RATES of Treasury bills (T-bills) and bonds (T-bonds) could be mixed this week after the Bangko Sentral ng Pilipinas (BSP) chief reiterated that their policy easing cycle could start as early as next month.

The Bureau of the Treasury (BTr) will auction off P15 billion in T-bills on Monday, or P6.5 billion each in 91- and 183-day papers and P7 billion in 364-day notes. The six-month tenor on offer this week was adjusted as its maturity date falls on a holiday.

On Tuesday, the government will offer P30 billion in reissued seven-year T-bonds with a remaining life of four years and 10 months.

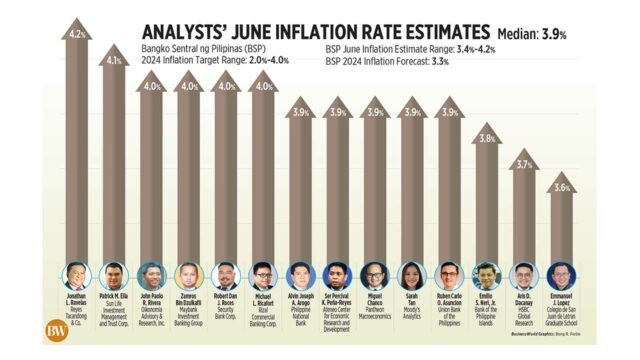

The rates of T-bills and T-bonds on offer this week could track the mixed movements in secondary market yields after BSP Governor Eli M. Remolona, Jr. said the Monetary Board could start cutting benchmark interest rates by August, Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said in a Viber message.

Secondary market levels ended mostly lower on Friday due to bargain hunting after the BSP meeting, a trader said in an e-mail.

The trader said the T-bonds on offer this week to be “well-received amid rate cut expectations,” adding they could fetch rates ranging from 6.25% to 6.4%.

At the secondary market on Friday, the rates of the 91-day and 182-day T-bills went up by 4.35 basis points (bps) and 5.72 bps week on week to end at 5.7433% and 6.0035%, respectively, based on PHP Bloomberg Valuation Service Reference Rates data published on the Philippine Dealing System’s website.

Meanwhile, the 364-day T-bill’s yield went down by 1.55 bps week on week to 6.0741%.

On the other hand, the rate of seven-year bond decreased by 3.31 bps week on week to 6.5392% on Friday, while the five-year debt, the tenor closest to the remaining life of the papers to be offered this week, went down by 2.46 bps to yield 6.4298%.

Mr. Remolona on Thursday said the Monetary Board is “on track” and “somewhat more likely than before” to slash rates at its Aug. 15 policy meeting, well ahead of the US Federal Reserve, which has signaled it could begin easing by December.

The BSP could cut rates by 25 bps in the third quarter and by another 25 bps in the fourth quarter, he added.

The Monetary Board’s Aug. 15 review is its only meeting in the third quarter. Meanwhile, its last two reviews for the year will be held in the fourth quarter and are scheduled on Oct. 17 and Dec. 19.

The Monetary Board on Thursday left its target reverse repurchase rate unchanged at 6.5%, the highest in over 17 years, as expected by all 15 analysts in a BusinessWorld poll. Interest rates on the overnight deposit and lending facilities were also maintained at 6% and 7%, respectively.

The BSP hiked rates by a cumulative 450 bps from May 2022 to October 2023 to help bring down elevated inflation.

An August rate cut would be the first for the BSP in over three years, which last slashed borrowing costs by 25 bps in November 2020 to bring the policy rate to a record low of 2% during the height of the coronavirus pandemic.

Last week, the BTr raised P15 billion as planned from the T-bills it offered as total bids reached P39.795 billion, or more than twice the amount placed on the auction block.

Broken down, the Treasury borrowed P5 billion as programmed from the 91-day T-bills as tenders for the tenor reached P14.81 billion. The average rate for the three-month paper was unchanged at 5.666%, from the previous week’s award. Accepted rates ranged from 5.648% to 5.675%.

The government likewise made a full P5-billion award of the 183-day securities, with bids reaching P10.71 billion. The average rate for the six-month T-bill stood at 5.93%, inching up by 1.6 bps, with accepted rates at 5.912% to 5.95%.

Lastly, the Treasury raised the planned P5 billion via the 364-day debt papers as demand for the tenor totaled P14.275 billion. The average rate of the one-year debt slipped by 1.5 bps to 6.031%. Accepted yields were from 6.029% to 6.034%.

Meanwhile, the reissued seven-year bonds to be auctioned off on Tuesday were last offered on June 20, 2023, where the government made a full P25-billion award, The papers fetched an average rate of 6.097%, 40.3 bps below the 6.5% coupon for the series.

The BTr wants to raise P215 billion from the domestic market this month, or P100 billion from T-bills and P115 billion via T-bonds.

The government borrows from local and foreign sources to help fund its budget deficit, which is capped at P1.48 trillion or 5.6% of gross domestic product for this year. — AMCS