By Keisha B. Ta-asan, Reporter

HEADLINE INFLATION likely eased further in November amid lower pump prices, a slower rise in food costs and high base effects, analysts said.

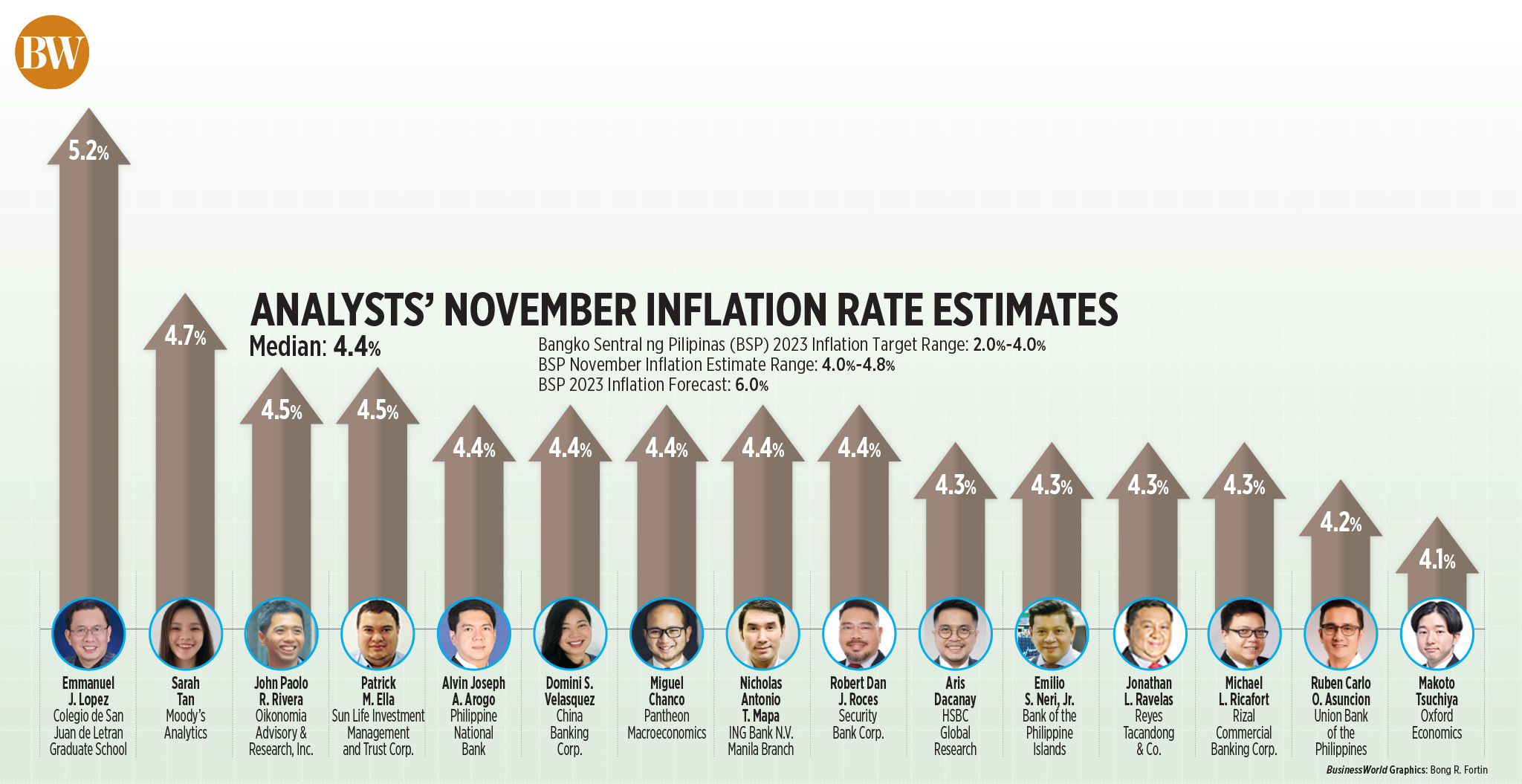

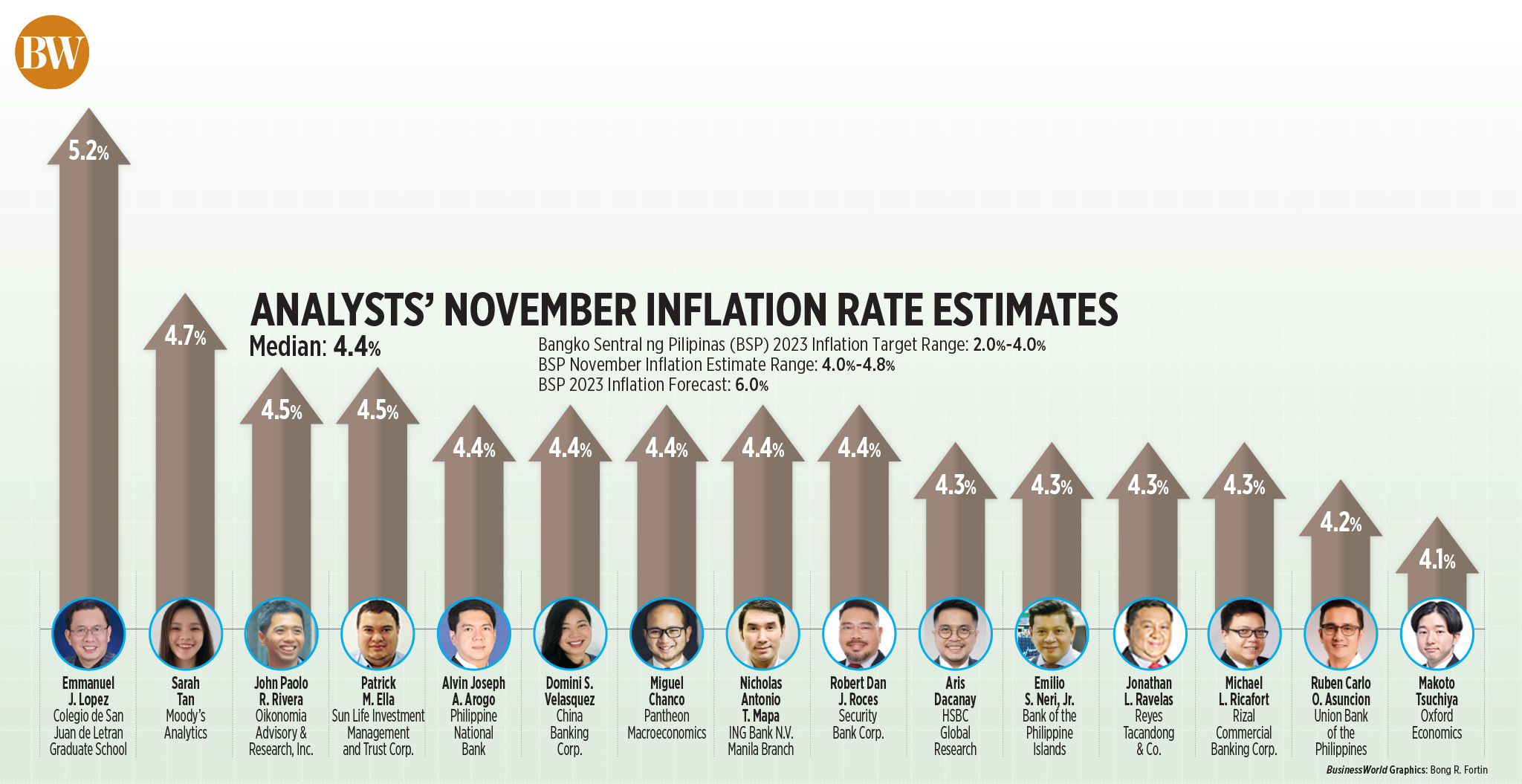

A BusinessWorld poll of 15 analysts yielded a median estimate of 4.4% for November inflation, which is also the midpoint of the 4% to 4.8% estimate given by the Bangko Sentral ng Pilipinas (BSP) last week.

If realized, last month’s consumer price index (CPI) would be slower than 4.9% in October and 8% logged a year earlier. However, it would mark the 20th straight month of inflation breaching the BSP’s 2-4% target range.

The Philippine Statistics Authority will release the November inflation report on Tuesday (Dec. 5).

Analysts said high base effects may have significantly helped in bringing down the November figure.

“On a year-on-year basis, the reading will be flattered by a high base effect,” Moody’s Analytics economist Sarah Tan said in an e-mail.

She said Typhoon Karding (international name: Noru) damaged farms and disrupted supply chains in Luzon last year, which pushed food prices up in the fourth quarter of 2022.

“Lower food and oil prices would be the two main reasons for the disinflation narrative to continue,” Union Bank of the Philippines, Inc. Chief Economist Ruben Carlo O. Asuncion said in a Viber message.

He said better weather conditions this month led to easing food supply constraints, while the decline in global oil prices likely prompted fuel retailers to roll back prices this month.

In November alone, pump price adjustments stood at a net decrease of P1.90 a liter for gasoline, P4.45 a liter for diesel, and P3.3 a liter for kerosene.

“We also estimate November core inflation to settle at 4.9% from 5.3% the previous period. This means more for the longer-term expectation for headline inflation,” Mr. Asuncion said.

Core inflation excludes volatile prices of food and fuel items. For the first 10 months of the year, core inflation stood at 7%.

However, inflation remains above target in November as prices of some food items and electricity rates went up, Ms. Tan said.

“According to the Department of Agriculture’s price monitoring tracker, the prices of major agri-fishery commodities in Metro Manila such as rice, fish, livestock and poultry produce were higher in November than October,” she said.

Data from the Agriculture department showed that regular-milled rice prices ranged from P33 to P52 a kilo as of Nov. 30, wider than the P41 to P44 band on Oct. 31. Retail prices of fish and meat products also went up.

“Further, households and businesses bore the brunt of a hike in electricity rate by Manila Electric Co. (Meralco) — one of the country’s main utilities providers — due to higher transmission charges,” Ms. Tan said.

Meralco earlier said the power rates for typical households increased by P0.2347 per kilowatt-hour (kWh) to P12.0545/kWh in November.

China Banking Corp. Chief Economist Domini S. Velasquez said the significant increases in electricity rates and cooking gas prices may have offset the decline in fuel costs.

“While areas serviced by Meralco experienced only a slight increase in electricity rates, other regions in Luzon and Visayas saw substantial increases in electricity rates. These factors will have an impact on the overall inflation rate for November,” she said.

Liquefied petroleum gas (LPG) prices went up by P0.45 a kilogram in November, its fourth straight month of increase. The cost of a regular 11-kg LPG tank rose by P4.95 to P5.50.

Security Bank Corp. Chief Economist Robert Dan J. Roces said restaurants and accommodation costs usually go up due to holiday demand.

“While the base effect from last year’s inflation should pull down the headline, the central bank will likely remain vigilant on the upside risks,” he said.

INFLATION DOWNTREND?

According to Ms. Tan, inflation may continue to ease in December, but the outlook remains uncertain for 2024.

“Come 2024, the path to lower inflation will be a bumpy one due to speed humps in the form of the food supply constraints, higher transport fares and wage adjustments, and the strengthening of the El Niño weather pattern that will hamper crops and lift food prices,” she said.

“Over the next few months, we expect inflation to hover around the BSP’s upper-end target of 4% before firmly returning within the 2-4% target range in mid-2024,” she added.

BSP Governor Eli M. Remolona, Jr. earlier said inflation may hit the 2-4% target briefly in the first quarter before it picks up again to above target from March to July.

China Bank’s Ms. Velasquez said December inflation may still be above the 2-4% target.

“But in the first quarter of 2024, we will likely see inflation nearer the 3% level, before moving above 4% again from April to August. This trend is largely driven by base effects,” she said.

Inflation peaked at 8.7% in January, before easing until July this year. Inflation picked up in August and September, before it started slowing again in October.

“We expect inflation rate to stay at around the same level in December, before settling within the 2%-4% target in January, largely helped by base effects,” Makoto Tsuchiya, an economist at Oxford Economics, said in an e-mail.

“Although risks are tilted to the upside given high uncertainty over supply-chain disruptions and climate-related issues, CPI should average 3.6% in 2024, higher than BSP’s target midpoint but within the target range,” he added.

In November, the BSP raised its baseline inflation forecast to 6% in 2023 (from 5.8% in September) and to 3.7% in 2024 (from 3.5%) but cut its 2025 inflation estimate to 3.2% (from 3.4%).

The BSP also gave a risk-adjusted inflation forecast at 6.1% for 2023, 4.4% for 2024 and 3.4% for 2025.

There is also a “decent chance” inflation returning to the 2-4% target by the end of the year, Pantheon Chief Emerging Asia Economist Miguel Chanco said.

“At the moment, we’re expecting a substantial slowdown in the average rate of inflation to 2.8% next year, from 6% this year, giving the BSP more than enough room to consider normalizing monetary policy,” he said.

At its Nov. 16 policy meeting, the BSP kept its target reverse repurchase rate at a 16-year high of 6.5%. The BSP has raised borrowing costs by a total of 450 basis points (bps) from May 2022 to October 2023 to tame inflation.

“Our forecast for now is for 100 bps worth of rate cuts in 2024,” Mr. Chanco added.

Mr. Remolona has said policy easing is still not on the table for the Monetary Board, and the current policy settings may continue to remain tighter for longer until inflation firmly falls within the 2-4% target.

The Monetary Board will have its final policy-setting meeting on Dec. 14.

Fairness and equality are promoted as well in Cocolife’s entire operations, as it believes everyone deserves to have the best service. The company assures that its services and products know no race, religion, preference, and title.

Fairness and equality are promoted as well in Cocolife’s entire operations, as it believes everyone deserves to have the best service. The company assures that its services and products know no race, religion, preference, and title.