Analysts upbeat on banks despite rate cut hopes

THE LISTED bank stocks picked up quarter-on-quarter in the first three months of the year as borrowing growth and improved net interest margins lifted its earnings.

The Philippine Stock Exchange index (PSEi) rose by 7% in the first three months, faster than the 2% quarter-on-quarter growth in the fourth quarter and the 6.2% a year ago.

Meanwhile, the financials subindex, which included the banks, grew by 17% in the first quarter. This was a turnaround from the 6.6% contraction in the previous quarter.

Year on year, the subindex went up by 12.4%.

The first quarter saw 11 out of 15 listed banks’ stock prices grow on a quarter-on-quarter basis. Metropolitan Bank & Trust Co. (MBT) led with 27% in its share price from P51.30 in the fourth quarter. This was followed by Philippine Bank of Communications (PBC, 23.7%), BDO Unibank, Inc. (BDO, 18.4%), China Banking Corp. (CHIB, 18.3%), Asia United Bank (AUB, 18%), Bank of the Philippine Islands (BPI, 13.8%), East West Banking Corp. (EW, 7%), Philippine National Bank (PNB, 6.7%), Philippine Savings Bank (PSB, 3.6%), Philippine Business Bank (PBB, 2.3%), and Rizal Commercial Banking Corp. (RCB, 1.7%).

On the other hand, four listed banks saw their share prices decline in the first quarter.

Philippine Trust Co. led the losers with a 29.2% decrease in its share price quarter on quarter. Other lenders also recorded declines including Union Bank of the Philippine (UBP, -10.6%), Bank of Commerce (BNCOM, -9.2%), and Security Bank Corp. (-4.1%).

“Accelerating industry loan growth, healthy lending margins, and stable asset quality underpinned the performance of banks in the first quarter,” BDO Securities Corp. First Vice-President and Head of Research Abigail Kathryn L. Chiw said in an e-mail.

Aggregate net income of universal and commercial banks grew by 9% to P337.28 billion as of end-March from P309.44 billion last year, data from the Bangko Sentral ng Pilipinas (BSP) showed.

Outstanding loans by universal and commercial banks, net of reverse repurchase (RRP) placements with the BSP, grew by 9.4% year on year to P11.8 trillion in March, faster than the 8.6% growth in February.

Gross total loan portfolio of these big lenders rose by 9.6% to P12.71 trillion as of end-March from P11.59 trillion last year.

Likewise, the big banks’ gross nonperforming loans (NPLs) ratio went up by 3.07% in March from 3.03% in March a year ago.

The big bank’s net interest margin (NIM) — a ratio that measure banks’ efficiency in investing their fund by dividing annualized net interest income to average earning asset — improved to 3.96% in the first quarter from 3.59% recorded in the same period last year.

Provision for credit losses by these big banks reached P20.87 billion, up by 28.2% from P16.28 billion in March 2023.

Luis A. Limlingan, head of sales at Regina Capital Development Corp., said that listed banks’ performance in the first quarter was mainly affected by macroeconomic conditions, interest rate environment, regulatory changes, loan growth, asset quality, and operational efficiency.

“Additionally, the interest rate environment, especially any changes in central bank policies, directly impacted NIMs and profitability,” Mr. Limlingan said in an e-mail.

At its May meeting, the Monetary Board kept its benchmark rate at a 17-year high of 6.5%. The BSP raised borrowing costs by a cumulative 450 basis points (bps) from May 2022 to October 2023.

For the first quarter, the Philippine economy expanded by 5.7%, up from the 5.5% growth in the last three months of 2023. However, this was still below the 6-7% growth target of the government.

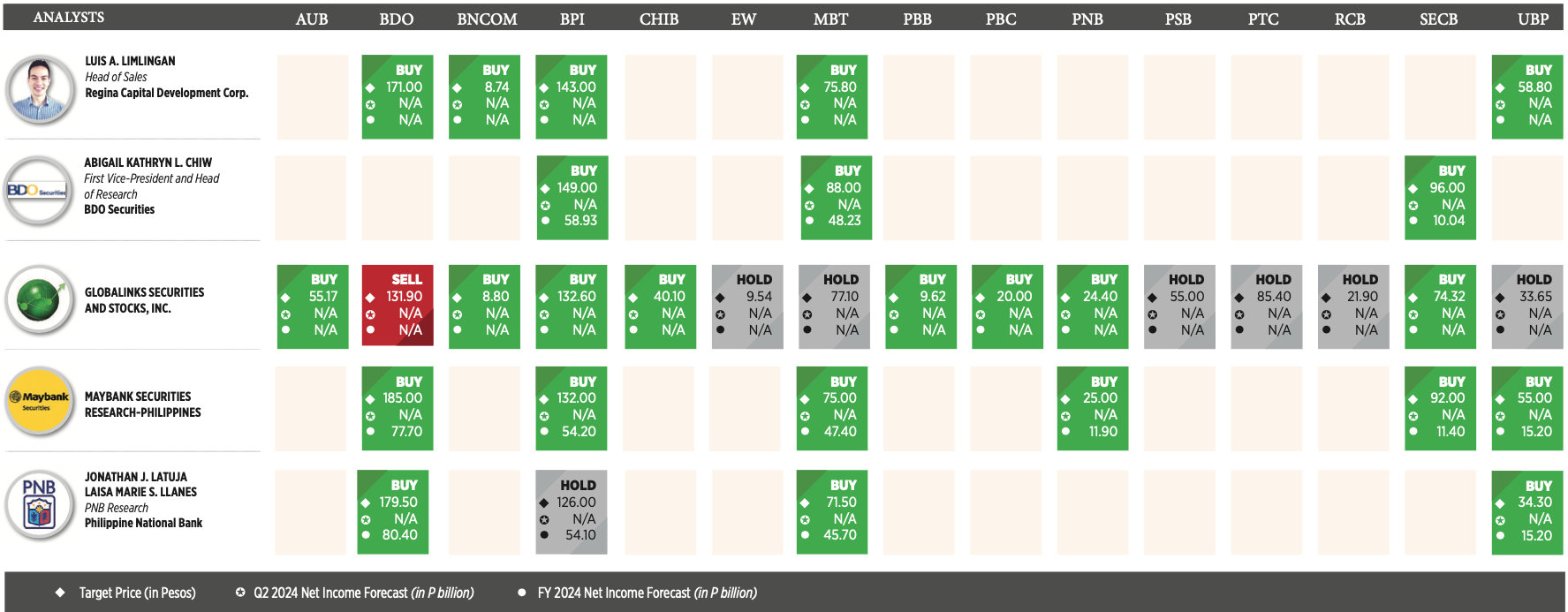

BANK STOCK PICKS

Analysts said market players should closely monitor economic trends affecting loan demand and asset quality.

“Steady growth in economic activity is likely to support loan demand, while still, elevated interest rates may discourage businesses and households from taking on new additional debt,” BDO Securities’ Ms. Chiw said.

Ms. Chiw also expects bank segments such as lending, credit cards, and various fee-based services to expand; however, she noted that trading and investment banking will tone down due to the volatility of financial markets.

Meanwhile, PNB Research said developments in the US Federal Reserve’s and BSP policy decisions would dictate the NIM performance of banks.

“The banks’ strategies in growing their respective loan portfolios and ability to control increases in their operating expenses and loan loss provisions are now more important compared to last year because we are expecting limited NIM expansions this year,” PNB Research said in an e-mail.

For those seeking potential investments, Maybank Securities Research–Philippines picked out BDO and Metrobank as a good choice to buy.

“BDO remains our top pick as its scale makes it best placed to capture lending growth in a growing economy. We also believe it has the best mix of digital banking and branches to gain market share, especially in the Philippines where many still don’t have bank accounts. We also like Metrobank for its high dividend yield post its announcement of special dividends,” Maybank Securities Research–Philippines said in an e-mail.

For Mr. Limlingan, BPI and Chinabank stood out due to its ability to “navigate regulatory challenges and maintained prudent risk management practices demonstrated resilience amidst market uncertainties, reflected in robust loan growth, improved asset quality, effective cost management, and diversified revenue streams,” he said.

OUTLOOK

With the hope of rate reduction this year, analysts point out its possible effects to the banks’ income growth.

The central bank is expected to cut rates by up to 150 bps with an anticipation that the inflation will settle within the BSP’s 2-4% target.

Inflation continued to accelerate to a six-month high of 3.9% in May. To date, inflation averaged 3.5%.

Globalinks Research expressed optimism about the banks’ performance in the coming quarter despite potential cheaper borrowing costs this year.

“There is speculation that although Fed officials are looking to cut rates in September, insufficient progress bringing inflation down further alongside rising price expectations has stoked some doubts about whether the Fed will move at all this year,” Globalinks Research said in an e-mail.

PNB Research sees a delayed impact on the banks’ NIM once the central bank decides to cut rates, but this would depend on the magnitude of rate cut.

“A lower interest rate environment would stimulate the economy and business activity so this might have a positive effect on the bank’s loan growth performances,” PNB Research said.

For Ms. Chiw, the impact of rate cuts on the banks’ NIM may be compensated by robust loan growth and lower provisioning costs.

“As long as banks are able to demonstrate the ability to sustain healthy earnings growth, then we think stock prices of banks will remain supported,” she added. — MIUC