Second of two parts

IN BRIEF:

• Philippine CEOs are embracing transformation to remain competitive and drive sustainable business growth in an evolving business landscape.

• Global disruption, macroeconomic uncertainty, and increasing pressures relating to sustainability are among the critical considerations in the transformation agenda.

• CEOs are looking to leverage M&A to accelerate transformation, especially in terms of achieving operational efficiencies and customer-centric innovation.

Tasked with navigating a more complex business landscape in 2025, it is crucial for business leaders to implement bold strategies to effectively steer their organizations toward a clear vision for the future.

In order to provide CEOs with the necessary insights to accomplish this, EY-Parthenon conducted the EY CEO Outlook Pulse survey, which gathers insights from 1,200 CEOs worldwide, including Philippine respondents. The survey explores the ongoing transformations within organizations, driven by executive leadership. In the Philippine edition of the survey, SGV zooms in on the unique perspective provided by CEOs here on their expectations for future growth and long-term value creation in light of the global uncertainties and the country’s current economic conditions, aiming to deliver essential insights into market trends affecting major companies in the Philippines.

In the first part of this article, we discussed the growth of the Philippine economy, its challenges, and the cautious optimism of CEOs as they seek to prioritize strategic initiatives for 2025. This second part will discuss how CEOs are embarking on transformation initiatives to accelerate business advancement, including mergers and acquisitions (M&A) as a catalyst for growth and transformation.

TRANSFORMING OPERATIONS

Enhancing offerings and operations is crucial for sustainable business growth. With the emergence of digital banking, e-commerce, and AI-powered solutions, traditional business models are also evolving to become increasingly aligned with technological innovation. Furthermore, globalization is driving shifts in consumer behavior and trends in the job market, providing both customers and employees with a broader range of businesses to engage with or patronize.

In light of this, it is essential for companies to refine their strategies in three key areas: customer journey, talent management, and operational optimization. The survey shows that Philippine CEOs prioritize these transformation outcomes for the next 12 months, with 50% emphasizing the importance of maintaining strong customer relations, 46% focusing on enhancing product offerings, 42% prioritizing employee retention, and 40% aiming to optimize operations.

Transformation initiatives that leverage data to deliver more personalized experiences are crucial for driving customer loyalty and expanding customer bases. For example, the shift to omnichannel retail, which offers customers an integrated shopping experience across both physical and digital platforms, has enabled companies to implement more targeted marketing campaigns using data collected from various channels. Similarly, programs that align company culture with employees’ personal value systems enhance retention and productivity. In both instances, companies are increasingly creating pathways to ensure that customers and employees strongly connect with the products and services they provide, thereby securing business growth.

The respondents underscore the significant impact of external uncertainties on effective transformation. Over 60% of Philippine CEOs identify the growing interconnectedness with external stimuli, macroeconomic and policy-related uncertainty, and sustainability pressures as highly pressing trends that may influence their transformation agendas.

Supply chain disruptions, global market volatility, and regulatory changes are also among the challenges that CEOs anticipate in the coming year. Furthermore, there is mounting pressure to adopt and comply with sustainability-related practices as regulations continue to evolve. This includes the implementation of the IFRS Sustainability Disclosure Standards, the enactment of the Extended Producer Responsibility (EPR) law, the Philippine Ecosystem and Natural Capital Accounting System (PENCAS), and advancements in the legislation of the Low Carbon Economy Act. Companies are increasingly incorporating sustainable practices into their operations, as evidenced by the emergence of the electric vehicle industry and the growth of the renewable energy sector.

Philippine CEOs acknowledge that there is still potential for improvement in implementing effective transformation initiatives. Notably, 60% of CEOs indicate that significant improvements are necessary in building resiliency to address sudden disruptions. Enhancing resiliency by developing roadmaps that are iterative and flexible to accommodate inevitable disruptions will be a key differentiator among successful initiatives.

Moreover, cost-saving measures are regarded as essential for ensuring the sustainability of transformation programs, with 50% of CEOs emphasizing this as an area requiring major improvement. A common strategy to reduce costs involves outsourcing certain functions within transformation initiatives. For instance, strategy advisory services are frequently employed to create efficient programs and expedite delivery. Additionally, operational and IT capabilities that necessitate substantial investment are often outsourced to facilitate the scalability of infrastructure required for transformation.

Among the Philippine CEOs who identified operational optimization and productivity enhancement as their transformation priorities, as much as 73% express strong confidence in achieving these outcomes. Similarly, those who selected sustainability targets, enhancing offerings, improving talent management, and reimagining their business models also maintain a positive outlook, with over 50% indicating they are very confident in reaching these goals. Conversely, 71% of Philippine CEOs prioritizing customer engagement and top-line growth are only moderately confident.

Overall, CEOs demonstrate greater confidence in achieving transformation outcomes that are within their internal organizations. However, when it comes to outcomes heavily reliant on the external market, CEOs exhibit only moderate confidence, reflecting their anticipation of external uncertainties. Despite ranking the improvement of customer engagement and retention as the top priority for transformation initiatives, most CEOs remain only moderately confident in achieving this goal, indicating a need for more robust strategies and clearer metrics to measure progress and success in addressing external uncertainties.

M&A AS A CATALYST FOR GROWTH

As CEOs navigate an era marked by economic pressures, technological disruption, and evolving consumer demands, 94% of leaders envision transaction initiatives as a means to accelerate their transformation journeys.

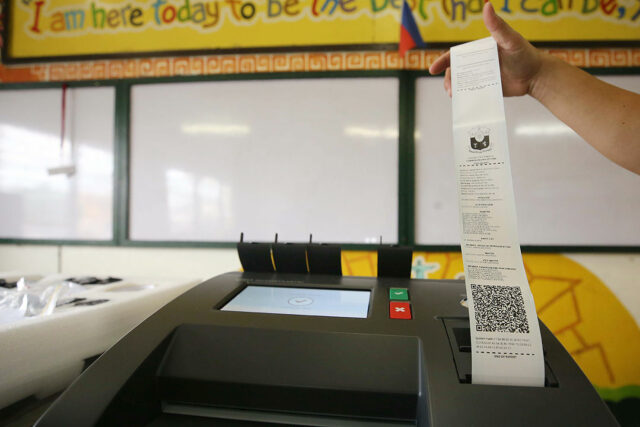

The Philippines’ robust GDP growth of 5.6% in 2024, coupled with investor-friendly policies targeting high-growth industries such as transportation, renewable energy, and telecommunications, has created a conducive environment for increased M&A activity, with the number of deals rising from 87 in 2023 to 113 by the end of 2024 and positioning the country as a dynamic player in the Asia-Pacific.

This surge was supported by emerging fintech capabilities in the financial services sector, the rise of data hubs in the technology sector, and a shift toward renewable energy in the energy sector. Additionally, improved tax incentives, such as enhanced deductions and value-added tax zero-rating for priority sectors enacted through the CREATE MORE Act implemented in November, are expected to attract more foreign investors, positioning the Philippines as an appealing investment hub.

CEOs are indicating an increased emphasis on M&A and strategic partnerships in the coming year, anticipating that operational efficiency will bolster internal growth. In the Philippines, 60% of CEOs have identified potential M&A transactions, surpassing the global average of 56% and closely aligning with the Asia-Pacific average of 61%. This trend reflects shared regional dynamics driven by economic expansion and investment opportunities.

Divestments, spin-offs, and initial public offerings (IPOs) are also key areas of focus for 52% of CEOs, reflecting their intent to streamline operations and reallocate resources toward transformative initiatives. Similarly, 50% of CEOs anticipate joint ventures or strategic alliances to leverage complementary strengths, enhance operational capabilities, and better respond to evolving customer needs. These strategic actions underscore a commitment to driving efficiency and fostering innovation as businesses adapt to a rapidly changing environment.

Looking ahead, CEOs are expected to take a more proactive approach in utilizing M&A to accelerate both operational efficiency and customer-centric innovation. Collaborating with other companies allows businesses to achieve economies of scale, streamline processes, and integrate advanced technologies to enhance cost structures. For example, acquisitions in AI, automation, and cloud computing can significantly boost productivity and efficiency, ultimately leading to improvements in the bottom line.

Simultaneously, M&A allows companies to stay ahead of evolving consumer demands. Through acquisitions, businesses can quickly expand their product offerings, integrate new service models, and enhance customer experiences. Strategic deals in fintech, customer experience platforms, and digital infrastructure illustrate how Philippine companies are leveraging M&A to strengthen their customer propositions. The integration of these strategies will be crucial for driving transformation and achieving long-term growth in an increasingly dynamic business landscape.

DRIVING SUSTAINABLE GROWTH IN 2025

As the Philippine economy continues to evolve, corporate leaders must remain agile and forward-thinking to navigate the complexities of the business landscape. The insights gathered from the Philippine edition of the EY CEO Outlook Pulse survey highlight the importance of balancing optimism with strategic decision-making, particularly in the face of both local and global challenges.

By prioritizing investments in technology, embracing M&As, and focusing on enhanced customer engagement and operational efficiency, Philippine CEOs are well-positioned to drive sustainable growth. As they prepare for 2025 and beyond, fostering resilience and adaptability will be key to seizing opportunities and mitigating risks, ultimately ensuring that their organizations thrive.

This article is for general information only and is not a substitute for professional advice where the facts and circumstances warrant. The views and opinions expressed above are those of the author and do not necessarily represent the views of SGV & Co.

Noel P. Rabaja is the strategy and transactions leader of SGV & Co.