Filipina cybersecurity expert advocates for women’s awareness in combating technology abuse

Gogolook Philippines Country Head Mel Migriño recently emphasized the critical role of education in combating gender-based violence through technology abuse.

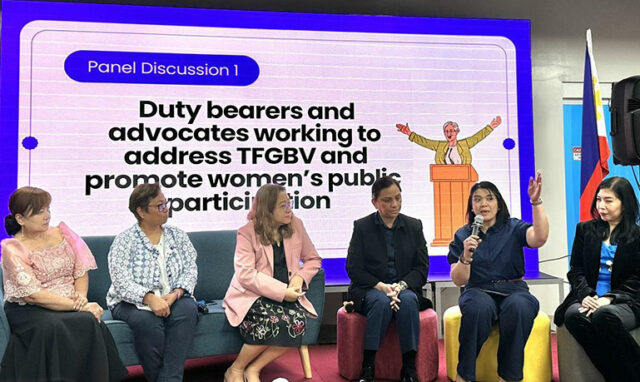

Speaking at a forum organized by UN Women, the Department of Information and Communications Technology (DICT), and the Australian Embassy, Ms. Migriño explained that awareness is essential for Filipinos as they navigate the online world, especially for those seeking public office.

“Educating Filipinos, especially female political candidates, about the risks associated with election campaigns — including election-related scams and deepfakes — is crucial,” Ms. Migriño said.

The event, titled “Disinformed, Disempowered, Disenfranchised: How Technology-Facilitated Gender-Based Violence Keeps Women from Politics — And What We Can Do About It,” tackled the barriers women face online and how technology-facilitated gender-based violence (TFGBV) challenges impact their participation in politics and leadership.

Ms. Migriño, who also serves as the chairperson and president of Women in Security Alliance Philippines (WiSAP) — a nonprofit organization dedicated to empowering women in the cyber ecosystem — discussed various cyber threats affecting women.

“If I may share, the most common and rampant cyber threats today include scams and deepfakes, cyber harassment, online sexual assault, character impersonation, revenge porn — where an ex-partner shares intimate photos without consent — and cyberbullying,” she said.

The Gogolook PH Country Head further pointed out that these cyber threats can be mitigated with proper protection measures.

She took the opportunity to educate attendees about the growing threat of online scams and shared practical tips on how women can safeguard themselves from cyber threats while navigating the digital landscape.

“Be able to identify red flags that may lead to character attacks or harassment. Avoid engaging with online strangers or unverified identities. Research the profile of the person you are communicating with,” she explained.

“Be cautious of suspicious web domains and URLs — use web link scanners like VirusTotal (VT) or the Whoscall mobile app to assess risks and take necessary action. Most importantly, exercise your right to privacy,” she added.

Gogolook, a global leader in TrustTech, is the developer of Whoscall, a globally used anti-scam application. It has gained popularity in the Philippines for helping Filipinos stay safe while navigating the online world, where scams are rampant.

Ms. Migriño highlighted key features of the Whoscall App — Web Checker, Caller ID, and ID Security — as essential tools in helping women protect themselves against online threats.

Held at the Cybercrime Investigation and Coordinating Center (CICC), an attached agency of the DICT in Taguig City, the event brought together notable female leaders, including Ermelita Valdeavilla of the Philippine Commission on Women; Foundation for Media Alternatives Executive Director Liza Garcia; DICT Undersecretary for ICT Industry Development Jocelle Batapa-Sigue; PNP Women and Children Protection Center Chief PBGen. Portia Manalad; and Project Director of the 2025 BSKE-PMO Commission on Elections, Michelle Frances.

More technological development

Answering a question from the moderator, Ms. Migriño emphasized that the role of tech companies, government agencies, and civil society in creating safer online spaces for women politicians is the continuous process of development.

“For tech companies, it’s about the continuous development of tools with algorithms that can detect and prevent harassment of women in digital spaces,” she said.

She further stressed the importance of government policies, saying, “Tech companies should align with policies set forth by the government as part of a comprehensive gender mainstreaming program. Additionally, they must ensure that the technology they develop is secure to prevent the infiltration of malicious code, which could compromise AI algorithms and distort analysis or inference.”

Spotlight is BusinessWorld’s sponsored section that allows advertisers to amplify their brand and connect with BusinessWorld’s audience by publishing their stories on the BusinessWorld Web site. For more information, send an email to online@bworldonline.com.

Join us on Viber at https://bit.ly/3hv6bLA to get more updates and subscribe to BusinessWorld’s titles and get exclusive content through www.bworld-x.com.

Guests had the opportunity to explore the vivo V50 up close during its unveiling. Many were quick to test its advanced camera system and appreciate its stylish colorways: Ancora Red, Mist Purple, and Satin Black.

Guests had the opportunity to explore the vivo V50 up close during its unveiling. Many were quick to test its advanced camera system and appreciate its stylish colorways: Ancora Red, Mist Purple, and Satin Black.