Shares to move sideways amid lack of catalysts

PHILIPPINE SHARES could move sideways this shortened trading week amid cautious sentiment and a lack of catalysts.

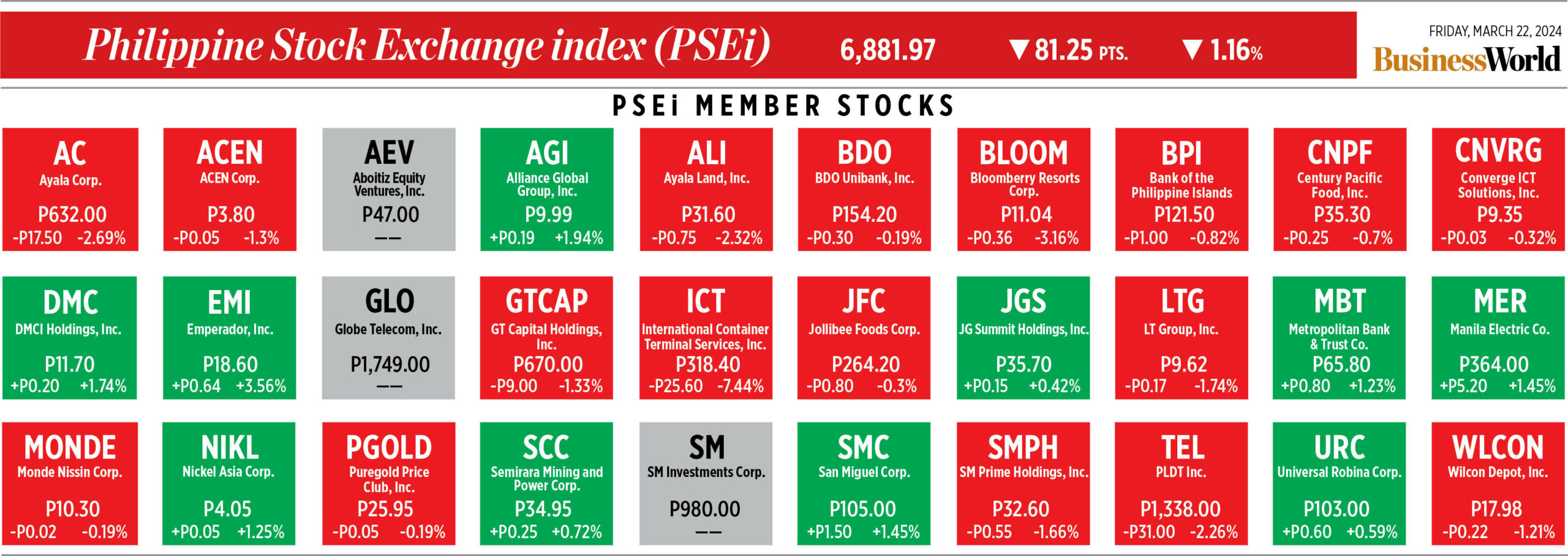

On Friday, the benchmark Philippine Stock Exchange index (PSEi) fell by 1.16% or 81.25 points to end at 6,881.97, while the broader all shares index declined by 0.75% or 27.34 points to close at 3,587.90.

Still, week on week, the PSEi improved by 0.87% or 59.65 points from its 6,822.32 close on March 15.

“The US Federal Reserve’s status quo move boosted another round of global buying this week, but supply pressure capped local gains,” online brokerage firm 2TradeAsia.com said in a market note.

Fed Chair Jerome H. Powell said on Wednesday recent high inflation readings had not changed the underlying “story” of slowly easing price pressures in the US as the central bank stayed on track for three interest rate cuts this year and affirmed that solid economic growth will continue, Reuters reported.

Speaking after a policy meeting at which officials left the benchmark overnight interest rate in the 5.25%-5.5% range and held onto their outlook for three cuts in borrowing costs this year, Mr. Powell said the timing of those reductions still depends on officials becoming more secure that inflation will continue to decline towards the Fed’s 2% target even as the economy continues to outperform expectations.

For this week, the PSEi may move sideways due to “cautious market sentiment,” Philstocks Financial, Inc. Senior Research Analyst Japhet Louis O. Tantiangco said in a Viber message.

“At 6,881.97, the local market is still at attractive levels with a price earnings ratio of 14.1 times, lower compared to its 2019-2023 average of 18.2 times. This shows that there is still room for bargain hunting. However, the market is not seen to have a strong positive catalyst,” he said.

“Looking at other markets, Wall Street’s rally, if sustained, may give positive spillovers to the local bourse which could help it move with an upward bias. Meanwhile, the peso’s depreciation against the dollar, if it continues, may weigh on market sentiment,” Mr. Tantiangco added.

He placed the PSEi’s support at 6,700 and resistance at 7,000.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort put the PSEi’s immediate minor support at 6,600-6,760.

“One of the upcoming Philippine economic data is the next local policy rate-setting meeting on April 8, which could match the Fed rate pause on March 20 in order to maintain healthy interest rate differentials to help support the peso exchange rate, import prices, and overall inflation,” Mr. Ricafort said in a Viber message.

2TradeAsia.com placed the main index’s immediate support at 6,800 and resistance at 7,000.

“Brace for month- and quarter-end window dressing in the upcoming shortened trading week, whilst anticipating potentially lower volumes ahead of Lent,” it said.

Philippine financial markets will be closed on March 28-29 in observance of Maundy Thursday and Good Friday. — R.M.D. Ochave with Reuters

Peso may be range-bound before PCE, Powell speech

THE PESO could trade sideways against the dollar this week ahead of the release of February US personal consumption expenditures (PCE) price index data and a speech by US Federal Reserve Chair Jerome H. Powell.

The local unit closed at P56.27 per dollar on Friday, weakening by 24 centavos from its P56.03 finish on Thursday, Bankers Association of the Philippines data showed.

This was the peso’s weakest close in more than one month or since its P56.29-per-dollar finish on Feb. 5.

Week on week, the peso sank by 74 centavos from its P55.53 close on March 15.

The peso dropped on Friday as the dollar was generally stronger, Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said in a Viber message.

The dollar was headed toward a second week of gains on Friday, after a slight rate hike in Japan gave the yen a slight reprieve and a surprise cut in Switzerland highlighted the gap in interest rate policy between the Federal Reserve and other central banks, Reuters reported.

The week marked a shift in global monetary policy as the Swiss National Bank and central banks in developing countries cut rates or indicated their intention to do so, with June the likely moment for the European Central Bank to move.

The Fed left its overnight rate on hold between 5.25-5.5% and stuck with projections for three cuts by year’s end. But it also said it would not cut until it was confident that inflation was sustainably declining toward its 2% target.

About 84 basis points of cuts are priced in for this year — much lower than the 160 or so at the start of the year — but higher than earlier in the week as rate cut bets gained steam.

The dollar index, a measure of the US currency against six major trading partners, rose 0.45% while the dollar weakened 0.12% against the Japanese yen at 151.44 per dollar.

The dollar was up about 1.5% last week versus the yen after approaching levels that prompted Japanese intervention in 2022.

The peso was also dragged down by a possible revision in the country’s gross domestic product (GDP) growth target for the year, Mr. Ricafort said.

The Development Budget Coordination Committee (DBCC) met on Friday to review their medium-term economic assumptions, Finance Secretary Ralph G. Recto said to reporters on Thursday.

Mr. Recto said the GDP growth target for this year may be revised downward from the current 6.5-7.5%.

The DBCC did not release a statement on Friday.

For this week, Mr. Ricafort said the peso could remain range-bound as the market looks ahead to Mr. Powell’s speech and the release of February PCE price index data on March 29.

He sees the peso moving between P55.95 and P56.45 per dollar this week. — A.M.C. Sy with Reuters

EU, US tech tie-ups eyed for lab-sized wafer fab

THE Department of Trade and Industry (DTI) said that it is looking for international technical partners for its plan to build a lab-sized wafer fabrication hub to upgrade the Philippines’ capacity for prototyping chips.

On the sidelines of the Induction Ceremonies and Oath-taking of the Council of Engineering Consultants of the Philippines (CECOPHIL), Trade Secretary Alfredo E. Pascual said that the department has started talking to potential partners.

“We are already talking to some that we are inviting. Of course, they are those that have experience in wafer fabrication,” Mr. Pascual told reporters. “Some are from Europe, some are from the US.”

“We are yet to (come up with firm plans). Our plant visits may help in organizing our thoughts on how to go about it,” he said.

According to Mr. Pascual, the DTI has visited a plant in Leuven, Belgium after meeting with the European Commission (EC) early this week to get a deeper understanding on how wafer fabrication plants work.

“It is better to see for myself how they do it,” he said.

On Monday, Mr. Pascual and EC Executive Vice-President Valdis Dombrovskis made a joint announcement that the Philippines and the European Union (EU) will be resuming negotiations for a free trade agreement (FTA).

Mr. Pascual said talks have started at lower levels before Undersecretary of International Trade Allan B. Gepty meets with EU officials by May.

“The formal or the face-to-face negotiation will start early in the second half of the year or third quarter because there is a lot of preparatory work to be done,” he said.

“But the work has started… we already did a scoping study from September to December to see if the ambitions of the two sides match because if not, we would not have continued to negotiate,” he added.

During his keynote speech at the event, Mr. Pascual said that FTAs include market access for services, including professional services.

“By committing market access, this means that a trading partner country guarantees the entry of these service providers and professionals,” he said.

This, he said, may also be a part of the business proposals for the EU-Philippine FTA to allow Filipino professionals to set up firms in the host country and be paid at the host country’s salary scale.

He said that at present, many foreign firms operate in the Philippines hiring Filipinos at domestic rates while charging based on their international rates which creates disparity.

Meanwhile, Mr. Pascual also called for CECOPHIL’s participation in the ongoing public consultations of DTI’s Philippine Contractors Accreditation Board (PCAB).

He said that the PCAB is conducting consultations on the needed revisions to the implementing rules and regulations (IRR) governing contractor licensing.

“The Supreme Court made a decision (in 2020) that foreign firms could be licensed in the Philippines. It affirmed this decision in 2022 and so that would require amendments to the IRR,” he said.

“This is not in effect yet because there is a need to amend the IRR first. What we want is to update the IRR to be able to implement the SC’s decision,” he added. — Justine Irish D. Tabile

‘Buy local’ procurement questioned by industry

BUSINESS GROUPS at the weekend asked Congress to revisit the domestic-supplier preference rules in the proposed New Government Procurement Act, saying the practice could weaken competition and discourage participation in government bidding.

In a joint statement on Friday, the business groups said the provision in Senate Bill No. 2593 “may inadvertently weaken the administration’s goal of fostering competition among potential suppliers.”

“This limits the diversity of the pool of competitors from which the government can even select the best value-for-money option — one that balances quality, performance, sustainability, and cost,” the groups said.

Legislators are seeking to modernize procurement to rid the system of corruption and unwarranted delays.

The proposed New Government Procurement Act aims to streamline the procurement process from 120 days to 27 days.

It also seeks to give preference to bids that feature locally manufactured and environment-friendly goods, articles, and materials.

Citing the complexity of supply chains, business groups said it would be difficult to classify products or services as simply “local” or “domestic.”

“If a Filipino supplier forms part of a foreign provider’s supply chain but is not necessarily the dominant player in that relationship, the domestic preference rule works against the Filipino supplier in such a case,” according to the groups.

They added that “if the bid of a domestic bidder is higher than the lowest foreign bidder but within a 25% margin, the domestic bidder wins.”

The bill could also hamper the development of other industries, like defense and state-owned enterprises, which “will be forced to purchase from Filipino-owned firms with higher prices.”

Preferential treatment would also limit the government’s options for digitalization amid President Ferdinand R. Marcos, Jr.’s earlier directive to digitalize vital services in government agencies.

“The administration’s goal of whole-of-government digitalization means accessing innovative and secure solutions from technology-forward companies that can provide solutions at scale,” the groups said.

The bill is still being debated in the Senate plenary. The House of Representatives passed its version of the measure on third and final reading last year.

House Senior Deputy Speaker and Pampanga Rep. Aurelio D. Gonzales, Jr. told reporters last week that the new procurement law will be passed in time for the President’s State of the Nation Address in July.

The measure, which is also backed by the Budget department, is included in the Legislative Executive Development Advisory Council’s (LEDAC) priority measures for approval this year.

Signatories to the statement include the Makati Business Club (MBC), American Chamber of Commerce of the Philippines (AmCham), European Chamber of Commerce of the Philippines (ECCP), Japanese Chamber of Commerce and Industry of the Philippines (JCCIP), Korean Chamber of Commerce Philippines (KCCP), and the Foundation for Economic Freedom (FEF). — Beatriz Marie D. Cruz

SC rules dam water excluded from tax on national wealth

THE Supreme Court (SC) has ruled that dam water no longer fits the definition of natural resources and cannot be subject to the tax on national wealth.

In a 28-page decision, the SC sitting en banc reversed a decision of the Court of Appeals (CA), which had found the Metropolitan Waterworks and Sewerage System (MWSS) liable to pay the Bulacan provincial government a share in the use of water from Angat Dam.

“All told, the Court finds that the CA erred in affirming the RTC Decision which found petitioner liable to pay respondent a share in the utilization and development of national wealth,” according to the decision, written by Associate Justice Henri Jean Paul B. Inting.

The Supreme Court said water impounded in a dam ceases to a natural resource, and thus cannot be subject to the tax on national wealth.

“Being already appropriated, dam water is no longer subject to national wealth tax because appropriate tax is to be determined and imposed upon the extraction of water from a natural resource and accordingly, prior to the impounding and appropriation of water,” according to the decision.

The Bulacan provincial government, through Governor Josefina M. Dela Cruz, had claimed that the MWSS profited from the water resources of Angat Dam, located in Bulacan.

They argued that MWSS is liable to pay the local government a share from its utilization and development of national wealth.

The tribunal decided otherwise, noting that the MWSS does not generate income or derive profit from the use and development of dam water. the MWSS was created for regulatory purposes, it added.

The MWSS had argued that water in Angat Dam doesn’t necessarily come from Bulacan, but was stored in the catchment area.

“A dam is a man-made structure; it does not fall within the purview of national wealth that would entitle a local government unit to an equitable share in the proceeds derived from its utilization and development,” the MWSS said. — Chloe Mari A. Hufana

GOCC regulator to submit revised charter proposals within the year

THE Governance Commission for GOCCs (GCG) said its proposal to revise its charter is still being worked on and should be submitted to Congress within this year.

“We are working on the proposal,” GCG chairman Marius P. Corpus told BusinessWorld on the sidelines of the GCG Gender and Development Conference last week.

He said the latest draft proposal is expected to be submitted to Congress “maybe within this year.”

Last year, the GCG floated plans to amend its charter to strengthen its power to sanction government-owned and -controlled corporations (GOCCs) that it oversees.

Republic Act No. 10149, which created the GCG, does not give the commission power to investigate and sanction underperforming GOCCs and its officials.

“We don’t have coercive power; our powers are mostly advisory,” Mr. Corpus said last year.

Proposed amendments to the charter also include upgrading positions within the GCG, with its staff often being “pirated” by other GOCCs, according to the chairman.

“That’s happening because compensation in other government agencies is higher,” Mr. Corpus said.

In December 2022, the GCG sent its proposals to Senator Allan Peter S. Cayetano, who headed the Senate Committee on Government Corporations and Public Enterprises in the 18th Congress.

Previous amendments included the standardization of the definition of GOCCs, as well as authorizing the GCG to consolidate, rationalize, and integrate GOCCs into national government agencies. It also proposed fixed terms of office for the GCG chairman and commissioners, as well as the creation of an office for the GCG executive director.

It also proposed that the GCG be granted subpoena and contempt powers, and the authority to determine incentive programs for employees. — Beatriz Marie D. Cruz

Infra, governance seen as more critical to FDI than charter reform

ENHANCEMENTS to infrastructure and governance are key to attracting foreign investors, not just opening up the economic provisions of the 1987 Constitution, analysts said.

“Attracting FDI (foreign direct investment) is not just about economic provisions (of the Constitution), it’s also about maintaining a good socio-economic-political environment conducive to the conduct of business,” John Paolo R. Rivera, president and chief economist at Oikonomia Advisory & Research, Inc., told BusinessWorld in a Viber message.

Legislators have pitched the Charter reform campaign as a means to open up industries to foreign capital and encourage more FDIs.

The Philippines has one of the most restrictive economies in Southeast Asia as the Constitution limits foreign participation to a 40% equity stake in most domestic companies. The Philippines ranked third most restrictive out of 83 economies — scoring 0.374 on a scale of 0 (open) to 1 (closed) — according to a 2020 FDI analysis by the Organization for Economic Co-operation and Development.

“The RBH (Resolution of Both Houses) No. 7 is necessary but not sufficient,” Foundation for Economic Freedom President Calixto V. Chikiamco told BusinessWorld via Viber, referring to how the proposal could open the economy to foreign investment.

He added: “RBH No. 7 just inserts the phrase ‘unless otherwise provided by law’ (into the Constitution), meaning Congress has to pass a specific law first in order to open up education, advertising, and public utilities to 100% foreign investment.”

While ease of doing business policies and a well-managed economy are important factors for foreign investors, Mr. Rivera said that “good housekeeping and good governance” are also key considerations for foreign investors.

He added that the Philippines should also have “excellent infrastructure” to further attract foreign investment.

“Key infrastructures are those involving our connections to the world: airports, ports, shipping, warehouses, and broadband connectivity,” Mr. Chikiamco said.

Terry L. Ridon, a public investment analyst and convenor of think-tank InfraWatch PH, said the “administration’s flagship infrastructure program is off to a good start” with the expected rehabilitation of Ninoy Aquino International Airport by the San Miguel Corp.-led consortium.

“(The) government is also well on its way to process other PPPs (public-private partnerships),” Mr. Ridon told BusinessWorld via Viber. He said the proposal by Aboitiz InfraCapital, Inc. to develop regional airports and other pending projects for the“EDSA busway project and the MRT-3 redevelopment would help improve infrastructure overall.

He added that increasing FDI inflows also depends on “sector-specific equity restrictions, the governance climate, and sustainability commitments, among others.”

“There is no single leading factor that ensures FDI inflows, but the government should work towards improving outcomes in these various areas,” Mr. Ridon added.

The Philippines is on the right track to improve FDI, Mr. Chikiamco said, referring to the efforts of the government to reform its policies and upgrade infrastructures.

“(The) government is active in improving the investment climate but it will take time before the benefits are reaped,” Mr. Rivera said. — Kenneth Christiane L. Basilio

Multipolarity and de-risking: Navigating geopolitical uncertainties

Second of two parts

IN BRIEF:

• Major shifts in the global market along with rising geopolitical tensions may propel organizations to adapt and rethink their strategies.

• According to the EY 2024 Geostrategic Outlook, organizations will need to consider two critical concepts as they plan for geopolitical disruptions: multipolarity and de-risking.

• The prevalent trend of de-risking indicates a shift in policy focus towards national security over pure economic considerations.

Faced with the prospect of an increasingly uncertain future, the world faces an era of unprecedented change. Rising geopolitical tensions and major shifts in the global market may propel organizations to adapt and rethink their strategies, with two critical concepts coming to the fore: multipolarity and de-risking.

The EY Geostrategic Outlook is an annual report by the EY Geostrategic Business Group (GBG) that selects the top geopolitical developments for the year by analyzing the global political risk environment. The GBG first conducts a crowdsourced horizon scanning exercise with subject matter resources to identify potential risks, then conducts an impact assessment to narrow down the top geopolitical developments that are both highly impactful and highly probable for companies worldwide.

In the first part of this article, we discussed the evolving multipolarity in geopolitics, specifically tackling the developments surrounding the geopolitical multiverse, AI, the oceans, and competition for essential commodities. These underscore the need for economic diversification and resilient supply chains due to increased geopolitical disruptions. However, they also aggravate global policy coordination challenges, escalating potential transnational uncertainties.

The second theme is de-risking, with governments increasingly combining economic policy with national security to stimulate domestic production of critical products in sectors such as semiconductors, telecommunications, renewable energy, electric vehicles, and biotechnology. This trend, more prevalent in 2024, indicates a shift in policy focus towards national security over pure economic considerations, possibly fueling inflation and hindering global innovation due to increased government intervention in supply chains and investments.

GLOBAL ELECTIONS SUPERCYCLE

With a wave of elections happening in geopolitically significant markets representing more than half of the global population and the global GDP, this global elections supercycle will generate policy and regulatory uncertainty. This in turn has long-term implications for industrial strategies, ongoing military conflicts, and climate policies.

The outcome of Taiwan’s presidential election, which concluded on Jan. 13, may affect political and economic relations with China as well as broader geopolitical dynamics. Later this year, campaign dynamics from the US elections could increase volatility for businesses, while election outcomes can result in far-reaching shifts on domestic and foreign policy issues on global alliances, regulations, and climate change.

ECONOMIC SECURITY

Recent global developments have increased geopolitical rivalries and heightened the neo-statism (a new cross-party consensus about needing a more interventionist state) trend, leading to a greater focus on economic self-sufficiency and increased intervention in supply chains. In 2024, de-risking global interdependencies is expected to be a critical tool in geostrategic competition, with policies targeting reduced reliance on geopolitical competitors, promoting domestic industry competitiveness, and enhancing sociopolitical stability.

The White House readout on the meeting between President Marcos and VP Harris on the sidelines of the November APEC meetings in San Francisco states that VP Harris announced a “new partnership with the Government of the Philippines to grow and diversify the global semiconductor ecosystem under the International Technology Security and Innovation (ITSI) Fund, created by the CHIPS Act of 2022. This partnership will help create a more resilient, secure, and sustainable global semiconductor value chain.”

Particularly impacted will be sectors like aerospace, defense, and advanced digital technologies, where stringent economic security policies will be enforced. Traditional strategic sectors, like energy and critical infrastructure, will see regulations and incentives used to protect or promote domestic production. Emerging strategic sectors, such as healthcare and agriculture, will come into greater focus with regulations aimed at increasing resilience to supply chain disruptions.

VALUE CHAIN DIVERSIFICATION

According to the July 2023 EY CEO Outlook Pulse survey, 99% of CEOs plan strategic changes in response to geopolitical challenges such as government tensions and policies encouraging value chain diversification. This creates political risks for companies entering or expanding in alternative markets in 2024. Despite ongoing investment in developed markets, geopolitical swing states are expected to be key to diversification efforts. Country-level political risk, infrastructure quality, labor dynamics, global interest rates, and government incentives will influence these decisions.

Sustainability considerations, including carbon taxes and emissions reporting requirements, will further shape the diversification agenda. The 2024 election supercycle intensifies policy uncertainty in several markets affecting labor laws, infrastructure investments, and industry policies, adding another layer of complexity to diversification and investment decisions.

SUSTAINABILITY

Currently, some countries are prioritizing economic growth and energy security over emissions reductions, leading to inconsistent sustainability regulations. Some governments are boosting their domestic green economy while potentially slowing the implementation of sustainability regulations to meet short-term economic goals.

Green policies could face opposition if they are viewed as protectionist or discriminatory. For example, the EU’s Carbon Border Adjustment Mechanism (CBAM), a tariff on carbon-intensive products, may trigger global trade tensions as impacted countries may retaliate with their own tariffs on European goods. However, it can also act as a key driver for developments in international carbon pricing policy, as several countries are now seen either exploring or creating their own CBAM or are revisiting their current carbon taxation levels.

For the Philippines, understanding how CBAM may impact direct exporters to EU of scoped-in industries, including looking at those industries where the raw materials of scoped-in industries are coming from the country, should be prioritized. This is aside from the legislative action exploring the implementation of an emissions trading scheme or the imposition of a carbon tax on the industries that contribute most to our emissions.

Consequently, geopolitical tensions could grow between countries advocating for ambitious climate action and those perceived as impeding this progression. Despite these tensions, geopolitical competition could increase green investments in emerging markets, with major players like China, the US, and the EU targeting geopolitical swing states.

CLIMATE ADAPTATION

While the United Nations Framework Convention on Climate Change (UNFCCC) initially focused on reducing greenhouse emissions, in 2024, about 80% of its parties have established a national adaptation plan, policy, or strategy due to increasing global temperatures.

For instance, the National Framework Strategy on Climate Change highlights that the Philippines’ approach on climate change identifies climate change adaptation as its anchor strategy, with climate change mitigation as a function of adaptation. This is mainly a result of the country’s less than 1% contribution to global emissions and the various studies highlighting the vulnerability of the Philippines to the impacts of climate change, with the February 2024 Swiss Re publication, “Changing Climates: The Heat is (Still) On,” indicating that the country suffers the most significant economic losses as a percentage of GDP mainly resulting from flooding and tropical cyclones.

It is because of the heightening risk and accelerating climate change impacts experienced globally that the urgency for more actions relating to adaptation have increased. Combined with the more modest growth in adaptation finance flows, the global adaptation funding gap is widening, with developing countries needing about $212 billion per year up to 2030 and around $239 billion per year from 2030 to 2050, based on the 2023 Global Landscape of Climate Finance, issued by the Climate Policy Initiative.

Geopolitics and adaptation funding for developing nations have previously been at the forefront of climate negotiations. This will only continue, as central to the politics of adaptation funding is the fact that countries such as the Philippines have contributed almost nothing to making climate change happen, and yet are the ones experiencing the first and worst impacts as a result.

C-LEVEL CONSIDERATIONS TO NAVIGATE GEOPOLITICAL UNCERTAINTIES

The evolving geopolitical landscape calls for a thorough recalibration of business strategies for organizations to navigate through uncertainties effectively. By embracing multipolarity and de-risking strategies, organizations can foster resilience and agility amid heightened geopolitical competition.

While juggling these challenges, sustainability remains critical. Conflicting interests may lead to inconsistent regulations in the short term, but moving toward a greener economy remains paramount. Therefore, organizations must prioritize green investments and climate adaptation measures in their strategic planning.

Navigating the geopolitical uncertainties of 2024 and beyond requires proactively anticipating the shifts in economic policies, regulations, and global relations. The exact path may still be uncharted, but understanding and responding to these developments will help boards remain competitive in the global market and future-proof their organizations.

This article is for general information only and is not a substitute for professional advice where the facts and circumstances warrant. The views and opinions expressed above are those of the authors and do not necessarily represent the views of SGV & Co.

Marie Stephanie C. Tan-Hamed is a Strategy and Transactions partner and the PH Government and Public Sector leader of SGV & Co., and Katrina F. Francisco is a partner from the Climate Change and Sustainability Services of SGV & Co.

US rebukes China for ‘dangerous and destabilizing conduct’ after sea ruckus

THE UNITED STATES at the weekend condemned China’s “dangerous actions” after its coast guard again fired water cannons at a wooden boat used by the Philippines in a resupply mission for Filipino troops at a remote outpost in the South China Sea.

“The United States stands with its ally the Philippines and condemns the dangerous actions by the People’s Republic of China (PRC) against lawful Philippine maritime operations in the South China Sea on March 23,” US Department of State spokesman Matthew Miller said in a state posted on its website.

“The People’s Republic of China’s actions are destabilizing to the region and show clear disregard for international law,” he added.

Tensions between the Philippines and China have worsened in the past year as the Chinese Coast Guard continues to block Philippine boats trying to deliver food and other supplies to BRP Sierra Madre, a World War II- era ship that Manila grounded at Second Thomas Shoal in 1999 to assert its sovereignty.

Second Thomas Shoal is about 200 kilometers from the Philippine island of Palawan and more than 1,000 kilometers from China’s nearest major landmass, Hainan Island.

Japan through its embassy in Manila “reiterates its grave concern on the repeated dangerous actions by China Coast Guard vessels in the South China Sea which resulted in Filipino injuries.”

The envoys of Canada, Australia, Germany and the European Union also expressed concern over the Chinese ships’ actions that they said were “dangerous.”

China’s Coast Guard accused the Philippines of transporting construction materials to the “illegally grounded” warship.

“It is a deliberate and provocative move that infringes upon China’s sovereignty and legitimate rights and interests and undermines peace and stability in the South China Sea,” Gan Yu, spokesperson for the Chinese Coast Guard, said in a statement.

“We warn the Philippines that playing with fire is an invitation of disgrace, and the China Coast Guard is ready at all times to defend the country’s territorial sovereignty and maritime rights and interests.”

Saturday’s incident comes days after US Secretary of State Antony Blinken said during his visit to Manila that the US stands by its “ironclad” commitments to defend the Philippines against an armed attack in the South China Sea.

“These waterways are critical to the Philippines, to its security, to its economy, but they’re also critical to the interests of the region, the United States and the world,” he said at a joint press conference in Manila with his Philippine counterpart.

In a statement at the weekend, a Philippine task force handling South China Sea disputes said the water cannon had injured Filipinos on board the Unaizah May 4 civilian supply boat.

It added the actions of the Chinese Coast Guard “belie (China’s) hollow claims to peace, dialogue and adherence to international law.”

The same Philippine boat had been damaged by a Chinese water cannon during a similar mission early this month. Four coast guard officers were injured in the March 5 incident, the council said.

Before Saturday’s water cannon incident, the Chinese Coast Guard vessel BN21551 had used “dangerous maneuvers” including crossing the bow of the Philippine boat and a “reverse blocking maneuver… causing a near collision.”

To complete the Philippine resupply mission, BRP Sierra Madre deployed rigid inflatable boats to Unaizah Mae 4 “to ferry personnel to be rotated in,” the task force said.

The Chinese coast guard then placed a floating barrier at the northwestern entrance of the lagoon of Second Thomas Shoal to block the mission, it added.

DIPLOMATIC COST

Mr. Miller said the US “reaffirms that Article IV of the 1951 US-Philippine Mutual Defense Treaty extends to armed attacks on Philippine armed forces, public vessels or aircraft — including those of its Coast Guard — anywhere in the South China Sea.”

China continues to block Philippine vessels’ exercise of high seas freedom of navigation, he added.

He cited the 2016 ruling by a United Nations (UN)-backed tribunal based in the Hague in 2016 voiding China’s claim to almost the entire South China Sea.

“According to [the] international tribunal’s legally binding decision issued in July 2016, the PRC has no lawful maritime claims to the waters around Second Thomas Shoal, and that Second Thomas Shoal is a low tide feature clearly within the Philippines’ exclusive economic zone,” Mr. Miller said.

The 2016 arbitral decision is final and legally binding on China and the Philippines, he added, citing the UN Convention on the Law of the Sea. “The United States calls upon the PRC to abide by the ruling and desist from its dangerous and destabilizing conduct,” he said.

The Philippines should step up efforts with allies to keep China’s territorial advances in the South China Sea at bay, political analysts said, as Beijing warned Manila that it would not hesitate to adopt stronger measures.

“Maritime security and [diplomatic] cost imposition for the People’s Republic of China’ aggression should be top issues for the trilateral US-Japan-Philippines leaders’ summit in Washington DC,” Raymond M. Powell, a fellow at Stanford University’s Gordian Knot Center for National Security Innovation, said in an X message. “President Marcos should be appreciative of the support he’s received so far but should not be timid about approaching his counterparts with additional requests,” he added.

The three nations could champion a UN Security Council resolution condemning the Chinese Coast Guard’s actions, he said. “The resolution would be vetoed of course by China and Russia, but it would force the other countries on the Security Council to take a stand.”

Mr. Powell said Beijing seeks to paint the Philippines into a corner by suggesting it is just a pawn in the United States’ great power competition with China.

“This papers over Manila’s very real security concerns and pretends they are just America’s convenient excuse to enlist the Philippines to its side,” he said. “The fact is that if America left the western Pacific altogether, the Philippines would face the same problems, but now without a powerful treaty ally.”

“If the Philippines insists on going its own way, China will continue to adopt resolute measures to safeguard its territorial sovereignty and maritime rights and interests,” the Chinese Foreign Ministry said late Saturday. “The Philippines should be prepared to bear all potential consequences.” — Norman P. Aquino, Kyle Aristophere T. Atienza and John Victor D. Ordoñez

China envoy urged to avoid ‘veiled threats’

CHINA’s top envoy to the Philippines should avoid “veiled threats” against Manila and its allies to avoid further straining their relations amid rising tensions in the South China Sea, political analysts said at the weekend.

This comes after Chinese Ambassador to the Philippines Huang Xilian’s remarks at a business forum on Philippine-China relations last week that nations that “talk down on” and misjudge China would miss out on opportunities as it sets an economic expansion target of about 5% this year.

“Mr. Huang should stop making veiled threats to the government and its partners during his tour of duty in the Philippines,” Terry L. Ridon, a public investment analyst and convenor of think tank InfraWatch PH, said in a Facebook Messenger chat.

“The Philippines is in no position to talk down on Beijing because China is a superpower and its Coast Guard and maritime militia have been regularly harassing our fishing vessels within our own exclusive economic zone,” he added.

The Chinese Embassy in Manila did not immediately reply to a Viber message seeking comment.

The envoy’s remarks came just days after US Secretary of State Antony Blinken visited Manila to reaffirm America’s “ironclad” commitments to defend the Philippines against an armed attack in the South China Sea.

Chinese Premier Li Qiang first announced the growth target early this month to boost confidence in China’s economy as it deals with deflationary pressures, a struggling property sector, an exodus of foreign capital, a stock market rout and a record-low birth rate.

In his speech last week, Mr. Huang said China’s growth target is expected to “far exceed” the International Monetary Fund’s growth forecast for the US and European Union. Its economy will have become twice the size that of the Philippines by yearend.

The Chinese economy has been showing positive signals since the start of the year, including a 7.7% increase in domestic tourist spending during the Chinese New Year to 632.6 billion yuan (P4.9 trillion) from 2019, he added.

China’s total trade in goods in the first two months of this year grew by 8.7% from a year earlier to 6.61 trillion yuan.

China should look into its own issues in urban planning and its struggling property sector before it brags about economic growth, Hansley A. Juliano, a political science professor at the Ateneo de Manila University, said in a Facebook Messenger chat.

“There seems to be this overwhelming belief in Beijing that offense is the best defense,” he said. “I also get the impression Mr. Huang’s job in Chinese foreign policy is to be the torpedo and bulldoze everyone, which gives Beijing plausible deniability should there be a policy change.”

The ambassador said China has been the Philippines’ biggest trading partner for eight straight years, and one of its biggest sources of foreign investments.

“The Chinese and the Philippine economy are both part of the global value, industrial and supply chains,” Mr. Huang said. “We have formed a deeply intertwined pattern of interests.” — John Victor D. Ordoñez

Marcos condemns Moscow attack

PHILIPPINE President Ferdinand R. Marcos, Jr. has condemned a shooting rampage in Russia that killed at least 115 people before the performance of a Soviet-era musical band inside a concert hall.

“I am profoundly saddened by the innocent lives lost in the horrific ISIS attack at the concert hall in Moscow,” Mr. Marcos said in a social media post. “My deepest condolences to the families affected by this senseless act of terrorism.” “We stand united in condemning terrorism in all its forms.”

The Islamic State (IS) claimed responsibility for the deadliest terror attack in Russia’s history, but Russian President Vladimir Putin has been linking the terror attack to the war in Ukraine.

The Afghan arm of IS, also known as the Islamic State in Khorasan Province, said via the Telegram channel of an affiliate media outlet that it was behind the attack, a claim that the US has backed.

“ISIS bears sole responsibility for this attack,” US National Security spokesperson Adrienne Watson said in a statement. “There was no Ukrainian involvement whatsoever.”

She said Washington had “shared information with Russia about a planned terrorist attack in Moscow.”

Ukraine, which has been locked in a war with Russia since 2022, has denied involvement in the terror attack, saying it has never “resorted to the use of terrorist methods.”

In an X post, Ukrainian presidential adviser Mykhailo Podolyak said Moscow might use the attack to justify its war against Kyiv and step up operations as part of its “military propaganda.”

In an X post on March 8, the US Bureau of Consular Affairs advised US citizens in Russia to avoid large gatherings, saying Washington’s embassy in Moscow was monitoring reports that “extremists have imminent plans to target large gatherings in Moscow, to include concerts.”

The United Nations Security Council called the attack “heinous and cowardly.”

“We condemn terrorism in all its forms and stand in solidarity with the people of Russia in grieving the loss of life from this horrific event,” the US State Department said.

China, France, India and Italy also condemned the attack.

The Philippine Foreign Affairs department earlier said no Filipinos were harmed in the gun attack. — Kyle Aristophere T. Atienza