Rampant UP, wounded Ateneo headline unexpected Final Four

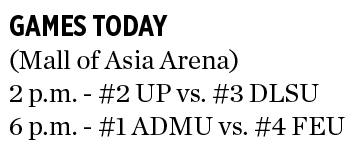

TOP-SEEDED rivals Ateneo and University of the Philippines (UP) shoot for a quick finals date when they tackle lower-ranked Far Eastern University (FEU) and La Salle, respectively, in the Final Four of the University Athletic Association of the Philippines (UAAP) Season 84 at the Mall of Asia Arena in Pasay City.

Armed with the twice-to-beat advantage, the No. 1 and three-time reigning champion Blue Eagles (13-1) want to make quick work of the fourth-running Tamaraws (7-7) in the main game at 6 p.m., while the second-seeded Fighting Maroons (12-2) aim to do the same against the No. 3 Green Archers (9-5) at 2 p.m.

A win by the Katipunan rivals would push them straight to the finals to dispute a first-ever UAAP final under bubble conditions.

If they were to meet for the championship, it would be a rematch of the same teams that met for the UAAP crown in 2018.

If they were to meet for the championship, it would be a rematch of the same teams that met for the UAAP crown in 2018.

But for both teams coming off different paths on to the Final Four, the job is easier said than done.

“You know coach Olsen (Racela) does a great job and they’re gonna be ready. But we will regroup and we have to make sure that our loss (against UP) is useful for us. There will be lessons taken and lessons learned,” coach Tab Baldwin said after Ateneo’s outright finals dream was spoiled over the weekend.

Needing one last triumph to book a direct flight to the championship, the Blue Eagles, then on a 13-0 season start, fumbled and landed hard at the expense of the Fighting Maroons with a gut-wrenching 84-83 loss.

The loss sent the Blue Eagles into the semifinal against the Tamaraws, instead of awaiting the survivor of a stepladder playoff among the other teams.

The costly defeat also snapped Ateneo’s 39-game win streak dating back to 2018, adding fuel to an already spirited UP side on the other end.

“I hope we can carry (the momentum) over to the semis. It’s all about the bigger picture,” Maroons mentor Goldwin Monteverde said as UP seeks to end a 36-year UAAP title drought.

UP as of press time is hoping for the availability of gunner CJ Cansino, who went in for MRI tests on Tuesday following a knee injury against Ateneo.

Both Ateneo and UP swept their semis counterparts in the elimination round. The Blue Eagles clipped the Tamaraws, 79-70 and 70-53, while the Fighting Maroons bested the Green Archers, 61-59 and 72-69. — John Bryan Ulanday