Spotify brings Taylor Swift experience to Asia

SPOTIFY is bringing an immersive exhibition, This Is Taylor Swift: A Spotify Playlist Experience, to Jakarta, Manila and Seoul. Bringing Spotify’s “This Is Taylor Swift” playlist to life, every element of the experience has been created to reflect the evolution of the singer’s artistry. There will be a gallery chronicling a journey through her 11 musical eras; a space where Swift’s iconic lyrics come to life; and an exclusive Spotify “This Is Taylor Swift” limited-edition keychain designed for fans to easily access Taylor’s discography on Spotify after the event. This Is Taylor Swift: A Spotify Playlist Experience will be in Manila on Feb. 21-23. For updates, look for @spotifyph on social media.

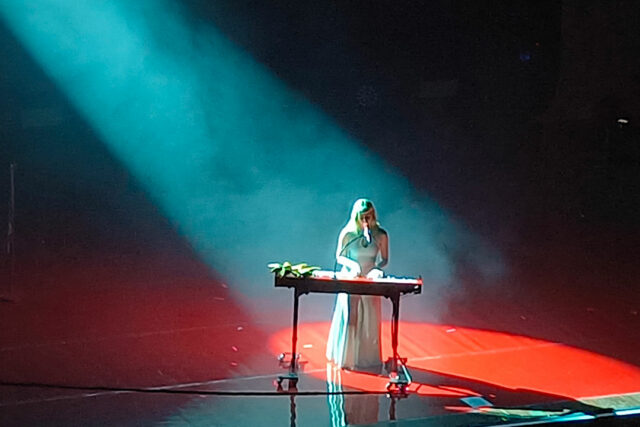

Sarah Geronimo to headline Enigma Music City

ASIA’S Popstar Royalty, Sarah Geronimo, is set to headline Enigma Music City on Feb. 8, 1 p.m. onwards, at Bridgetowne Open Grounds in Pasig City. The music festival hopes to provide an immersive experience, blending music, art, and interactive storytelling. Ms. Geronimo will be performing a new setlist. The festival lineup also includes James Reid, Barbie Almalbis, Adie, Arthur Nery, Drag Race PH S3 Queens, The Juans, Rob Deniel, Janine Tenoso, Paul Pablo, Ace Banzuelo, Over October, Loki, Alamat, and Kaia. Tickets are available in four tiers: VIP (P3,980), Platinum (P2,550), Gold (P1,620), and City (P640). To purchase tickets, visit enigmacityph.com.

Bacolod joins PHL film industry roadmap

BACOLOD CITY government officials and Negrense filmmakers recently met with the Film Development Council of the Philippines and global creative industries research organization Olsberg•SPI to discuss the development of a strategic roadmap for the future of the country’s film industry. The consultative meeting focused on the Bacolod filmmaking industry, the city’s pitch to become a UNESCO Creative City of Film, the recently concluded Bacolod Film Festival, and proposals for a filmmaking workshop or bootcamp.

Netflix announces 3 local titles for 2025

THIS year, Netflix is bringing in a fresh wave of original Filipino content. First off is the Maris Racal and Anthony Jennings starrer Sosyal Climbers, where the two controversial celebrities play hustlers Jessa and Ray. The trailer is now available online. Coming later this year are One Hit Wonder, a music-centered romance starring Sue Ramirez and Khalil Ramos, and the comedy Kontrabida Academy with Eugene Domingo and Barbie Forteza.

CreaZion Studios unveils Everything About My Wife

TO KICK off love month, CreaZion Studios has released the official poster and cast photos for the upcoming romance film Everything About My Wife. The film, a collaboration with GMA Pictures, highlights Dennis Trillo, Jennylyn Mercado, and Sam Milby in a love triangle set in a fine dining restaurant setting. The film is directed by award-winning filmmaker Real Florido and written by Rona Co.

Disney announces Jonas Brothers Christmas movie

DISNEY Branded Television has announced the development of the Jonas Brothers Christmas Movie, a holiday comedy from 20th Television that is slated to premiere during the 2025 holiday season on Disney+. In the movie, the Jonas brothers — Kevin, Joe, and Nick — face a series of escalating obstacles as they struggle to make it from London to New York in time to spend Christmas with their families. The Jonas Brothers also serve as producers. Isaac Aptaker and Elizabeth Berger will write and produce while Jessica Yu will direct, with original songs by Justin Tranter.

You’re Cordially Invited streaming on Prime Video

PRIME VIDEO has just released the wedding comedy, You’re Cordially Invited, now streaming in the Philippines. It is directed by Nicholas “Nick” Stoller and features an all-star cast including Will Ferrell, Reese Witherspoon, Geraldine Viswanathan, and Meredith Hagner. Set in a remote island resort, the story follows the chaos of a double-booked wedding.

Mickey 17 to premiere in Philippines in March

FROM the Oscar-winning Parasite director Bong Joon-ho comes the sci-fi dark comedy epic Mickey 17, starring Robert Pattinson. It is set to hit Philippine cinemas on March 5. The film stars Mr. Pattinson as Mickey, a disposable employee whose body is regenerated upon death to continuously fulfill his tasks in a space expedition. The cast also includes Naomi Ackie, Steven Yeun, Toni Collette, and Mark Ruffalo.

Netflix’s next K-drama When Life Gives You Tangerines

ON March 7, Netflix will be releasing a South Korean romance slice-of-life K-drama titled When Life Gives You Tangerines. It stars singer-songwriter and actress Lee Ji-eun as “the remarkable rebel” Ae-sun and award-winning actor Park Bo-gum as “the unyielding iron” Gwan-sik, whose love story develops through four seasons on Jeju Island. The series is created by director Kim Won-suk and screenwriter Lim Sang-choon.

Jolianne drops coming-of-age debut EP

CEBUANA singer-songwriter Jolianne has released her debut EP, Plain Girl, via Sony Music Entertainment and Careless Music. Featuring songs written between the ages of 16 and 20, the record captures a transformative period in her life, as she navigates the complexities of teenhood and embraces self-discovery. The R&B-infused pop EP Plain Girl is now on all digital music streaming platforms.

Number_i celebrates 1st anniversary with new single

J-POP group Number_i, composed of Hirano Sho, Jinjuji Yuta, and Kishi Yuta, has released a new single titled “GOD_i.” The track showcases a fresh sonic direction for the group, blending a melancholic top line with an upbeat chorus. It follows their debut appearance at the 75th NHK Kohaku Uta Gassen in December, and arrived in time to commemorate their first anniversary as a group on Jan. 1. It can be streamed on digital music platforms worldwide.

Imago releases new single under Sony

FILIPINO alt-rock band Imago has officially signed with Sony Music Entertainment and released a new song under the label, titled “Gulong-Gulo.” The track is a sonic exploration of love’s complexities. The song is out now on all music streaming platforms.

Sasha Alex Sloan contributes to Arcane’s soundtrack

RIOT GAMES and Virgin Music Group have revealed a new version of a song from the animated series Arcane called “What Have They Done to Us,” featuring the vocals of Sasha Alex Sloan. This new take on the standout track from Arcane League of Legends: Season 2 is composed by Mako and Grey. The single will be featured on a deluxe extended edition of the season 2 soundtrack, which will be released in spring 2025 and will include several additional remixes and features.