Trump policies may force central banks to keep rates elevated

By Luisa Maria Jacinta C. Jocson, Reporter

INTEREST RATES may need to be kept higher for longer as US President-elect Donald J. Trump’s policies could delay the US Federal Reserve’s rate cuts and forcing other central banks to do the same, analysts said.

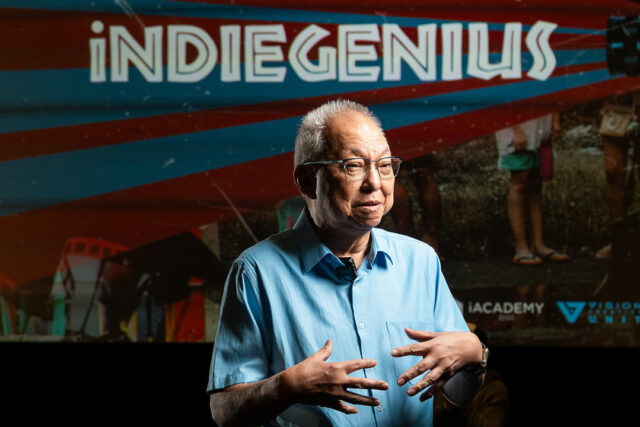

“The inflation problem in the US is likely to last a little longer and be persistent, therefore really the Fed cannot lower interest rates as quickly as Mr. Trump would like it to,” University of the Philippines (UP) School of Economics Professor Maria Socorro Gochoco-Bautista said at a forum on Monday.

“(This) means that all the rest of us also have to more or less toe the line and keep interest rates high,” she added.

Economies around the world are bracing for potential inflationary pressures arising from Mr. Trump’s proposals of import tariffs, tax cuts and tighter immigration measures. He is set to assume the presidency on Jan. 20.

“The dominance of the United States and the US dollar may be threatened by increased uncertainty, perceived erosion of the rule of law and credibility of institutions, an anticipated larger budget deficit and expected higher inflation that will necessitate higher interest rates,” Asian Financial Regulatory Committee Chair Martin Young said at the same event.

The US central bank began its rate-cutting cycle in September, slashing rates by a cumulative 100 basis points (bps) last year.

The Bangko Sentral ng Pilipinas (BSP), which cut ahead of the Fed in August, delivered a total of 75 bps worth of rate cuts last year.

The Monetary Board cut rates for three straight meetings, bringing the benchmark to 5.75%. BSP Governor Eli M. Remolona, Jr. has said the current policy rate is still in “restrictive territory.”

“As we can see, the dollar is appreciating. Studies have shown that whenever the US dollar appreciates, there are negative effects on the rest of the world,” Ms. Gochoco-Bautista said.

Ms. Gochoco-Bautista also noted the impact of currency depreciation on inflationary pressures and effects on output growth.

“The dollar isn’t just used as a means of transactions — it’s actually an asset, so in a world where there is so much uncertainty, there is already a natural tendency for countries to want to hold and acquire dollar assets,” she said.

“That also in and of itself, contributes to the strength of the US dollar independently of the fact that interest rates remain high in the US and somehow have to maintain the usual interest rate differential to prevent very large depreciations in our currency, which would compromise the inflation targets,” she added.

The peso closed at P58.70 per dollar on Monday, weakening by 34 centavos from its P58.36 finish on Friday.

This was its weakest finish in more than three weeks or since its P58.81-per-dollar close on Dec. 20.

“The market euphoria in the US following Trump’s election and persistent high inflation will likely keep interest rates high and the US dollar strong. As other currencies weaken, inflationary pressures will rise and hinder economic growth in those countries,” Mr. Young said.

Philippine headline inflation averaged 3.2% last year, settling within the 2-4% target band.

However, the central bank has warned that risks remain tilted to the upside for the inflation outlook from 2025 to 2026.

Meanwhile, Ms. Gochoco-Bautista said that Asian countries were individually affected by the first Trump administration.

“The welfare losses in terms of inflation, output growth, and tariff revenues, were negative in almost all Asian countries except Singapore,” she said.

Among Mr. Trump’s proposals are a 60% tariff on Chinese goods and a 10% universal tariff.

“Using blanket and higher tariffs to contain China could harm it but may not significantly benefit the US. It will also impact other countries, especially in Asia,” Mr. Young said.

He said the proposed tariff on Chinese imports “could disrupt global supply chains and increase US inflation.”

“These tariffs will affect other Asian nations directly and indirectly,” he added.

The United States is the Philippines’ top destination for exports, typically accounting for around 17% of overall export goods.

“It’s going to be harder to have a united ASEAN (Association of Southeast Asian Nations) response to the tariffs because the effects on individual countries also vary to a great degree. There are winners and losers,” Ms. Gochoco-Bautista said.

“But in general, we know countries grew by being open economies, open to trade and investment. And anytime you have policies that restrict trade, in the end, nobody gains.”