Finding the right combination of ingredients leads to diabetic-friendly ice cream

THE SUGAR-FREE variety of artisanal ice cream brand Sebastian’s Ice Cream was spurred on by a personal story.

“My dad was diabetic, and so it was drilled into me early on what life with diabetes was like: how eating sugar could literally do them great harm, and watching people with diabetes have to live without foods everyone takes for granted,” said Ian Carandang, founder and resident sorbetero (ice cream dealer) at Sebastian’s Ice Cream in an e-mail to BusinessWorld. “When I started making ice cream for a living, it was important to come up with an ice cream that felt and tasted just like regular ice cream without compromising the quality.”

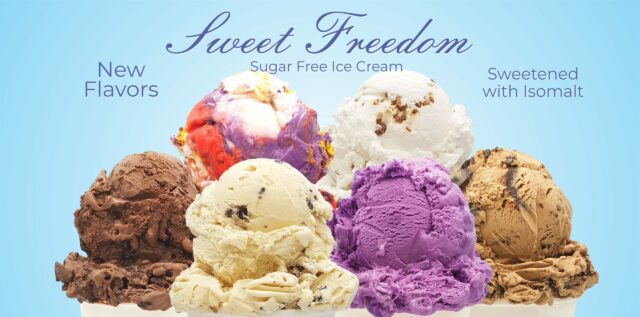

Mr. Carandang announced the arrival of Sebastian’s Cookie Dough flavor earlier this month for its Sweet Freedom sugar-free line, although other flavors have been available since the early years of the brand, founded 2004.

In a Facebook post from March 1, 2022, the brand said, “From the very start of our shop, Cookie Dough has been our top-selling ice cream flavor. There’s something about the sublime combination of Vanilla Ice Cream and unbaked cookie dough. After months of tests and research, we have FINALLY made a sugar-free version as good as the original!”

The post said that the Cookie Dough Ice Cream is made with sugar-free vanilla ice cream mixed with sugar-free unbaked chocolate-chip cookie dough with walnuts. The ice cream and cookie dough are sweetened with isomalt, and it uses Hershey’s sugar-free chocolate chips sweetened with maltitol.

“It’s tricky making truly sugar-free flavors because a lot of ingredients have sugar mixed into them already: cookies, candy, chocolate, etc.,” Mr. Carandang told BusinessWorld. “Our first batch of flavors were constrained by that, and me choosing sugar-free ingredients: coffee, mocha, chocolate. We’ve had the same roster of flavors for years, and I decided it was time to try and make sugar-free versions of our popular flavors, so our sugar-sensitive customer base could enjoy our best flavors as well. It ended up taking more steps: making the fudge chunks for chocoholics, making our own halaya (mashed sweetened purple yam dessert) for sapin-sapin (a colorful Filipino rice cake). But these steps were worth it.”

Other flavors in the Sweet Freedom line include French Vanilla, Butter Pecan, Chocoholics Anonymous, Sapin-Sapin, Ubetopia, and Up All Night.

SUGAR SUBSTITUTES

“The difficult part was sourcing sugar-free chocolate chips that tasted good because a lot of sugar-free chocolate has textural issues. When I found a supplier of Hershey’s sugar free chocolate chips, that’s when I knew I could do this flavor. Once we had the chips, mixing in our sweetener into cookie dough replacing regular sugar was simple enough.”

He discussed the differences in working with artificial sweeteners to make ice cream, as opposed to using conventional ingredients. “You have to take texture into account as well. Along with sweetness, sugar prevents the formation of ice crystals and helps give ice cream that creamy mouthfeel. Not all sweeteners perform the same way. In addition to that, some sweeteners aren’t as sweet as regular sugar and have a wall on how sweet they can be, which when working with a frozen product can be difficult, because flavors are dulled when frozen,” he said. “You have to make everything just a little sweeter than usual in the cooking stage for it to taste the way you want it to taste in its final form, which means you need a strong sweetener. We settled on a supplier that makes isomalt mixed with a little acesulfame-K for added sweetness.”

Mr. Carandang mentioned that the ice cream contains both isomalt and maltitol, and provided links to this writer for more information about the artificial sweeteners.

“It was important for me to make sure I knew what was going into the products we were making, so I did my research,” he said.

According to Polyols (polyols.org), isomalt is made from sucrose and “looks much like table sugar.” According to the website, “It is white, crystalline and odorless. Isomalt is a mixture of two disaccharide alcohols: gluco-mannitol and gluco-sorbitol.” According to Polyols, it claims to have lower caloric value, support gut health, has a “very low blood glucose and insulin response,” and carries less risk for dental caries. As for maltitol, Food Insight (foodinsight.org) says that it is a type of carbohydrate called a sugar alcohol, or polyol, and contains “half as many calories as sugar and is 90% as sweet.”

“As it is with most sugar substitutes, there is no perfect response as every study one finds that says that a sweetener is healthy, another one can be found that says it causes side effects and health risks,” said Mr. Carandang. “What I can say is that this is the best combination I found that was able to keep prices at a reasonable level — the next viable sweetener, erythritol, would have ended up making a pint cost P700 per pint,” he said. “What I can tell people is that to look at the sweetners, do their own research and make their own informed decision about it.”

AN INDULGENCE

“I am not just someone who works with artificial sweetener, I am someone who has benefitted from it and is very grateful to it,” he said, saying that Coke Zero and Diet Dr Pepper are his favorite drinks, “It allows me to enjoy my favorite drink without putting myself at diabetic risk because despite my shape, I am still diabetes-free.”

Still, despite Sweet Freedom’s sugar-free status, Mr. Carandang wouldn’t call this particular line a healthy food.

“I wouldn’t call it a healthy food. I would call it an indulgence that is accessible to people who can’t eat sugar for one reason or another.” The rest of the ingredients still include items like egg yolks, milk, and cream. “It may have fewer calories because it doesn’t have sugar, but it is definitely still calorific.”

Aside from the personal reasons he gave, Mr. Carandang touched on the practical side for having more options for people with dietary restrictions: “It’s a changing marketplace,” he said. “People are more aware of what’s going into their bodies and want more say into what they eat.”

He pointed to his ginataan-based (coconut milk) ice creams, which are 100% dairy-free and vegan-friendly. “I want to go beyond coming up with variants on coconut flavors. It’s still early, but plant-based, dairy-free products are definitely on my mind and it’s something I’ve been working on in the kitchen, but I wouldn’t say to expect anything in the near future because I want to do this right.”

NO MORE MALL STALLS

On another note, Mr. Carandang’s ice cream reach has gone beyond his Podium branch. He has resellers through Rachel’s Fine Foods in Ortigas, FrozenMNL for Metro Manila, Rizal, Bulacan, and Cavite; going as far as having a reseller in Tarlac (among others).

“Distributors have been essential to our business, especially during the pandemic. We’ve learned during the two-year lockdown that putting up mall branches sinks too much capital into one fixed location which does not have a guaranteed market and with heavy regular costs like rent, labor and utilities,” he said. “Since our product is basically resold and not produced onsite in the way milk teas or cookies are, when you boil it all down, for our business setup, all that is needed is an electrical outlet for a freezer, and someone to sell it,” he noted.

“Having distributor partners either in markets far from our shop or partners who have a better distribution network for frozen products like FrozenMNL have shown that we can expand our network without having to sink down six figures on a mall branch,” he added. “We’re not saying we’ll never have another mall branch again, but we will be far more focused on expanding our network, and not having a shop for the sake of having a shop.”

Sebastian’s Ice Cream is available at the Podium mall in Ortigas Center, Pasig, and can be delivered through sebastiansicecream.com, or through www.frozenmnl.com. — Joseph L. Garcia