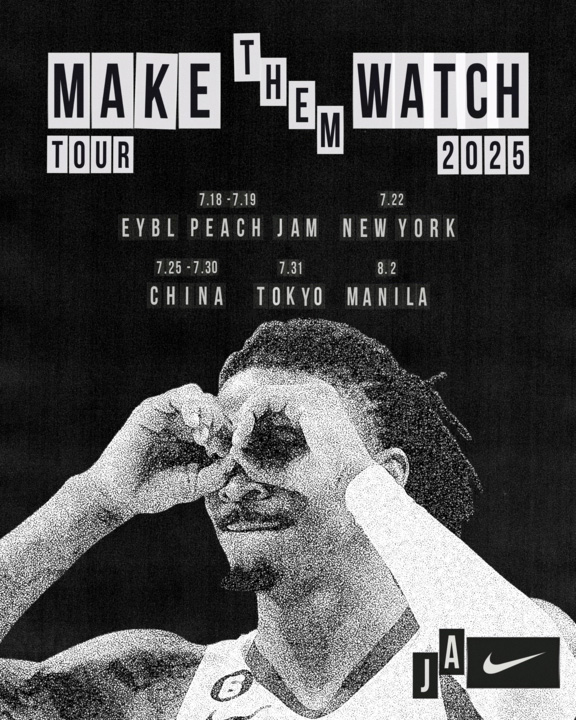

Nike signature athlete Ja Morant to inspire hoopers globally through the Make Them Watch Tour

NIKE and Ja Morant are teaming up to inspire athletes around the world to bring their own creativity to the game with the launch of the Make Them Watch Tour: a four-country journey that further introduces Ja to the global basketball community.

NIKE and Ja Morant are teaming up to inspire athletes around the world to bring their own creativity to the game with the launch of the Make Them Watch Tour: a four-country journey that further introduces Ja to the global basketball community.

For his first international tour as a Nike signature athlete, Ja will connect with hoopers in the US, China, Japan and the Philippines, helping the next generation shape the game in their local communities and discover their sense of style and expression on the court.

“Basketball is all about work and creativity — putting in that grind but also playing with your own style,” says Ja. “I’m excited to pull up and share a piece of my journey with the next generation of hoopers around the world, and I also want to check how basketball is played in their own communities. Getting to learn new cultures through hoops is a unique opportunity, and I’m hyped about that.”

The Make Them Watch Tour represents Ja and Nike’s commitment to giving back to the game: championing athletes, inspiring the next generation and fueling global basketball culture. The tour also reflects a shared belief in the power of basketball to build bridges between countries, challenge young athletes to chase their dreams, and create lasting impact among athletes and fans.

Further, the Make Them Watch Tour will celebrate what hoopers around the world love most about Ja: his undeniable, electric style of play; his hard work, creativity and self-expression; and his dedication to powering the future of the game.

Ja will kick off the Make Them Watch tour in Augusta, Georgia, by inspiring young hoopers at Nike Peach Jam, the brand’s premier Elite Youth Basketball League (EYBL) tournament.

The tour will then take Ja to New York (NY) during a celebration of summer hoops in the city, Nike’s annual NY vs NY tournament.

From New York, Ja will travel to China, where he’ll host clinics and training opportunities for local hoopers and future stars in Mission Rise 2025, a program to give talented youth a shot to become the next world-class players. He’ll then continue to Tokyo to connect with local athletes and fans while building a deeper connection with Japanese culture.

The Make Them Watch Tour will conclude in Manila, where Ja will continue to lift up the next generation, create new experiences for athletes, learn local culture and grow the game. He’ll invite local high school players to watch his workout and inspire Filipino hoopers of all levels at a Make Them Watch exhibition game while in Manila, a hotbed of basketball culture.

For Ja, connection to the game and its culture also extends beyond the court, and he will use each stop on the Make Them Watch Tour to meet athletes and fans at Nike stores; experience the culture of the city; and explore local art, food and music