High inflation, rate hike pause, economic slowdowns sway markets in Q2

By Mariedel Irish U. Catilogo, Researcher

SOFTER global economic growth, high inflation, and the US Federal Reserve’s hawkish stance stirred the domestic financial markets in the second quarter.

The barometer Philippine Stock Exchange index (PSEi)closed the second quarter at 6,468.07, down 0.5% quarter on quarter from 6,499.68 in the first quarter. Year on year, the index went up by 5.1% from the 6,155.43 finish in the second quarter of 2022.

Meanwhile, the peso closed P55.20 against the dollar in the second quarter, down by 1.5% from the previous quarter’s finish of P54.36 to a dollar. On an annual basis, the local unit inched down by 0.4% from P54.98 close in the same quarter last year.

The demand for Treasury bills auctions recorded a total subscription amounting to P416.6 billion with P157.4-billion total offered amount in the second quarter.

The oversubscription amount of P259.2 billion was lower than the P266 billion in the first quarter.

Meanwhile, the demand for Treasury bonds saw a total of P687.2 billion, lower than the P1.1 trillion in the first quarter. The demand was higher than the aggregate offered amount of P319.5 billion in the April-to-June period.

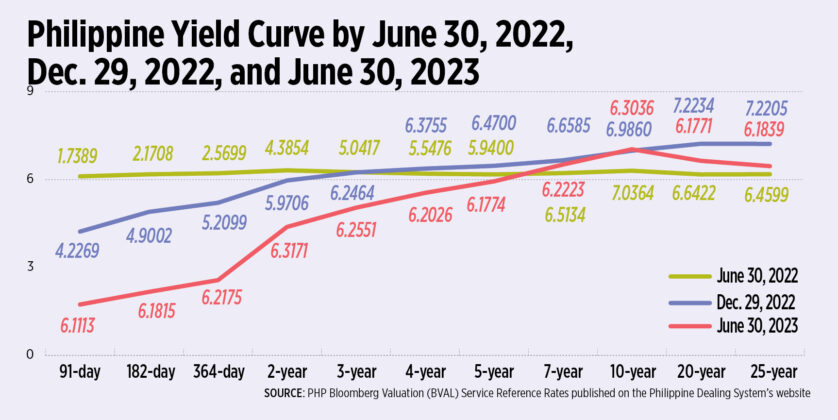

At the secondary bond market, domestic yields saw an increase by 3.97 basis points (bps) on a quarter-on-quarter average, based on the PHP Bloomberg Valuation (BVAL) Service Reference Rates published on the Philippine Dealing System’s website.

On a year-on-year basis, yields also grew by 57.81 bps.

“The Fed proved to be more hawkish than financial markets expected in the second quarter where the revised dot-plot showed that an additional 50 bps increase is expected. This caused rates to move up and urged market players to adjust their expectations,” China Banking Corp. (China Bank) Chief Economist Domini S. Velasquez said in an e-mail.

The US Federal Reserve in July hiked its benchmark rate by 25 bps to 5.25-5.5% range, after it paused its tightening cycle the previous month.

The Fed has raised its policy rate by a total of 525 bps since March 2022.

“With the easing inflation in the US (June and July CPI prints), the Fed is looking to be a little more dovish and markets are currently pricing in a small chance of another rate hike,” Ms. Velasquez added.

Nicholas Antonio T. Mapa, senior economist at ING Bank N.V. Manila Branch, attributed the overall sentiment to the developments of China’s slower economic growth.

“Where will the Fed go is the main theme for the quarter with investors trying to gauge whether the Fed would end its current rate hike cycle or whether they would continue to push rates higher,” Mr. Mapa said in an e-mail.

In April-to-June period, China’s economy expanded by 0.8% from the 2.2% expansion in the first quarter, the National Bureau of Statistics reported. Year on year, its gross domestic product (GDP) grew by 6.3% in the second quarter, up from 4.5% in the first quarter.

POLICY RATE CUTS?

Despite the downtrend in the country’s headline inflation, analysts believed that policy rate cuts are still unlikely to happen.

“At most one more rate hike is likely from the Fed this year before it ends its monetary tightening cycle. With a possible narrower interest rate differential, the BSP may use other non-monetary measure such as using its foreign reserves to resist excessive depreciation of the peso,” China Bank’s Ms. Velasquez said.

The BSP told BusinessWorld that policy rate cuts may be considered once inflation settles within its 2-4% target range.

“While the data seems to suggest that inflation is gradually moving in the right direction, persistent upside pressures on prices require continued monitoring, particularly as they could contribute to the emergence of further knock-on effects,” the BSP said in an-email.

The central bank also emphasized that while international policy decision is measured in policymaking process in the local scene, the Fed’s decision is currently “not as important” to the BSP’s decision-making process.

“At this time, the BSP sees less need to match the actions of the US Fed and other advanced economy central banks, as the recent decline in domestic headline inflation provides the BSP grounds to pause its monetary tightening,” the BSP added.

The country’s headline inflation rose by 5.3% in August from 4.7% in July and 6.3% in the same period last year. The August print marked the 17th straight month of inflation exceeding the central bank’s target range.

For the eight months of 2023, it averaged 6.6%, way above the BSP’s 5.6% full-year forecast.

BSP, for its part, kept its key rates steady at its fourth straight meeting in September. Current target reverse repurchase rate still stands at 6.25%, while overnight deposit and lending rates are maintained at 5.75% and 6.75%, respectively.

Meanwhile, University of Asia and the Pacific Senior Economist Cid L. Terosa expects the central bank to track closely decisions made by the Fed as the “economy lacks enough fiscal and monetary space to detach effectively from Fed’s policy decisions.”

He also noted that market players should monitor the local impact of food and commodity markets including economic growth trends in major world economies.

“In the second half of the year, sustained inflation, economic slowdown, and geopolitical tensions in the global economy will help determine if inflation rates at home will continue to slow down,” he said via e-mail.

“In addition, we cannot discount the inflationary effect of El Niño on agricultural production and the perennial menace of more lethal weather disturbances in the second half of the year,” Mr. Terosa added.

The Philippines’ economy saw the second quarter with a weaker-than-expected growth as its GDP expanded by 4.3%, the slowest in over two years.

It was slower compared to the 6.4% growth in the first three months of 2023 and 7.5% last year.

For the first half of the year, GDP growth averaged 5.3%, well below the government’s 6-7% full-year target.

FIXED-INCOME MARKET

BSP: The performance of the fixed income market will largely depend on the movement of domestic policy rates and local bond supply concerns. In the near term, domestic yields may trade sideways with an upward bias as the BSP remains hawkish in its monetary stance despite the temporary pause in monetary tightening.

Meanwhile, risks to the outlook remain, stemming from the uncertainty over future monetary policy decisions from the US Fed amid easing but above-target inflation. Given the recent policy rate increase of the US Fed and expectations of another rate increase before the end of the year, the narrowing of the interest rate differential between the US Fed’s and the BSP’s key policy rate may provide downside risks to the performance of the fixed income markets in the medium term.

Ms. Velasquez: Domestic market interest rate will continue its downtrend as inflation also cools down and as most emerging market economies’ central banks have also reached their terminal rate. The yield curve will be relatively flat until the fourth quarter, when we think central banks will be open to talks on rate cuts already.

Mr. Terosa: This market may benefit from historically higher interest and inflation rates because both will help invigorate current demand for fixed-income securities.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort: Easing inflation trend in the US and in the Philippines towards the inflation targets would fundamentally support a pause in policy rates and, eventually, justify any subsequent policy rate cuts, especially in 2024, if inflation rates sustain at the central bank targets.

There would also be relatively large maturities of government bonds/Treasury bonds in March 2023 that could fundamentally support demand for government securities/bonds amid the search for reinvestment opportunities as T-bond yields remain relatively high/elevated, or still among cycle highs, in terms of yield-to-maturity.

Mr. Mapa: We could see an improvement in sentiment as inflation should continue to trend lower and with the BSP possibly finally shifting to a more accommodative stance should the Fed do the same.

FOREIGN EXCHANGE (FX MARKET)

BSP: For [third quarter 2023], the peso is expected to trade sideways with slight appreciation bias on expectations that the country will be one of the fastest growing economies in the region (as featured in the latest reports by the IMF, ADB, and Moody’s Analytics) and expectation that the BSP may resume its monetary policy tightening following continued hawkish remarks.

In the near term, the country’s overall balance of payments will be a significant determinant of the future path of the peso-dollar exchange rate. In particular, the country’s improving current account amid the expected increased growth in services exports and the business process outsourcing (BPO) sector will provide support to the peso.

Moreover, optimism regarding global and regional growth outlook are expected to provide relief to regional currencies, including the peso.

At the same time, uncertainty over the path of the US Fed’s policy rate adjustments amid still-elevated inflation as well as lingering geopolitical concerns may likewise contribute to movements in the exchange rate.

Nonetheless, structural FX flows coming from the BPO sector and overseas Filipinos will continue to provide support to the peso.

Likewise, the eased rules on foreign entry and mobility restrictions coupled with renewed influx of tourists are expected to generate FX receipts in the form of increased tourism revenues. The substantial holdings of international reserves also provide a level of comfort in the peso amid the current challenging global environment.

Ms. Velasquez: In the third quarter, we expect the peso to depreciate due to seasonal importation and a possible rate hike from the Fed. The peso is expected to rebound towards the end of the year as remittances surge ahead of the holidays. Also, the Fed will have likely reached the ends of its tightening cycle by that time. Narrowing trade deficit, tourism receipts, revenues from BPO, and moderating net foreign direct and portfolio investments will also support the country’s balance of payments position.

Mr. Terosa: Inflation can make the peso weaker. Indications of more tightening in the USA will probably contribute to the weakening of the peso.

Mr. Ricafort: Seasonal increase in importation activities in [third quarter 2023] (after the tail-end of the seasonal increase in OFW remittances and conversion to pesos used for tuition payments and other related expenses in preparation for the start of the new school year), in preparation for the expected seasonal increase in demand locally and for exports in [fourth quarter 2023]; then the seasonal increase in OFW remittances and conversion to pesos during the holiday season in the latter part of [fourth quarter 2023].

Mr. Mapa: Current scenario sees a strong USD theme with US yields elevated due to expectations for the Fed to possibly hike rates further. Once the Fed signals they are done tightening we could see a reversal of this trend with the PHP possibly rebounding before yearend.

EQUITIES MARKET

BSP: Market concerns over domestic and international developments will continue to determine the future performance of the domestic stock market. pressure arising from concerns over its impact on economic activity, borrowing costs, and corporate profits is expected to increase, thereby, weighing on domestic stock market performance.

Risks to the external outlook continue to persist, which include: 1) potential escalation of geopolitical conflicts; 2) adverse weather conditions that could drive up global food commodity prices anew; and 3) China’s economic slowdown which may have a negative spillover effect on neighboring economies, more directly on the revenue of their exporting firms.

On the domestic front, the country’s robust economic growth and the downward path of domestic inflation are expected to boost confidence in Philippine equities.

For [third quarter 2023], the PSEi is expected to rise due to optimism over Philippine economic growth, which is seen to remain as one of the fastest in the region (as mentioned in the latest reports by the International Monetary Fund (IMF), the Asian Development Bank (ADB), and Moody’s Analytics).

The index may be also supported by expectations that the US Fed will soon end its monetary policy tightening. Nonetheless, gains may be limited due to geopolitical concerns (e.g., US-China, China-Taiwan, Ukraine-Russia, and Korea) and worries over China’s economic recovery.

Mr. Terosa: This market will be adversely affected by relatively higher interest and inflation rates since both can weaken company sales and profits. It would be better to park funds in bank deposits or fixed-income securities if both interest and inflation rates continue to be historically elevated.

Mr. Ricafort: Any start of cut in policy rates in the US and locally would help reduce interest rate benchmarks, which would translate to lower borrowing/costs, thereby would help reduce corporate expenditures on interest rate payments on loans and would lead to higher earnings.

Further recovery of business activities as the economy reopens towards greater normalcy with no more large-scale lockdowns since 2022 and no more lockdowns as a policy priority, would lead to higher sales, income, jobs, and overall valuations of listed companies.

Easing inflation and, eventually, policy rates, especially into 2024 would also support sentiment on Emerging Markets such as the Philippines as global investors such for higher returns.