YIELDS on government securities (GS) edged lower last week due to cautiousness before the US Federal Reserve’s policy decision and with the market awaiting key events at home, including the Bangko Sentral ng Pilipinas’ (BSP) own review and the release of March inflation data.

GS yields, which move opposite to prices, went down by an average of 2.09 basis points (bps) at the secondary market last week, based on data from PHP Bloomberg Valuation Service Reference Rates published on the Philippine Dealing System’s website as of March 21.

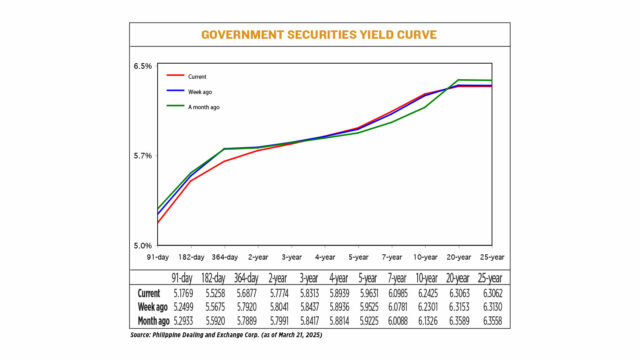

At the short end of the curve, yields on 91-, 182-, and 364-day Treasury bills dropped by 7.30 bps, 4.17 bps, and 10.43 bps week on week to 5.1769%, 5.5258%, and 5.6877%, respectively.

Meanwhile, yields at the belly were mixed. Rates of the two- and three-year Treasury bonds (T-bonds) went down by 2.67 bps (to 5.7774%) and 1.24 bps (5.8313%), while the four-, five-, and seven-year T-bonds climbed by 0.03 bp (to 5.8939%), 1.06 bps (5.9631%), and 2.04 bps (6.0985%), respectively.

At the long end, the yield on the 10-year bond went up by 1.24 bps (to 6.2425%), while the 20- and 25-year tenors inched down by 0.9 bp and 0.68 bp to 6.3063% and 6.3062%, respectively.

GS volume traded amounted to P27.98 billion on Friday, rising from the P22.72 billion recorded on March 14.

Analysts said the GS market was range-bound before the Fed’s policy meeting, with the US central bank’s decision and cautious stance already mostly priced in.

The Trump administration’s initial policies, including extensive import tariffs, appear to have tilted the US economy toward slower growth and at least temporarily higher inflation, Fed Chair Jerome H. Powell said on Wednesday, Reuters reported. In explaining why rates were being kept unchanged, Mr. Powell described the uncertainty faced by Fed policy makers as “unusually elevated.

With overall sentiment sliding due to policy “turmoil,” prices are projected to rise faster than previously expected at least in part, and perhaps largely, because of US President Donald J. Trump’s plans to impose duties on imports from US trading partners, Mr. Powell said after the Fed announced it had held its benchmark overnight rate steady in the 4.25%-4.5% range.

While Fed policy makers still expect the central bank to deliver two quarter-percentage-point rate cuts by the end of this year, matching their projection in December, that is largely due to weakened economic growth offsetting higher inflation, and what Mr. Powell called the “inertia” of not knowing what else to do given the muddled outlook.

“Local markets remain in a wait-and-see mood, looking for further catalysts ahead of the BSP meeting on April 10. The local inflation print which will be released ahead of the BSP meeting could play a pivotal role in the BSP’s decision,” Dino Angelo C. Aquino, vice-president and head of fixed income at Security Bank Corp., said in an e-mail.

“Outside of the Fed, local players remain focused on President Donald J. Trump’s trade war with various countries, which adds uncertainty to local markets,” Mr. Aquino said.

BSP Governor Eli M. Remolona, Jr. told Bloomberg News last week that the Monetary Board could resume its easing cycle at their April 10 meeting following the surprise pause at their February review, especially if March inflation turns out better than expected.

March inflation data will be released on April 4.

Inflation sharply eased to 2.1% in February, bringing the two-month average to 2.5%. This is well within the central bank’s 2-4% target.

Mr. Remolona added that the BSP could deliver 50 bps in cuts this year, with 75 bps in reductions likely if economic growth weakens further.

Philippine gross domestic product grew by 5.6% in 2024, falling short of the government’s revised 6-6.5% full-year target.

The BSP has brought down benchmark borrowing costs by a cumulative 75 bps since it began its easing cycle in August last year.

A bond trader said in a Viber message that Mr. Remolona’s dovish comments and the favorable outlook for domestic inflation helped drive GS yield movements last week.

“The belly is relatively steady because of favorable news recently, like the drop in US Treasury yields and the BSP’s views on rates,” the trader said.

For this week, the market will wait for the release of the Bureau of the Treasury’s (BTr) second-quarter borrowing plan for leads, the bond trader said.

“If the concentration is on the long end so that the BTr can extend its maturity profile, then we will just see a steepening of the curve. However, it will be interesting if the BTr will opt to include shorter tenors at bigger volumes to ensure that there is strong demand,” the trader said, adding that about P170 billion worth of government issuances are due to mature in the coming weeks, which could also affect GS rates.

Meanwhile, Mr. Aquino said that the market may track US yield movements this week due to the lack of fresh leads.

“The expected liquidity to be injected in the market on March 28 could also be a catalyst to move local bond yields lower,” he said, referring to the effectivity of the BSP’s reserve requirement ratio cuts, which are estimated to free up about P320 billion in cash. — Pierce Oel A. Montalvo with Reuters