Tariffs, Fed policy and BSP easing shape markets in Q2

US TARIFFS, Federal Reserve’s uncertain fiscal policies, and the Bangko Sentral ng Pilipinas’ (BSP) easing cycle, were the main drivers of the local financial market’s performance in the second quarter of 2025, analysts said.

These factors are expected to continue impacting the country’s financial market for the rest of the year, the central bank said.

At the end of the second quarter, the benchmark barometer Philippine Stock Exchange Index (PSEi) closed at 6,364.94, down 0.7% from a year earlier.

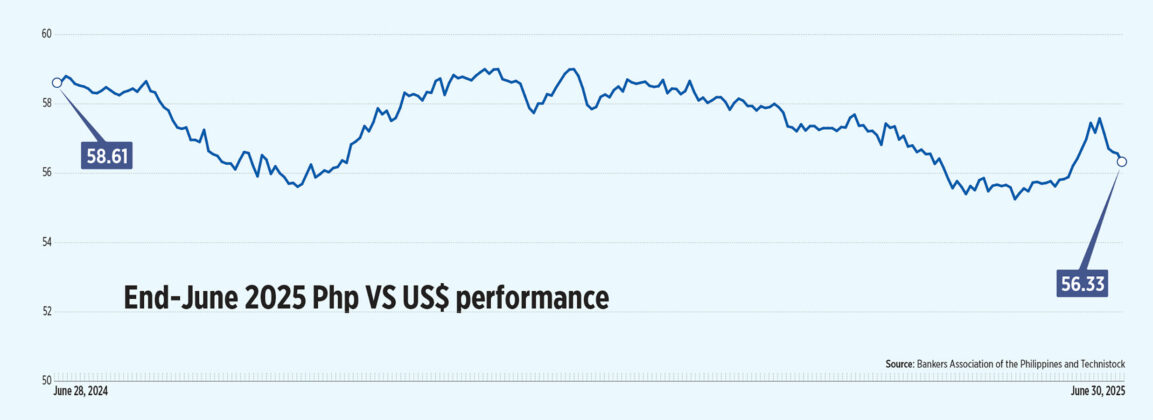

Meanwhile, data from the Bankers Association of the Philippines showed that the peso closed at P56.33 as of end-June, stronger than the P58.61 finish a year ago.

At the secondary bond market, domestic yields dropped by an average of 6.22 basis points (bps) year on year, based on PHP Bloomberg Valuation (BVAL) Service Reference Rates published on the Philippine Dealing System’s website as of end-June.

TRADE UNCERTAINTY

Analysts said that the US trade policies was one of the main drivers of the domestic market movements during the second quarter.

“US President Donald J. Trump’s sweeping tariffs and rapidly shifting policies triggered a wave of uncertainty across the global economy, (which) led the US Federal Reserve to hold off on interest rate cuts, and weighed on investor sentiment,” Chinabank Research said in an e-mail.

It added that with Mr. Trump promising more tariffs, changes to US trade policy will likely remain a significant market mover for the year.

This escalation of US tariffs created volatility in global markets, said Ruben Carlo O. Asuncion, chief economist at Union Bank of the Philippines, Inc., in an e-mail.

He added that uncertainty over future trade measures contributed to a cautious sentiment from investors and global supply chains.

Last Aug. 7, Mr. Trump implemented a 19% tariff on Philippine goods. This was lower than the 20% the US had threatened to carry out, but still higher than the 17% levy initially announced last April.

On the other hand, Pantheon Macroeconomics Chief Emerging Asia Economist Miguel Chanco said that while tariffs had fueled much of the market volatility since early April, this would likely be less of a concern moving forward.

“Now that the US has arrived at a somewhat settled tax rate vis-à-vis most countries, who, for the most part, are accepting this new status quo,” he said in an e-mail.

He added that the 19% levy isn’t a “huge hit” as it doesn’t put the country at a disadvantage among its competitors in the region.

For the central bank, this 19% levy slapped on Philippine goods had broadly similar rates with some neighboring economies and lower than others.

“While the US tariffs may have downside impact on our economy, this could be less than the impact on our neighbors given that the Philippines relies less on exports,” the BSP said in an e-mail.

The country’s new US tariff rate aligns with those of Indonesia, Cambodia, Malaysia and Thailand but is slightly lower than Vietnam’s 20%.

FED UNCERTAINTIES

Reinielle Matt M. Erece, an economist at Oikonomia Advisory and Research, Inc., said that speculations on US monetary policy decisions drove financial markets in the quarter.

“[US] inflation risks and economic performance have spillover impacts on all markets especially for emerging markets like the Philippines,” Mr. Erece said in an e-mail.

Aside from the ongoing tariff negotiations, developments related to the resumption of the US Fed rate cut cycle have been a major market movement, said Nicholas Antonio T. Mapa, chief economist at Metropolitan Bank & Trust Co.

“Domestically, developments related to the BSP’s own rate cut cycle and growth report also contributed to the movement of Philippine markets,” he said in an e-mail.

The US central bank’s benchmark rates held steady for the second quarter with a 4.25% to 4.5% but is signaling for two rate cuts by the end of 2025.

Analysts pointed out that Fed cuts could favor the emerging markets including the Philippines.

For Marites M. Tiongco, professor and dean of the School of Economics at the De La Salle University, every time the Fed would hint at rate cuts, global investors were more inclined to take risks, since a weaker dollar could be an advantage for Philippine markets.

Similarly, Mr. Asuncion said that the Federal Reserve may maintain a cautious stance with rate cuts in late 2025 to early 2026.

“A weaker US dollar trend could favor emerging market assets, including the Philippines,” he added.

The BSP said that the peso appreciated against the dollar in the second quarter as the dollar weakened due to trade uncertainty, soft US economic data, and dovish Fed signals.

The local unit is expected to remain stable despite BSP rate cuts, supported by growth, manageable inflation outlook, reforms, and steady foreign exchange inflows from BPOs, tourism, and remittances, the central bank added.

MONETARY EASING CYCLE

In its June policy meeting, the central bank slashed policy rates by 25 basis points (bps), to 5.25%, the lowest level in two and a half years.

This came amid benign inflation and weaker-than-expected economic growth.

“Lower interest rates may hopefully encourage more borrowing to be used for household spending or capital expenditures,” said Mr. Erece.

In the second quarter, the Philippine economy expanded by an annual 5.5%, weaker than the 6.5% growth in the same period last year. Still, this was slightly faster than the 5.4% expansion in the January to March period.

The latest GDP figure hit the lower end of the government’s 5.5% to 6.5% growth target this year.

Mr. Asuncion said that the recent BSP cuts since April supported “liquidity, lowered borrowing costs, and boosted sentiment in equities and credit-driven sectors such as real estate and banking.”

BSP Governor Eli M. Remolona, signaled the possibility of two more rate cuts this year, after the cut in June.

At its August policy meeting, the BSP slashed the target reverse repurchase rate by 25 bps to 5% from 5.25%, its lowest level in almost three years.

The central bank began its easing cycle in August last year, reducing borrowing costs by a total of 150 basis points (bps).

“The Bangko Sentral ng Pilipinas (BSP) is likely to continue cutting policy rates toward 4.75% by yearend,” Mr. Asuncion added.

Meanwhile, Mr. Chanco expects that “there could be more an upside surprise for markets here if the BSP goes for three [rate] cuts, which is within the realm of possibilities from our standpoint, given how elevated rates still are after adjusting for (very low) inflation.”

For the central bank, the rate cut delivered in August was “probably the end of the easing cycle, unless new data will necessitate another cut for the year.”

The latest rate cut, the BSP said, is expected to reduce borrowing costs and support domestic spending and investment, which in turn could support the local stock market.

For Ms. Tiongco, if inflation remains low, it could provide a “goldilocks” environment for the Philippine market.

August inflation quickened to a five-month high of 1.5%, a tad faster than the 0.9% in July but still slower than the 3.3% recorded in the same month last year.

The latest inflation reading settled with the BSP’s 1%-1.8% forecast for the month and marked the six straight month it fell below the central bank’s 2-4% target range.

For the first eight months, headline inflation averaged 1.7%, matching the BSP’s 1.7% target this year.

WHAT TO WATCH OUT FOR

The BSP noted that global factors such as trade, immigration, fiscal policies, and US monetary easing will shape market sentiment in the second half, while its own policy stance, alongside fiscal measures and structural reforms, will also play a crucial role.

For Chinabank Research, market participants should keep an eye on US tariff policy, rate cuts of both the Fed and BSP, and geopolitical risks.

“An escalation in geopolitical tensions could spur market volatility and disrupt supply chains, potentially affecting commodity prices,” Chinabank Research added.

For Mr. Mapa, he said that tariffs and Fed policy “remain the major and pivotal issues that should continue to drive market sentiment for the rest of 2025.”

He said that the BSP outlook as well as Philippine economic growth would influence the market in the following months.

Meanwhile, Mr. Chanco said that Asia’s export growth is expected to slow sharply in the second half as earlier front-loaded shipments to the US begin to unwind.

He noted that market sentiment could swing either way. He said that market sentiment could improve if export growth slows only gradually, suggesting first-half gains were driven by real demand.

However, risks remain should the US impose sector-specific tariffs on semiconductors and pharmaceuticals.

For her part, Ms. Tiongco said the third quarter may be “choppy,” with easing inflation and rate cuts balanced against US tariffs and geopolitical risks.

“The best trades are in domestic-facing sectors and medium-tenor bonds while the biggest risk is tariffs hitting electronics, which would dampen sentiment more than the actual economic hit,” she added.

FIXED-INCOME MARKET

Chinabank Research: We expect market interest rates to move lower this [third quarter], with the yield curve steeper, driven by expectations of further easing from both the BSP and Fed.

Mr. Mapa: It will take its cue from supply conditions as well as projected inflation and BSP policy. We could see a fundamental based rally if inflation remains target consistent and BSP pulls through on easing.

Mr. Asuncion: Lower policy rates reduce borrowing costs and push yields down, making existing bonds more valuable. Analysts expect 10-year yields to fall toward 5.5% from 6.2%, creating capital gains opportunities for bondholders.

Mr. Erece: Strong demand for assets in emerging markets may continue to persist and thus increase demand for peso-denominated bonds.

Ms. Tiongco: Duration strategies favor the “belly” of the curve (3-7Y). If yields on the 10Y spike above 6.2% due to supply or tariff noise, it’s a buying opportunity.

EQUITY

Chinabank Securities Corp. Research Director Rastine Mackie D. Mercado: We generally expect the PSEi to traverse the range between 6,150 and 6,550 level for most of third quarter, pending a fresh catalyst.

Mr. Asuncion: The easing cycle signals a pro-growth stance, which could attract both domestic and foreign investors, especially as inflation risks remain muted and the peso stays relatively stable.

Mr. Erece: We may expect to see sideways movement in equity markets as investors remain cautious with developments in the global economy as well as policy changes within the domestic economy.

Ms. Tiongco: Likely to trade between 6,100-6,600 and could climb toward 6,700-6,800 if tariffs are softened/delayed and US cuts rates but could fall to around 5,900 if tariffs worsen or oil spikes.

FOREIGN EXCHANGE MARKET

Chinabank Research: Expectations for the Fed’s policy rate path would remain a key driver of the USD and PHP. A rate cut by the Fed in September and guidance for further easing could weaken the US dollar.

Mr. Mapa: A bond market rally could attract foreign flows especially if the Philippines does gain inclusion or is confirmed to be on the watchlist for inclusion in the JPMorgan bond index.

Mr. Asuncion: Peso strength reflected resilient remittances, a narrower trade gap, and BSP’s credibility, though volatility persisted due to global risk sentiment and tariff headlines.

Mr. Erece: We may expect the Fed to remain hawkish as inflation risks continue to loom amid the tariff impositions by the Trump administration.

Ms. Tiongco: USD/PHP stays in P56 to P58 range, but tariff-related outflows or an oil spike could push it toward P59.5. — LPQB