YIELDS on government securities (GS) ended slightly higher last week amid the continued rise in US Treasuries due to safe-haven demand amid the worsening conflict between Iran and Israel.

However, the rise in yields was capped at the end of the week after the Bangko Sentral ng Pilipinas (BSP) delivered a second straight rate cut on Thursday while signaling further easing to support growth amid benign inflation and global uncertainties.

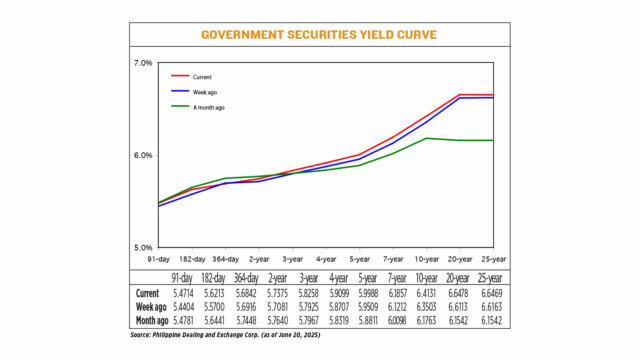

GS yields, which move opposite to prices, increased by an average of 3.81 basis points (bps) week on week, data from the Bloomberg Valuation Service Reference Rates as of June 20 published on the Philippine Dealing System’s website showed.

Rates of all tenors rose except the 364-day Treasury bill (T-bill), which dropped by 0.74 bp to fetch 5.6842%.

At the short end, yields on 91- and 182-day T-bills increased by 3.1 bps and 5.13 bps to 5.4714% and 5.6213%, respectively.

At the belly of the curve, the rates of the two-, three-, four-, five-, and seven-year Treasury bonds (T-bonds) went up by 2.94 bps (to 5.7375%), 3.33 bps (5.8258%), 3.92 bps (5.9099%), 4.79 bps (5.9988%), and 6.45 bps (6.1857%), respectively.

Lastly, at the long end, the 10-, 20-, and 25-year debt papers climbed by 6.28 bps, 3.65 bps and 3.06 bps to yield 6.4131%, 6.6478%, and 6.6469%, respectively.

GS volume traded fell to P27.93 billion on Friday from the P33.32 billion traded a week prior.

“Government securities saw mixed movements [last] week… reflecting cautious sentiment,” Jonathan L. Ravelas, senior adviser at professional service firm Reyes Tacandong & Co., said in an e-mail.

“The BSP’s 25-bp policy rate cut prompted a mild rally in longer-dated bonds as investors priced in easing inflation and slower growth. Market players shifted to medium- and long-term securities, expecting further monetary accommodation,” Mr. Ravelas added.

Yields were mostly higher as the BSP’s policy decision was mostly priced in already before the meeting, a bond trader said.

“It looks like we can expect the BSP to hold in the August monetary policy meeting given expected higher inflation in July amid the increase in oil prices and provisional fare hike,” the trader said.

On Thursday, the Monetary Board lowered benchmark interest rates by 25 bps for a second straight meeting, bringing the target reverse repurchase rate to 5.25%, as expected by 15 out of 16 analysts in a BusinessWorld poll last week.

It has now reduced benchmark borrowing costs by 125 bps since it began its easing cycle in August last year.

BSP Governor Eli M. Remolona, Jr. said they could deliver at least one more 25-bp cut this year, but noted that they remain watchful of emerging risks, including geopolitical tensions and the uncertainties brought about by trade policy shifts among the world’s largest economies.

The Monetary Board has three more policy meetings this year.

On Friday, concerns about the Middle East conflict supported demand for safe haven bonds, Reuters reported.

In the US bond market, which was open again after a federal holiday on Thursday, benchmark 10-year notes rose 2.8 bps to 4.423% from 4.395% late on Wednesday.

Yields had edged higher on Wednesday when US Federal Reserve Chair Jerome H. Powell said borrowing costs are still likely to fall in 2025.

Mr. Powell cautioned against holding on too strongly to forecasts and said he expects “meaningful” inflation ahead as consumers pay more for goods due to the Trump administration’s planned import tariffs.

Meanwhile, US forces struck Iran’s three main nuclear sites, President Donald J. Trump said late on Saturday, and he warned Tehran it would face more devastating attacks if it does not agree to peace.

After days of deliberation and long before his self-imposed two-week deadline, Mr. Trump’s decision to join Israel’s military campaign against its major rival Iran is a major escalation of the conflict and risks opening a new era of instability in the Middle East.

“The strikes were a spectacular military success,” Mr. Trump said in a televised address. “Iran’s key nuclear enrichment facilities have been completely and totally obliterated.”

In a speech that lasted just over three minutes, Mr. Trump said Iran’s future held “either peace or tragedy,” and there were many other targets that could be hit by the US military.

“If peace does not come quickly, we will go after those other targets with precision, speed and skill.”

The US reached out to Iran diplomatically on Saturday to say the strikes are all the US plans and it does not aim for regime change, CBS News reported.

Mr. Trump said US forces struck Iran’s three principal nuclear sites: Natanz, Isfahan and Fordow. He told Fox News’ Sean Hannity show that six bunker-buster bombs were dropped on Fordow, while 30 Tomahawk missiles were fired against other nuclear sites.

The strikes came as Israel and Iran have been engaged in more than a week of aerial combat that has resulted in deaths and injuries in both countries.

Israel launched the attacks on Iran saying it wanted to remove any chance of Tehran developing nuclear weapons. Iran says its nuclear program is for peaceful purposes only.

Diplomatic efforts by Western nations to stop the hostilities have so far failed. United Nations Secretary-General Antonio Guterres called Saturday’s strikes a “dangerous escalation in a region already on the edge — and a direct threat to international peace and security.”

Both sides’ attacks on energy infrastructure, including by Israel on Iran’s South Pars gas field and the risk of a complete shutdown of the OPEC member’s oil production, as well as Iran targeting shipping in the Straits of Hormuz, have fueled fears of a spike in oil prices and impacts on economies worldwide.

Israel launched attacks on June 13, saying Iran was on the verge of developing nuclear weapons. Israel is widely assumed to possess nuclear weapons, which it neither confirms nor denies.

For this week, Mr. Ravelas expects GS yields may trend sideways to slightly lower, especially in longer tenors, as the market digests the BSP’s rate cut and awaits the release of June Philippine inflation data.

“Investor demand could remain strong for benchmark issues amid dovish sentiment,” he said.

Meanwhile, the bond trader expects yields to stay elevated, especially if the Bureau of the Treasury (BTr) shows “a sign of aggressiveness” at this week’s T-bond auction.

On Wednesday, the BTr will offer P40 billion in reissued T-bonds in a dual-tenor auction. Broken down, it will auction off P20 billion in seven-year bonds with a remaining life of two years and 10 months, and P20 billion in 25-year notes with a remaining life of 24 years and seven months.

“The market will also wait for the third-quarter borrowing schedule,” the trader said. — Lourdes O. Pilar with Reuters