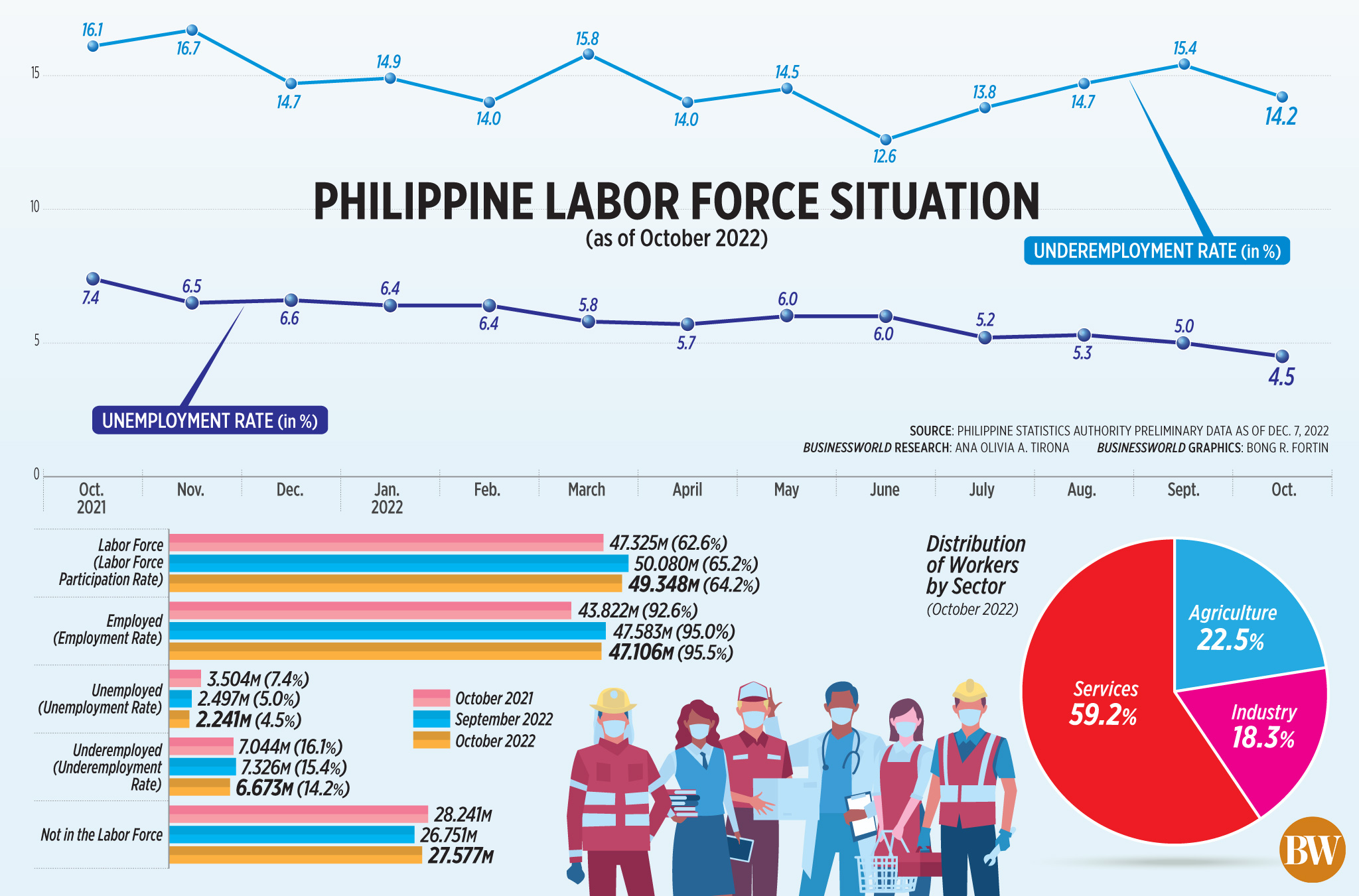

THE UNEMPLOYMENT RATE eased to 4.5% in October, returning to the record-low level last seen in October 2019 before the coronavirus pandemic hit, the Philippine Statistics Authority (PSA) said.

Preliminary results from the PSA’s Labor Force Survey (LFS) showed the unemployment rate stood at 4.5% in October, lower than the 5% in September and 7.4% a year earlier.

“So we are back to the 2019 level. The last time that we experienced this was in October 2019 wherein we had an unemployment rate of 4.5% also,” PSA Undersecretary and National Statistician Claire Dennis S. Mapa said during a press briefing on Wednesday.

The PSA said this translated to 2.241 million unemployed Filipinos in October, lower than the 2.497 million in September and the 3.504 million in the same month last year. This was also the lowest number of jobless Filipinos since October 2019.

For the first 10 months of the year, the unemployment rate averaged 5.6%, lower compared with the 7.8% average in 2021.

“The country’s sustained recovery of the labor market backs our confidence that our policies and interventions to reinvigorate our economy are working,” Socioeconomic Planning Secretary Arsenio M. Balisacan said in a statement.

Meanwhile, the job quality continued to improve in October as the underemployment rate eased to 14.2% from 15.4% in September, and 16.1% a year ago.

The October underemployment rate, or the rate of employed Filipinos looking for more work, was the slowest since the 13.8% posted in July.

For the January-to-October period, the underemployment rate averaged 14.4%, down from the 16% last year.

In absolute terms, the number of underemployed Filipinos fell to 6.673 million in October, from 7.326 million in September and 7.044 million in the same month in 2021.

Mr. Mapa said sectors that benefited from the uptick in economic activity saw lower underemployment. These included agriculture and forestry, retail trade, manufacturing, accommodation, and food services, he said.

However, the size of the total labor force shrank to 49.348 million in October, from 50.080 million in September. This is slightly higher than the 47.325 million seen in October 2021.

This translated to a labor force participation rate (LFPR) — or the share of labor force to the total population 15 years old and over — of 64.2%. The October rate is lower than the 65.2% in September but higher than the 62.6% a year ago.

Mr. Mapa said the dip in LFPR may have been due to seasonality, as young people aged between 15-24 may have returned to school during this time.

In October, the employment rate rose to 95.5%, slightly up from 95% in September and 92.6% in the same period a year ago.

This translates to 47.106 million employed Filipinos, lower than the 47.583 million in the previous month, but higher than the 43.822 million in October 2021.

MORE HOURS

On average, an employed Filipino worked 40.2 hours a week in October, up from 39.6 hours in September and 39.7 hours in October last year.

“On the 40 hours… this is a factor due to the holiday season. So we have a lot of extended hours in the malls and even shops,” Mr. Mapa said.

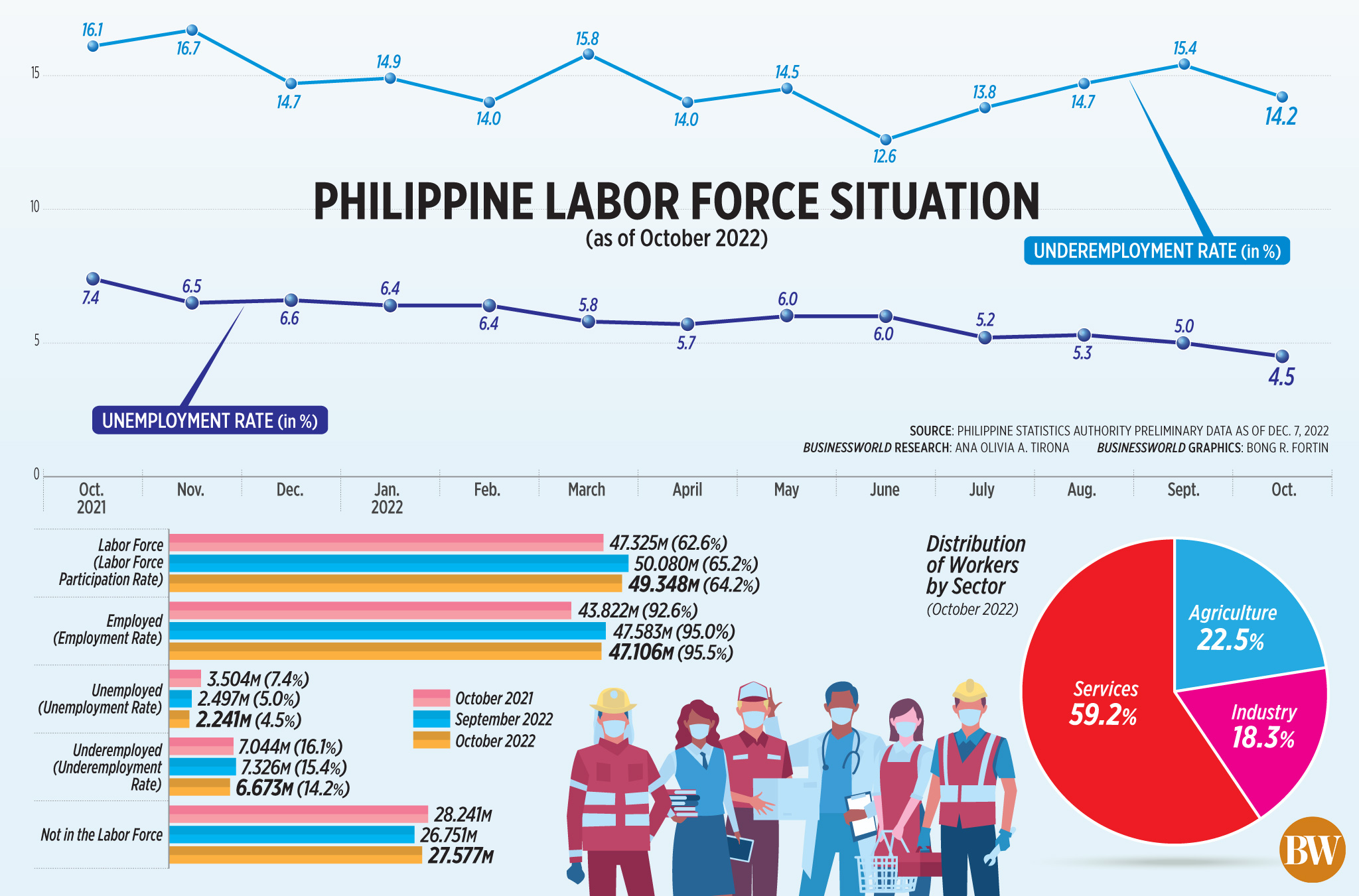

The service sector remained the top employer during the month, accounting for 59.2% of the total. This was followed by agriculture and industry with 22.5% and 18.3%, respectively.

The number of employed Filipinos in agriculture reached 10.605 million, 102,000 lower than the 10.707 million in September and 163,000 less than 10.768 million a year ago.

The industry sector employed 8.635 million Filipinos, adding 214,000 jobs to the 8.849 million in the previous month. This was also 823,000 higher than the 7.812 million last year.

Services, however, saw a 159,000 drop in month-on-month employment to 27.867 million in October. However, it was higher by 2.626 million from the 25.241 million in the same month in 2021.

Lower employment was seen in agriculture and forestry (down 367,000 to 9.219 million in October); manufacturing (down 785,000 to 3.667 million); water supply; sewerage, waste management and remediation activities (down 7,000 to 53,000); transportation and storage (down 73,000 to 3.389 million); wholesale and retail trade; and repair of motor vehicles and motorcycles (down 333,000 to 10.376 million), among others.

Meanwhile, there was a significant increase for jobs in fishing and aquaculture (up 265,000 to 1.386 million); mining and quarrying (up 30,000 to 237,000); electricity, gas, steam and air-conditioning supply (up 38,000 to 101,000); and construction (up 510,000 to 4.577 million) among others.

ING Bank NV Manila Senior Economist Nicholas Antonio T. Mapa attributed the decline in the number of unemployed Filipinos to improving economic activity as the economy reopened.

“However, if we look at the actual number of employed, we can see that this number actually fell (to 47.11 million from 47.58 million), with the participation rate dipping. This suggests that although there have been gains, a part of the dip in the unemployment rate can be traced to less workers looking for work,” he said in an e-mail.

Sentro ng mga Nagkakaisa at Progresibong Manggagawa Secretary-General Josua T. Mata said employment figures usually increase in the fourth quarter, when economic activities rise ahead of the holidays.

“But despite some possible improvements in the quality of jobs as measured by underemployment, underutilization of labor still hovers close to 20% of the labor force. That means that almost one out of five Filipino workers are unproductive due to unemployment and underemployment. This is the usual level of structural unemployment that we have had before the pandemic,” Mr. Mata said in a text message.

However, he noted jobs growth may slow in 2023 amid global headwinds.

“Once the demand surge in the 4th quarter is gone when we enter next year, we might see slower growth in employment. It’s really hard to stay optimistic especially when we cannot see concrete actions taken by the government to guarantee jobs,” Mr. Mata said.

Asian Institute of Management economist John Paolo R. Rivera is optimistic more jobs will be created in the next few months.

“Assuming prices stabilize and the economy is able to welcome more FDIs (foreign direct investments), facilitate new business and employment opportunities, more Filipinos will be able to secure job opportunities,” Mr. Rivera said in an e-mail.

Headline inflation surged to 8% in November from 7.7% in October, the highest in 14 years or since the 9.1% in November 2008. — Mariedel Irish U. Catilogo

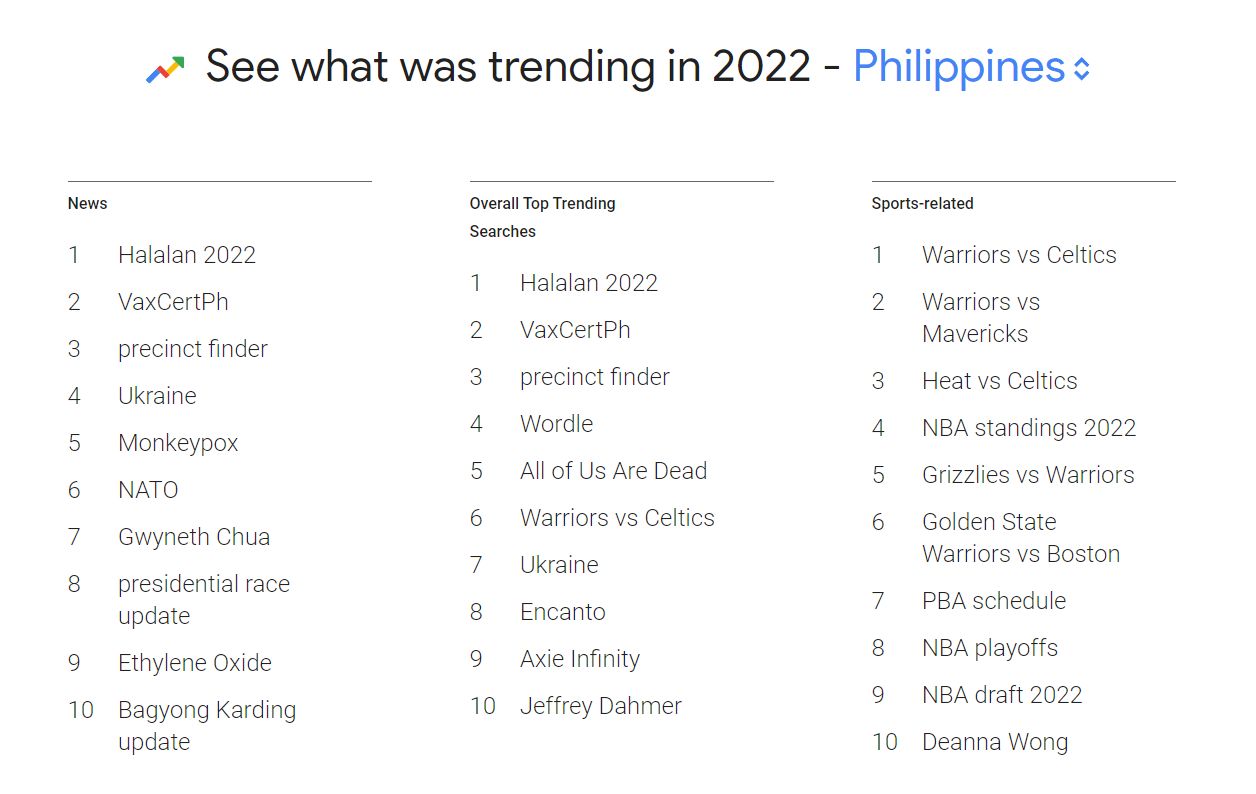

Meanwhile, “VaxCertPH” was the second most Googled term, jumping up from fourth in 2021. “Its rise to second place this year shows our acceleration into a post-pandemic era,” Mr. Wenke said.

Meanwhile, “VaxCertPH” was the second most Googled term, jumping up from fourth in 2021. “Its rise to second place this year shows our acceleration into a post-pandemic era,” Mr. Wenke said.