Manila Critics Circle to rebrand to Filipino Critics Circle

THE Ateneo de Manila University Press and the University of the Philippines (UP) Press were jointly named Publisher of the Year at the 42nd National Book Awards on Nov. 23. Each of them had seven winning titles this year.

The event’s organizers — the National Book Development Board (NBDB) and the Manila Critics Circle (MCC) — awarded 33 winners across literary, non-literary, design, and publishing categories.

In light of the Philippines’ selection as the Guest of Honor at the 2025 Frankfurt Book Fair, NBDB Executive Director Charisse Aquino-Tugade noted that the Philippine book publishing scene is in the midst of a historic milestone.

“We are here to finally represent, and to push for our stories out of the periphery and into that much coveted spotlight on the global stage as a central, vital contributor to the world’s literary heritage,” she said in her opening speech.

Ms. Aquino-Tugade acknowledged the contradictions in the milestone. “Some of you may ask, why focus on the international when we have much work to do in sustaining domestic growth? After years of working towards this honor, we have come to realize that creating an international market for our stories and championing the local is far from being mutually exclusive,” she said.

The National Book Awards and the Frankfurt Book Fair are both proof that NBDB aims to “take every possible avenue to let every reader in the world know of not just the endless possibilities and turns that our stories can take, but also of how far we have come as a storytelling nation.”

REBRANDING

Meanwhile, MCC chair Dean Francis Alfar made an announcement with regards to how to better nurture the Philippine literary ecosystem: “As of next year, we are officially rebranding the MCC to Filipino Critics Circle.”

“We’d like to increase our membership with more representation from various sectors outside of Manila, because this is long overdue,” Mr. Alfar said in his closing speech. “We no longer want to be Manila-centric in name.” — Brontë H. Lacsamana

Below is the full list of winners for this year’s National Book Awards:

LITERARY

Best Novel in English — 1762: A Novel by Vin dela Serna Lopez (Ateneo de Manila University Press)

Special Citation for Novel in English — But for the Lovers by Wilfrido D. Nolledo (Exploding Galaxies)

Best Novel in Filipino — Teorya ng Unang Panahon by Edgar Calabia Samar (Ateneo de Manila University Press)

National Artist Cirilo F. Bautista Prize for Best Book of Short Fiction in English — The Collected Stories of Gregorio C. Brillantes by Gregorio C. Brillantes (Ateneo de Manila University Press)

Gerardo P. Cabochan Prize for Best Book Short Fiction in Filipino — Mga Kalansay sa Hardin ng Panginoon: Isang Koleksiyon ng Maikling Kuwento by Ronaldo Soledad Vivo, Jr. (Self-Published)

Pablo A. Tan Prize for Best Book of Nonfiction Prose in English — Balik-Tanaw: The Road Taken by Soledad S. Reyes (De La Salle University Publishing House)

Special Citation for Nonfiction Prose in English — Daraga: Mirrors & Memory Essays by Marne Kilates (Savage Mind Publishing House)

Best Book of Nonfiction Prose in Filipino — Patining at Iba Pang Sanaysay by Soliman A. Santos (University of the Philippines Press)

Best Anthology in English — Bordered Lives No More: The Humanities and the Post-COVID-19 Recovery edited by Dinah Roma (De La Salle University Publishing House)

Best Anthology in Filipino — Bata, Hiwaga, Bansa: Pamana ni Rene O. Villanueva sa Panitikang Pambata edited by Eugene Y. Evasco and Cheeno Marlo M. Sayuno (University of the Philippines Press)

Best Book of Literary Criticism/Cultural Studies — Ang Bisa ng Pag-uulit sa Katutubong Panitikan by Alvin B. Yapan (Ateneo de Manila University Press)

Best Book on Media Studies — Ang Mahaba’t Kagyat ng Buhay ng Indie Sinema edited by Rolando B. Tolentino and Aristotle J. Atienza (University of the Philippines Press in collaboration with QCinema International Film Festival)

Philippine Literary Arts Council Prize for Best Book of Poetry in English — It Is Time to Come Home: New & Collected Poems by Marjorie Evasco (Milflores Publishing, Inc. and De La Salle University Publishing House)

Victorio C. Valledor Prize for Best Book of Poetry in Filipino — Turno Kong Nokturno: Mga Bago at Piling Tula by Lamberto E. Antonio (University of the Philippines Press and UP Institute of Creative Writing)

Best Graphic Novel and Comics in English — Sa Wala by Renren Galeno (Komiket Inc.)

Best Graphic Novel and Comics in Filipino — Sining Killing by Randy Valiente (Komiket Inc.)

Best Translated Book in English — Hubad: Ester Tapia by Ester Tapia, translated by Merlie M. Alunan (University of the Philippines Press and UP Institute of Creative Writing)

Best Translated Book in Filipino — Palaisgen: Epikong-bayan ng mga Tagbanua ng Aborlan, Palawan by Paul D. Jagmis Sr., Gem-Gem Bagued, Fernando Lingsan, Delia Jardinero; translated in English by Jonalyn B. Villarosa and in Filipino by Paul D. Jagmis Sr. and Mary Grace A. Jagmis (National Commission for Culture and the Arts)

Best Translated Book in Ilokano — Ti Bassit a Prinsipe by Antoine de Saint-Exupery; translated by Cles B. Rambaud and Faye Q. Flores-Melegrito (Southern Voices Printing Press)

Best Book on Drama and Film — Lutong Bahay by Glecy Cruz Atienza (Sentro ng Wikang Filipino — University of the Philippines Diliman)

Best Book on Short Fiction in Bikol — Kalatraban sa Alkawaraan by Niles Jordan Breis (Ateneo de Naga University Press)

Best Book of Poetry in Bikol — Mayong Katapusan na Pabalon Asin Iba Pang Huyon-Huyon: Mga Rawitdawit by Raul Giga Bradecina (Ateneo de Naga University Press)

NON-LITERARY

Alfonso T. Ongpin Prize for Best Book on Art — Julio Nakpil (1867-1960) Collected Works, Volume Two: Band and Orchestral Music, edited by Maria Alexandra Inigo Chua (University of Santo Tomas Publishing House)

Elfren S. Cruz Prize for Best Book in the Social Sciences — Plural Entanglements: Philippine Studies, edited by Dada Docot, Stephan B. Acabado, and Clement C. Camposano (Ateneo de Manila University Press)

Best Book in Philosophy — Critical Theory at the Margins: Applying Herbert Marcuse’s Model of Critical Social Theory to the Philippines by Jeffry Ocay (Aletheia Printing and Publishing House)

John C. Kaw Prize for Best Book on History — Tales of Post-Plantation: Unlikely Protagonists of Modern Philippine Banana History by Robin Theirs (Ateneo de Manila University Press)

Best Book on Humor, Sports, Lifestyle, and Business — Salumpuwit, Bangko, Silya, Atbp: Chairs in Filipino Life by Gerard Lico (Arc Lico International Services and College of Architecture, University of the Philippines)

Best Book on Food — Heritage Dishes of the Philippines by Lady Camille de Guia (Vibal Group, Inc.)

Best Book in Science — Wild City: A Photographic Guide to Amphibians, Mammals, and Reptiles of Metro Manila by Jelaine Gan, Trinket Constantino, and Abby Favis (University of the Philippines Press)

Best Book in Spirituality and Theology — Babaylan Sing Back: Philippine Shamans and Voice, Gender, and Place by Grace Nono (Ateneo de Manila University Press)

Best Book on Professions — A Cardiologist’s Guide to Lowering High Blood Pressure by Alan S. Tenerife (Self-Published)

Hilarion and Esther Vibal Prize for Best Book in Journalism — View from the Foxhole: Shaping the Political into the Personal by Joel Pablo Salud (University of the Philippines Press)

DESIGN

Best Book Design — Dogs in Philippine History by Ian Christopher B. Alfonso, design also by him (Philippine Historical Association, Project Saysay Inc., and Alaya Publishing)

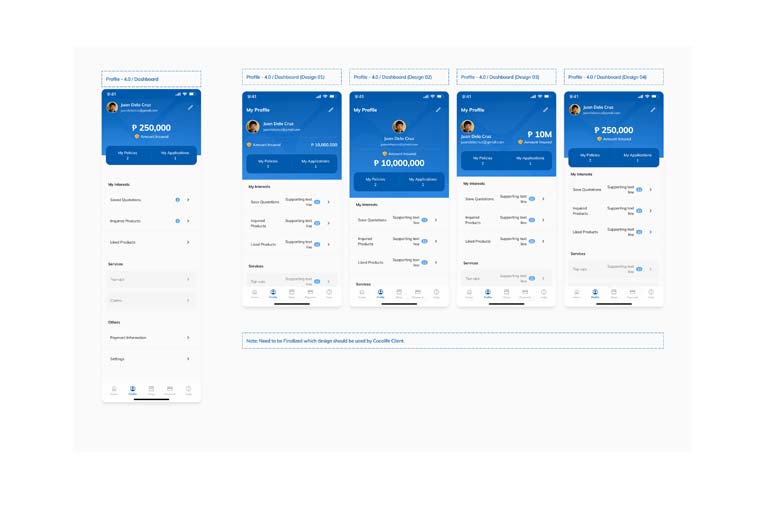

Through the myCOCOLIFE App, customers receive timely notifications and quick access to important information, including detailed guides about various insurance products. These features make obtaining insurance more accessible and instill confidence, knowing they can easily find the information they need.

Through the myCOCOLIFE App, customers receive timely notifications and quick access to important information, including detailed guides about various insurance products. These features make obtaining insurance more accessible and instill confidence, knowing they can easily find the information they need. In addition, the myCOCOLIFE App allows users to book appointments with agents for personalized consultations. This function ensures that customers are well-informed about their insurance options and can make educated decisions that fit their needs.

In addition, the myCOCOLIFE App allows users to book appointments with agents for personalized consultations. This function ensures that customers are well-informed about their insurance options and can make educated decisions that fit their needs.

The insurance provider also plans to introduce more dynamic features over the next few years to meet growing customer demands. The upcoming third phase will include agent assistance tools, the ability to submit claims through the app, and biometric login for added security. The app will also offer a renewal option for policies, including riders, and provide a dividends ledger for customers to track their financial benefits.

The insurance provider also plans to introduce more dynamic features over the next few years to meet growing customer demands. The upcoming third phase will include agent assistance tools, the ability to submit claims through the app, and biometric login for added security. The app will also offer a renewal option for policies, including riders, and provide a dividends ledger for customers to track their financial benefits.  One of the primary issues with traditional insurance is the time-consuming paperwork and manual processes involved. These often result in inaccuracies, limited access to product information, and slow turnaround times. Customers struggle with scheduling appointments and managing leads, leading to frustration and dissatisfaction, which can eventually cause lost sales.

One of the primary issues with traditional insurance is the time-consuming paperwork and manual processes involved. These often result in inaccuracies, limited access to product information, and slow turnaround times. Customers struggle with scheduling appointments and managing leads, leading to frustration and dissatisfaction, which can eventually cause lost sales. “The products and services offered by Cocolife speak volumes in itself. These are high-quality insurance products that are tailored to the specific needs of our clients,” said Cocolife President and Chief Executive Office Atty. Jose Martin A. Loon. “For Cocolife, it is our duty to serve our clients with the best insurance products, together with the highest standards of customer servicing especially during these most trying times.”

“The products and services offered by Cocolife speak volumes in itself. These are high-quality insurance products that are tailored to the specific needs of our clients,” said Cocolife President and Chief Executive Office Atty. Jose Martin A. Loon. “For Cocolife, it is our duty to serve our clients with the best insurance products, together with the highest standards of customer servicing especially during these most trying times.”

More to be done

More to be done

“But it’s not the matter of whether it’s 2033 or 2035, but the point is more on sustaining that growth and chasing that potential to reach the trillion-dollar economy,” he added.

“But it’s not the matter of whether it’s 2033 or 2035, but the point is more on sustaining that growth and chasing that potential to reach the trillion-dollar economy,” he added.