CCP lights up main building, theater for Women’s Month

THE Main Building and the Tanghalang Ignacio Gimenez of the Cultural Center of the Philippines (CCP) are bathed in vibrant purple this March to commemorate National Women’s Month. Purple symbolizes justice, dignity, and unwavering commitment to the advancement of women’s rights. Through this light display, the CCP aims to honor the contributions of Filipino women across various fields.

Tanghalang Pilipino stages Kisapmata

THIS MARCH, Tanghalang Pilipino (TP) is bringing back the stage adaptation of director Mike De Leon’s classic film Kisapmata, which was based on Nick Joaquin’s crime report, “The House on Zapote Street.” Directed by Guelan Luarca and featuring the TP Actors Company, Kisapmata is a psychological thriller that unravels the dark complexities of family, control, and power. It will run from March 7 to 30, with performances at 3 and 8 p.m., at the Tanghalang Ignacio Gimenez (CCP Blackbox Theater), Cultural Center of the Philippines Complex, Pasay City. Ticket prices are P1,500 and P2,000.

National Artists honored at UP’s Tanghal Tertulia

THE University of the Philippines (UP) System will be paying tribute to homegrown National Artists in this year’s Tanghal Tertulia, to be held on March 8, 5:30 p.m., at the UP Executive House Amphitheater, Diliman, Quezon City. The National Artists who will take the stage are Fides Cuyugan-Asensio, Ricky Lee, and Ryan Cayabyab. The night will feature performances from the honorees’ body of work as interpreted by UP artists and groups, including Lara Maigue, Nick Pichay, Aicelle Santos, Bianca Lopez-Aguila, Ervin Lumauag, Poppert A. Bernadas, the UP Jazz Ensemble, the UP Dance Company, and Iskollas. While all seats have been filled, the event will be livestreamed worldwide via TVUP’s YouTube and Facebook pages.

Galerie Stephanie brings Filipina artists to Art Fair Tokyo

GALERIE STEPHANIE is presenting a group of Filipina visual artists at Art Fair Tokyo 2025, marking its seventh appearance in Asia’s oldest and Japan’s largest art fair. The event will be held from March 7 to 9, at the Tokyo International Forum. The sole Filipino gallery at the event will be showing works by Kim Borja, Naburok, Jem Magbanua, and Thea Quiachon at Booth L015.

Coin, medals, and more at collectibles show

MINTED MNL, an organization dedicated to collecting rare Philippine coins and other historic items, is holding the Minted MNL Summer Show 2025 on March 8 to 9 at The Westin Manila Hotel in the Ortigas Center in Pasig City. Minted MNL is known for its auctions and exhibits. The Summer Show 2025 will showcase diverse collectibles, including coins, paper money, medals, tokens, trading cards, and antiques. There will be seminars about collecting, exhibits, and a marketplace and auction. Included in the auction are historical 19th-century items from Philippine Revolution heroes and rare coins of the 17th and 18th centuries. Visit the Minted MNL Facebook page for more information.

Nami Art Gallery’s Omi Reyes at Artistspace

AN EXHIBITION titled Sacred Fragments is on view right now at ArtistSpace. The 23rd solo show of artist Omi Reyes, it is presented by Nami Art Gallery. The exhibit serves both as a culmination and a transformation of Mr. Reyes’ artistic and spiritual journey spanning over 40 years. He employs various materials — wood, resin, metal, and paint on canvas — interwoven with found objects, to bear the weight of memory and time. The various broken pieces are reassembled for a renewed vision. Sacred Fragments is on view at ArtistSpace, Makati, until March 11.

Museum talk to shed light on the Filipina in periodicals

DR. KATHERINE LACSON will discuss how Filipinas appeared in periodicals in the early 1900s in a talk to be delivered at the Museo ng Muntinlupa on March 15, 9-10 a.m. Titled “Wicked and Wounded: Unveiling the Shadow Side of the Filipina in Periodicals (1898-1938),” the talk is presented by the Museum Foundation. Aside from the lecture, there will also be guided tours available around the museum. Admission is free and open to the public.

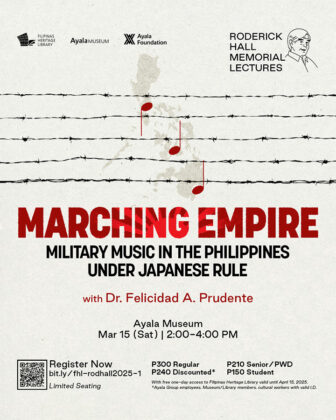

Lecture on Japanese military music during the occupation

MUSICOLOGIST Felicidad A. Prudente, PhD will be holding a talk on March 15 at the Ayala Museum. Part of the Roderick Hall Memorial Lecture series, it will explore the role of gunka, or military music, in shaping national identity and propaganda during the Japanese Occupation of the Philippines from 1942 to 1945. Dr. Prudente will discuss the music’s historical function, cultural impact, and usage in instilling loyalty and morale among soldiers and civilians alike. It will take place on March 15, 2-4 p.m., at the Ayala Museum in Makati City. Admission is priced at P300 for regular attendees, P210 for seniors and persons with disabilities, and P150 for students.

New Walden Bello memoir to be released

A NEW release from the Ateneo Press, Global Battlefields: My Close Encounters with Dictatorship, Capital, Empire, and Love follows the beginnings, the triumphs, the trials, and tribulations of renowned Filipino activist and academic, Walden Bello. In his own words, Mr. Bello recounts a life spent fighting injustice and oppression, and includes recollections of his childhood raised by two artist parents, his education under Jesuits, his leadership of anti-war student protests at Princeton University, his membership in the Communist Party of the Philippines, his time as a member of the House of Representatives for Akbayan, and many more reminiscences. In a press statement, Senator Risa Hontiveros is quoted as saying: “This memoir is both a compelling account of the achievements of Walden and his generation, and a candid discussion of their crises and failures. It is a must read for persons who have struggled and continue to struggle for a better future for all.” The book is now available for pre-order at a 15% discount at https://go.ateneo.net/GlobalBattlefieldsPO. Its official release will be at the Philippine Book Festival later this month.

PLDT, Smart provide cyber education through storybook

PLDT AND SMART, together with the Department of Justice Interagency Council Against Trafficking, is pushing its #BeCyberSmart campaign among children through storytelling. Its most recent event was The Storytelling Project founder Rey Bufi’s reading of Ang Paglalakbay ni Tala (The Adventures of Tala) to grade school students of St. Alphonsus Ligouri Integrated School and Victorious Homeschool. Co-developed with Kids for Kids PH and the Positive Youth Development Network, the book follows Tala as she enters the metaverse where she learns about her rights online and the various dangers on the internet.

Ordoñez, Facuri, Teodoro join Into the Woods cast

THEATRE GROUP ASIA (TGA) has announced the casting of actress Tex Ordoñez as Cinderella’s stepmother, theater and television actress Sarah Facuri as the stepsister Florinda, and theater, film, and television performer Kaki Teodoro as the stepsister Lucinda. The three join a lineup of theater stars including Lea Salonga for TGA’s production of Stephen Sondheim’s Into the Woods, coming in August at the Samsung Performing Arts Theater in Circuit Makati. The show is directed by Chari Arespacochaga.

![[PILATO]-Official-poster-thumb](https://www.bworldonline.com/wp-content/uploads/2025/03/PILATO-Official-poster-thumb-640x426.jpg)