interview.

The trader added that appetite for the bonds stayed strong even as December inflation came out higher than expected.

Philippine headline inflation picked up to 1.8% last month from 1.5% in November, but slowed from 2.9% in December 2024.

The December clip was within the Bangko Sentral ng Pilipinas’ (BSP) 1.2-2% forecast for the month, but was above the 1.4% median estimate in a BusinessWorld poll of 14 analysts.

For 2025, the consumer price index averaged 1.7%, the slowest in nine years or since the 1.3% recorded in 2016. This was slightly above the BSP’s 1.6% forecast for the year but below its 2%-4% target.

Meanwhile, T-bond yields ended mixed as the market remains hesitant about locking in their cash in longer tenors due to lingering risks here and abroad, Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said in a Viber message.

He said the peso’s recent weakness against the dollar could stoke inflation anew, while uncertainty over the US Federal Reserve’s policy path is also driving up long-end yields globally.

On Tuesday, the peso slid by eight centavos to close at a fresh near one-month trough of P59.21 against the dollar, just a shade stronger than its record low of P59.22.

The dollar index, which measures the currency against a basket of those three rivals and three more major peers, edged down 0.2% to 98.238, Reuters reported. It had popped as high as 98.861 on Monday for the first time since Dec. 10.

The closely watched US monthly employment report, due on Friday, will be key in shaping expectations for the outlook for monetary policy.

Traders currently expect two Federal Reserve interest rate cuts this year, showed LSEG calculations based on futures.

The nomination of a new Federal Reserve chair in early January is also a key event. Incumbent Jerome H. Powell’s term expires in May.

US President Donald J. Trump has pressured the Fed to cut rates, bringing central bank independence into question.

The BTr is looking to raise P180 billion from the domestic market this month, or P110 billion via Treasury bills and P70 billion through T-bonds.

The government borrows from local and foreign sources to help fund its budget deficit, which is capped at P1.647 trillion or 5.3% of gross domestic product this year. — Aaron Michael C. Sy with Reuters