By Aubrey Rose A. Inosante, Reporter

PHILIPPINE economic growth slowed a more than four-year low of 4% in the third quarter as public construction was hit by a corruption scandal involving state infrastructure projects that has dampened consumer and investor sentiment.

Gross domestic product (GDP) expanded by an annual 4% in the three months through September, sharply decelerating from the 5.5% growth in the second quarter and the 5.2% clip in the same quarter in 2024, data from the Philippine Statistics Authority (PSA) released on Friday showed.

This was substantially lower than the 5.3% median estimate in a BusinessWorld poll of 18 analysts and economists.

On a seasonally adjusted quarter-on-quarter basis, GDP grew by 0.4%, easing from 1.46% a year ago.

“The Philippine economy continues to grow, but the third quarter’s performance reminds us of the urgent need to address key challenges and strengthen our foundations for rapid, sustained, and inclusive growth,” Department of Economy, Planning, and Development Secretary Arsenio M. Balisacan said at a briefing.

The third-quarter clip was the slowest growth logged since the 3.8% contraction in the first quarter of 2021, when the country was still reeling from the impact of the coronavirus pandemic that brought economic activity to a halt.

Excluding the pandemic, this was the weakest expansion since the 3% growth in the third quarter of 2011.

This brought the nine-month average to 5%, slower than 5.9% in the same period last year and putting the government’s 5.5%-6.5% full-year GDP growth goal further out of reach.

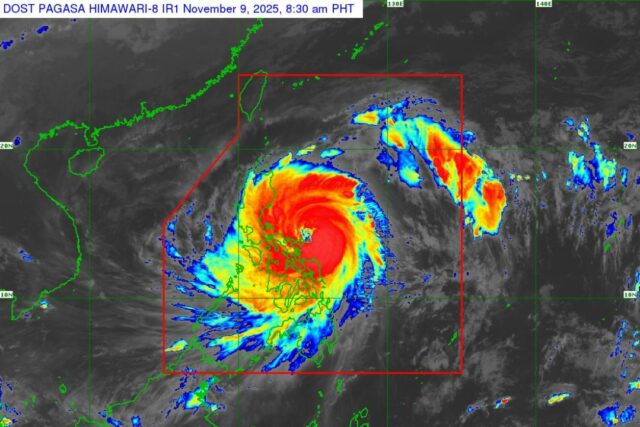

Mr. Balisacan said that meeting even the low end of the target would be “very challenging,” especially as more storms are expected to hit the country this quarter but added that they are optimistic that private spending could rebound on expectations of increased consumption and remittances amid the holiday season.

“While we may not be able to fully recover the economic losses within the year, we believe these are temporary setbacks. With sustained interventions and improved resilience, we expect the economy to rebound in 2026.”

In the third quarter, household final consumption expenditure, which accounts for over 70% of the economy, grew by a slower 4.1% from 5.3% in the second quarter and 5.2% a year ago.

This was the slowest since the 4.8% contraction in the first quarter of 2021. Counting out the pandemic years, it was the slowest growth in private spending since the 2.6% increase in the third quarter of 2010.

“Widespread cancellations of school, work, and travel activities due to typhoons likely dampened spending,” Mr. Balisacan said.

“Moreover, consumer confidence may have been affected by the ongoing probes and discussions on government infrastructure spending, prompting many households to postpone purchases, especially durable goods… These trends both reflect and affect consumer and business expectations and provide a clear signal for the government to act boldly and decisively.”

PUBLIC CONSTRUCTION

Meanwhile, government spending rose by 5.8% last quarter, easing from the 8.7% pace in the previous quarter, but faster than the 5% growth in the same period in 2024.

This came as corruption allegations surrounding state flood-control projects flagged by President Ferdinand R. Marcos, Jr. during his State of the Nation Address in July stalled public construction activity. Investigations into the graft scandal allegedly involving lawmakers, government officials, and private contractors are ongoing.

Gross capital formation, the investment component of the economy, contracted by 2.8% in the third quarter versus the 12.8% growth a year ago and the 1.2% expansion in the second quarter.

National Statistician Claire Dennis S. Mapa attributed this slowdown to the 26.2% contraction in general government construction, worse than the 8.2% fall in the second quarter and the biggest drop since the 28.6% decline in the third quarter of 2011.

“In the aftermath of these scandals, we see that there’s so much space for improving the quality of spending,” Mr. Balisacan said. “In recent years, we have been aiming for 5% to 6% of GDP for infrastructure spending just to catch up with the rest of our neighbors — and we needed to do that for the next decade or so. But as we are seeing now, the productive capacity that we had wanted to happen was muted by all this corruption.”

“Of course, everybody knew that there was corruption… But it’s just so shocking to see how extensive it was.”

He said bolstering investor and consumer confidence by making institutions stronger and improving governance are important in ensuring the economy’s recovery.

On the other hand, private construction “remained respectable” in the third quarter, but investment in durable equipment was subdued, Mr. Balisacan said.

He added that the external sector performed well in the third quarter compared to the net export decline seen in the prior three-month period even as the 19% tariff on the Philippines’ exports to the United States took effect.

“Unfortunately, there’s so much decline in the other sectors of the economy that the positive effects of the external sector were muted.”

The industry sector expanded by 0.7% in the third quarter, sharply slowing from the 5% growth a year ago and 2.1% in the second quarter.

“On the supply side, services and industry posted weaker growth, with a sharp contraction in public construction due to stricter validation measures for DPWH’s (Department of Public Works and Highways) civil works, as well as the implementation of stricter requirements that delayed billings and disbursements for government projects,” Mr. Balisacan said.

The services sector, which had the biggest contribution among major industries, expanded by 5.5% in the third quarter, slower than 6.3% a year ago.

Meanwhile, agriculture output grew by 2.8% in the third quarter, a reversal of the 2.7% decline a year ago but slower than the 7% growth in the second quarter.

The PSA added that among the main contributors to the third-quarter growth were wholesale and retail trade, repair of motor vehicles and motorcycles (5%), financial and insurance activities (5.5%), and professional and business services (6.2%).

Gross national income posted an annual 5.6% growth in the third quarter, slower than the 8% expansion in the previous quarter and 6.8% a year ago.

Net primary income went up by 16.9% in the third quarter, slower than the 20% in the same period in 2024.

RECOVERY IN DOUBT

Hongkong and Shanghai Banking Corp. economist for ASEAN Aris D. Dacanay said the contraction in public construction last quarter was expected given the graft probe.

“Without any immediate policy or institutional reform, history has shown us that the fiscal drag can persist for longer than a year,” he said, adding that every 10% fall in government infrastructure spending risks dragging growth by 0.4-0.6 percentage point.

ANZ Research economist Arindam Chakraborty and Chief Economist for Southeast Asia and India Sanjay Mathur said in a report that a near-term recovery is unlikely due to the impact of the graft scandal.

“We do not anticipate a turnaround in government spending until governance issues are resolved. Both business and household confidence surveys do not portend much improvement in spending. Credit growth has decelerated over the last three months, suggesting that the impact of rate cuts has been weak until now. Overall, it appears that the official 2025 GDP forecast of 5.5–6.5% will not be achieved,” they said.

They now expect the Philippine economy to expand by 4.9% this year, down from 5.4% previously, while they also lowered their 2026 forecast to 5% from 5.2% earlier.

Chinabank Research also said that the public construction component “may continue weighing down economic growth, as investigations continue and due to the proposed reallocation of some DPWH funding to other priority sectors in next year’s national budget.”

“In the fourth quarter, catch-up efforts in government spending could help lift growth, while natural calamities pose risks to consumption activities,” it said.

Weak economic prospects and a manageable inflation outlook would give the Bangko Sentral ng Pilipinas (BSP) ample room to continue its easing cycle, the analysts said.

The ANZ Research economists said they expect two more 25-basis-point (bp) cuts from the central bank.

Meanwhile, Mr. Dacanay said the base case is for a 25-bp reduction at the Monetary Board’s Dec. 11 meeting, but the slowdown opens the door for a larger cut, depending on the US Federal Reserve’s stance.

In October, the BSP trimmed benchmark rates by 25 bps for fourth straight meeting to bring the policy rate to 4.75%. It has now lowered borrowing costs by a total of 175 bps since its easing cycle began in August 2024.

BSP Governor Eli M. Remolona, Jr. has signaled further easing until next year to help support domestic demand as the corruption mess has hit investor sentiment and economic prospects.