By Karis Kasarinlan Paolo D. Mendoza, Researcher

On Nov. 26, 2020, the Bangko Sentral ng Pilipinas (BSP) introduced its Digital Banking Framework as part of its Digital Banking Transformation Roadmap — an initiative to a safe and secure digital payments ecosystem in the Philippines — with the objective of reinforcing consumer preference for digital payment options and increasing the availability of digital financial products and services.

The framework, which recognized digital banks as a new banking category, allows for a more efficient, technology-driven, and inclusive financial system.

“Digital banks operate entirely through digital platforms and electronic channels without physical branches or sub-branches. It is a distinct banking category created by the Bangko Sentral ng Pilipinas… Like other banks, digital banks adhere to a rigorous regulatory framework, reflecting their critical role in the financial ecosystem,” Angelo Madrid, President of the Digital Bank Association of the Philippines (DiBA PH) and president of Maya Bank, said in an e-mail.

He noted that while online lending platforms focus on providing loans, digital banks offer a comprehensive range of services.

“[Digital] banks provide a full suite of banking services, including savings accounts, loans, and payment services, all integrated into a seamless, user-friendly digital experience,” Tonik Digital Bank Founder and President Greg Krasnov said in an e-mail interview.

By Aug. 24, 2022, six digital banks — UNO Digital Bank, UnionDigital Bank, GoTyme, Overseas Filipino Bank, Tonik Digital Bank, and Maya Bank — were allowed to fully operate in the Philippines.

DEVELOPMENTS AND CHALLENGES

The BSP recently announced that it will be allowing four new digital banks to enter the scene as it lifts its three-year moratorium on applications for digital banking permits imposed in 2021. New licenses will be available starting Jan. 1, 2025.

“With this limit, the BSP can closely monitor developments in the digital banking industry, obtain broader perspective as these banks mature further in their operations, as well as assess the impact of the entry of new players on the banking system,” BSP Governor Eli M. Remolona, Jr., said in a press release.

Mr. Krasnov said that digital banks licensed next year will probably be operational by 2026.

“Traditional banks are likely to be interested in [securing the available slots], either by establishing their own digital banks or investing in partnerships with fintech companies. Some might even consider converting existing licenses to digital bank licenses,” Mike Singh, chief commercial and revenue officer of UnionDigital Bank, said in an e-mail.

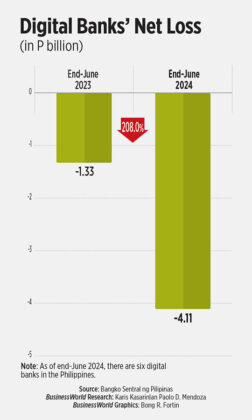

As a relatively new category in the financial ecosystem, digital banks now face the challenge of profitability, with only two of the six digital banks reporting profits as of March.

This, however, is not indicative of the underlying trend in the digital banking sector as they are subsidiaries of large universal banks, Mr. Krasnov explained.

“Their achievement of profitability was driven by large loan portfolio transfers from their parent institutions… Digital banking involves a significant upfront investment, both in terms of [capital] and ongoing [operational expenditures] to maintain the advanced digital bank stack. It typically takes five years for a new bank to become profitable,” he said.

Collectively, digital banks have posted a net loss of P4.11 billion, while traditional banks have an aggregate net income of P178.91 billion as of end-June, data from the BSP showed.

“Despite digital banking’s early stage, the sector is already hitting record growth milestones, a strong indicator of future profitability… The continued growth in customer base and deposits, coupled with ongoing innovations, positions the digital banking sector for sustained success and profitability in the coming years,” Mr. Madrid said.

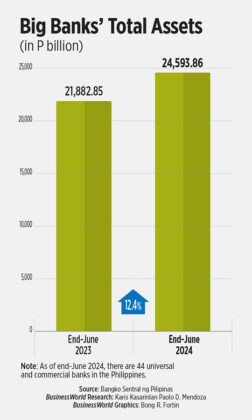

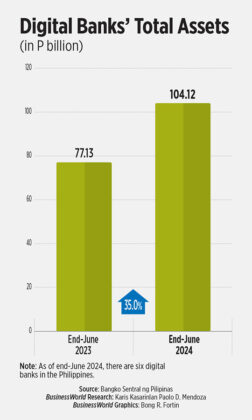

The total assets of digital banks grew 35% year on year as of end-June to P104.12 billion from P77.13 billion, outpacing the 12.4% year-on-year asset growth of universal and commercial banks, latest central bank data showed.

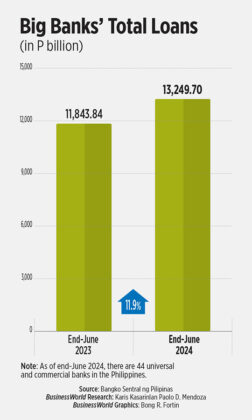

Similarly, digital banks’ total loans reached P28.27 billion in the first semester, up 26.2% from P22.39 billion a year ago.

Meanwhile, big banks posted an 11.9% year-on-year increase in loans with P13.25 trillion as of end-June.

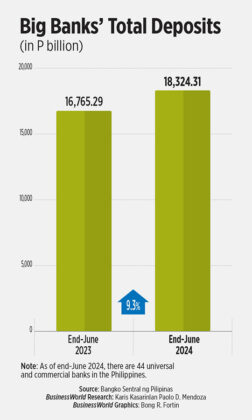

By the end of the first half, the total deposits of digital banks stood at P82.36 billion, up 32.8% from P62.01 billion a year ago. The big banks’ total deposits also grew 9.3% to P18.32 trillion — more than 222 times larger than the digital banks’.

PROS AND CONS

Existing purely in the digital space comes with its advantages and disadvantages.

“Some pros of digital banks include accessibility to banking services anytime and anywhere, lower fees and competitive interest rates brought by lower overhead costs, and innovative features like quick loan approvals and seamless digital experiences,” Mr. Krasnov said.

Karl De Galicia, a 24-year-old Filipino student in Taiwan, says the features he looks for in banks are accessibility and lower processing fees.

While he says that the features and services of digital banks are more in line with his needs, he admits to using traditional banks more frequently.

“I think digital banks are more accessible because you can cash in anywhere unlike with traditional banks where you have to line up to deposit,” he said in a Facebook Messenger chat.

“While GoTyme is more accessible, I more frequently use BDO because this is where my family sends money, and it was my established account when I left for Taiwan. I have also linked my apps to BDO because I’m more certain that I have money there,” he added.

Another advantage is the ability to implement cutting-edge technology, providing a more personalized and efficient banking experience, Mr. Madrid said.

“Digital banks have a better user-interface (UI), and I appreciate being able to check my balance anytime. Meanwhile, the online and mobile applications of my traditional bank are often out of service,” Mr. De Galicia said.

Anica Ang, 23, prefers digital banks. She prioritizes being able to pay her bills online and having access to her bank internationally.

“I think digital banks are safe. Cybersecurity challenges stem from users falling for scams rather than mistakes from the banks,” Ms. Ang said.

On the other hand, Mr. Singh cited the lack of physical branches as a challenge for digital banks in a “predominantly cash-based society.”

“[Cons for digital banks] are lack physical branches, potential security concerns, and limited customer service options,” Security Bank Corp. Chief Economist Robert Dan J. Roces likewise said.

IMPROVEMENT

“Traditional banks can learn from digital banks by embracing digital transformation more fully. This includes improving their mobile and online banking platforms to offer a more seamless and intuitive user experience,” Tonik’s Mr. Krasnov said.

“Additionally, traditional banks can adopt more flexible fee structures and competitive interest rates, leveraging their existing resources to offer value-added services that digital banks might lack, such as personalized financial advice and comprehensive financial planning,” he said.

He added that traditional banks should focus on expanding their digital reach to underserved areas via partnerships with fintech companies, or by developing their own “digital-only” products.

Mr. Madrid said that traditional banks should launch new products faster and improve existing services based on customer feedback. He stressed the importance of investing in robust mobile and online banking platforms

Meanwhile, digital banks can learn from traditional banks by enhancing customer trust and highlighting robust security measures, Mr. Roces said.

“Digital banks can learn the importance of building customer trust and maintaining a strong brand reputation, which traditional banks have cultivated over many years. This can be achieved through transparent communication, robust security measures, and consistent customer service,” Mr. Krasnov likewise said.

“Traditional banks have been around for a while and often excel in relationship banking, where bank representatives build long-term customer relationships. They have utilized their branch models to hone these relationships over time. Digital banks are adopting these learnings and taking relationship management into the digital age by going beyond bank branches, utilizing technology platforms, and ensuring security and reliability,” Mr. Madrid said.

OUTLOOK

For the digital banks here in the country, there’s no other way but to grow.

“As the digital banking industry becomes more crowded, we anticipate continued growth driven by increasing consumer adoption of the convenience and benefits offered by digital banking, including our competitive interest rates on savings and time deposits. More consumers are now leveraging these advantages compared to when the industry was first introduced,” Mr. Singh said.

“For the rest of the year, digital banks are expected to continue growing, albeit cautiously due to the challenging macroeconomic environment. They will likely focus on refining their products, working towards profitability, and expanding their customer base through targeted marketing and innovative financial products,” Mr. Krasnov said.

He added that traditional banks will diversify their digital offerings and leverage their customer base.

“Both sectors will need to navigate economic challenges carefully, but the trend toward digitalization will persist, driving continued innovation and competition in the financial industry,” Mr. Krasnov said.

![Wavy_Bus-23_Single-04-[Converted]](https://www.bworldonline.com/wp-content/uploads/2024/09/Wavy_Bus-23_Single-04-Converted-640x360.jpg)