By Abigail Marie P. Yraola, Deputy Research Head

By Abigail Marie P. Yraola, Deputy Research Head

BANK STOCKS struggled in the fourth quarter of 2024 as rate cuts coupled with rising inflation and developments abroad affect profit margins, analysts said.

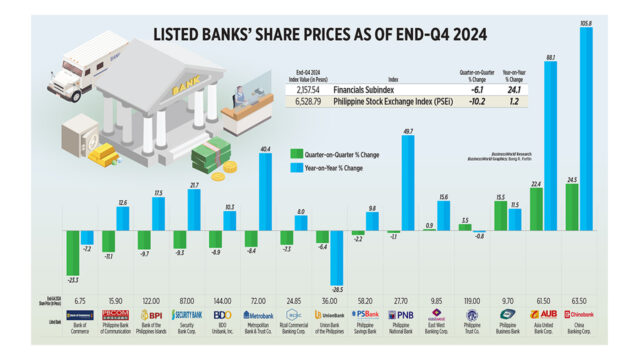

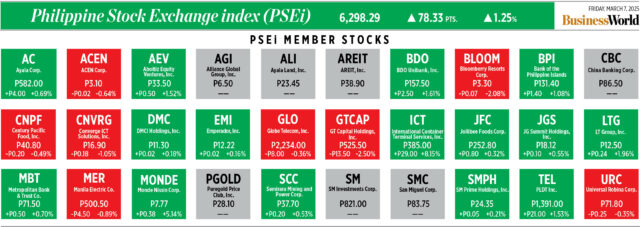

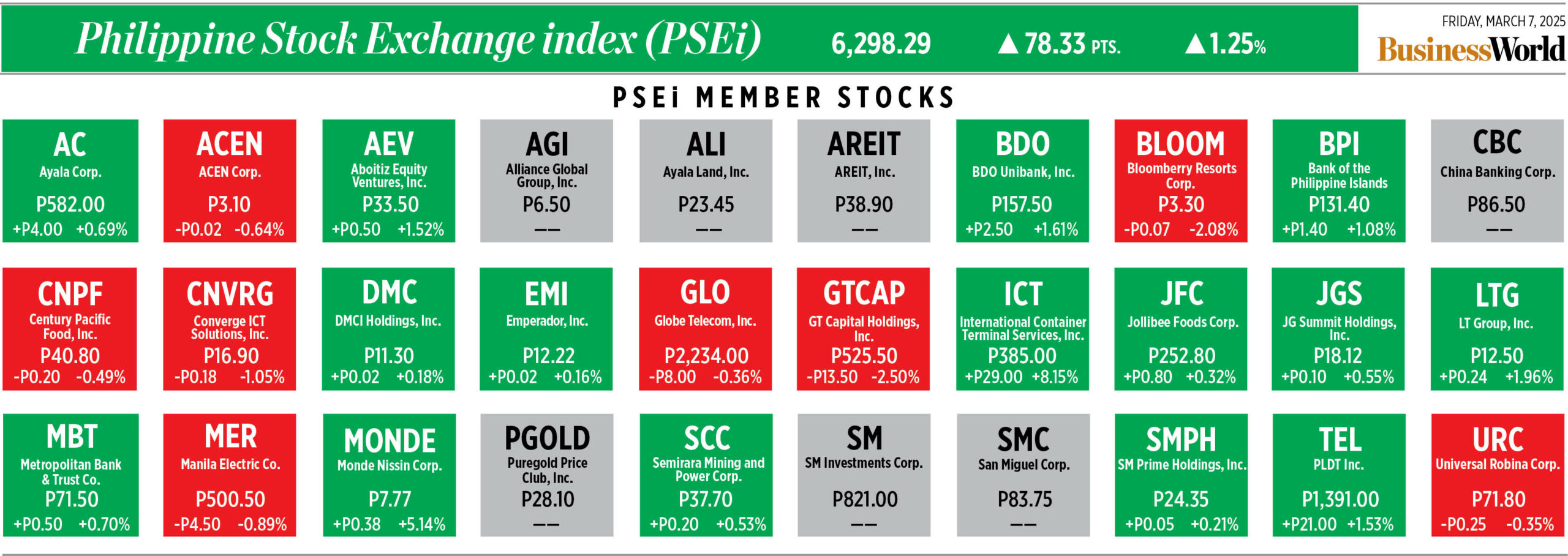

The Philippine Stock Exchange index (PSEi) declined by 10.2% in the last three months, a reversal from the 13.4% growth a quarter earlier.

However, year on year, the local bourse inched up by 1.2%.

The financials subindex, which includes the banks, fell by 6.1% in the October to December period. Year on year, the subindex rose by 24.1%.

During the period, 10 out of 15 listed banks fell on a quarterly basis. Bank of Commerce loed the decliners with a 23.3% drop, followed by Philippine Bank of Communications (-11.1%) and Bank of the Philippine Islands (BPI, -9.7%),

On an annual basis, 12 out of 15 banks posted growth in their share prices at the end of fourth quarter. China Banking Corp. (Chinabank) led with 105.8% year-on-year surge. It was followed by Asia United Bank Corp. (AUB, 88.1%) and Philippine National Bank (PNB, 49.7%).

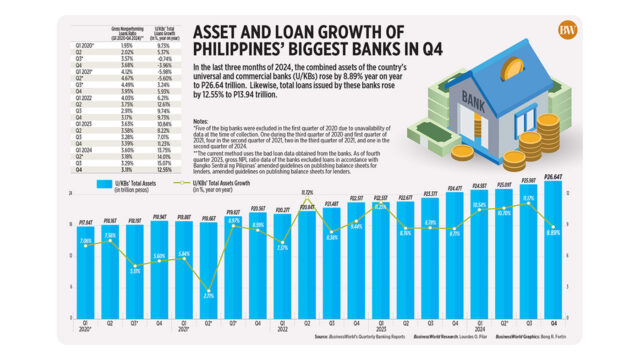

Despite the unfavorable sentiment of the stock market for the period, aggregate net income of universal and commercial banks grew by 9.7% to P366.02 billion as of end-December from P333.76 billion in 2023, data from the Bangko Sentral ng Pilipinas (BSP) showed.

Gross total loan portfolio of these big lenders rose by 10.5% to P14.20 trillion as of end-December from P12.85 trillion a year ago.

The big banks’ gross nonperforming loans (NPLs) ratio slightly inched up to 2.99% as of end-December from 2.96% in December 2023.

Meanwhile, the big banks’ net interest margin (NIM) — a ratio that measures banks’ efficiency in investing their funds by dividing annualized net interest income to average earning asset — rose to 4.04% in the fourth quarter from 3.84% recorded in the same period a year earlier.

Provision for credit losses by these big banks reached P101.15 billion, up by 29.5% from P79.10 billion in December 2023.

Ralph Jonathan B. Fausto, research associate at China Bank Securities Corp., said that macroeconomic factors affecting the market primarily influenced the stock performance of listed banks in the fourth quarter.

“Investors digested the possible impact of potential changes to US policy on the economic and growth outlook,” Mr. Fausto said in an e-mail.

He also pointed out that the US administration’s policy priorities, including the prospect of trade tariffs, led investors to anticipate a more cautious approach to policy easing by both the US Federal Reserve and the BSP.

“For banks, a more restrained path to policy easing and macro uncertainties could lead to tempered loan demand from businesses and consumers,” he added.

Wendy B. Estacio-Cruz, head of research at Unicapital Securities, Inc., said that some listed banks recorded double-digit growth in their net income mainly due to high net interest margins as interest rates remain elevated.

“In terms of share price movement, majority of banks declined due to negative market sentiment. However, do note that most of the listed banks, especially the top banks, continue to show strong earnings growth and high Return on Equity (RoE),” Maybank Securities, Inc. Research said in an e-mail.

Favorable macroeconomic and regulatory developments have supported bank earnings during the period with stabilizing inflation and interest rates lifting loan demand coupled with the reduction in reserve requirements supporting lending margins, Abigail Kathryn L. Chiw, first vice-president and head of research at BDO Securities Corp., said in an e-mail.

Maybank Securities also said that most banks during the quarter have the same trend share price movement.

“For the exception of Chinabank, note that it continues to do well in terms of loan growth, profitability and RoE. But what made CBC resilient versus other banks share pricewise is due to its high probability in being added in the PSE index,” Maybank Securities said.

For Arielle Anne D. Santos, an equity analyst at Regina Capital Development Corp., some banks, like BPI and UBP, saw strong performances due to consumer loan growth, fee income, digital initiatives, and effective risk management strategies.

“BPI benefited from consumer loans and fee income, while UBP gained from its acquisition of Citi’s retail business and its digital initiatives,” Ms. Santos said.

Other reasons for banks that have reported their earnings result include expanding NIM and improving NPL ratios (as in the case for BPI) as well as achieving positive returns and expanding consumer loan portfolio during the quarter.

“[The] strong performance was driven by substantial growth in noninterest income and a significant reduction in provisions, complementing solid expansion in core lending revenues,” Mr. Fausto said.

The central bank slashed its key rate by 25 basis points (bps) to 5.75% in their Monetary Board meeting last December. Since its easing cycle in August, the BSP has reduced rate by a total of 75 bps.

However, during their first policy meeting this year, the BSP held rate cuts, surprising market expectations and at the same time signaled fewer rate cuts.

“In the near term, investors need to watch out for the movements of the BSP in terms of policy rate cuts and reserve requirement ratios (RRR) cuts,” Maybank Securities said.

In September 2024, the central bank decided to reduce RRR by 250 bps to 7% from 9.5% for banks and nonbank financial institutions with quasi-banking functions which took effect on Oct. 25.

In February, the central bank announced they will cut RRR by 200 bps to 5% from 7% for universal and commercial banks (U/KBs) and nonbank financial institutions which will take effect on March 28.

The jumbo cut came after the central bank kept rates steady.

It also added that large banks may be negatively affected in terms of their NIMs with additional policy rate cuts but since the central bank held its rate cut in its recent policy meeting, banks can be expected to maintain high NIMs in the near term.

For Regina Capital’s Ms. Santos and BDO’s Ms. Chiw, it would be wise if the market will continue to monitor further BSP rate moves and impacts of inflation on loan quality and profit margins.

“NPL trends, capital adequacy, and fintech-driven cost efficiencies will be key, additionally peso-dollar volatility remains a risk,” Ms. Santos added.

Additionally, for Ms. Chiw, concerns right now are Trump policy uncertainties which are affecting financial markets with renewed interest rate and exchange rate volatility potentially hurting consumption and investment appetite.

“Risks of reaccelerating inflation and interest rates remaining high and restrictive, could also have knock-on effects to the ability of borrowers to repay their debts,” she said.

She cautioned that these risks may require banks to incur more loan loss provisions to buffer against the potential rise in loan delinquencies.

According to RCBC Securities, Inc., investors should keep an eye on the loan portfolio and growth, as well as whether NIMs continue to expand. “A potential 200-basis-point increase could positively impact loan growth and NIM,” RCBC noted.

Unicapital’s Ms. Estacio-Cruz remains optimistic about the banking sector’s prospects in 2025, anticipating that strong asset quality and improved loan growth will help offset the impact of rate cuts, thereby supporting RoE.

For Chinabank’s Mr. Fausto, the market will monitor changes to US policies and its potential impact on inflation and interest rates both locally and abroad.

“Additionally, full-year earnings reports of listed banks (including management teams’ guidance against the backdrop of the changing global and local macroeconomic landscape), prospective RRR cut and policy rate cuts from the BSP could serve as near-term catalysts,” he said.

WHAT TO CONSIDER IN 2025 AND OUTLOOK

For Mr. Fausto, outlook remains supportive for the central bank to implement further rate cuts which in turn could help support loan growth prospects.

Additionally, he said that banks that have built up comfortable coverage levels are expected to remain relatively resilient even as NIM compression may be relatively subdued.

“This comes as risks of a more tempered pace of loan growth could be partially offset by a more moderate decline in lending margins amid prospects of less policy rate cuts,” he said.

Ms. Estacio-Cruz said that NIMs are expected to remain stable as the downward repricing of loans should be partly offset by faster credit growth, driven by consumer loans.

“We see net interest margins stable for this year as banks manage to lower cost of funds while keeping asset yields steady,” Ms. Estacio-Cruz added.

Meanwhile, while these rate cuts may spur loan growth, rising inflation could put a strain to funding costs and repayment capacity, Ms. Santos of Regina Capital said.

She added that profit margins may tighten, but diversified banks, with strong liquidity and operational efficiency, will fare better.

“Loan growth may be modest, with margin pressures ongoing. Fee income from digital services should help offset declines. Big banks like BDO and BPI are expected to outperform due to scale, while UBP benefits from digital expansion,” she noted.

Charmaine Co, a research analyst at COL Financial Group, Inc., also projected continued loan growth momentum for banks, supported by favorable conditions such as monetary easing, stable economic growth, and subdued inflation.

“We also expect NIM to come under pressure from rate cuts. NIM compression may be on the modest side as the impact of rate cuts are moderated by balance sheet adjustments and tailwinds from the reduction in the banks’ reserve requirement ratio,” Ms. Co said in an e-mail.

For Maybank Securities, the rate cuts should put downward pressure on NIMs but the central bank’s RRR cut partially offset the potential impact on NIMs since an RRR cut is generally favorable for banks’ margins.

Additionally, they said that banks continue to expand their consumer loan portfolios, which typically have higher margins and yields compared to institutional loans.

“The banking sector is our top sector pick for the first half of 2025. With less rate cuts, we expect the banks to continue to enjoy high NIMs, high RoEs and strong profitability,” Maybank Securities said.

Moreover, Maybank Securities noted that with gross domestic product growth projected to be close to 6%, this could imply that industry loan growth to be around 10%-12% level.

Likewise, for RCBC Securities, banks will continue to perform strongly, backed by sustained double-digit loan growth due to the RRR cut.

For Ms. Chiw, inflation settling within the 2%-4% target of the central bank for the year will sustain further monetary policy easing.

“We believe there is room for two interest rate cuts, especially after the slower-than-expected 2.1% inflation print for February, which should help sustain loan demand,” she said.

However, she noted that the detrimental effect of rate cuts to profit margins, will be offset by favorable impact of RRR reductions in which banks can expect NIMs to remain stable.

“There will also be opportunities for banks to realize trading gains from their bond portfolios as interest rates shift lower,” she added.

In December, inflation accelerated to 2.9% which brought the full-year 2024 headline inflation to 3.2%, still settling within the BSP’s forecast.

Meanwhile, latest inflation data from the government’s statistics agency showed that in February, inflation eased to 2.1%, its slowest pace in five months or since the 1.9% posted in September 2024.

For the first two months of the year, inflation averaged 2.5%, still within the BSP target.