The Philippine economy in 2025

The Philippine’s GDP grew at 5.6% for the whole year of 2024, pulled down by the usual non-performer and Achilles heel of the Philippine economy, the Agriculture, Forestry and Fishing (AFF) sector that contracted at 1.6%. Services grew by 6.7% while industry expanded 5.6%. Although the GDP growth was below the Government’s target of 6% to 6.5% (close to the average of the last 14 years, with the exception of the pandemic years), at 5.6%, the Philippines is still ranked, together with India and Vietnam, as among the fastest growing economies in the Indo-Pacific region and in the whole world.

This should not be, however, a consolation to our leaders because, as I have written time and again in the past, we should be growing at 8% or more if we want to reduce the scandalously high poverty incidence of 16% for the whole country (and more than 30% in many regions, especially in Mindanao) to single-digits by the end of the Marcos Jr. Administration. All of our peers in the ASEAN region have poverty incidences of zero to five percent!

The encouraging news is that 2025 can see GDP growth of at least 6.5% because of a combination of global and domestic forces that can lift the volume of production of the national economy. As in previous global economic crises (the East Asian Financial Crisis of 1997 to 2000, the Great Recession of 2008 to 2012, and the COVID-19 pandemic from 2020 to 2022), the Philippines will be one of the least negatively impacted by the global economic slowdown that will be precipitated by the tariff wars that US President Donald Trump has already launched so very early in his presidency.

As we have analyzed over the last 25 years, the Philippines is practically immune to global economic crises because of its very low export-to-GDP ratio, which currently stands at 27% (as contrasted with 100% to 150% of neighbors like Singapore, Hong Kong, Vietnam, etc.). Our weakness in global trade becomes a strength during times of crisis. As practically all large, medium-, and small-scale enterprises in the country can attest to, their business predominantly depends on the domestic demand generated by 120 million people residing in the country.

Consumers will continue to be loaded with purchasing power from the $40 billion of OFW remittances, which will have greater purchasing power because the exchange rate will continue to depreciate at the P58 to P59 level. The moves of the Trump Government to deport residents will hardly include Filipinos in the US because they don’t belong to the “criminal illegal immigrants.” In fact, they are among the most helpful to the American public as nurses, caregivers, tourist workers, teachers, and even IT professionals.

Also, the information technology-business process outsourcing (IT-BPO) industry of the Philippines, which now employs some 1.7 million workers, is not being targeted by the MAGA policy of President Trump. They are doing work that Americans are reluctant to do. Besides, our leaders in the BPO-IT sector are so pro-active that they are quickly reskilling, retooling, and upskilling their workers in order to meet the threat of their replaced by Artificial Intelligence. Unemployment is being reduced as industry is actively promoting Enterprise Based Learning to reduce the mismatch between the output of our schools and the demand of industry for specific skills. Also, the Bangko Sentral ng Pilipinas (BSP) is expected to continue easing interest rates even if the US Federal Reserve pauses in its cutting interest rates due to the possibility of inflation being re-ignited in the US because of all the tariffs that Trump is imposing on imports. Lower interest rates in the Philippines can encourage higher consumption. With expert management of our BSP, inflation has been brought down to a low of 2-3%.

On the expenditure side, government spending boosted GDP growth by increasing 9.7% in 2024. Consumer spending and Gross Capital Formation (Investment) were muted at 4.7% and 4.1%, respectively. Both exports and imports grew at a lackluster rate of 3.2%.

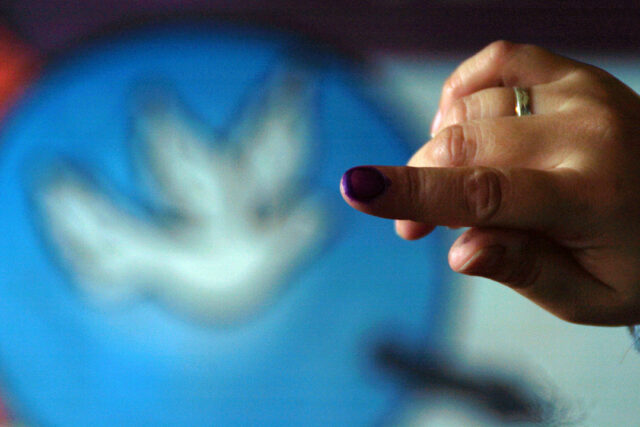

Election-related spending will be especially high in the first semester of 2025, ironically benefiting from the very controversial manipulation by Congress of the budget by which funds originally meant for education and health were diverted to pork barrel items that will help the incumbent politicians to buy votes. This temporary boost to GDP growth, however, does not justify the misallocation of scarce resources, especially since we are so far from investing the required 6% or more of GDP which our ASEAN neighbors are spending on education. The same thing can be said of the need to jack up the percentage of GDP spent on public health. It is hoped that the President will take greater control of the budgeting process and make sure that the tinkering with the budget by members of Congress does not happen again next year. He still has time to prevent the raid on public coffers by politicians who are using the so-called ayuda (assistance) to increase their pork barrel funds.

On the investment side, we can expect higher investments from the US and Japan, in line with the advocacy of their governments to construct the Luzon Economic Corridor which is meant to relocate a significant part of the US and Japanese chips manufacturers now operating in China. The Philippines has a reasonable chance of attracting some of these higher-value electronics and semi-conductor firms away from China (and Taiwan) because the governments of our ASEAN neighbors (Indonesia, Thailand, Malaysia, and Vietnam) have decided to join the so-called BRICS (Brazil, Russia, India, China, South Africa) intergovernmental grouping being promoted by China and Russia to counter the political and economic influence of the US in the Indo-Pacific region. There are also African and Latin American nations that have joined this new version of BRICS*. It was wise for President Ferdinand “Bongbong” Marcos, Jr. to decide not to join this political grouping. We can be sure that President Trump will take note of this despite the fact that the Luzon Economic Corridor idea was conceived during the time of his predecessor, Joe Biden.

Another reason why President Trump will exempt us from the harshest MAGA measures is that we have two of his closest advisers, Secretary of State Marco Rubio and multi-billionaire Elon Musk, very well disposed towards the Philippines.

When Mr. Rubio appeared before the US Senate for the confirmation of his appointment as Secretary State, I counted that he mentioned the Philippines at least four times. He was constantly insisting on how the US has a serious responsibility to help the Philippines (and Taiwan), because we are the closest ally of the US in this region.

Elon Musk also manifests a certain special attachment to the Philippines. He is putting his money where his mouth is in the numerous Starlink satellite connections he is installing on many of our isolated islands. He also has started selling his Tesla electric cars here, even while realizing that it would be difficult for him at this time to compete price-wise with the BYD car of the Chinese.

I partly attribute his fondness for us because of our “young and growing” population. He very frequently refers to the “demographic suicide” that many advanced countries have committed, leading to very low fertility rates and a rapidly ageing population, including China. I am sure he will always put us in a good light when he advises President Trump on his foreign policy towards the Indo-Pacific region.

Fortune shines on us during this Year of the Snake. This optimistic note about the economy should partly counter the pessimistic expectation that once again, in the coming May elections, the electorate will vote for many unqualified candidates to the Philippine Senate.

*Current membership consists of Brazil, Russia, India, China, South Africa, Egypt, Ethiopia, Indonesia, Iran, and the United Arab Emirates.

Bernardo M. Villegas has a Ph.D. in Economics from Harvard, is professor emeritus at the University of Asia and the Pacific, and a visiting professor at the IESE Business School in Barcelona, Spain. He was a member of the 1986 Constitutional Commission.