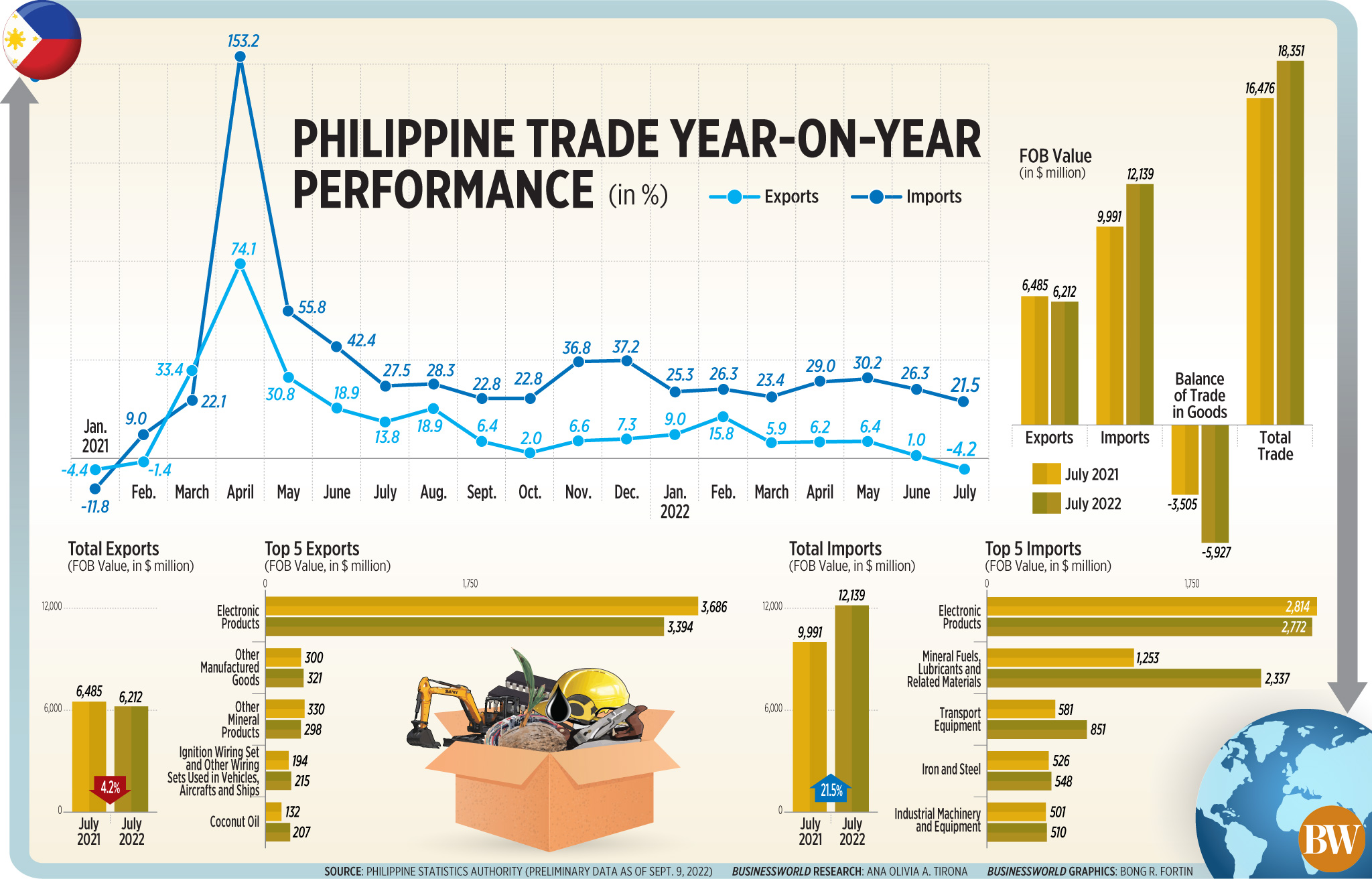

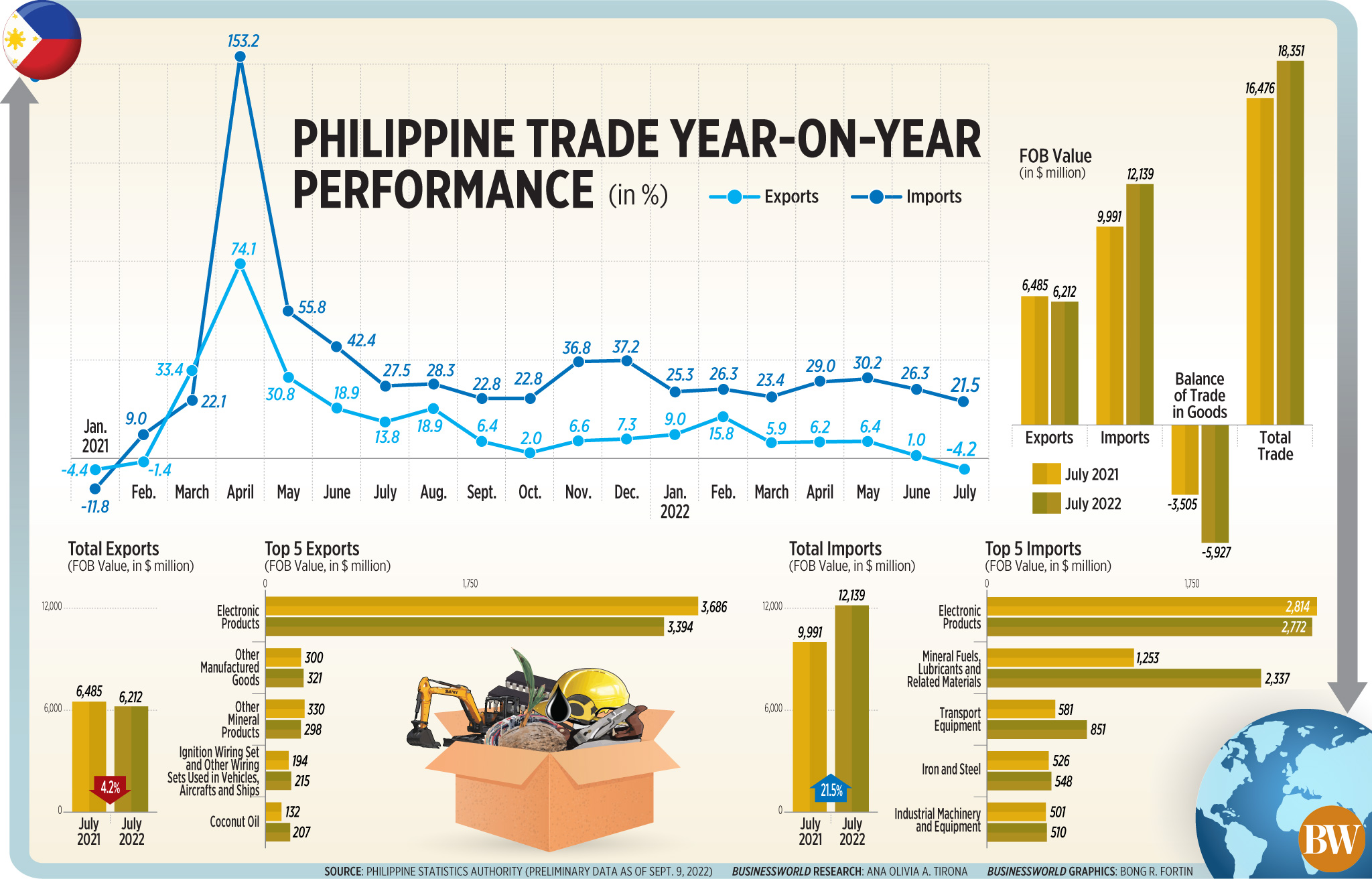

The demand for locally made products contracted for the first time in over a year in July while imports eased, bringing the trade deficit widening to another record, the Philippine Statistics Authority (PSA) reported on Friday.

Preliminary data from the agency showed the value of outbound shipment of goods amounted to $6.212 billion in July, declining by 4.2% annually from $6.485 billion in the same month last year. It was also lower than the revised $6.644 billion recorded in June.

July’s contraction ended 16 straight months of export growth. It was the sharpest fall in 18 months, or since the 4.4% decline in January 2021.

Meanwhile, imports continued to grow by at least double digits for the 17th consecutive month in July after increasing by 21.5% annually to $12.139 billion from $9.991 billion in the same month last year. However, the pace eased from 26.3% year-on-year expansion in June.

It was the slowest import growth in 17 months, or since the 9% increase in February last year.

This brought the trade-in-goods balance — the difference between exports and imports — to a record $5.927-billion deficit in July.

It was wider than the $5.869-billion gap recorded the previous month and the revised $3.505-billion deficit in July 2021.

The total trade — the sum of exports and imports — increased 11.4% to $18.351 billion in July. The growth was slower than the revised 16.2% in the preceding month and the 21.8% of the same month last year.

Year to date, exports rose by 5.4% to $44.739 billion, below the 7% growth target set by the Development Budget Coordination Committee.

Imports also increased by 25.9% to $80.486 billion in the January to July period. This was already above the government’s 18% full-year target this year.

ING Bank N.V. Manila Senior Economist Nicholas Antonio T. Mapa attributed the decline in locally made products in July to the weaker demand in electronics, a major export merchandise of the country.

“Exports were weighed by the electronics subsector. In turn, electronics exports were down because of softening demand for electronics on a global scale, something noted by trading partners like Taiwan and China,” Mr. Mapa said in an e-mail interview.

“Global growth is slowing and so is China as a market for electronics, which is capping demand for electronics and its components. Unfortunately, the Philippine export market is almost 40% electronics components and thus we can expect exports to struggle in the coming months,” he added.

“The extremely wide trade deficit suggests that the current account will also stay in the red, which should add to pressure on the PHP to weaken in the coming months,” Mr. Mapa said.

In a phone interview, Philippine Exporters Confederation, Inc. President Sergio R. Ortiz-Luis, Jr. said that while there was a decrease in the exports due to the difficulties in logistics, he believed that this is not a significant decline and will not be a trend in the export industry for the coming months.

“The export will grow. In percentage it will suffer. Not at the level we expected but it will grow,” he added.

Semiconductor and Electronics Industries in the Philippines Foundation, Inc. President Danilo C. Lachica said that they are still aiming for its planned growth for the year amid the decrease in electronics products in export.

“We don’t respond to the month-to-month variations, what is important is the year to date. For January to July, we had $26.5 billion, that is 2% growth which is still our planned 10% growth for the year,” Mr. Lachica said in a phone interview.

He also said that the depreciation of peso is more favorable for exports.

“For every peso forex decrease, exports grow by 1-1.5%,” Mr. Lachica said.

The local unit finished against the dollar at all-time low for the fifth straight session on Thursday after closing at P57.18 versus the greenback.

Manufactured goods, which accounted for 80% of the total exports in July, dipped by 4.6% year on year to $4.977 billion.

Electronic products, which cornered 54.6% of total sales in July and accounted for 68.2% of manufactured goods, also fell by 7.9% to $3.394 billion.

Composing three-fourths of the electronic products and 41.3% of total exports, semiconductors slipped by 2% to $2.567 billion in July.

Meanwhile, importation of raw materials and intermediate goods, which accounted for 38.5% of total imports in July, went up by 12.7% year on year to $4.670 billion.

Capital goods, which comprised 25.8% of the total imports that month, also rose by 6.6% to $3.128 billion.

Importation of mineral fuels, lubricant, and related materials, which cornered nearly a fifth of total imports, surged by 86.5% to $2.337 billion.

Consumer goods also climbed 26.3% to $1.943 billion in July.

The United States, which accounted for 17% or $1.056 billion of the total receipts, remained as the top export destination in July. It was followed by Japan’s $903.617 million (14.5% share) and China’s $798.665 million (12.9%).

China, meanwhile, was the country’s main source of imports in July with 20% share or $2.427 billion of the total import, followed by South Korea’s $1.281 billion (10.6% share), and Indonesia’s $1.224 billion (10.1%).

Mr. Mapa expects the export industry to dwindle “largely due to the outlook on global demand for electronics,” while imports are expected to grow because of the higher prices of basic commodities and the impact brought by the reopening of the economy.

He also said that the country’s trade deficit is expected to “stay at close to record wide levels.” — Mariedel Irish U. Catilogo

This optimum charging power boosts its huge 5000 mAh battery ensuring uninterrupted work and play all throughout the day. The vivo Y35’s battery allows for 14 hours of video streaming or about 7 hours of uninterrupted gameplay. Worried about running out of battery? Get back in the game quickly as it will only take 30-34 minutes for the vivo Y35 to achieve 70% of its power back.

This optimum charging power boosts its huge 5000 mAh battery ensuring uninterrupted work and play all throughout the day. The vivo Y35’s battery allows for 14 hours of video streaming or about 7 hours of uninterrupted gameplay. Worried about running out of battery? Get back in the game quickly as it will only take 30-34 minutes for the vivo Y35 to achieve 70% of its power back. Apart from its 44W Fast Charge feature, which is a first in the vivo Y series, the vivo Y35 also boasts a bigger storage as it officially allows 8GB+8GB Extended RAM. The extended RAM 3.0 is vivo’s cutting-edge technology to better utilize the smartphone’s storage and optimize the system operation by eliminating lags even with multiple apps running in the background. Ensuring smoother operation and bigger storage for its users, the vivo Y35 offers 256GB Internal ROM and supports up to 1TB of extension giving its users the freedom to capture more of life’s important moments and download files essential for work or leisure.

Apart from its 44W Fast Charge feature, which is a first in the vivo Y series, the vivo Y35 also boasts a bigger storage as it officially allows 8GB+8GB Extended RAM. The extended RAM 3.0 is vivo’s cutting-edge technology to better utilize the smartphone’s storage and optimize the system operation by eliminating lags even with multiple apps running in the background. Ensuring smoother operation and bigger storage for its users, the vivo Y35 offers 256GB Internal ROM and supports up to 1TB of extension giving its users the freedom to capture more of life’s important moments and download files essential for work or leisure. Taking it all to the next level, the vivo Y35 is equipped with smarter camera features. Users can capture photos like a pro with its Triple AI Rear camera. vivo Y35’s 50MP main camera utilizes a large sensor to ensure high-definition photos every time. For dramatic effect, its 2MP Bokeh Camera delivers accurate and sophisticated results to achieve more realistic looking portraits. Users can also have fun discovering the tiny and interesting world with the naked eye through the lenses of vivo Y35’s 2MP Macro Camera.

Taking it all to the next level, the vivo Y35 is equipped with smarter camera features. Users can capture photos like a pro with its Triple AI Rear camera. vivo Y35’s 50MP main camera utilizes a large sensor to ensure high-definition photos every time. For dramatic effect, its 2MP Bokeh Camera delivers accurate and sophisticated results to achieve more realistic looking portraits. Users can also have fun discovering the tiny and interesting world with the naked eye through the lenses of vivo Y35’s 2MP Macro Camera.