Last week the Department of Budget and Management (DBM) submitted the budget 2026 materials to Congress — the National Expenditure Program (NEP), the Budget of Expenditures and Sources of Financing (BESF), the Staffing Summary, and the Budget Priorities Framework.

And last Monday, Aug. 18, the Development Budget Coordination Committee (DBCC) — composed of DBM Secretary Amenah F. Pangandaman, Finance Secretary Ralph G. Recto, Secretary Arsenio M. Balisacan of the Department of Economy, Planning, and Development, and the Bangko Sentral ng Pilipinas Governor represented by Deputy Governor Zeno Abenoja — presented the budget and fiscal program to the House of Representatives’ Committee on Appropriations.

My favorite material is the BESF. Thick, all numbers, it contains not only spending programs but also revenues and borrowings, regular agencies and government corporations, and local government spending and revenues.

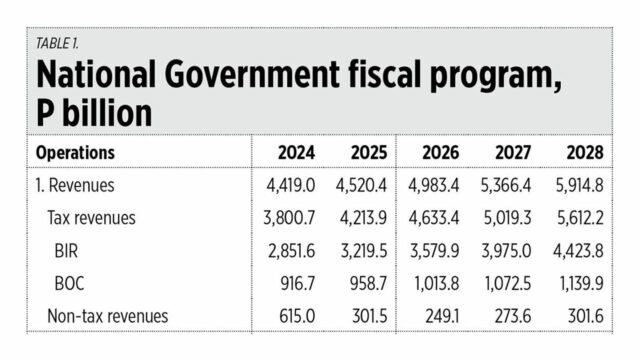

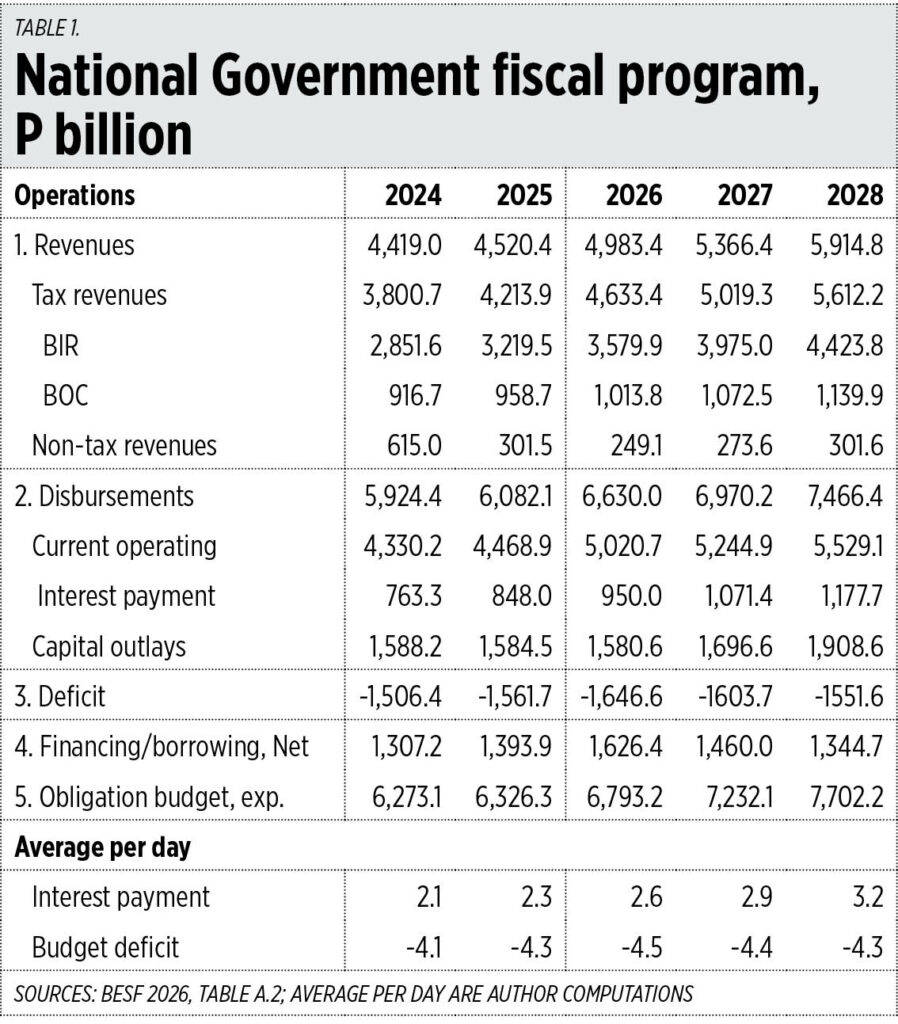

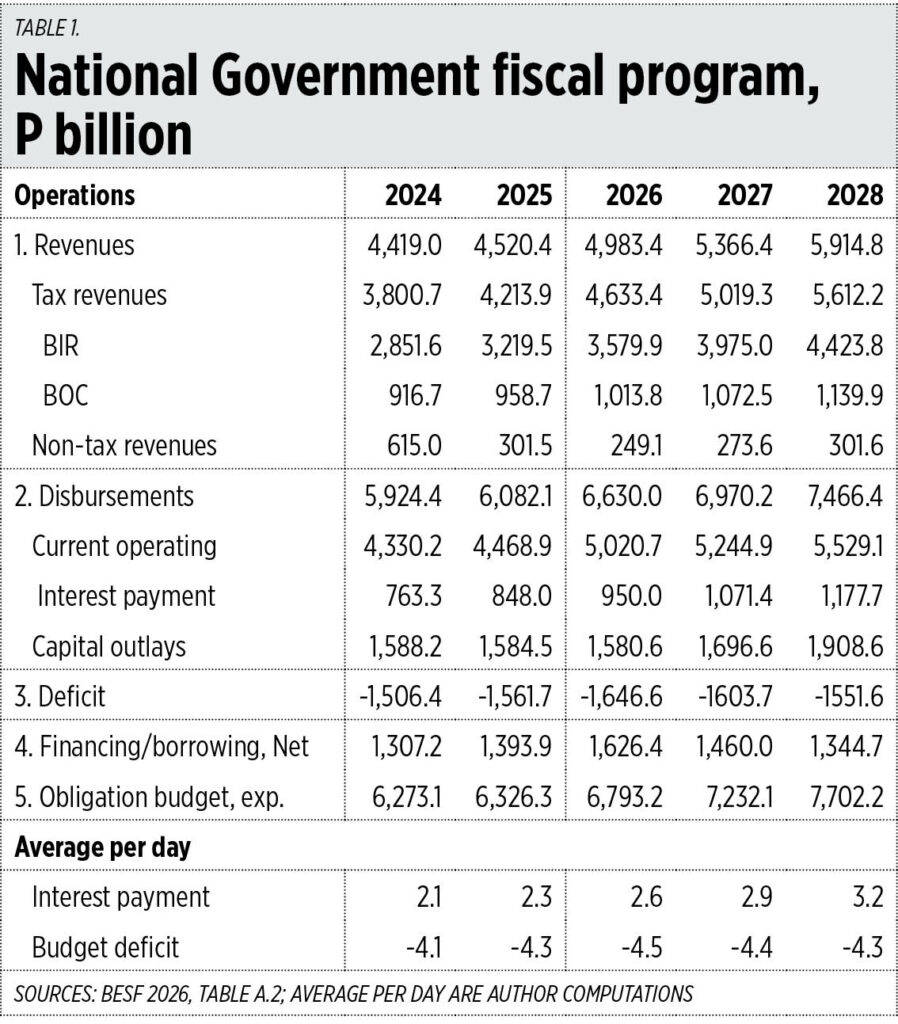

The first thing I checked was the fiscal program. There will be a nearly P600 billion increase in disbursements and spending next year from this year’s level, which is huge. That should reflect the various new freebies and expansion of subsidies that President Ferdinand Marcos, Jr. announced during the 2025 State of the Nation Address (SONA) on July 28.

When spending makes a big jump while revenues rise at normal level, then the budget deficit also jumps, from P1.56 trillion in 2025 to P1.65 trillion in 2026. A trillion pesos may look abstract for many people, so I computed the average deficit — it was P4.1 billion/day last year, P4.3 billion/day this year, and will be P4.5 billion/day next year.

Our interest payment alone was P2.1 billion/day last year, P2.3 billion/day this year, and will be P2.6 billion/day next year (see Table 1).

How big is P1 billion? Well, if one spends P100,000/day on partying and gambling, it will take 10,000 days or 27 years and four months to finish and lose that P1 billion. And we will be paying P2.3 billion/day this year on interest payment alone, with the principal amortization not included yet. That is the high cost of over-spending, even without any economic or finance crisis.

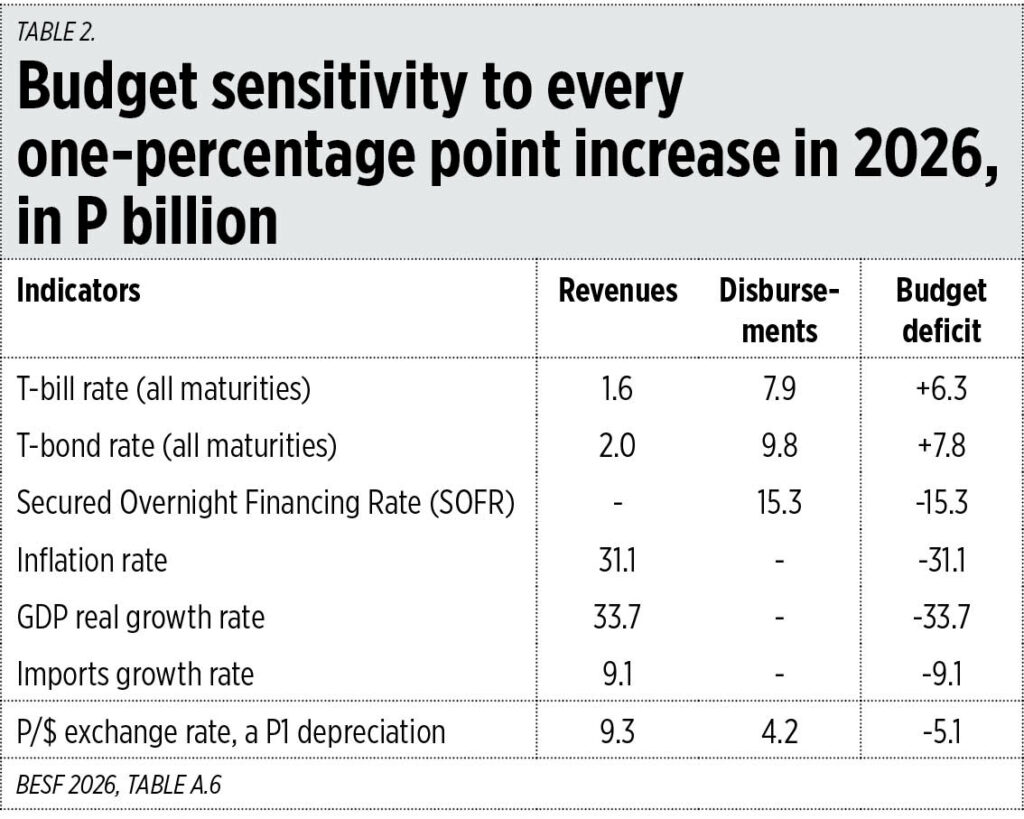

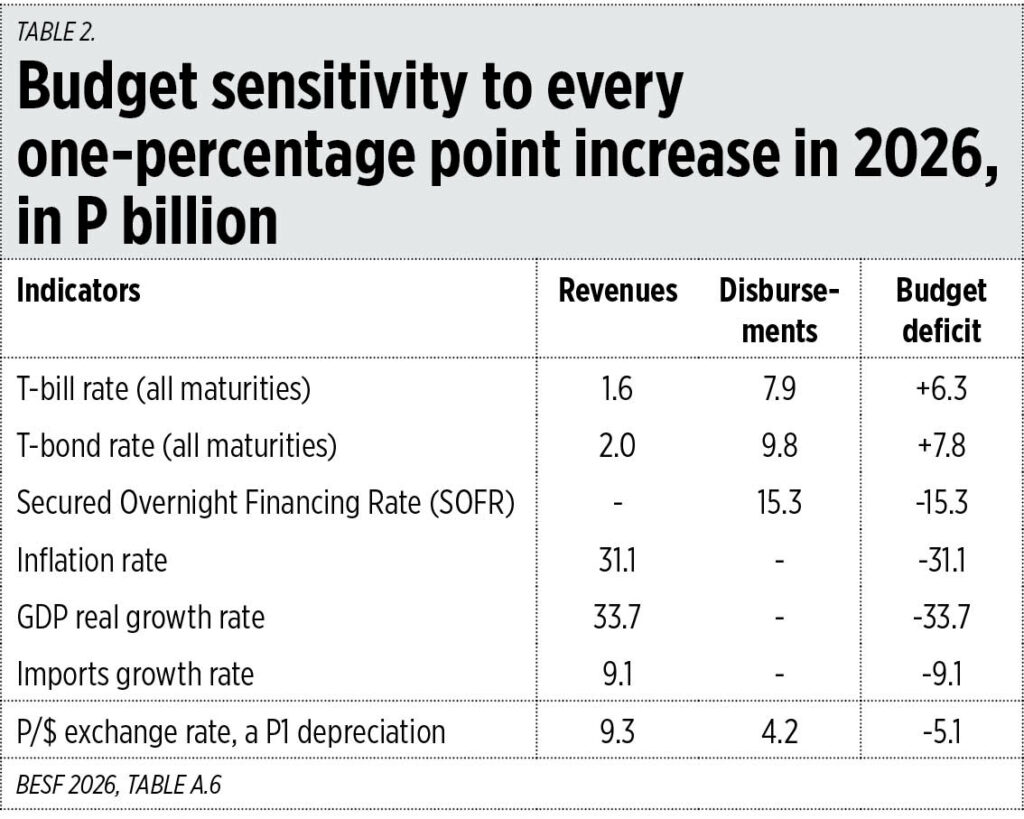

One thing that is seldom discussed publicly is the “sensitivity” or responsiveness in expenditures, revenues, and budget balance of changes in the interest rate, the inflation rate, the GDP growth rate, and the Peso/$ exchange rate.

Below is a “rule of thumb” summary of such sensitivity.

If the Treasury bill rate increases by one percentage point, say from 5% to 6%, it means that revenues can increase by P1.6 billion, disbursements can increase by P7.9 billion, and the budget deficit will further increase by P6.3 billion.

If the inflation rate increases by one percentage point, say from 2% to 3%, government revenues increase by P31 billion and the budget deficit will decline by the same amount as disbursement is not affected (see Table 2).

The Lesson: We really have to find ways to cut spending, especially of the seemingly forever subsidies and freebies which make our people become more state-dependent instead of becoming more self-reliant.

ALUMNI AWARDS

Last Saturday I attended the UP Alumni Association (UPAA) awards for Distinguished Alumni. The opening speakers were UP President Angelo “Jijil” Jimenez and UPAA President Robert Aranton. The Keynote speech was given towards the end by the star of the night, the 2025 UPAA Most Distinguished Alumnus Awardee Executive Secretary Lucas P. Bersamin, who is also a retired Supreme Court Chief Justice. He finished AB Political Science in 1968 but pursued law at another university.

Among the 64 Distinguished Alumni awardees were four of my batchmates from the UP School of Economics (UPSE) undergrad batch 1984: Lynette V. Ortiz, President and CEO of the Land Bank of the Philippines; Gladys Cruz-Sta. Rita, Vice-President of the Maharlika Investment Corp.; Jesse T. Andres, Undersecretary of the Department of Justice; and Kennedy B. Sarmiento, trade and investment lawyer. Congratulations, batchmates.

Another awardee was DBM Secretary Pangandaman. She was my classmate when I went back to UPSE for my graduate studies, Program in Development Economics (PDE) Batch 33, SY 1997-1999. Congratulations too, Secretary Mina.

Among our PDE classmates who came that night were: DBM Undersecretary Joselito Basilio, Tariff Commission Chairperson Louie Mendoza, Sorsogon RTC Judge Maliz Aragon, Campus Executive Officer Victor Balatico of the Cagayan State University-Lasam campus, and Ateneo Economics Prof. Joey Sescon. Retirees also attended: from the Supreme Court, Dory Yulo; from the National Statistics Office/Philippine Statistics Authority, Manny Rivera; and Arnel Cantilep. I was the Class President of Batch 33 and our Adviser was Prof. Ruperto “Ruping” Alonzo (RIP).

Other contemporaries from UP Diliman 1983-85 that I saw that night were: from UPSE, Finance Undersecretary Joven Balbosa, Thad Alvizo, UP Legal Officer Marcel Meneses, and Dondi Alikpala; from the College of Arts and Science, Supreme Court Justice Jhosep Lopez who is a Lifetime Achievement awardee, SSS Commissioner Jojo Sale (who says he regularly reads my column in BusinessWorld and his wife) who is also an Awardee, former Energy Assistant Secretary Gerpy Erguiza, Acel Papa, Prof. Jorge Tigno, my former teacher Prof. Doy Romero, Yolly Robles who is an awardee from UP Manila, and several other familiar faces.

On my way back home, I wished that UP alumni, awardees or not, would be part of a new movement for citizen self-reliance, not more state dependence. Then slowly we should be able to confront that ever-rising public debt from ever-rising public spending.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.

minimalgovernment@gmail.com