The Provincial Government of South Cotabato has a delicate balancing act to do. Nearly 10 years ago, it banned open pit mining in its territory. Xstrata, an Anglo-Swiss multinational mining company, was ready to invest about $5-5.9 billion to construct the copper mines in Tampakan, South Cotabato and operate it. The firm was locally registered as Sagittarius Mines, Inc. (SMI). Unfortunately, it was unable to operate. It continued to work for the lifting of the ban, unsuccessfully.

The late former President Benigno “Pnoy” Aquino imposed a moratorium to new mining projects while Congress was deliberating on mining tax reforms.

The mining industry’s challenges turned worse when the current government of President Rodrigo Duterte echoed the same concern of its predecessor on revenue sharing. The late Environmental Secretary Gina Lopez, who was fiercely anti-mining, then imposed a nation-wide ban on open pit mining and added to the list of concerns against large scale mining, namely the alleged huge mining footprint and alienation of host communities. Then the COVID-19 pandemic hit the world and triggered a relatively prolonged slump of the global economy.

While all these setbacks unfolded, Xstrata merged with Glencore, another multi-national in 2013. The Filipino partners of Glencore purchased their partners’ share in the company in 2015.

THE TAMPAKAN COPPER PROJECT

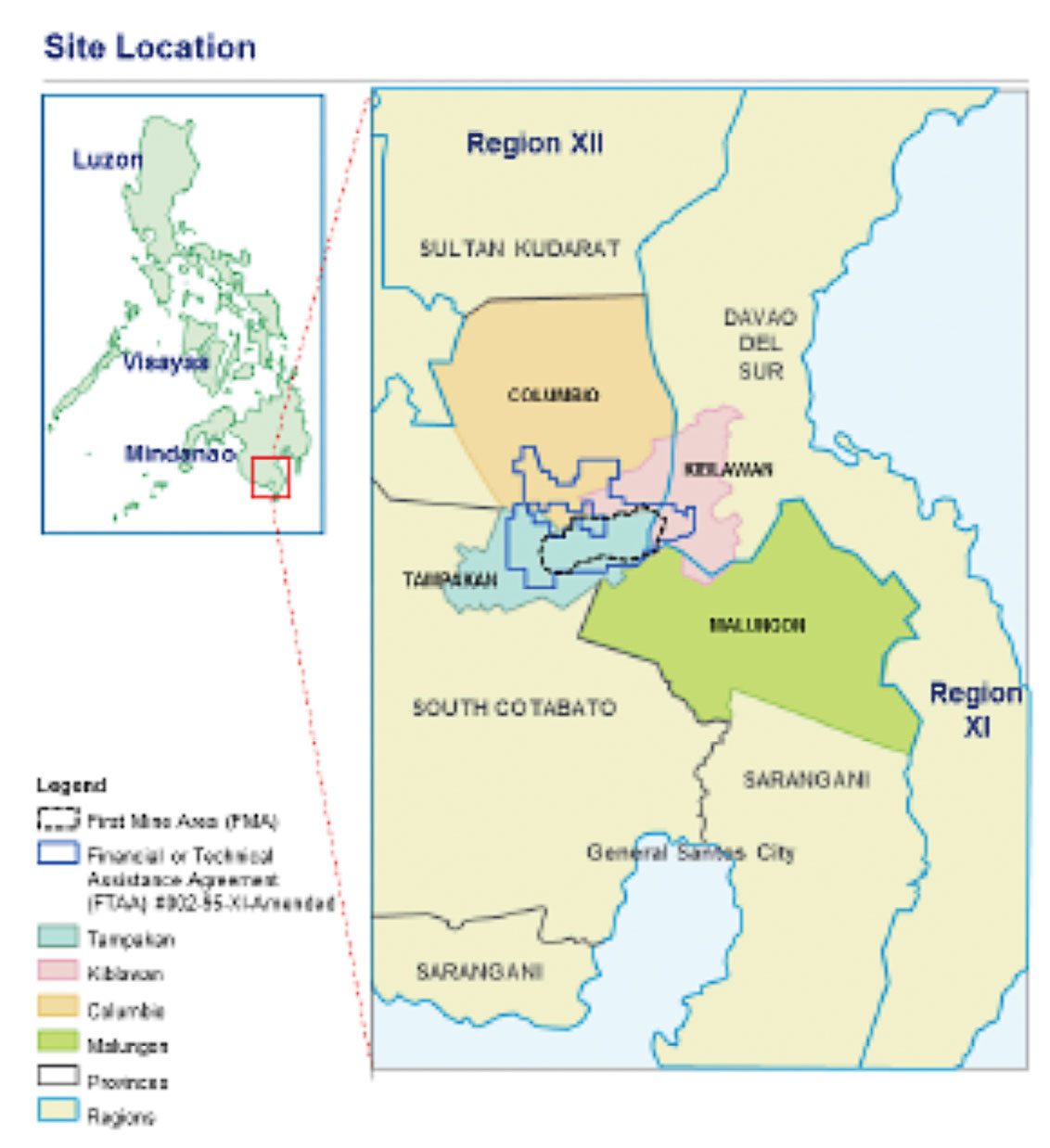

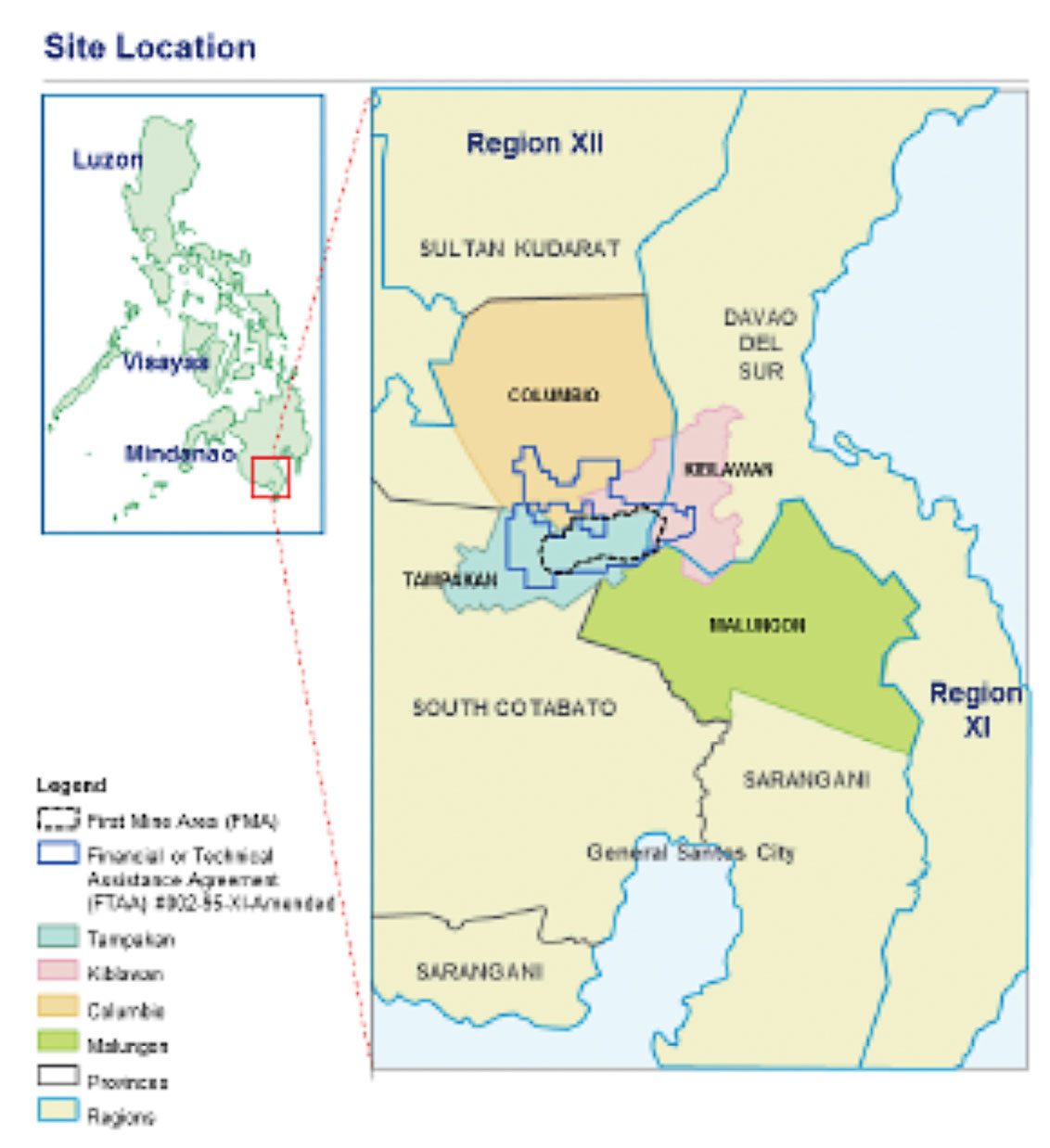

Once operational, the Tampakan copper project in South Cotabato would put the Philippines on the global map. The site is one of the largest undeveloped copper deposits in the world. The site offers 15 million tons of copper and 17.9 million ounces of gold at a 0.2% copper cut-off grade.

SMI reported that since 1995, when the company secured a financial and technical assistance agreement (FTAA) with the Philippine government to develop the copper mine, and eventually to construct and operate it, nearly P30 billion had already been invested. From these investments, the national and local governments earned P2.7 billion in taxes and fees, while the host communities obtained P1.2 billion of benefits in the form of schools constructed or assisted, college scholarships, health access, infrastructure, and forest programs.

Under new ownership since 2015, SMI decided to construct and operate the Tampakan copper project in three phases. Under the first phase, SMI would start at a reduced production rate; in 10 years, it would calibrate its operation to attain its production objective with a reduced mining footprint and expanded benefits to host communities. The company is committed to let stakeholders assess the company’s performance against its stated production, environmental protection plans, and social development goals.

BENEFITS FROM THE COPPER MINE

The national and local governments would receive billions of pesos from its commercial operation under Phase 1 or the first 10 years of its operation. Indigenous peoples and the host communities also expect to receive billions of pesos in royalty payments and social development and management programs.

Mining investments like this one have tremendous development impact on the regional economy. The opportunity could not have come at a better time than now, when the country is just recovering from the recession due to COVID-19. People are looking for jobs and income opportunities. Small and medium enterprises need to be back in business.

SMI would directly employ 1,000 workers during construction and 500 during operations. To get this mine operating, SMI would need supplies and would have to engage local businesses, contractors, and service providers. The core investment of SMI to construct and operate the Tampakan copper project would have significant ripple effects of stimulating the provincial economy and those of its neighboring provinces and cities.

The project would have beneficial effects as well for the national economy, aside from the tax revenues going to the national government. Over the life of the project, SMI is projecting net exports from copper worth billions of US dollars. With the country being a net exporter of copper, it is in a position of stimulating downstream industries dependent on copper. Those in turn will generate new jobs and incomes.

BAN ON OPEN PIT MINING

The holdouts to getting this copper project constructed and operating are the Department of Environment and Natural Resources (DENR) and the Provincial Government. The late former Environmental Secretary Gina Lopez imposed a nationwide ban on open-pit mining. This not only prevents the operation of the Tampakan copper projects but also those of two other large-scale mines. Both located in Mindanao, these are the Silangan Project of Philex and the King-king Project of NADECOR.

There appears to be hope that the DENR will lift the nationwide ban on open pit mining, according to a report by Catherine Talavera, which appeared in the Philippine Star yesterday.

As for the provincial ban on open pit mining in South Cotabato, this continues to be a challenge to SMI. Based on the pattern of copper deposits in the area, the company has to operate the project as a surface mine. However, it cannot proceed without the Sangguniang Panlalawigan of South Cotabato lifting the ban. Opponents of mining in the province say that South Cotabato will be left with an abandoned mine, one with a gaping hole.

ABANDONED MINES

While there appears to be a basis for this concern, the matter of abandoned and inactive mines reflects the problem of either a lack of rules and regulations and weak enforcement of rules as the following show. Let us look into a few of the abandoned and inactive mines.

According to the Mines and Geosciences Bureau (MGB) of the DENR, in its report to the National Economic and Development Authority’s Philippine Council for Sustainable Development several years ago, there are five abandoned mines and 18 inactive mines in the country.

Abandoned mines are those without any legal owner and where the rehabilitation and closure are either not done or incomplete. Inactive mines are temporarily not operating for a variety of reasons including waiting for the approval of their respective applications to explore or operate, or being temporarily suspended due to the lack of integrity of the overall mine.

The Bagacay mine in Western Samar was abandoned in 1992. Its previous owner apparently encountered high recovery cost of pyrite concentrates, and had a dispute with the local union. The MGB is presently rehabilitating the area using Philippine government funds and official development assistance.

The abandonment occurred before the 1995 Mining Act. It was only in 1995 that the rules and obligations of mining companies with respect to protecting the environment were set.

This point applies as well to the Privatization Management Office (PMO), which took over the mine in consideration of the unpaid loan that its previous owner incurred. The PMO is unfamiliar, in the first place, with mining operations, including as owner its obligation under the law to rehabilitate the mine. Many of the abandoned mines got sequestered like the Bagacay mine, and were abandoned for a long period of time.

Another case of abandonment before the rules were set in 1995 is the Palawan Quicksilver Mines, Inc. The mine started operating in 1955 and its owner abandoned it in 1976.

The third case is different. The mine suspended operations because of a tailings spill and problems with the integrity of the mine’s structure. The Marcopper incident happened in 1996 in Marinduque, but again before the rules and regulations of the 1995 Mining Act were issued. The suspension of operations followed the tailing spill incident in 1996.

All three cases illustrate the importance of rules and regulations that would need to be crafted and issued in order to elicit proper behavior by mining companies towards conserving the environment.

The fourth case is entirely different as it occurred after the 1995 Mining Act. The abandonment occurred in 2010 and therefore this is a case of lack or weak enforcement of regulations. Black Mountain, Inc. abandoned its operation in 2010 due to bankruptcy.

The MGB is slow in carrying out its mandate to rehabilitate abandoned/inactive mines. Under the 1995 Mining Act, funds are set aside by the company and deposited with the MGB, earmarked for the rehabilitation/closure of mines. For example, the Bagacay mine was abandoned in 1992 and it was only several years later that the MGB rehabilitated the mining site.

CONSIDER OUTSOURCING THE REHABILITATION OF MINES

The government may consider outsourcing the rehabilitation of a mine to the private sector. The MGB calls for proposals to rehabilitate the mine and selects the best. The best may even propose to convert the mine into another asset that can be operated by the private company, such as housing, parks, farming, fishing, and other assets suitable to the area of the mine to be closed.

Presently, the mining company comes up with its proposal to close the mine, or the final mine decommissioning plan, before it is even allowed to operate. But the more detailed decommissioning and rehabilitation plan is finalized five years before closure, and the MGB approves it. The MGB may improve on this plan by procuring private sector services for this purpose.

The benefit of outsourcing the rehabilitation of the mine is that better ideas of transforming the previous mine to other assets can come out. The present protocol is such that the company initiates the planning for the rehabilitation. Expectedly, it has very little interest in coming up with better ideas of rehabilitation. Definitely, the host LGU should partner with the MGB in selecting the best proposal.

Ramon L. Clarete is a professor at the University of the Philippines School of Economics.