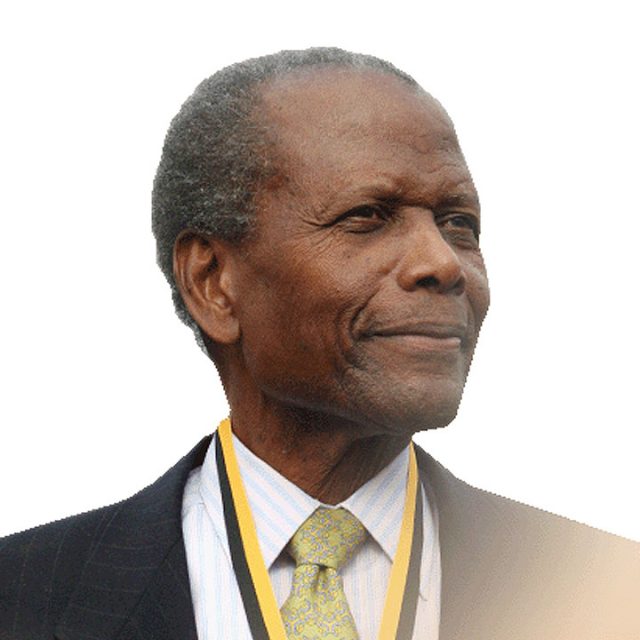

Sidney Poitier, first Black actor to win best actor Academy Award, 94

SIDNEY Poitier, who broke through racial barriers as the first Black winner of the best actor Oscar for his role in Lilies of the Field, and inspired a generation during the civil rights movement, has died at age 94, Bahamas Prime Minister Philip Davis said on Friday.

“It is with great sadness that I learned this morning of the passing of Sir Sidney Poitier,” Mr. Davis said in a speech broadcast on Facebook. “But even as we mourn, we celebrate the life of a great Bahamian: a cultural icon, an actor and film director, an entrepreneur, civil and human rights activist and, latterly, a diplomat.”

Mr. Poitier created a distinguished film legacy in a single year with three 1967 films at a time when segregation prevailed in much of the United States.

In Guess Who’s Coming to Dinner he played a Black man with a white fiancée and In the Heat of the Night he was Virgil Tibbs, a Black police officer confronting racism during a murder investigation. He also played a teacher in a tough London school that year in To Sir, With Love.

Mr. Poitier had won his history-making best actor Oscar for Lilies of the Field in 1963, playing a handyman who helps German nuns build a chapel in the desert. Five years before that Mr. Poitier had been the first Black man nominated for a lead actor Oscar for his role in The Defiant Ones.

His Tibbs character from In the Heat of the Night was immortalized in two sequels — They Call Me Mister Tibbs! in 1970 and The Organization in 1971 — and became the basis of the television series In the Heat of the Night starring Howard Rollins and Carroll O’Connor.

His other classic films of that era included A Patch of Blue in 1965 in which his character was befriended by a blind white girl, The Blackboard Jungle and A Raisin in the Sun, which Mr. Poitier also performed on Broadway.

“If you wanted the sky I would write across the sky in letters that would soar a thousand feet high.. To Sir… with Love Sir Sidney Poitier R.I.P. He showed us how to reach for the stars,” Whoopi Goldberg, Oscar winning actress and TV host, wrote on Twitter.

“The dignity, normalcy, strength, excellence and sheer electricity you brought to your roles showed us that we, as Black folks, mattered!!!,” Oscar winner Viola Davis tweeted.

Mr. Poitier was born in Miami on Feb. 20, 1927, and raised on a tomato farm in the Bahamas, and had just one year of formal schooling. He struggled against poverty, illiteracy, and prejudice to become one of the first Black actors to be known and accepted in major roles by mainstream audiences.

Mr. Poitier picked his roles with care, burying the old Hollywood idea that Black actors could appear only in demeaning contexts as shoeshine boys, train conductors, and maids.

“I love you, I respect you, I imitate you,” Denzel Washington, another Oscar winner, once told Mr. Poitier at a public ceremony.

As a director, Mr. Poitier worked with his friend Harry Belafonte and Bill Cosby in Uptown Saturday Night in 1974 and Richard Pryor and Gene Wilder in 1980’s Stir Crazy.

Mr. Poitier was knighted by Britain’s Queen Elizabeth II in 1974 and served as the Bahamian ambassador to Japan and to UNESCO, the UN cultural agency. He also sat on Walt Disney Co.’s board of directors from 1994 to 2003.

STARTED ON STAGE

Mr. Poitier grew up in the small Bahamian village of Cat Island and in Nassau before he moved to New York at 16, lying about his age to sign up for a short stint in the Army and then working at odd jobs, including dishwasher, while taking acting lessons.

The young actor got his first break when he met the casting director of the American Negro Theater. He was an understudy in Days of Our Youth and took over when the star, Mr. Belafonte, who also would become a pioneering Black actor, fell ill.

Mr. Poitier went on to success on Broadway in Anna Lucasta in 1948 and, two years later, got his first movie role in No Way Out with Richard Widmark.

In all, he acted in more than 50 films and directed nine, starting in 1972 with Buck and the Preacher in which he co-starred with Mr. Belafonte.

In 1992, Mr. Poitier was given the Life Achievement Award by the American Film Institute, the most prestigious honor after the Oscar, joining recipients such as Bette Davis, Alfred Hitchcock, Fred Astaire, James Cagney and Orson Welles.

“I must also pay thanks to an elderly Jewish waiter who took time to help a young Black dishwasher learn to read,” Mr. Poitier told the audience. “I cannot tell you his name. I never knew it. But I read pretty good now.”

In 2002, an honorary Oscar recognized “his remarkable accomplishments as an artist and as a human being.”

Mr. Poitier married actress Joanna Shimkus, his second wife, in the mid-1970s. He had six daughters with his two wives and wrote three autobiographical books — This Life (1980), The Measure of a Man: A Spiritual Autobiography (2000), and Life Beyond Measure: Letters to My Great-Granddaughter (2008).

“If you apply reason and logic to this career of mine, you’re not going to get very far,” he told the Washington Post. “The journey has been incredible from its beginning. So much of life, it seems to me, is determined by pure randomness.”

In 2013 he published Montaro Caine, a novel that was described as part mystery, part science fiction.

In 2009, Mr. Poitier was awarded the highest US civilian honor, the Presidential Medal of Freedom, by President Barack Obama.

The 2014 Academy Awards ceremony marked the 50th anniversary of Mr. Poitier’s historic Oscar and he was there to present the award for best director. — Reuters