The use of the excess and idle funds of the Philippine Health Insurance Corp. or PhilHealth continue to be discussed in the country.

See these five recent reports in BusinessWorld: “DoF: Tapping GOCC funds keeps inflation from new taxes in check” (Sept. 5); “PhilHealth urged to increase benefits, suspend rate hike” (Sept. 8, a call by the Philippine Chamber of Commerce and Industry or PCCI); “Junk PhilHealth petition, SC told” (Sept. 8, a call by the Office of the Solicitor General); “PHL government urged to impose new taxes to fund health programs for poor” (Sept. 8, a call by the Action for Economic Reforms or AER); and “Patronage politics has caused the loss of health insurance coverage for millions of Filipinos” (Sept. 9, a “Yellow Pad” column by Juan Antonio Perez III).

Last week, in this column (“Sectoral parochialism vs fiscal realism, the case of the PhilHealth idle funds,” Sept. 5), I wrote that “the health sector has shown itself as being addicted to the gambling fund, the alcohol and tobacco tax fund, while at the same time lambasting alcohol and tobacco products. This is double talk and lacking intellectual honesty.”

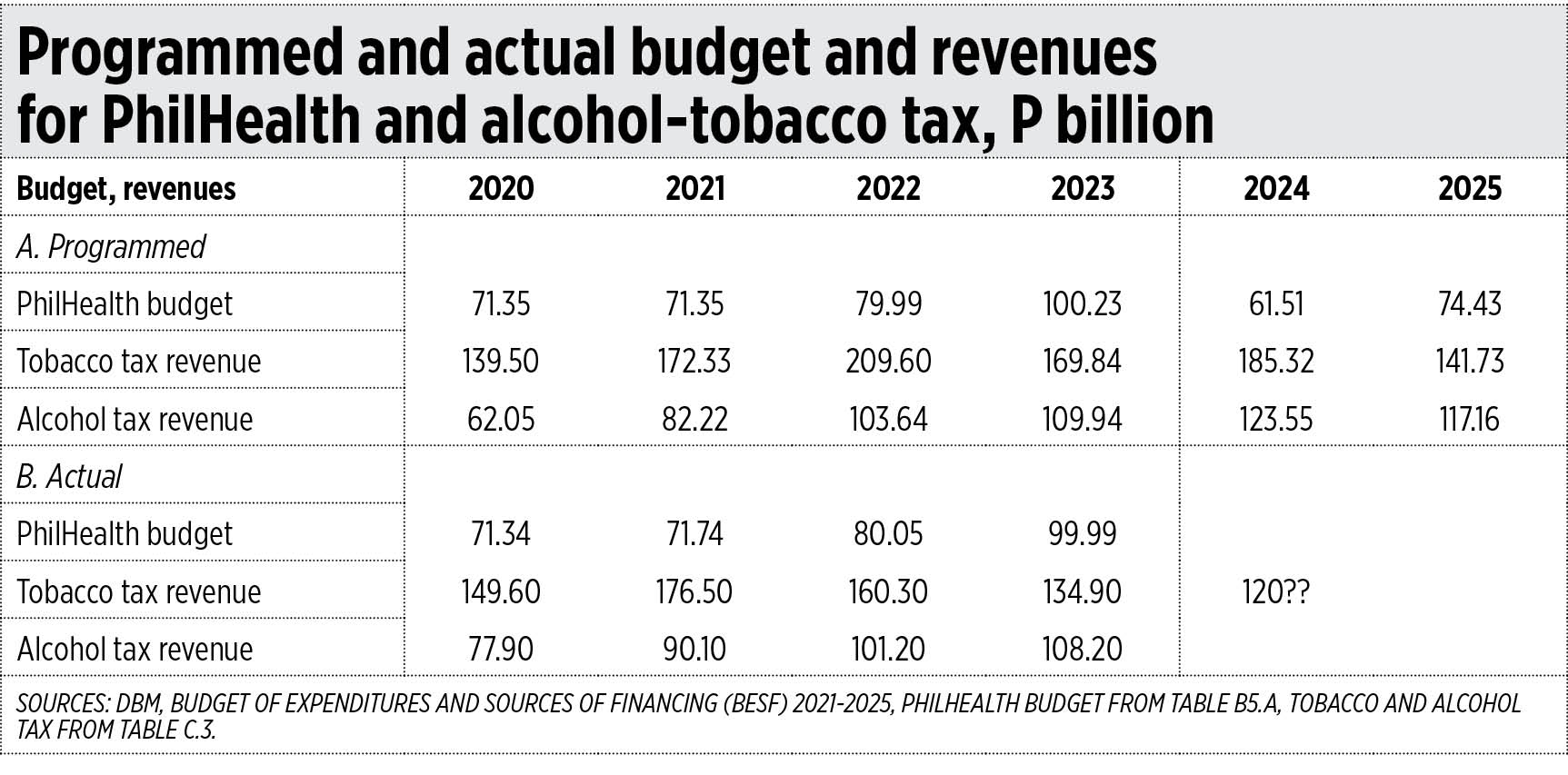

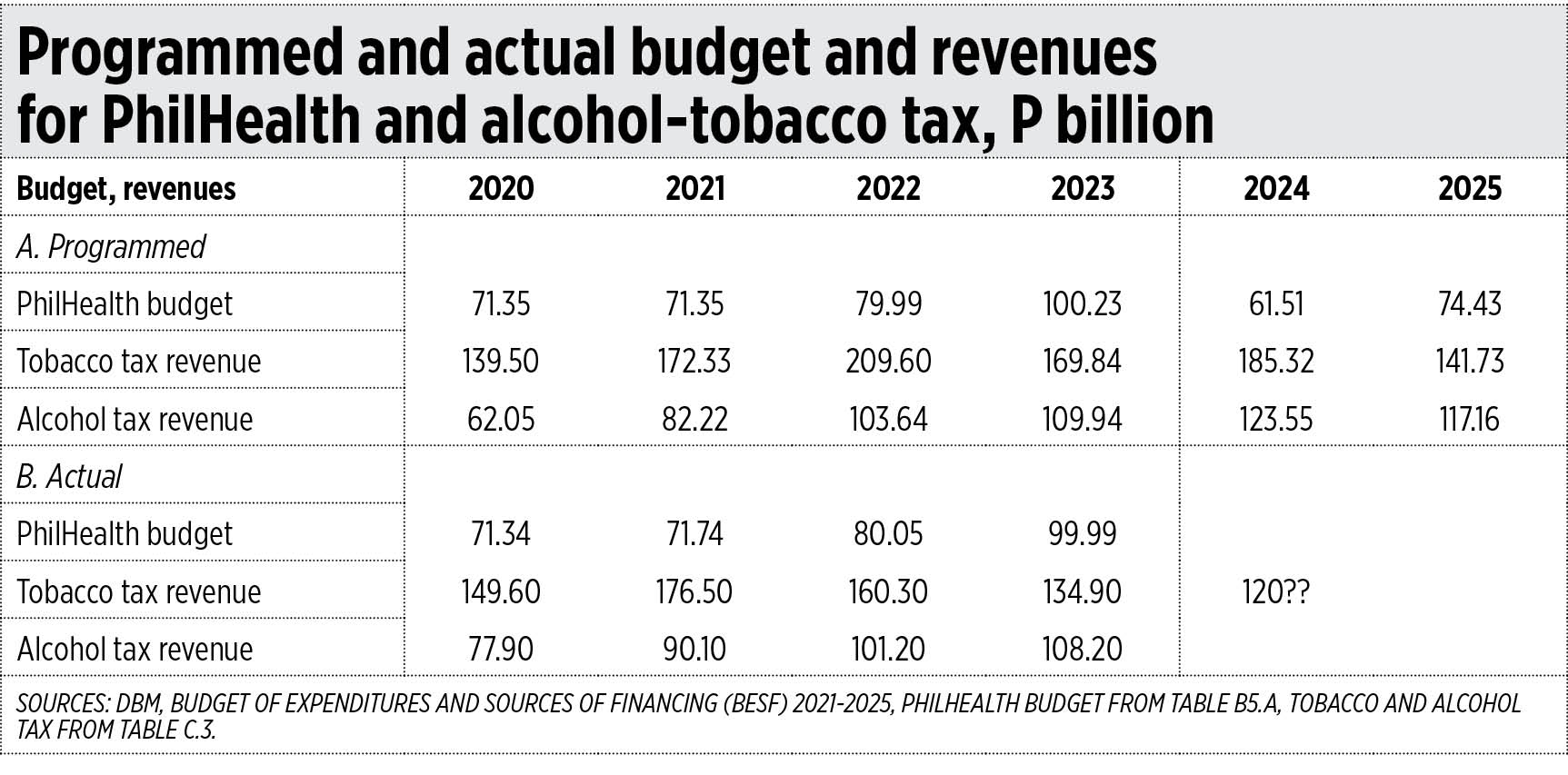

Let us look at PhilHealth’s dependence on “sin tax” revenues. In 2021, total excise tax collection was P317.67 billion, of which 84% came from alcohol and tobacco taxes alone. In 2023, the total excise tax collection was P293 billion, of which 83% came from alcohol and tobacco taxes. A big portion of this goes to PhilHealth as the government’s subsidy for non-paying PhilHealth members like indigents and senior citizens.

Recently, tobacco tax revenues declined significantly, from P176 billion in 2021, to P160 billion in 2022, and only P135 billion in 2023. This is a direct result of higher tobacco tax rates, from P50/pack in 2021, to P55/pack in 2022, P60/pack in 2023, and P63/pack in 2024. Legal tobacco has become more expensive and illicit or smuggled tobacco has become more attractive with its retail price only around P45/pack vs legal tobacco’s cheapest at around P110/pack.

Alcohol tax revenue shows a consistent increase, mainly because it is more difficult, as it is bulkier, to produce and sell illicit or smuggled beer, gin, or brandy, than illicit tobacco. I think actual tobacco tax revenues in 2024 will decline further to only around P120 billion. Why?

The actual excise tax collections (there is no breakdown by products) from January-July this year was only P167.48 billion, which is lower than the P174.68 billion collected in January-July 2023, which was in turn lower than the P180.46 billion collected in January-July 2022.

So, with the significant decline in tobacco tax and overall excise tax revenues in 2023, the projected budget for PhilHealth would decline from P100 billion in 2023 to P61 billion in 2024, and P74 billion in 2025 (see table).

Again, the Department of Finance (DoF) is correct in tapping the excess PhilHealth funds to finance certain projects under the unfunded appropriations. Not only because it avoids having to borrow anew and pay high interest payments, but also because it means the health sector from high dependence on alcohol and tobacco taxes while labeling the same as “sin, harmful, unhealthy” products.

The NGOs that double down on their lobbying for even higher tobacco tax rates are wrong and they seem to be the unintended big allies of the smugglers, terror organizations, and criminal gangs that are in the business of illicit tobacco. Because as legal tobacco becomes more expensive with higher taxes, cheap illegal tobacco becomes more attractive and more profitable for these criminal gangs and their protectors in government. The DoF’s tax revenue for each pack of illicit products sold on the market is zero.

Mr. Perez made several allegations against the DBM in his column, like “For 2025, DBM (the Department of Budget and Management) must explain why it has recommended a reduction of indirect contributors from 25,229,037 to 14,157,910.”

In a Facebook post by the DBM on Sept. 7, they said that the “DBM recommended the coverage of 21.1 million beneficiaries and it was Congress (that) reduced the recommended budget of [PhilHealth] in the FY 2024 GAA [General Appropriations Act] to P61.5 billion… The revised number of target beneficiaries of 10,626,874 (exclusive of PAMANA) came from the [PhilHealth] itself, not from DBM, given their reduced budget level in the FY 2024 GAA.”

So the claim that the DBM recommended 14.2 million beneficiaries was an error since the DBM actually recommended 21.1 million beneficiaries. See also this report in Philippine Star, “DBM debunks ‘fake news’ claiming 30 million Filipinos to lose PhilHealth coverage” (Sept. 8).

THE PHILIPPINES’ PHILLIPS CURVE

The Philippine Statistics Authority (PSA) last week released the inflation rate for August, and it was low at only 3.3%. Meanwhile, the unemployment rate for July increased to 4.7%.

One concept in Economics that relates to the jobs market and consumer prices is the Phillips Curve, developed by New Zealand economist William Phillips. It states that inflation and unemployment have an inverse relationship, that higher inflation is associated with lower unemployment and vice versa.

The curve itself is downward sloping. I plotted the Philippines’ inflation rate and unemployment rate from 1990-2023, or over 34 years. It seems that the inverse relationship between the two is confirmed in 24 out of the 34 years. The 10 years that were exceptions were 1991, 1998, and 2000 when both inflation and unemployment were going up, and 1992, 1993, 1999, 2006, 2007, 2015, and 2024 when both inflation and unemployment were going down (see the chart).

In cases where policies to produce low unemployment can lead to higher inflation, I would prefer to see this. So long as people have jobs, or they can shift from low-paying to higher-paying jobs, they can adjust to higher consumer prices.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.

minimalgovernment@gmail.com