By Aubrey Rose A. Inosante and Justine Irish D. Tabile, Reporters

US PRESIDENT Donald J. Trump’s proposal to impose up to 300% tariffs on semiconductor chip imports to the US would kill global trade, according to Philippine Economy Secretary Arsenio M. Balisacan.

“It’s practically saying no trade. It’s prohibitive,” Mr. Balisacan told BusinessWorld on the sidelines of the House of Representatives Committee on Appropriations hearing late on Monday.

Mr. Trump had earlier floated a 100% tariff on imports of semiconductors, but companies that plan to build manufacturing facilities in the US would be exempted.

However, he has now suggested raising the tariffs on chips to as much as 300%, with the announcement expected to come later this month.

“I’m going to have a rate that is going to be 200%, 300%?” Mr. Trump was quoted as saying in a Bloomberg story last week.

Analysts warned that Mr. Trump’s latest proposal may put the local industry in peril.

“If a 100% tariff is already considered prohibitive — effectively eliminating imports — then any figure beyond that becomes superfluous,” Associate Professor of the University of Asia and the Pacific George N. Manzano said in a Viber message.

“That said, I believe the US still needs to import semiconductors, so this 300% tariff may be more rhetorical than real,” Mr. Manzano added.

Foundation for Economic Freedom President Calixto V. Chikiamco said the possibility of losing the US market would be a “devastating blow” to the industry and the economy.

“A 300% tariff on semiconductors would be devastating to the semiconductor industry and could result in the loss of high-paying jobs,” Mr. Chikiamco said in a Viber message.

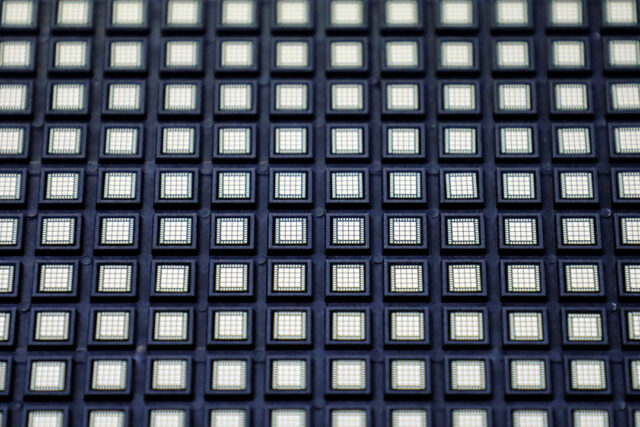

Semiconductors and electronics are the Philippines’ top exports to the US. The Philippines exported $12.14 billion to the US in 2024, of which electronic products accounted for $6.43 billion or 53% of the total.

“With such a huge impact on the costs, of course, the demand is going to be affected,” Philippine Institute for Development Studies Emeritus Research Fellow and Former Trade Undersecretary Rafaelita M. Aldaba said, referring to the potential impact of the semiconductor tariff.

Since the Philippines does assembly, testing, and packaging (ATP), she noted the decline in exports will also be reflected in imports.

“We import a lot of the components. These are really high-tech products. And so, on balance, I would say, there’s going to be a reduction on both sides of the equation, the import side as well as the export side,” she said.

“This is given that the stage or the type of manufacturing that we do here in the country is really more of ATP, which really requires a lot of imported high-tech semiconductor components,” she added.

To address this, she said that it is important for the Philippines to diversify its trading partners and find new markets for the products that the country will not be able to sell to the US.

“Of course, we need to find new markets, and hence the emphasis as well on supply-chain resilience. We need to be able to shift and pivot to other markets where to send all these new products that we’re currently manufacturing,” Ms. Aldaba said.

Ms. Aldaba said the implementation of the Regional Comprehensive Economic Partnership is also important for the Philippines, as it would open up markets in 14 countries and help divert trade from the US to other countries.

WIDER TRADE GAP

Meanwhile, the Philippines’ trade gap will likely widen due to the US’ imposition of a 19% tariff on Philippine goods, as well as a possible increase on tariffs on semiconductors.

“We think that the 19% imposed for the Philippines will most likely affect some of the exports in the Philippines,” said Peter Louise D. Garnace, equity research analyst at Unicapital Securities, Inc.

In particular, he said that the 19% tariff for Philippine goods entering the US market which took effect on Aug. 7, is expected to affect sectors such as coconut, seafood, and garments.

“We think that if the tariffs kick in, the trade balance would definitely contract given that exports will slow down, which will lead to the widening of the trade deficit of the Philippines,” he added.

He said that the widening trade gap is underpinned by the slow growth in terms of exports and even slower growth of imports.

“There’s going to be a contraction in terms of the overall trade balance of the Philippines. So, from what we’ve also gathered, it’s going to be around a high single-digit decline in terms of both the export growth as well as the import growth,” he added.

For the first semester of 2025, the country’s trade-in-goods deficit narrowed to $23.97 billion from the $25.06-billion deficit a year ago. Exports increased by 13.2% to $41.24 billion, while imports rose by 6% to $65.22 billion.

The country’s balance of trade in goods has been in the red for over a decade or since the $64.95-million surplus in May 2015.

“We believe that uncertainty is here to stay all throughout President Trump’s term,” Mr. Garnace said.

However, he said that the export industry in the Philippines constitutes only a minimal or small amount of the gross domestic product (GDP).

For this year, Unicapital downgraded its GDP growth forecast to 5.5% from 6.3% previously.

“We factored here our assumptions of global trade uncertainties, as well as domestic headwinds in the Philippines,” he said.

“But despite this, we still continue to see the Philippines to be among the fastest-growing economies in Southeast Asia, next only to Vietnam,” he added.