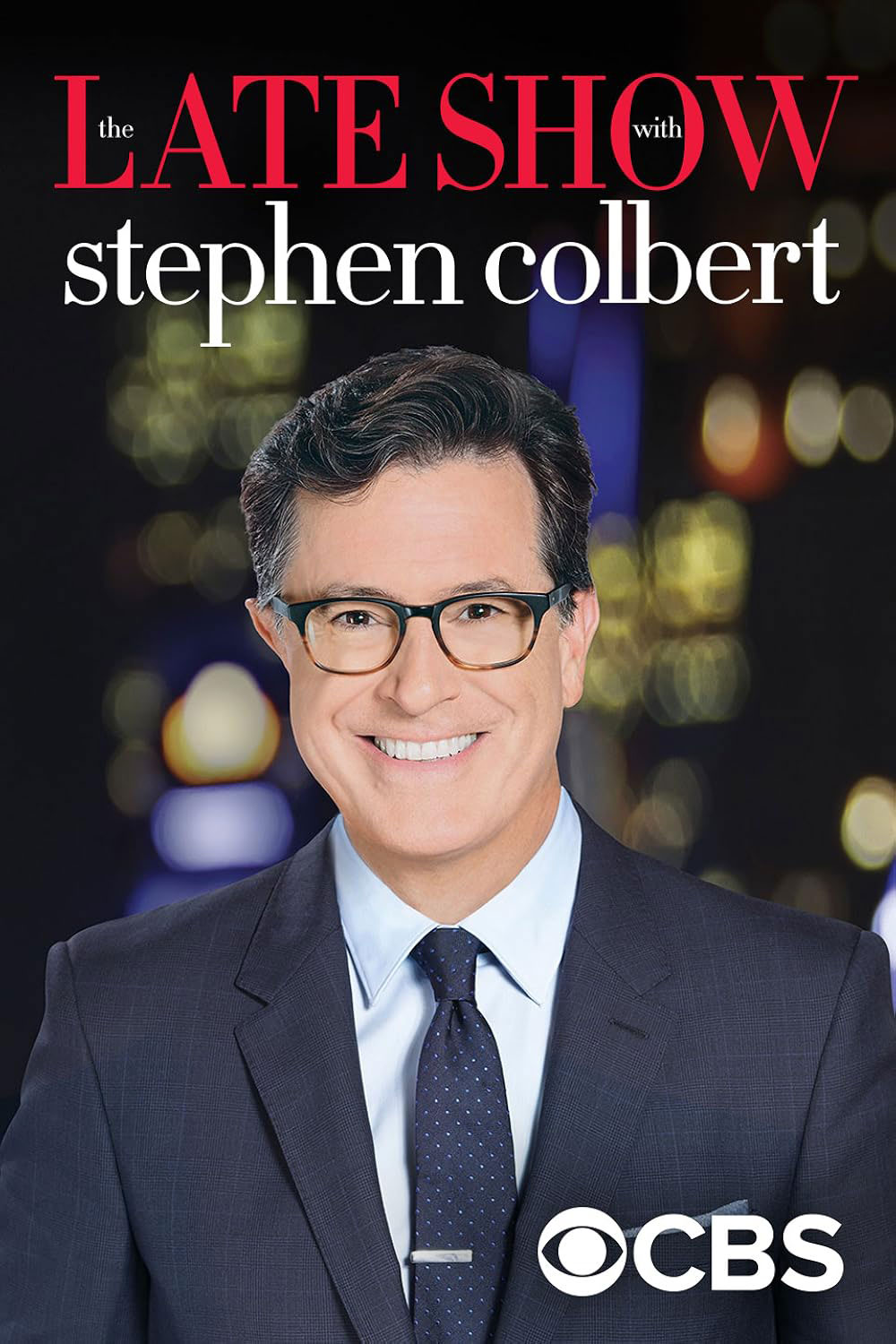

Colbert is latest casualty of late-night TV’s fade-out

LOS ANGELES — Late-night television had been fighting for its survival even before The Late Show with Stephen Colbert was canceled this week.

LOS ANGELES — Late-night television had been fighting for its survival even before The Late Show with Stephen Colbert was canceled this week.

The announced end of one of the most popular broadcast late-night shows, days after host Stephen Colbert accused the network owner of bribing President Donald J. Trump to approve a merger, drew cries of political foul play from liberal politicians, artists and entertainers.

“Stephen Colbert, an extraordinary talent and the most popular late-night host, slams the deal. Days later, he’s fired. Do I think this is a coincidence? NO,” Vermont Senator Bernie Sanders, an independent, wrote on X.

CBS executives said in a statement that dropping the show was “purely a financial decision against a challenging backdrop in late night. It is not related in any way to the show’s performance, content or other matters happening at Paramount.”

Whether or not politics were at play, the late-night format has been struggling for years, as viewers increasingly cut the cable TV cord and migrate to streaming. Younger viewers, in particular, are more apt to find amusement on YouTube or TikTok, leaving smaller, aging TV audiences and declining ad revenues.

Americans used to religiously turn on Johnny Carson or Jay Leno before bed, but nowadays many fans prefer to watch quick clips on social media at their convenience. Advertising revenue for Mr. Colbert’s show has dropped 40% since 2018 — the financial reality that CBS said prompted the decision to end The Late Show in May 2026.

One former TV network executive said the program was a casualty of the fading economics of broadcast television.

Fifteen years ago, a popular late-night show like The Tonight Show could earn $100 million a year, the executive said. Recently, though, The Late Show has been losing $40 million a year, said a person briefed on the matter.

The show’s ad revenue plummeted to $70.2 million last year from $121.1 million in 2018, according to ad tracking firm Guideline. Ratings for Mr. Colbert’s show peaked at 3.1 million viewers on average during the 2017-18 season, according to Nielsen data.

For the season that ended in May, the show’s audience averaged 1.9 million.

‘SHOCKED BUT NOT SURPRISED’

Comedians like Mr. Colbert followed their younger audiences online, with the network releasing clips to YouTube or TikTok. But digital advertising did not make up for the lost TV ad revenue, the source with knowledge of the matter said.

The TV executive said reruns of a hit prime-time show like Tracker would leave CBS with “limited costs, and the ratings could even go up.”

The Late Show with Stephen Colbert is just the latest casualty of the collapse of one of television’s most durable formats. When The Late Late Show host James Corden left in 2023, CBS opted not to hire a replacement. The network also canceled After Midnight this year, after host Taylor Tomlinson chose to return to full-time stand-up comedy.

But the end came at a politically sensitive time.

Paramount Global, the parent company of CBS, is seeking approval from the Federal Communications Commission for an $8.4-billion merger with Skydance Media. This month Paramount agreed to settle a lawsuit filed by Mr. Trump over a 60 Minutes interview with his 2024 Democratic challenger, Kamala Harris.

Mr. Colbert called the payment “a big fat bribe” two days before he was told his show was canceled.

Many in the entertainment industry and Democratic politicians have called for probes into the decision, including the Writers Guild of America and Senator Edward Markey, who asked Paramount Chair Shari Redstone whether the Trump administration had pressured the company.

Paramount has the right to fire Mr. Colbert, including for his political positions, Mr. Markey said, but “if the Trump administration is using its regulatory authority to influence or otherwise pressure your company’s editorial decisions, the public deserves to know.”

A spokesperson for Redstone declined comment.

“It’s a completely new world that artists and writers and journalists are living in, and it’s scary,” said Tom Nunan, a veteran film and TV producer who is co-head of the producers program at UCLA’s School of Theater, Film and Television. “When the news came in about Colbert, we were shocked but not surprised.” — Reuters