PHL stocks end flat before two-day trading break

PHILIPPINE STOCKS ended a tad higher on Tuesday on last-minute buying as players mostly stayed on the sidelines and took safe positions before the Christmas break.

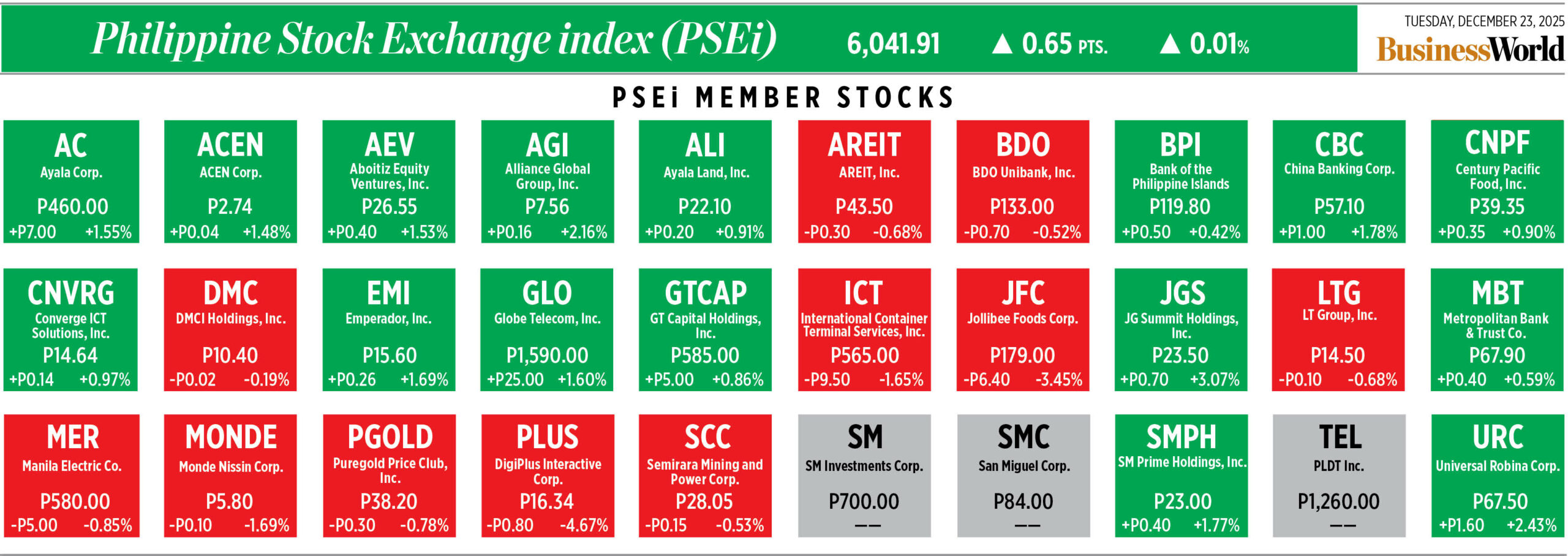

The bellwether Philippine Stock Exchange index (PSEi) edged up by 0.01% or 0.65 point to end at 6,041.91, while the broader all shares index rose by 0.03% or 1.23 points to 3,447.53.

“The local market pocketed a last-minute uptick, barely clutching higher grounds as investors seized the opportunity to position early before the Christmas break,” AP Securities, Inc. said in a market note.

“For the most part of the day, the local market was in the negative territory as investors booked gains to shield themselves from uncertainties and possible negative developments during the holidays,” Philstocks Financial, Inc. Research Manager Japhet Louis O. Tantiangco said in a Viber message. “Still, last-minute bargain hunting allowed the market to have a flat close.”

The PSEi opened Tuesday’s session at 6,058.10, higher than Monday’s close of 6,041.26. It hit an intraday high of 6,063.82 and a low of 5,988.67.

Philippine financial markets are closed on Dec. 24-25 for the Christmas holidays.

Most sectoral indices closed higher on Tuesday. Mining and oil climbed by 1.95% or 282.58 points to 14,768.3; property rose by 0.82% or 18.67 points to 2,269.70; holding firms went up by 0.66% or 31.09 points to 4,739.75; and financials increased by 0.21% or 4.31 points to close the session at 2,055.62.

Meanwhile, services fell by 1.11% or 26.65 points to 2,368.77, and industrials went down by 0.46% or 39.96 points to 8,600.38.

“JG Summit Holdings, Inc. was the day’s top index gainer, climbing 3.07% to P23.50. DigiPlus Interactive Corp. was the main index laggard, falling 4.67% to P16.34,” Mr. Tantiangco said.

Decliners outnumbered advancers, 107 to 88, while 49 names closed unchanged.

Value turnover went down to P4.7 billion on Tuesday with 1.52 billion shares traded from the P8.28 billion with 7.16 billion issues that changed hands on Monday.

Net foreign buying was at P107.99 million, a reversal of the P975.15 million in net selling recorded on Monday.

Meanwhile, Asia shares rose alongside precious metals on Tuesday as buying momentum from investors extended ahead of the festive holidays, with an advanced reading on US gross domestic product expected later in the day, Reuters reported.

Third-quarter growth figures are forecast to show the US economy had continued to grow strongly. The market mood remained buoyant ahead of the outcome and MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.39%, while Tokyo’s Nikkei eased 0.1%, weighed down by a stronger yen.

European futures were mixed, while S&P 500 futures and Nasdaq futures were little changed. — A.G.C. Magno with Reuters

DoF could limit BIR offices authorized to issue LoAs

FINANCE Secretary Frederick D. Go said the government is seeking to limit the Bureau of Internal Revenue (BIR) offices authorized to issue letters of authority (LoA) following allegations that the tax audit process is being abused.

“There are many departments that can issue an LoA. We’re looking at reducing that,” Mr. Go told reporters in a Dec. 18 briefing.

To curb potential abuse of the tax audit process, only the Commissioner, Charlito Martin R. Mendoza or the Deputy Commissioner, can approve LoAs and mission orders, the Department of Finance (DoF) said.

There are currently four offices that can issue assessments. The current plan is to consolidate the Assessment Division and VAT Audit Section’s issuing authority, the DoF said.

“If a company is being investigated, we can probably combine the VAT (value-added tax) investigation and the income tax investigation as one, rather getting them to deal with a separate group for VAT and a separate group for income tax,” Mr. Go said.

Field audits are currently suspended as the tax authorities look into the alleged abuse of the process. Audits require LoAs and mission orders before they can be initiated. Business groups and legislators had warned that audits are being used for extortion.

On Dec. 11, the BIR said it will crack down on the issuance of LoAs for tax audits, which will be subject to clearance from Mr. Mendoza.

Mr. Go also said the government is looking to reduce the frequency of LoAs to once a year.

“There has to be a centralized digital record of LoAs being issued,” he added, noting that taxpayers will thereby gain the ability to check the documents for authenticity.

Benedicta Du-Baladad, founding partner, chair, and chief executive officer of Du-Baladad and Associates, expressed support for the BIR’s planned moves regarding tax audits.

“But in addition to that, the selection of taxpayers to be (subject to examination) must be system-generated with no manual intervention based on a certain strict, defined, clear audit criteria of auditable taxpayers during the year,” she said via Viber.

Ms. Du-Baladad also urged the BIR to remove its investigating office and field officers’ discretion in selecting taxpayers for examination.

“Only the Commissioner (and only in justifiable circumstances), should have the discretion to deviate from an issued audit plan,” she added. — Aubrey Rose A. Inosante

National Single Window deal awarded to TradeX

THE Department of Information and Communications Technology signed a contract with TradeX Network, Inc. to develop the National Single Window system, the Public-Private Partnership (PPP) Center said.

In a statement on Dec. 19, the PPP said the deal covers the Integrated Trade Facilitation Platform project, which is structured as a public-private partnership.

“The project aims to facilitate trade by streamlining and digitizing processes for import, export, and international trade-related regulatory requirements,” the PPP Center said.

The project seeks to connect businesses engaged in trade to 77 government agencies involved in the permit-issuance process.

Phase 1 will initially onboard 11 agencies from the Department of Agriculture to help traders and farmers conduct their trade digitally.

“It opens the door for our traders. The mountain of paperwork becomes a single online form. Weeks of waiting become hours, or even minutes. Grit is now rewarded with speed, not frustration,” Information and Communications Technology Secretary Henry Rhoel R. Aguda said.

Mr. Aguda and TradeX Network, Inc. President Jason Cheng signed the contract on Dec. 19, in the presence of PPP Center Executive Director Rizza Blanco‑Latorre and Information and Communications Technology Undersecretary Faye Condez‑De Sagon.

The project will help traders minimize delays in trade, with farmers shipping perishable goods expected to benefit, Mr. Cheng said.

The single window is unsolicited, structured as a build-operate-transfer project and subject to the rules outlined by the PPP Code of the Philippines.

This was the first time for a national implementing agency to complete the awarding of a project under the PPP Code framework, the PPP Center said. — Aubrey Rose A. Inosante

Clark garment firm to shut down, lay off 500

CHARTER LINK Clark, Inc., a garment manufacturer based in the Clark Freeport Zone, has announced its closure, leaving about 500 jobless.

In a Dec. 22 letter to its employees, the company cited a “consistent decline in orders” over the past three years, compounded by the loss of its primary foreign customer, which resulted in zero projected sales for 2026.

The letter confirmed that all workers would receive severance pay, pro-rated 13th month pay, conversion of unused leave credits to cash, and one month’s salary in lieu of notice.

The Federation of Free Workers (FFW) described the timing and manner of the shutdown as “abusive” and “Grinch-like,” after the closure notice was delivered during a Christmas party and allegations that the workers were pressured to sign release forms in the presence of purported government officials.

“If the company’s Christmas party is turned into a meeting to hand out the ‘gift’ of being fired… that’s disrespectful and coercive,” according to Arta Maines, vice-president of FFW’s women’s network.

The company’s planned closure follows earlier legal disputes with union officials, the FFW said. Charter Link previously terminated union officials, who later won their case before the Court of Appeals.

The FFW has called on the Department of Labor and Employment and the Philippine Economic Zone Authority to investigate the closure, ensure due process, and guarantee the lawful payment of all final wages and entitlements.

It added that the abrupt closure casts a shadow over recent positive developments in the investment sphere, including the reported interest of Polish shipbuilder JPP Marine to establish operations in the country.

Jose G. Matula, FFW president said that while foreign investment is welcome, it must be aligned with a responsible industrial policy that ensures decent work and protects workers both inside and outside economic zones.

“The Philippines cannot be ‘investment-friendly’ while being ‘worker-hostile,’” he said. — Erika Mae P. Sinaking

PHL palay output estimated at 19.6 MMT — USDA

PHILIPPINE PRODUCTION of palay (unmilled rice) is expected to decline 0.16% to 19.6 million metric tons (MMT) in marketing year (MY) 2025-2026, the US Department of Agriculture (USDA) said.

In a report, the USDA’s Foreign Agricultural Service (FAS) in Manila said palay production during the MY, which runs between July 2025 and June 2026, is expected to decline from 19.64 MMT in the previous MY.

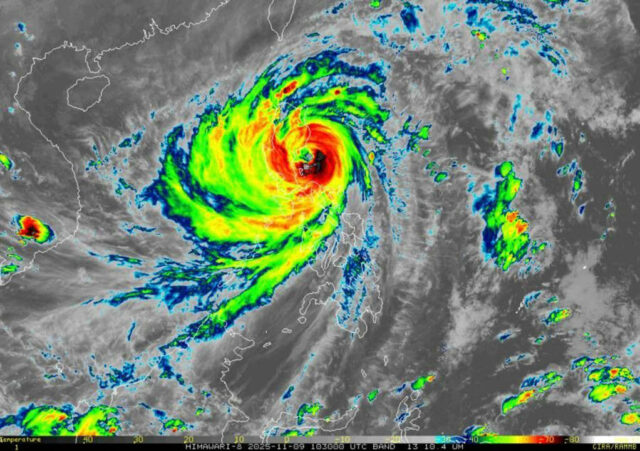

The USDA attributed the decrease in production to weaker-than-projected fourth-quarter output following typhoon-related losses and challenging post-harvest conditions.

Milled rice production is also projected to decline 0.16% to 12.35 MMT.

Rice consumption is projected to increase to 17.6 MMT from 17.4 MMT in the previous MY, while ending stocks are likely to fall to 2.95 MMT from 3.8 MMT previously.

“Consumption remains strong, driven by population growth and stable retail prices … Likewise, FAS Manila estimates ending stocks to decline because of lower production and reduced imports,” the USDA said.

The USDA said corn production is also projected to decline 0.73% to 8.27 MMT.

“Despite a strong harvest earlier in Q2 2025, overall output was reduced as weather disruptions offset gains from improved yields and government support,” the USDA said.

Corn consumption is projected to increase to 10.15 MMT from 9.9 MMT in the previous MY.

“FAS Manila estimates total corn consumption to increase, driven by growth in the broiler, layer, pet food, and recovering swine industries, with food, seed, and industrial (FSI) remaining robust,” the report said.

Total wheat consumption is also projected to increase 6.15% to 6.9 MMT.

“Growth in milling wheat consumption is supported by increasing demand for bread, pasta, and biscuits … Feed wheat consumption is estimated to rise as the swine, poultry, and pet food industries continue to expand, offsetting the decline in aquaculture,” the USDA said.

Meanwhile, the USDA said the Philippine food supply, or the total milled rice-equivalent volume of rice, corn and wheat, is projected to increase 1.78% to 25.8 MMT in the current MY. — Vonn Andrei E. Villamiel

Crop damage estimate after Uwan upgraded to P14 billion

THE final estimate of damage to agriculture caused by Super Typhoon Uwan (international name: Fung-wong, has been set at P14.12 billion, according to the Department of Agriculture (DA).

The final total is more than three times the DA’s previous estimate of P4.19 billion in crop damage issued in late November.

According to the DA’s Disaster Risk Reduction Management Operations Center, damage from Uwan by volume was 455,911 metric tons (MT), including crops like rice, corn, cassava, high-value crops and livestock. It affected 254,751 farmers.

Uwan, which traversed the country in early November, affected 180,067 hectares of farmland in Luzon, Visayas, and the north of Mindanao.

The DA reported P10.26 billion worth of damage to high-value crops, including fruit and vegetables, affecting over 46,000 hectares of farmland, mostly in Luzon, the Eastern Visayas, and Negros Island.

The department also reported P2.25 billion in damage to rice, affecting over 57,000 hectares of farmland in Luzon, the Western Visayas, and the Eastern Visayas.

The damage to corn amounted to P654.11 million, affecting more than 17,000 hectares of farmland in Luzon, the Eastern and Western Visayas, and Negros Island.

The fiber industry, which includes abaca, was also severely affected, with damage inflicted by Uwan valued at P535.72 million. Over 58,000 hectares of farmland planted to fiber crops were affected, mostly in the Bicol region and Samar.

The DA said it prepared P467.1 million worth of inputs for affected farmers and stood ready to disburse quick-response funds, which can be tapped for rehabilitation and recovery in affected areas. Indemnification is also available for Philippine Crop Insurance Corp. policy holders.

Affected farmers may also apply for zero-interest loans of up to P25,000 under the Survival and Recovery Program of the Agricultural Credit Policy Council, payable over three years at zero interest. — Vonn Andrei E. Villamiel

Iloilo’s MORE Power slashes Dec. power rates

ILOILO CITY power consumers served by MORE Electric and Power Corp. (MORE Power) will pay less in the December billing cycle after the power distributor reduced rates by 4.2%.

The average electricity rate fell to P11.3477 per kilowatt-hour (kWh) in December from P11.8558 in November, the company said in a statement on Tuesday.

The rate for commercial power users, meanwhile, fell to P10.6661 per kWh from P11.1741 previously.

MORE Power attributed the downward adjustment to the wider power supply margin as demand fell on the Wholesale Electricity Spot Market.

Meanwhile, the transmission charge decreased 3.7% month on month to P1.7918 per kWh, following the decline in the cost of regulated charges and ancillary services on the reserve market.

MORE Power’s distribution charge has not been adjusted.

The company also cited a decrease in system losses to P0.4086 per kWh from P0.4512 per kWh a month earlier. — Sheldeen Joy Talavera

NCR Nov. retail price growth hits 11-month high

RETAIL PRICE growth of general goods in the National Capital Region (NCR) hit an 11-month high in November with demand boosted by holiday spending, analysts said.

Citing preliminary data, the Philippine Statistics Authority (PSA) said the general retail price index (GRPI) in the NCR grew 1.4% year on year in November, against the 1.3% reading in October. The growth rate was unchanged from its year-earlier reading.

The index had come in at 1.5% in December 2024.

“The rise in prices can still be attributed to holiday demand. Higher demand for goods and services while supply plays catch-up can cause price upticks during the period,” Reinielle Matt M. Erece, economist at Oikonomia Advisory and Research, Inc., said in an e-mail.

He added that the delayed effects of rate cuts may have started showing up in the retail sector.

Ser Percival K. Peña-Reyes, director of the Ateneo Center for Economic Research and Development, attributed November’s faster GRPI growth in Metro Manila to cost pressures on retailers, early holiday price adjustments, specific goods’ price shifts despite low overall inflation, and base effects.

“These factors can cause the retail price index to rise even when national headline inflation is subdued due to slow food price growth,” he said.

In its December policy meeting, the Bangko Sentral ng Pilipinas lowered its benchmark policy rate by 25 basis points (bps) to 4.5%.

The Monetary Board cut its target reverse repurchase rate for a fifth meeting in a row, bringing the rate to its lowest since September 2022.

The central bank has so far lowered key borrowing costs by 200 bps since it began its easing cycle in August 2024.

In the first 11 months, GRPI growth averaged 1.1%, significantly lower than the year-earlier 1.8% average.

Growth in the heavily weighted food index, which accounts for 37.5% of the overall index, accelerated to 1.5% from 1.3% in October.

Faster price growth was also noted in mineral fuels, lubricants and related materials (2.8% from 1.9%), machinery and transport equipment (0.7% from 0.6%), and miscellaneous manufactured articles (0.9% from 0.8%).

“The price movements imply that the economy is experiencing selective inflation pressures rather than widespread stress,” Mr. Peña-Reyes said.

Meanwhile, price growth decelerated in beverages and tobacco (1.7% from 1.9%); crude materials, inedible except fuels (1.9% from 2.1%); and manufactured goods classified chiefly by materials (1.5% from 1.6%).

“Overall, this supports steady but cautious economic activity, with growth likely continuing at a modest pace rather than accelerating sharply,” Mr. Peña-Reyes said.

Mr. Erece said inflation remains below the central bank’s target range, so concerns about rising prices should be limited, though careful monitoring is still warranted as the first quarter approaches.

Meanwhile, Mr. Peña-Reyes said retail price growth in the following month “is expected to increase modestly from November’s level but will remain contained.”

“As for full-year 2025 retail price growth, it will likely stay moderate to low, in line with the generally low-inflation environment.”

In November, the consumer price index rose 1.5% from a year earlier, against the 1.7% reading in October. The year-to-date average was 1.6%, below the central bank’s target of 2% to 4%.

The PSA uses the GRPI as a deflator in the National Accounts, particularly in the retail trade sector, and serves as a basis for forecasting. — Heather Caitlin P. Mañago

Goat breeding program under review after CoA finding of animal neglect

THE Department of Agriculture (DA) said it ordered a review of its goat breeding program, after the Commission on Audit (CoA) flagged animal deaths linked to poor care.

The DA said the assessment will determine whether it should continue, scale down, or terminate the upgrades to the small ruminant project at the Pangasinan Research and Experiment Center in Sual, Pangasinan.

The DA said it will examine both the program’s technical viability and the resources required to sustain it.

The CoA said in its 2024 audit report that 52 of the 101 Anglo Nubian and Saanen goats procured for the project had died due to inadequate feed and nutrition. The animals were intended to serve as breeding stock for high-quality small ruminants.

According to the CoA report, the losses were estimated at P2.44 million on a book-value basis.

The DA said beyond basic feed and veterinary needs, no adequate funding was set aside during the previous administration to expand or sustain the goat production initiative.

The program also moved forward without the long-term budget support needed to sustain breeding operations, it said.

The CoA report found that allocations for goat feed were included in the 2025 budget under the National Livestock Program, with sufficient feed inventory now available at the station.

The DA said additional funds for animal care and maintenance have likewise been identified and incorporated into its 2026 budget proposal.

While assessments are ongoing, the DA said it plans to distribute the remaining Anglo Nubian and Saanen goats to farmers in Catanduanes severely affected by recent typhoons and livestock losses.

The DA said it also intends to temporarily repurpose the 140-hectare Pangasinan facility for high-value crop production and as an innovation hub. — Vonn Andrei E. Villamiel

DTI launches Christmas trade show at Megamall

THE Department of Trade and Industry (DTI) said on Tuesday that it opened a Christmas-themed trade show at SM Megamall which will run until Dec. 28.

Trade Secretary Ma. Cristina A. Roque said: “This is our last trade show for the year. It will give (exhibitors) an opportunity to sell during the Christmas season because that is really when the sales are,” she told reporters.

“If you are in the retail sector, ang pinakamataas na benta ay (the most sales take place on) Dec. 23,” she said.

This year, the Christmas Village will feature 300 businesses, up from only around 250 in previous shows.

“Trade shows are important for everyone, especially for micro, small and medium enterprises (MSMEs), because this is how they showcase their products,” she said.

She said the show accommodates MSMEs from all over the country with free exhibit space, adding that the DTI stepped up its trade-show activity this year.

“In the past, we did only five trade shows, but this year we did 12 trade shows. These shows are opportunities for them to sell, become better known, and be exposed to wholesale buyers both locally and globally,” she said.

The DTI is also banking on Tatak Pinoy to develop more quality products worthy of export.

Tatak Pinoy will enable a “more aggressive” approach to selling Philippine products, she said.

“The DTI is here to assist if you want to export. We are helping our entrepreneurs refine their packaging, sharpen their branding, and elevate their quality so that they are ready to face the global market,” she added. — Justine Irish D. Tabile

US law granting PHL $2.5-B military aid may be tied to Taiwan risk — analysts

By Kenneth Christiane L. Basilio, Reporter

US PRESIDENT Donald J. Trump’s approval of a bill that could provide $2.5 billion in multi-year military funding for the Philippines may reflect his administration’s bid to bolster its ally as the US prepares for a possible conflict over Taiwan, analysts said.

While the South China Sea remains a flashpoint, Washington’s greater concern is Taiwan, the self-ruled island that Beijing claims as its own and has not ruled out taking by force, said Vincent Kyle Parada, an emerging leaders fellow at think tank FACTS Asia.

Still, the security assistance — $500 million annually over the next five years — could give Manila a financial lifeline to upgrade its military arsenal amid lingering tensions in the disputed waterway, including long-sought advanced fighter jets, additional warships and missile systems, he added.

“The fact is that increased defense cooperation between the US, and the Philippines has primarily been in preparation for a Taiwan contingency — not a South China Sea one,” Mr. Parada, also a former defense research analyst with the Philippine Navy, said in a Viber message.

Mr. Trump last week signed a sweeping $900-billion military budget and defense policy bill, as Washington seeks to recalibrate defense priorities amid a shifting global strategic landscape.

The White House has released its National Security Strategy, with Washington looking inward to restore “American preeminence in the Western Hemisphere,” while still keeping a close watch on Taiwan.

“This recent aid package should be seen as a telling sign of Washington’s continued patronage [of Manila],” Mr. Parada said.

The Philippines and US are long-time allies, with their security ties anchored on the 1950s Mutual Defense Treaty that obligates both nations to come to each other’s aid in case of an armed attack in the Pacific. Manila also hosts several joint bases shared with US military personnel.

Like the US, the Philippines has kept a close watch on the Taiwan situation, where hundreds of thousands of Filipinos are staying.

The Philippines’ National Security Policy 2023-2028 identified the Taiwan conflict as a potential flashpoint due to the country’s proximity from the island, which could not only affect Filipinos in Taiwan but also lead to an influx of refugees.

Philippine military chief Romeo S. Brawner, Jr. in April directed the armed forces to prepare for a possible invasion of Taiwan, while President Ferdinand R. Marcos, Jr. in August warned the Philippines would be dragged “kicking and screaming” into any confrontation over Taiwan, which lies less than 200 kilometers from its northernmost islands.

While the US has vowed to protect Taiwan, Washington has adopted a policy of “strategic ambiguity” whether to militarily step in if China launches an invasion. Beijing claims Taiwan as a breakaway province and has threatened to annex the island, putting its 23 million people and the world’s most advanced semiconductor factories at risk.

Taiwan’s ex-Defense Minister Chiu Kuo-cheng in 2021 said China could be ready to mount a full-scale invasion of the island state by this year, while former US Indo-Pacific Commander John C. Aquilino said indications point to the possibility of a Taiwan invasion by 2027.

The Philippines is also at odds with China as it lays claim over almost the entire South China Sea based on a “nine-dash line” map, a claim voided by a United Nations-backed tribunal in 2016.

“While the two could be seen as a single operational theatre with significant spill-over effects between them, there should be no pretense. A Taiwan contingency will cross the threshold of armed conflict, and South China Sea tensions are deliberated being kept below that threshold,” Mr. Parada said.

The 2026 US military spending law also seeks to boost Washington’s “multilateral security cooperation and capacity-building efforts” with the Philippines and other regional partners, according to the bill posted on the US Congress website.

It also strengthens the US-Philippine alliance by helping modernize the Southeast Asian nation’s military to safeguard “maritime domain awareness,” counter “coercive military activities” and improve structures needed to prepare for regional contingencies.

The law also provides foreign military financing assistance of up to $500 million a year through 2030.

Chester B. Cabalza, founding president of Manila-based think tank International Development and Security Cooperation, said the security aid would strengthen the Philippines’ drive to modernize its military.

The Philippines has launched a sweeping $35-billion (P2-trillion) modernization program aimed at bolstering its military assets over the next decade, through the acquisition of advanced naval vessels, planes and missile systems, as it pushes back against China’s military might in the region.

“There are several key capabilities the armed forces are looking to develop under the modernization program, chief among them the anti-access and area denial capabilities, like missile defense systems,” Mr. Parada said.

He said the law gives the Philippines the freedom to acquire military assets it deems crucial to advancing its modernization program.

“While the continued expansion and modernization of the armed forces is an admirable effort, it needs to proceed at a sustainable rate… it’s a delicate balancing act,” said Mr. Parada.

“You can’t buy too much in quick succession because then they’ll become obsolete in quick succession,” he said. “At the same time, you can’t buy too sparingly because the evolving threat landscape demands that you invest in your immediate security.”