US firms’ cost-cutting driving growth in health outsourcing

HEALTHCARE OUTSOURCING growth is being driven by demand from US companies which are seeking to cut costs, the Healthcare Information Management Association of the Philippines (HIMAP) said.

The Board of Investments (BoI) in a statement Monday said the industry is expected to see strong growth this year despite the pandemic.

“The Information Technology-Business Process Management (IT-BPM) sector remains one of the top industry investments in the Philippines by US firms, with Health Information Management Services as one of the fastest-growing sub-sectors achieving double-digit growth despite the global economic slowdown brought about by the COVID-19 pandemic,” BoI Chairman and Trade Secretary Ramon M. Lopez said.

HIMAP Vice-President Vincent Remo has said that US companies continue to outsource to the Philippines due to the cost advantage and the local talent pool.

He said that the Philippines is able to provide healthcare outsourcing through a nurse and pharmacist workforce that are licensed in the US.

An accelerated coronavirus disease 2019 (COVID-19) vaccination rollout, he added, would help support the expansion of US companies.

“Our highly skilled talent pool remains our key advantage in attracting global IT-BPM companies,” he said.

The healthcare information management sector is expecting between 5-10% revenue growth to $3.4 billion in 2021.

The overall business process outsourcing industry revenue projection stands at 3.2-5.5% compound annual growth to $27.88-$29.09 billion for 2022, a forecast that was lowered to reflect the impact of the coronavirus pandemic. — Jenina P. Ibañez

ARTA presses ERC to act on petition to nullify FiT hike

THE Anti-Red Tape Authority (ARTA) issued notice to the Energy Regulatory Commission (ERC) of an eight-months-delayed Laban Konsyumer, Inc. (LKI) petition to nullify feed-in tariff (FiT) increases.

The LKI petition sought the withdrawal of an ERC resolution last year clearing the way for an increase in the FiT, a fixed payment to renewable energy developers that is passed on to electricity end-users in the form of the FiT-Allowance.

According to documents obtained Monday by BusinessWorld, the red-tape regulator took note of LKI’s complaint through a notice of referral e-mailed to ERC Commissioner-in-Charge Floresinda G. Baldo-Digal.

“We are referring the above complaint to your office for your appropriate action. Kindly furnish us your acknowledgement and action taken within three days from receipt of this notice,” ARTA Director for Investigation, Enforcement and Litigation Jedrek C. Ng said in a letter dated Sept. 2, 2021.

“Please take note that failure to notify the Authority regarding your action taken on this matter will amount to a violation of R.A. No. 11032 (Ease of Doing Business and Efficient Government Service Delivery Act of 2018),” he added.

In a statement issued Monday, LKI President Victorio Mario A. Dimagiba said the ERC has not yet issued the order to hear the group’s petition to nullify the FiT increases.

Last year, the FiT rate for solar projects was P11.2758 per kilowatt-hour (kWh), up from the 2014 level of P9.680/kWh. Meanwhile, the FiT rate for wind projects was at P9.8976/kWh in 2020, against the 2014 rate of P8.5300/kWh.

LKI’s Mr. Dimagiba has said that the FiT adjustments in solar and wind last year contributed to higher electricity bills as the state-run National Transmission Corp. recovered the allowance paid by consumers.

BusinessWorld asked the ERC to comment, but it had not replied at deadline time. — Angelica Y. Yang

PSEi drops as PAL files for bankruptcy in the US

SHARES declined on Monday on profit taking and as Philippine Airlines, Inc. (PAL) filed for bankruptcy protection in the United States.

The Philippine Stock Exchange index (PSEi) went down by 20.03 points or 0.29% to close at 6,877.10 on Monday, while the all shares index shed 5.96 points or 0.14% to 4,255.73.

“Market went on profit taking today after [two] days [of] consecutive [gains], after PAL filed for bankruptcy protection or Chapter 11 in the US,” said in a text message on Monday.

“The PSEi corrected slightly lower today… after near record-high new COVID-19 (coronavirus disease 2019) cases, PAL filed for Chapter 11 over the weekend, and after the softer-than-expected US nonfarm jobs…,” Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said in a Viber message on Monday.

PAL filed for Chapter 11 bankruptcy in New York with a lender-supported plan that helps the country’s main carrier recover after the pandemic devastated global travel, it said in a statement on Saturday.

Meanwhile, US Labor department data showed nonfarm payrolls increased by 235,000 last month, its smallest rise since January, Reuters reported.

“However, these are offset by the easing of NCR’s (National Capital Region) quarantine classification to GCQ (general community quarantine) proposed granular lockdowns, with guidelines being awaited, to be piloted in NCR,” Mr. Ricafort said.

“Going forward, easing of NCR to GCQ and the granular lockdowns could be de facto measures to further reopen the economy from lockdowns and mitigate the drag on the economy,” he added.

“Others are keeping an eye out for the August inflation data and July unemployment data [that] will be out [on Tuesday],” Regina Capital Development Corp. Head of Sales Luis A. Limlingan said in a separate Viber message.

Headline inflation likely quickened in August and settled above the central bank’s official target range anew, as a weaker peso pushed food prices up, according to analysts.

A BusinessWorld poll of 16 analysts yielded a median estimate of 4.4% for August inflation, near the lower end of the 4.1% to 4.9% estimate given by the Bangko Sentral ng Pilipinas.

Most sectoral indices started the week in the green except for holding firms, which lost 53.81 points or 0.77% to finish at 6,921.08, and services, which inched down by 5.98 points or 0.33% to 1,762.74.

Meanwhile, mining and oil gained 203.50 points or 2.14% to 9,689.72; financials went up by 6.68 points or 0.46% to 1,457.29; property improved by 0.92 point or 0.03% to end at 3,076.83; and industrials rose by 1.49 points or 0.01% to close at 10,139.45.

Value turnover declined to P5.30 billion with 1.8 billion issues switching hands on Monday, from the P6.45 billion with 1.58 billion shares traded on Friday.

Advancers beat decliners, 95 against 86, as 57 names closed unchanged. Net foreign buying increased to P263.06 million yesterday from P242.74 million on Friday. — K.C.G. Valmonte with Reuters

Peso declines on rising cases, inflation bets

THE PESO retreated versus the dollar on Monday due to rising coronavirus infections ahead of the release of August inflation data.

The local unit closed at P49.925 per dollar on Monday, weakening by 8.5 centavos from its P49.84 finish on Friday, based on data from the Bankers Association of the Philippines.

The peso opened Monday’s session at P49.92 per dollar. Its weakest showing was at P50.035, while its intraday best was at P49.82 versus the greenback.

Dollars exchanged dropped to $717.4 million on Monday from $924.2 million on Friday.

The peso declined versus the greenback as coronavirus disease 2019 (COVID-19) cases continued to surge, Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said.

Active cases rose by 22,415 to 159,633 on Monday, based on data from the Department of Health. This marked the fourth consecutive day that new infections breached 20,000.

Peso-dollar trading was also affected by market expectations of faster inflation in August, a trader said.

A BusinessWorld poll of 16 analysts yielded a median estimate of 4.4% for August headline inflation. If realized, inflation will again surpass the central bank’s 2-4% target following the 4% print in July and will be faster than the 2.4% logged in August 2020.

The Philippine Statistics Authority will release inflation data on Sept. 7.

For today, Mr. Ricafort gave a forecast range of P49.80 to P50 per dollar, while the trader expects the local unit to move within P49.85 to P50.10. — LWTN

House approves ease of paying taxes bill on 2nd reading

HOUSE LEGISLATORS approved a measure on second reading Monday that would ease the process of filing taxes in order to encourage taxpayers to pay their dues.

House Bill 8942 or the Ease of Paying Taxes Act seeks to simplify rules and processes in filing and paying taxes, such as removing venue restrictions and introducing a medium taxpayer classification.

The measure would also remove the P500 annual taxpayer registration fee, create registration facilities for non-resident taxpayers, and institutionalize a “Taxpayer’s Bill of Rights.”

The measure seeks to amend sections of the National Internal Revenue Code of 1997. It was approved by the House Ways and Means committee on Jan. 25.

PBA Party-list Rep. Jericho Jonas B. Nograles introduced amendments to the bill that would include the creation of the Taxpayer’s Advocate Office in the Bill of Rights.

The Taxpayer’s Advocate Office will be under the supervision of the Department of Finance and is independent from the Bureau of Internal Revenue (BIR).

The office is tasked with ensuring protection of the rights of taxpayers and finding solutions to solve systemic problems in the BIR that prevent efficient tax administration.

The measure was among the priority measures listed by House Speaker Lord Allan Jay Q. Velasco when plenary deliberations resumed for the third and final session of the 18th Congress on July 26. — Russell Louis C. Ku

National ID seen easing remittance transactions

THE NATIONAL ID initiative will help simplify the remittance process for recipients, an analyst for the Economist Intelligence Unit said.

The biggest beneficiaries could be rural residents currently experiencing difficulty proving their identities for cash transfers, according to Swarup Gupta, industry manager at the EIU said.

“That could really change things, because that makes identification easy, it makes the idea of a digital identity central to the concept of any digital interaction of payments, including remittances,” he said in an online interview.

He noted that the Philippines has a “fairly aggressive mobile penetration rate” coupled with a large unbanked population.

The central bank estimates that only 29% of adults had bank accounts in 2019, leaving 51.2 million with no formal financial accounts. Documentary requirements have been blamed for hindering financial inclusion.

By 2023, the BSP (Bangko Sentral ng Pilipinas) hopes to bring 70% of adults into the banked population.

The National Economic and Development Authority said 1.23 million Filipinos have received a national ID as of Aug. 20. More than 40 million citizens have started the registration process, on track to hit the 50-70 million government target for the end of 2021.

In June, the central bank told financial institutions to accept the national ID as sole proof of people’s identity when opening accounts. Prior to this, the Know-Your-Customer process for most financial institutions required at least two government IDs to open an account.

Apart from the national ID, improvement of digital networks through government- and private-sector initiatives will also allow easier remittance transactions for people in rural areas, Mr. Swarup said.

“In this case, it’s not telecom, but digital networks using modern technology, preferably 5G in the days ahead. You need it to be pervasive, you need it to be inclusive. So it needs to have available bandwidth across the rural regions of emerging Asia, including the Philippines,” he said.

“This will ensure that the digital divide that exists, especially between rural and urban areas, is reduced in the longer- to medium-term,” he added.

The Philippines is the world’s fourth-largest recipient of remittances. Last year, inflows slipped 0.8% to $29.903 billion because of the pandemic. — Luz Wendy T. Noble

Steel sheet roofing quality norms put on hold by court order

THE COURTS have ordered a stay on the enforcement of product quality standards for steel sheet roofing, the Department of Trade and Industry (DTI) said.

“Unfortunately, the courts issued preliminary injunctions against the DTI so our hands are tied now. We cannot enforce the standards on glass and steel sheet roofing because of the injunction cases that we have,” DTI Undersecretary Ruth B. Castelo said in a webinar last week.

“And we actually appealed to the courts to please allow us to proceed with implementation or enforcement of these standards so that we can provide consumer protection, but these cases are still pending.”

The injunction on steel standards was issued earlier this year after a request from Galvaphil, Inc., she said in a mobile message Monday.

A DTI order that took effect in January placed galvanized steel sheet for roofing and general applications in the list of products that must be certified to have met quality standards, requiring all manufacturers to secure a Philippine Standard safety certification mark license before selling their products.

Ms. Castelo has said that the measure will ensure that construction materials are strong enough to withstand frequent storms.

The order was designed to improve the quality of both locally manufactured and imported products and ensure consumer safety, Trade Secretary Ramon M. Lopez said.

An injunction in 2019 also halted a DTI order on mandatory certification of flat glass products after importers filed a petition.

As part of a crackdown on substandard goods, plywood last year was also restored to the list of products that must be certified for quality. But the mandatory certification for imported plywood has been put on hold to 2022 after a request from an industry group to be given more time, citing pandemic-related restrictions. — Jenina P. Ibañez

Clarifying IAET exemption for PEZA entities

Prior to the effectivity of the Corporate Recovery and Tax Incentives for Enterprises (CREATE) Law, Philippine tax rules imposed a 10% tax on improperly accumulated taxable income of corporations. This improperly accumulated earnings tax (IAET) is imposed as a penalty on corporations which allow accumulation of earnings for the purpose of avoiding tax liability for their shareholders if they decide to distribute profits in the form of dividends.

Not all corporations, though, are subject to IAET. Revenue Regulation (RR) No. 2-2001 identifies corporate taxpayers who are exempt from IAET. These include:

a) banks and other non-bank financial intermediaries;

b) insurance companies;

c) publicly held corporations;

d) taxable partnerships;

e) general professional partnerships;

f) non-taxable joint ventures; and

g) enterprises duly registered with the Philippine Economic Zone Authority (PEZA) under R.A. 7916, and enterprises registered pursuant to the Bases Conversion and Development Act (BCDA) of 1992 under R.A. 7227, as well as other enterprises duly registered under special economic zones declared by law which enjoy payment of special tax rates on their registered operations or activities in lieu of other taxes, national or local.

There have been several instances during tax assessments or audits when PEZA-registered entities, especially those that are under income tax holiday (ITH), find themselves being assessed for IAET. Based on some examiners’ interpretations of the exception (g) cited above, PEZA-registered enterprises may enjoy exemption from IAET if they are under the 5% preferential tax regime.

But just recently, the Supreme Court (SC) decided on a tax case where one of the issues involved is whether the respondent, a PEZA-registered entity, is subject to IAET on its accumulated income from registered activities enjoying the ITH incentive.

In that case, the Bureau of Internal Revenue (BIR) made a distinction between the respondent’s income from certain registered activities which have been granted ITH extension and its income from the rest of its registered activities which were subject to the preferential five percent (5%) tax rate. The tax authority argued that only the latter is exempt from IAET since the registered enterprises exempt under Sec. 4(g) of RR No. 2-2001 pertain only to those enjoying the special tax rate.

The SC concurred with the CTA en banc’s interpretation that the phrase “which enjoy payment of special tax rate on their registered operations or activities in lieu of other taxes, national or local” applies only to corporations belonging to the third group, that is, the other enterprises duly registered under special economic zones declared by law. The CTA explained that the use of comma in Section 4(g) of RR No. 2-2001 signifies independence of one thing from the others included in the enumeration, such that the particular portion contemplates three different groups excluded from the coverage of the imposition of the IAET.

In addition, the CTA en banc also noted that qualifying words restrict or modify only the words or phrases to which they are immediately associated, and not those distantly or remotely located. In this case, the court ruled that PEZA-registered enterprises and those registered pursuant to the BCDA are exempted from the imposition of the IAET without further qualification. Therefore, regardless of whether a corporation duly registered with the PEZA or registered pursuant to the BCDA enjoys an ITH or the special tax regime at a rate of 5% on its registered activities, it shall be exempt from IAET.

This interpretation now opens some concerns for taxpayers falling under the third group and are enjoying ITH incentive. With the repeal of the imposition of the IAET under the CREATE Law, the tax authority is left with only a few open taxable years to pursue assessments related to IAET. Thus, the BIR may be on the lookout for possible improperly accumulated earnings in its tax audits covering taxable years prior to the effectivity of the CREATE Law.

Nevertheless, taxpayers need not fret that much considering that IAET will only be imposed in case of failure to prove that the accumulation of profits is for reasonable business needs and not for the purpose of avoiding dividend tax liability upon corporate shareholders. Now that IAET is no longer imposed, companies are not compelled any longer to distribute profits to investors. This provides more potential for reinvestment for business expansion in the Philippines which would, in turn, generate more employment for our countrymen.

Let’s Talk Tax is a weekly newspaper column of P&A Grant Thornton that aims to keep the public informed of various developments in taxation. This article is not intended to be a substitute for competent professional advice.

Arianne Cyril L. Mandac is a manager of Tax Advisory & Compliance division of P&A Grant Thornton, the Philippine member firm of Grant Thornton International Ltd.

Manila lockdown eased as gov’t changes tack

By Kyle Aristophere T. Atienza, Reporter

METRO MANILA will be placed under a more relaxed quarantine level starting Sept. 8 even as the Philippines logged another record-breaking number of coronavirus infections on Monday.

The Health department recorded 22,415 coronavirus infections on Sept. 6, bringing the total to 2.1 million.

The death toll rose to 34,337 after 103 more patients died, while recoveries increased by 20,109 to 1,909,361 million, the Department of Health (DoH) said in a bulletin.

There were 159,633 active cases, 92.1% of which were mild, 3.3% were asymptomatic, 1.4% were severe, 2.48% were moderate and 0.6% were critical.

The agency said 68 duplicates were removed from the tally, 53 of which were recoveries. Seven recoveries were tagged as deaths. Eight laboratories did not submit data on Sept. 4.

The National Capital Region would be placed under a regular general community quarantine, the least restrictive lockdown level, from Sept. 8 to 30, Palace Spokesman Herminio L. Roque, Jr. told a televised news briefing.

Under a general lockdown, limited dine-in services and religious gatherings will be allowed again, Mr. Roque said.

LOCALIZED LOCKDOWN

He also said President Rodrigo R. Duterte has already approved “in principle” a plan to pilot-test localized lockdowns in the capital region.

An inter-agency task force has yet to adopt a resolution that will set the guidelines for the localized lockdowns, Mr. Roque said. “The guidelines will be released, at the latest, tomorrow.”

The localized lockdowns will cover specific streets, villages or other granular areas that will be decided upon by local governments.

The national government has said the new lockdown strategy will give Metro Manila mayors more flexibility to contain virus contagion.

Health Undersecretary Maria Rosario S. Vergeire, in a briefing on Monday, said localized lockdowns will help the national government focus its pandemic efforts on high-risk areas.

The new lockdown strategy would help the government boost its active case finding, intensify testing, and enhance isolation of cases, she said.

The Health agency will include the potential impact of granular lockdowns in its coronavirus analysis, she added.

The OCTA Research Group, which has been tracking the coronavirus data in the country, however, raised concern over the new lockdown system, saying it may affect the country’s pandemic control.

“We’re concerned that if this does not work, at a point when we’re actually seeing that the curve might plateau soon in two to three weeks,” OCTA fellow Fredugusto P. David told ABS-CBN News Channel. “There’s a chance that we might lose effective control of the pandemic and it will become much worse than it is.”

Mr. David said there is not yet enough evidence to prove that granular lockdowns can address a widespread community transmission.

On vaccination, more doses will be given to workers in the construction and manufacturing sectors starting Wednesday, according to Labor Secretary Silvestre H. Bello III.

The initial rollout for those specific sectors will provide 2,000 jabs, which is part of the 452,000 doses allotted for the workers, Mr. Bello said in a news briefing on Monday.

The additional vaccines for workers in different industries is an initiative of the Employers Confederation of the Philippines, in coordination with the Labor department, under the 1 Million Jobs Project, which aims to create that many work opportunities by December 2021 as part of the economic recovery plan.

Meanwhile, the DoH on Monday reported 279 new cases of the Delta variant, bringing the total to 1,273. Of these, 245 were local cases, 21 were returning migrant Filipino workers, and 13 cases are still being verified.

On the other variants, the country’s record were: Alpha, 2,424, and Beta, 2,697. The DoH also reported that 13 more people have been infected with the P.3 variant first detected in the Philippines.

Ms. Vergeire also said a new peak in COVID-19 deaths was seen in the previous week.

“At the national level, deaths have been increasing since the last week of July and a new peak was seen during the previous week,” she told a virtual news briefing.

Ms. Vergeire warned of more fatalities ahead. “This number is still expected to increase.”

“The average deaths per day in August of 2021 is now at 131, nearing the deaths last April 2021,” Ms. Vergeire said. “Partial data for September data shows that we have an average of 40 deaths per day.”

Central Luzon, Calabarzon, and Central Visayas were among the regions that recorded the highest number of deaths, she said. — with a report from Bianca Angelica D. Añago

2 items in budget worth P38.1B are pork barrel in disguise — solons

TWO ITEMS in the proposed 2022 budget have been questioned by lawmakers as potential pork barrel funds that could be used by the administration for its candidates in next year’s local and national elections.

The P28.1 billion allocated for the barangay development program (BDP) of the task force to end communist insurgency is pork barrel, Gabriela Party-list Rep. Arlene D. Brosas said in Filipino during Monday’s budget hearing covering the Department of the Interior and Local Government (DILG).

On Sunday, Ms. Brosas said in a statement that a P10-billion allocation labeled as Growth Equity Fund for local governments is another “variant” of the pork barrel, or public money used for projects intended to influence voters.

“We’re hesitant because there is no list of (barangays) that would be given P20 million each under the BDP. There’s no breakdown for the P28.1 billion. This is lump sum, this is pork barrel,” Ms. Brosas said.

She questioned the lack of specific projects placed under these funds after Interior Secretary Eduardo M. Año said that 1,406 barangays would benefit from the program.

“How can we make sure that the projects from the (National Task Force to End Local Communist Armed Conflict) are implementation-ready? The project of some lawmakers was blocked because they were not implementation-ready, but there is already an allotted (budget) in the case of the BDP,” she said.

The barangay development program would provide at least P20 million each to villages that would be deemed cleared of alleged communist influence by the police, military, and local government units.

In this year’s budget, P16.44 billion was allocated under the BDP program for 822 barangays which were identified as former communist strongholds.

These funds, 99% of which were already released as of July, were used for infrastructure projects such as farm-to-market roads and schools, electrification, and livelihood and medical assistance, among others, according to a DILG statement.

Kabataan Party-list Rep. Sarah Jane I. Elago, however, said a special audit should be conducted on the implementation of the BDP, citing “discrepancies” in how barangays are deemed cleared by the task force.

Ms. Brosas also said BDP funds could be easily misused since the task force has discretionary power over which areas would become beneficiaries.

Mr. Año said they would provide lawmakers a list of the 1,406 beneficiary barangays for next year before plenary deliberations begin for the proposed 2022 national budget.

EQUITY FUND

Presidential Spokesman Herminio L. Roque, Jr., meanwhile, defended the insertion of a P10-billion assistance fund for local government units (LGUs) that Ms. Brosas said looks more like “Greater Election Fund.”

In a televised news briefing, Mr. Roque said Ms. Brosas’ claim is just an “imagination.”

Despite the start of implementation next year of a court ruling that increased the share of local governments from national taxes, Mr. Roque said an additional support fund is still needed because “not all LGUs are as wealthy as Makati City.”

“This is why there’s an equity fund, (which) will go to fourth, fifth and sixth class municipalities,” he said.

The Supreme Court ruling named after Batangas Governor Hermilando I. Mandanas clarified that the share from the Internal Revenue Allotment (IRA) of local governments does not exclude other national taxes. The World Bank in June said the IRA are programmed to increase by 55% in the 2022 budget.

Mr. Roque earlier defended the national government’s plan to continue subsidizing the development projects of villages that have cleared their territories of Maoist rebels.

The multibillion BDP of the government’s anti-communist task force is still needed for municipalities that don’t have enough funds for development projects even if they will get a higher IRA next year, he said. — Russell Louis C. Ku and Kyle Aristophere T. Atienza

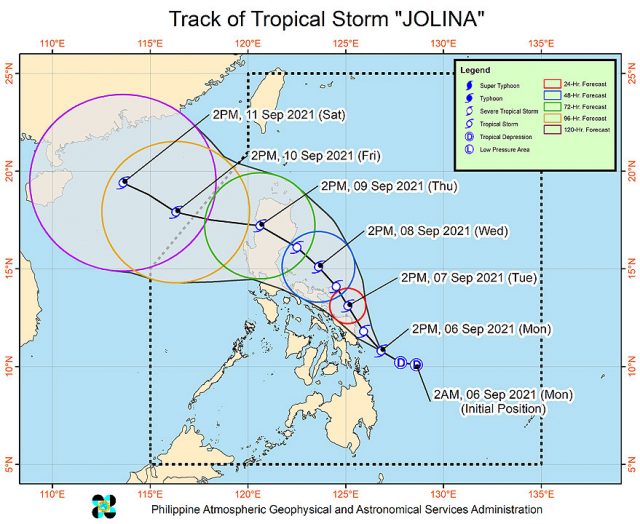

Tropical storm Jolina brings heavy rains as it heads over Luzon

TROPICAL STORM Jolina, the 10th typhoon to enter the country this year, brought strong winds and heavy rains over the central-eastern part of the country on Monday as it headed over mainland Luzon.

State weather agency Philippine Atmospheric, Geophysical and Astronomical Services Administration (PAGASA), in its 5 p.m. bulletin on Monday, said Jolina was located 95 kilometers (km) east of Guiuan, Eastern Samar and moving northwestward with maximum sustained winds of 75 km per hour and gustiness of up to 90 km/h. Its tropical cyclone winds extend outwards up to 150 km from the center.

Storm signal #2 in a 5-level system was up in several parts of the Samar provinces. A lower signal #1 was up in southeastern portions of Luzon, parts of the Eastern Visayas Region, and the islands of Dinagat, Siargao, and Bucas Grande in Mindanao.

“In the next 24 hours, Tropical Storm Jolina may bring moderate to rough seas (1.2 to 2.8 meters) over the eastern seaboards of Visayas and Mindanao. Mariners of small seacrafts are advised to take precautionary measures when venturing out to sea. Inexperienced mariners should avoid navigating in these conditions,” PAGASA warned.

The tropical storm is forecasted to make landfall over the northern-central Luzon area by Thursday morning. However, PAGASA said a shift towards a more westward direction may move the landfall near Eastern or Northern Samar. — MSJ