Large Uniqlo store opens at Ayala mall

AYALA Malls Manila Bay is now the home of the newest and biggest Uniqlo branch in Parañaque at 1,949 sqm. In celebration of its opening week, the store is extending limited offer prices exclusive to Uniqlo Ayala Malls Manila Bay customers until Dec. 1. The branch carries a wide selection of Men, Women, Kids, and Babies items. Uniqlo Ayala Malls Manila Bay is located in Building B, Ground Floor, near the mall’s Lumbera Entrance. The store opens at 11a.m. Meanwhile, Ayala Malls Manila Bay recently announced the opening of more lifestyle brands from various categories. Those that have already opened include One Storage, a storage unit facility that has 24/7 storage access, security, and free insurance; and Food Wanderer, the country’s biggest food art display museum by the Philippine Amusement and Entertainment Corporation. Scheduled to open in 2023 are Landmark Supermarket and Department Store and Seda hotel.

M&S Christmas family pajamas collection

THIS Christmas, Marks & Spencer (M&S) offers matching pajamas for all ages. An array of fun prints and patterns are found on tops, bottoms, and nightshirts made from super-soft responsibly sourced cotton or cozy fleece fabrics. For this season’s sleepwear selection, M&S has re-introduced the character of Spencer Bear. Having been in the M&S family since the 1930s, he has been one of the brand’s most beloved icons. New styles include the jungle-inspired “Pawjama” sleepwear set, featuring playful animal prints. Add a festive touch by opting the classic pure-cotton checked pajamas, available for the entire family. Percy Pig fans will be happy with the choice of PJs available. Find the matching pajamas in M&S stores now. Shop in-store and earn Loyalty points through the M&S Philippines Viber Community at bit.ly/MSPH-VC. Shop selected styles launching online at www.marksandspencer.com.

Rustan’s Christmas gift suggestions

THROUGHOUT its 70 years, the art of gifting has been one of the core pillars of Rustan’s, a reflection of its expertise in luxury retail. This season, apart from the wide selection of luxurious offerings, the whole family gets to enjoy a day filled with wonder and fun. For gentlemen, check out the pieces from the newest additions to Rustan’s roster of menswear: Faherty, Onia, and Tailor Vintage which combine sophistication with modern trends. Special holiday discounts from Braun, Crep Protect, and Speedo are lined up. For the skin-care obsessive, there are anti-aging products like the new Clarins Super Restorative collection, La Prairie Skin Caviar Harmony, L’Occitane Immortelle, or Estee Lauder Advanced Night Repair Synchronized Multi-Recovery Gel-Cream. Toys for the big boys? Bring a piece of childhood back with a Montblanc x Naruto wallet, something fun, luxurious, and elegant that can last for years. On the other hand, the Discovery Shop and Prizmic and Brill offer bespoke pieces that can decorate and add personality to the library or home office. For coffee drinkers, maybe a coffee upgrade is just the thing, like a Breville, De’Longhi, Nespresso, or SMEG machine. Get a taste of the experience in an onsite coffee tasting every day at all Rustan’s department stores from Nov. 26 to Dec. 18. Choose the perfect whisky to give by trying it as The Dalmore, Tamnavaulin, and Shackleton will offer tastings at Rustan’s Makati on Dec. 3-4 and Dec. 17-18 from 3-7 p.m. Other brands that will host their own whiskey and wine tastings are Diageo whiskey brands at Rustan’s Shangri-La on Dec. 3-4, 17-18, and 21-22 from 3-7 p.m.; Philippine Wine Merchants will host a wine tasting every Saturday and Sunday until Dec. 18 at Rustan’s Makati, Shangri-La, and Alabang. Wondering what to get the kids? Ask Santa. Start things off by bringing the children to meet him, and find out what they want. Catch Santa at Rustan’s Makati on Dec. 18, Rustan’s Shangri-La on Dec. 11, Rustan’s Gateway on Dec. 10, Rustan’s Alabang on Dec. 3 and 17, and Rustan’s Cebu on Dec. 3, 10, 17, 18, and 23. Board game aficionados can play at Rustan’s Shangri-la on Dec. 3-4. Rustan’s also has gift wrapping, delivery, and alteration services. The store’s personal shoppers can assist customers in-store or through a call. Customers can also choose to send their gift list and Rustan’s personal shoppers will happily get things covered. To make presents even more special, give gifts a personal touch by choosing an embroidery, embossment, or engraving add-on. For more updates, specials, and events, visit www.rustans.com.

Puma opens new store in PHL

INTERNATIONAL sports company Puma continues its Southeast Asia expansion with the opening of a new store in the Philippines. This comes after opening their biggest flagship store in Southeast Asia at 313@somerset Singapore earlier this year. Set over a sales floor area of 309 square meters, the new Puma store is located on Level 2, Glorietta 3 in Makati. Situated at a prime location, Puma puts its spotlight on the latest campaigns of the season such as Slipstream worn by Korean K-pop group NCT127, and the award-winning running shoes Deviate Nitro 2. Consumers can also find LaMelo Ball’s MB.02 collection, Puma x Coca-Cola, and Puma x Pokémon, which are exclusively available in Puma Glorietta and PUMA.com. This new store embodies the “Puma Forever Faster Concept,” which brings together stylish technical sports categories, with a heavy emphasis on performance and sport-inspired lifestyle products in categories such as Football, Running and Training, Basketball, and Motorsports. Puma’s exclusive seasonal drops and the latest collection of urban clothing and athleisure apparel will be available at Puma Glorietta 3.

Kiehl’s offers gift sets for the holidays

KIEHL’S Philippines offering several holiday sets this year which cost collectively less than if the buyer bought the components separately. Now available are the Hydration Starter Kit for P1,785 (worth P2,100), Men’s Groom on the Go for P2,380 (worth P2,980), Cleanser and Toner Duo for P3,400 (worth P4,250), and Anti-Aging Essentials for P7,390 (worth P8,799). Men’s Groom on the Go includes Kiehl’s Ultra Facial Cream, formulated with Glacial Glycoprotein and olive-derived Squalane, which has a unique lightweight texture and lasting 24-hour hydration. The Cleansing and Toner Duo includes Kiehl’s Calendula Herbal-Extract Alcohol-Free Toner, which is effective in reducing redness and oiliness while improving the skin’s texture as fast as three days. The Anti-Aging set includes Kiehl’s Super Multi-Corrective Anti-Aging Cream, a face and neck cream powered by PhytoMimetic Vitamin A, Chaga Mushroom, and Hyaluronic Acid to address and fight the most common signs of aging. The gift sets are available at Kiehl’s stores and at Kiehl’s official Lazada flagship store this holiday season. For more information and updates regarding the latest Kiehl’s products, visit the official website at http://www.kiehls.com.ph.

Face oil For Besties

IT’S safe to say that skincare has always been a strong foundation for most friendships. From coming home following a fun night out to a regular weekend sleepover, capping off the night with a skincare routine has always been a staple for just about every friendship. For this holiday, treat your bestie with Kiehl’s Midnight Recovery Concentrate facial oil. The top-rated facial oil by Kiehl’s is formulated with quality ingredients such as Lavender Essential Oil and Evening Primrose Oil to help the skin appear more visibly smooth with a radiant glow.

Vitamin C Serum For You

OF COURSE, the holidays aren’t complete without rewarding yourself for all the hard work you’ve put in throughout the year. Pamper yourself and give your skin the ultimate skin-replenishing treatment with Kiehl’s Clearly Corrective Dark Spot Corrector. The dark spot corrector by Kiehl’s is formulated with top-of-the-line ingredients such as Activated C and buffered Salicylic Acid that visibly helps the skin reduce the appearance of a wide array of discolorations. If you’re looking to get rid of dark spots, hyperpigmentation, and post-acne marks, Kiehl’s Clearly Corrective Dark Spot Corrector is the way to go.

Gap’s holiday gifts and promos

GAP is expanding its gifting assortment in multiple product categories for the holidays. Gifts for the family include cute sweatshirts, classic denim, PJs, and accessories (even for dogs) and more. At the tail end of its Black Friday promo, on Nov. 28 its “buy 1 get 1” on sweatshirts plus 40% on all regular items. Gift suggestions for Christmas include logo sweatshirts that start at P725 for kids and babies and P1,650 for adults, and the sleepwear collection from P1,950. Collaboration pieces with Disney and Smiley will be available in-stores and online soon. Choose from a collection of hoodies, sweaters, beanies, and socks this December. There are Gap stores at Glorietta 4, Shangri-la Mall, SM Mall of Asia, SM Megamall, Trinoma, Alabang Town Center and Abreeza, Davao, or shop online at gap.com.ph.

Pond’s gives chance to win a limited edition NFT

GLOBAL skincare brand Pond’s is partnering with e-commerce platform Shopee to launch the interactive #PondsGlowStage at its Brand Spotlight Day on Nov. 28. #PondsGlowStage is a one-day only event that takes Shopee users’ online shopping experience to the next level through interactive games, exclusive promotions and discounts on Pond’s products and for the first-time ever, limited edition Non-Fungible Tokens (NFTs). The limited-edition artwork is exclusive to Shopee, which is also the e-commerce platform’s first foray into giving out NFTs as gifts with purchase. The NFT is an exclusive, first-of-its-kind digital collectible designed by artist Rifqi Ardiansyah. Customers who purchase P1,499 worth of Pond’s products during the #PondsGlowStage Day will have the chance to own one of only 1,000 #PondsGlowStage NFTs in the Philippines, which will give them access to exclusive benefits such as being the first to receive alerts on Pond’s latest product releases and best value deals in the future. Customers can redeem their NFTs by first registering on OurSong, a global NFT platform co-founded by R&B star John Legend. Once logged in, they need to input their redemption code, which will be issued to them via Shopee Chat, before they claim their exclusive NFT via OurSong’s Collection Page. Until Nov. 28, consumers can play the interactive Pond’s Glow Stage Catch Game and earn points to redeem special giveaways worth at least P1,650. Players must tap and hold the shopping basket to catch as many of the falling Pond’s products and elements they can within the time limit, all while avoiding harmful skin spots.

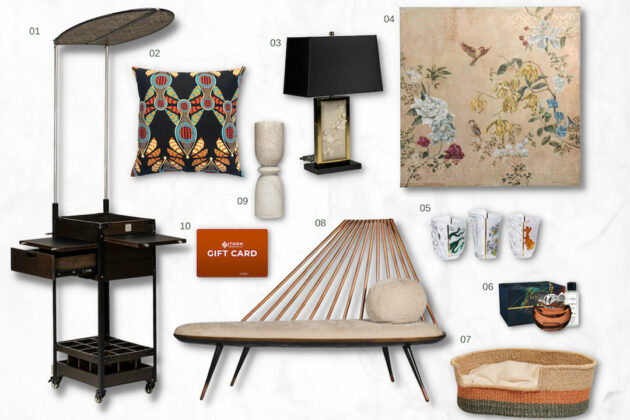

The 2022 shopITOOH Holiday Gift Guide

FOR this holiday season, shopITOOH came up with gift ideas for every room, with tips on what to give loved ones this holiday season. First, send a piece of art. A particular artwork that is distinctly Filipino is Ilang Ilang At Iba Pa by Alfred Galvez, a mixed-media floral painting. Secondly, lean into the recipient’s love of pets. The reversible Abacama Hand Woven Pet Bed is an option that happens to be Filipino-made and crafted with eco-friendly materials. The woven abaca used is also hand-dyed for that unique coloring that isn’t achieved by regular machine processing. Third, embrace the accent piece. Go for something like the Black Alien Bees Remix and the Temptation Gift Set. The former is a pillow cover that can really tie a living aesthetic together while the latter is a sleek collection that includes a lamp, wick-burner, metallic corolla diffuser and stopper, and a Sandalwood Temptation Purifying Scent. Fourth, go bigger with furniture for the festive home. The Raggio Divan, for instance, is an elegant accent chair that would fit into any classic Hollywood picture. If the recipient is a lover of cocktails and gatherings, there is the Prizmic & Brill Bar Cart that comes equipped with prep stations, drawers, bottle racks, and tray sections. Fifth, don’t be afraid to blend practicality and style., like the Seletti Hybrid Aglaura Glass Set which comes with three unique Italian hand-blown and painted glasses, or the marble Mendo Candle Holder which is chic yet durable and readily usable, or the Malabulak Sculpted Blossom Lamp, a limited edition high-polish titanium brass gold body with hand-sculpted floral leather detailing. Sixth, you can’t go wrong with a gift card. The ITOOH Homestyle Gift Card comes in values of P1,000, P3,000, P5,000, and P10,000. ITOOH’s Homestyle Holiday Sale features more items and other goods for living, bed & bath, dining & kitchen, and kids and more all at up to 70% off. The shopITOOH Christmas Sale runs from Nov. 30 to Dec. 18, with major discounts, free delivery, and zero installment options. For more information, browse the website (www.shopitooh.com).

Shop for a chance to win a Suzuki Jimny

SHOP at the Shangri-La Plaza for a chance to bring home a brand-new Suzuki Jimny this Christmas. Get a chance to win a brand-new off-roader Suzuki Jimny GLX with the Drive Home a 4WD with the Christmas Holidaze Raffle Promo which is ongoing until Jan. 31, 2023. To join, shop at any Shang store with a single receipt of P2,500 to get one digital raffle coupon. Shang is giving away three Suzuki Jimny GLX 1.5L A/Ts, one in Solid Kinetic Yellow and two in classic Metallic Chiffon Ivory. The promo is open to mall guests of at least 18 years of age with a Philippine address. To redeem the Digital Raffle Coupon, mall guests should scan the QR code at the Concierge or go to the website raffle.shangrila-plaza.com/raffle to submit their personal information. An e-mail will be sent back to confirm their raffle entry. The Grand Raffle Draw will be on Feb. 2, 2023, 5 p.m., and the winners will be announced on Shang’s website.

Uniqlo presents special holiday offers

GIFT giving comes easy this holiday season as Japanese global apparel retailer Uniqlo has offers, novelties, and events throughout November and December. Personalize gifts with the Holiday Gift Charms. It comes in three designs — a Gift Box, Christmas Tree and a Christmas Stocking, all with a space to write a message at the back. Available in-stores when customers get a paper bag or a gift bag along with their purchase. Customers can complete their Christmas shopping lists with mega sales. The Thank You Festival is ongoing until Dec. 1 while the 12.12 Shopping Fest will be held from Dec. 9 to 15. Uniqlo has also started distributing one-of-a-kind novelties during its key events. This includes a three-piece travel organizer, a cable organizer, and the Uniqlo Planner. Families can join the Kids Gift Giving Day on Dec. 1 at Uniqlo Westgate Alabang, where children can select items they’d like to give to their loved ones, and a child in need. To join, download the Uniqlo App where sign-ups would open towards the latter part of November. Followers can shop for LifeWear pieces in real-time on the livestream of Live Station Episodes for Thank You Festival on Nov. 25 and 12.12 on Dec. 9. For more updates, visit Uniqlo Philippines’ Holiday feature page at https://www.uniqlo.com/ph/en/spl/holiday-gifting and download the Uniqlo App via Google Play Store and Apple Store.