By Kyle Aristophere T. Atienza, Reporter

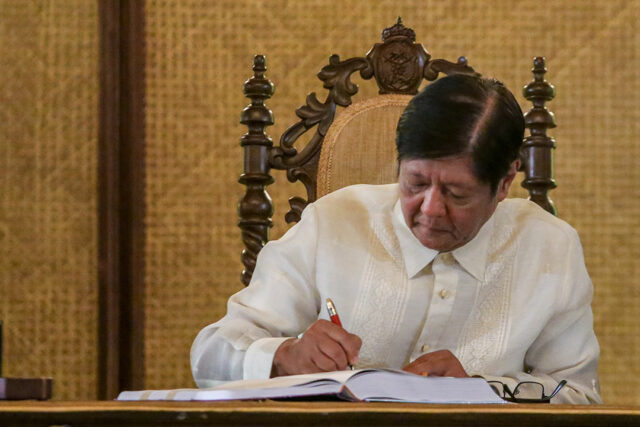

PHILIPPINE President Ferdinand R. Marcos, Jr. on Monday signed into law the P6.326-trillion national budget for 2025 but vetoed more than P194 billion worth of line items that he said were inconsistent with his administration’s priorities.

These include appropriations for certain programs of the Department of Public Works and Highways (DPWH) and unprogrammed funds that increased four times, Mr. Marcos said during the signing ceremony for the budget at the presidential palace.

“Cognizant that our resources are finite, and our people’s needs are plenty, we need to carefully curate the particulars of the budget, so much so that even grand ambitions and great plans must be tempered,” the president said.

“We must exercise maximum prudence, otherwise we run the risk of increasing our deficit and debt and derailing our development agenda for our country.”

The P6.326-trillion national budget is 0.4% lower than the P6.352-trillion spending plan that the Department of Budget and Management (DBM) submitted to Congress in August. This is equivalent to 22% of the projected gross domestic product (GDP) in 2025.

Mr. Marcos was initially scheduled to sign the budget on Dec. 20, but it was postponed to allow a more “rigorous” review after questions were raised over revisions made by the bicameral conference committee.

The items that have been vetoed by Mr. Marcos included P26.065 billion worth of projects under the DPWH and projects worth P168.24 billion under “unprogrammed appropriations.”

Public Works Secretary Manuel M. Bonoan said the projects that have been vetoed were “not ready for implementation.” “It will take us sometime anyway to make sure that these will be implemented right away,” he said in mixed English and Filipino.

Mr. Marcos also noted that unprogrammed appropriations under the Congress-approved budget bill increased by 300%.

At a briefing after the signing ceremony, Budget Secretary Amenah F. Pangandaman said unprogrammed appropriations now account for 4.7% of the General Appropriations Act of 2025, “consistent” with the standard that standby funds should only be 5% of the total budget.

She said the education sector will still receive the highest allocation with P1.053 trillion, amid questions on the legality of massive budget cuts faced by the Department of Education (DepEd).

The education sector is composed of DepEd, state universities and colleges (SUCs), the Commission on Higher Education (CHED), and the Technical Education and Skills Development Authority (TESDA).

Ms. Pangandaman said the DPWH will now have a P1.007-trillion budget for 2025, lower than the P1.034-trillion funding approved by Congress.

Aside from the vetoed items, Mr. Marcos said there will be “conditional implementation” on certain items to make sure “the people’s funds are utilized in accordance with their authorized and stated purposes.”

This includes the Ayuda sa Kapos Ang Kita Program (AKAP), which was originally implemented by the Department of Social Welfare and Development (DSWD) but will now be co-implemented with the Department of Labor and Employment (DoLE) and the National Economic and Development Authority (NEDA).

The implementation of AKAP, which provides one-time cash assistance of up to P5,000 for workers “will be strategic, leading to the long-term improvement of the lives of qualified beneficiaries, while guarding against misuse and duplication,” Mr. Marcos said.

Executive Secretary Lucas P. Bersamin told reporters that AKAP will have strict guidelines, but did not rule out the possibility of local politicians seeking funding for their constituents.

“Don’t be naive. Don’t be naive,” he said. “Always, in our life here in the Philippines, there must be somebody to initiate.”

He added that the National Government is not fully knowledgeable of local situations. “It should come from lower levels.”

Public finance analyst Zyza Nadine M. Suzara said the direct veto on P168 billion worth of items under unprogrammed appropriations “does not significantly alter the structure of the 2025 national budget,” which means that “pork remains huge in the DPWH budget.”

“In the first place, projects under unprogrammed appropriations cannot be released unless there are certain conditions,” she said in an X message. “The President and the economic managers simply conceded to the decisions of the bicam.”

EDUCATION

Meanwhile, Ms. Pangandaman reiterated that unprogrammed appropriations can be used for DepEd’s computerization program.

“As long as we have additional revenues from the DoF (Department of Finance), we can actually augment or increase the budget of DepEd, especially for its computerization program,” she said.

Members of the bicam had reduced DepEd’s budget by P12 billion, including P10 billion for its computerization program.

Enrico P. Villanueva, who teaches money and banking at the University of the Philippines Los Baños, said bicam members inflated the DPWH budget by P288 billion, but the President reduced this “only by P26.1 billion, which is not even 10% of the Congress-dictated increase.”

“For many Filipinos, that Congress-initiated increase is deemed as pork barrel, because it did not undergo the consultative budgeting process involved in making the National Expenditure Program,” he said in an X message. “People also view infra projects as a source of corruption and possible funding for the 2025 elections.”

“If the President wanted to address the concerns of the people, it should have vetoed the DPWH budget increase substantially if not totally.”

Ibon Foundation Executive Director Jose Enrique “Sonny” A. Africa said the President’s last-minute effort to veto a few items was aimed at averting “an obvious Constitutional challenge where the entire education sector budget is lower than even just the DPWH’s.”

“The tiny P26.1-billion cut in the DPWH budget was just enough to be able to claim that the education sector budget defined as DepEd, SUCs, CHED and TESDA combined is more than DPWH’s P1.007 trillion,” he said in a Facebook Messenger chat.

Mr. Africa also noted the P1.055-trillion allocation for the education sector is less than the P1.13-trillion budget for infrastructure, which includes the P1.007 trillion for the DPWH’s projects and P123.7 billion for the Department of Transportation’s projects.

A reenacted budget should have been used for the first quarter of the year, he said, while constructing “a socially rational people-biased 2025 budget deliberated transparently.”

However, Mr. Marcos said in his speech that a reenacted budget would “delay vital programs and jeopardize targets for economic growth.”

The Marcos administration may have averted operating under a reenacted budget but it disregarded health and other forms of social protection “that can increase the contribution of labor to overall productivity,” Leonardo A. Lanzona, an economics professor at the Ateneo de Manila University, said via Messenger chat.

PHILHEALTH

Another analyst said the President failed to address concerns on the removal of state subsidy for the Philippine Health Insurance Corp. (PhilHealth), the agency responsible for the implementation of universal healthcare.

“It’s frustrating, it’s heartbreaking, and very unheroic on the day of Rizal anniversary,” Health advocate and former Health department advisor Anthony C. Leachon said of the President’s inaction on the defunding of PhilHealth.

Mr. Marcos vowed to expand PhilHealth members’ benefits in his speech, a move that Mr. Leachon said was a mere “lip service.”

“Without the funds, how can you increase the benefits? You cannot increase the benefits by not giving the P74-billion subsidy,” he said in a phone interview.

Mr. Marcos earlier defended the bicam’s move to defund PhilHealth, citing its reserve funds.

PhilHealth’s reserve funds, which are not surplus funds and are meant to decrease the amount of members’ contributions as well as expand services for them, will be eroded in two to three years, Mr. Leachon said.

“And you’re not supposed to spend that because they have a big mistake in saying that the reserve funds are surplus funds. These are contingency funds that should be used to expand the benefit package, reduce the premium, and reduce the out-of-pocket expenses,” he said.

Meanwhile, the President also subjected 11 other items to conditional implementation, such as DSWD’s “PAyapa at MAsaganang PamayaNAn Program, the Rice Competitiveness Enhancement Fund and support for foreign-assisted programs.

The use of excess funds from the annual tariff revenue from rice imports will also be subjected to guidelines of the departments of Finance and Agriculture.

Four items in the 2025 budget were also put under general observation to “clarify changes made by Congress.” These items include the payment of additional compensation for the organizational structure of the Senate and the House of Representatives, as well as the two chambers’ electoral tribunals and the Commission on Appointments.