The adequacy of proportional regulation

The concept of proportionality in legal systems stems from the need to limit public intervention in the form of rules, sanctions, and oversight to what is needed to achieve the desired policy objectives. For banking, the principle of proportionality means that regulatory requirements must consider not just the size and scale of a bank’s operations, but also an institution’s complexity and risk profile.

Financial sector policy objectives include financial stability, market integrity and consumer protection. Proportionality aims at avoiding policies that could distort the financial services market by unduly constraining its development, curbing competition, or limiting the diversity of market participants. A uniform system may lead to unjustifiable resource burden not just on banks but on the regulators themselves.

A proportionate approach aims to avoid excessive compliance costs or regulatory burden for smaller and non-complex banks that could unduly dampen their competitive positions without a clear prudential justification (Lautenschlager (2017)).

The Bangko Sentral ng Pilipinas (BSP) reported to the World Bank how proportionality is being applied in its supervisory work commensurate with the financial institution’s risk profile and systemic importance. Simple standards are being applied without compromising regulatory objectives.

The BSP segments banks according to business model and risk profile as either simple or complex. Universal and commercial banks (U/KBs) are automatically classified as complex. Thrift banks (TBs) as well as rural and cooperative banks (RCBs) can be considered complex if at least three of the following characteristics exist: (a) total assets of at least P6 billion, (b) extensive branch network, (c) non-traditional financial products and services, (d) use of non-conventional business model and (e) with a business strategy characterized by aggressive risk appetite and increasing risk exposure.

Corporate governance is calibrated in terms of board of directors composition The management structure of key risk areas such as internal audit, compliance risk, risk governance, operational risk, security risk and business continuity is flexible. Concurrency for certain positions is allowed in simple banks, provided that a designated officer is qualified, and the Board of Directors is more active in these areas. The risk management guidelines are appropriately modified on the key risk areas: credit risk, liquidity risk, operational risk, information technology and stress testing.

The BSP has adopted a segmented Basel regulatory framework and differentiated liquidity metrics to support proportionality in banking regulations. These moves are meant to: promote continuing soundness and stability of the banking system; ensure convergence of regulatory and business objective; allocate supervisory resources efficiently; and lead to broad-based inclusive growth and innovation.

The conceptual framework for proportionality provides clear justification to how our BSP has proceeded for which it deserves applause. Similarly, however, given the characteristics of the Philippine banking industry, is the simple dichotomy between simple and complex sufficient?

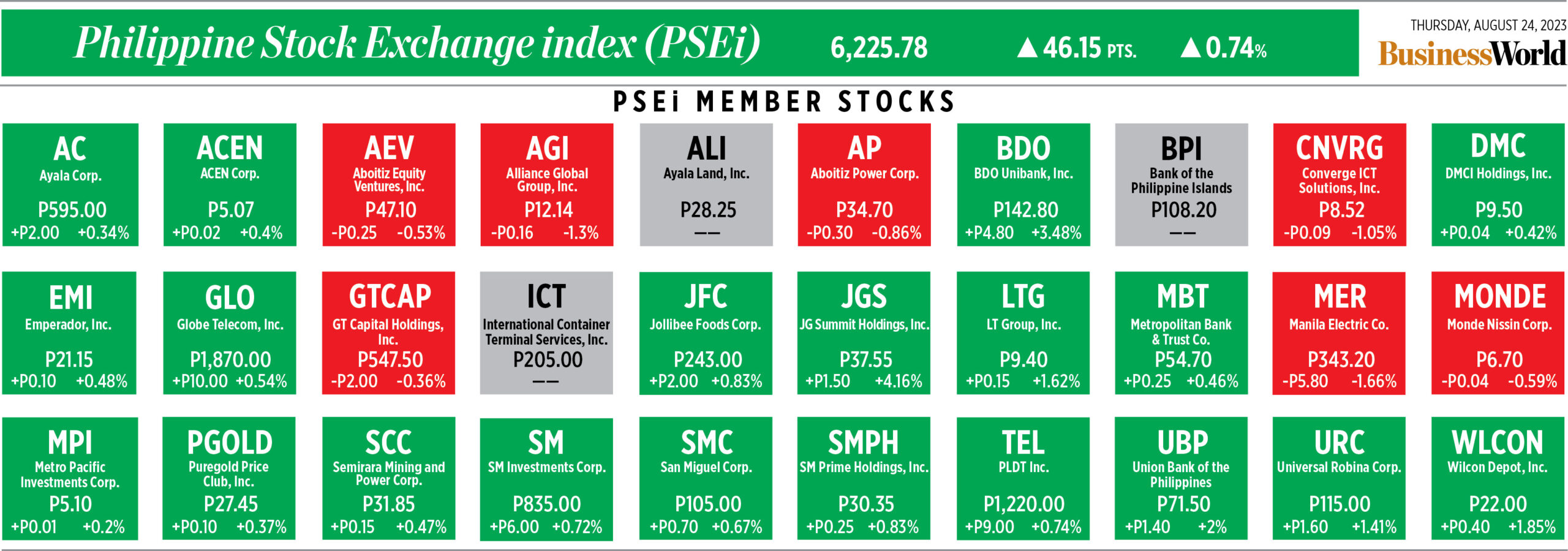

The Philippine banking sector is dominated by several large domestic banks. Forty-six U/KBs hold over 94% of bank assets, of which 60% are held by the top five banks (all domestic). Foreign bank subsidiaries and branches hold seven percent of bank assets. There are about 500 small TBs and RCBs.

In a paper by the Financial Stability Institute, it noted the need to achieve a common understanding of the pros and cons of the varied proportionality approaches that have been adopted by different jurisdictions. “Against this background, considerations could be given to adopting a categorization (or tiering) approach where banks are grouped into several classes (defined by various criteria); and these categories are used as basis for differentiating requirements.”

To be fair, the tiering challenge will deserve further study especially given the diversity of banking sizes at the smaller category — RBs from as low as P50 million capitalization to P200 million and TB’s from P500 million to P2 billion. The lower capitalization is quite far from the P6 billion threshold set for complex banks. The concept of proportionality must be well communicated to the assigned banking examiners.

The proportionality debate is not complete without recognizing the social role that small institutions play in facilitating access to credit and financial services by households and small firms, especially in a country with still so many unbanked areas. Excessive burdensome regulation for small banks may damage their competitiveness and undermines the level playing field.

In its 2022 Country Report, the IMF reported that access to finance in the Philippines is significantly lower than comparator systems, with only a third of adults having formal accounts. Digital payments are used much less. Informal financing among family members is more significant to households than retail banks loans. There are barriers to establishing IT and communication infrastructure for the archipelago of over 7,000 islands.

In devising the proportionality concept, the balance between keeping the regulatory burden to a minimum and ensuring compliance with prudential standards is a delicate one. But in this writer’s view, the bigger banks have a natural aversion to MSME clients and the marginalization of empowered smaller banks catering to the small business category can have negative consequences. Smaller community banks in a brick and mortar setting still play a critical role and hopefully will be subjected to resource-friendly and cost-efficient regulatory standards.

Benel D. Lagua was previously EVP and chief development officer at the Development Bank of the Philippines. He is an active FINEX member and an advocate of risk-based lending for SMEs. Today, he is independent director in progressive banks and in some NGOs.