Entertainment News (08/26/25)

ONErpm expands into the Philippines

RECORD LABEL ONErpm marked its 15th anniversary with the announcement of its expansion into the Philippines. With this milestone, it aims to deliver “transformative solutions and sustainable opportunities for artists to thrive in an increasingly dynamic and competitive music market,” it said in a statement. As part of the expansion, ONErpm has announced that it has a dedicated team in the Philippines, composed of Project Manager Louie Tamon, A&R Representative Presh Ong, Marketing Manager Alyssa “Pebs” Pe Benito, and Senior Business Development Manager Clark Cunanan.

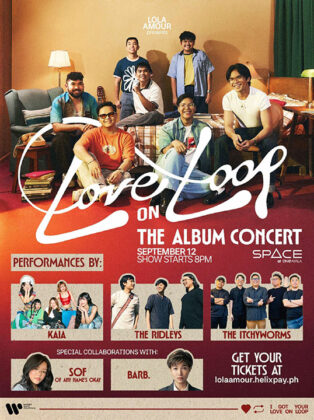

Lola Amour releases album, readies concert

FILIPINO band Lola Amour has released their sophomore album, Love On Loop, now available on all major streaming platforms. Across eight tracks, the album explores love in all its phases, from first crush to heartbreak to inevitable romance relapses. It features collaborations with New Zealand artist RIIKI REID and Japanese collective KOKORO of Psychic Fever from EXILE TRIBE, produced in collaboration with international hitmakers Hyuk Shin and Cuurley. The album will be supported by Love On Loop: The Album Concert, set for Sept. 12 at One Ayala, Makati City, which, aside from the songs in the album, will feature Lola Amour’s biggest hits. Concert tickets are available via https://lolaamour.helixpay.ph/https://lolaamour.helixpay.ph/.

Tadhana marks 8th year with special episode

GMA PUBLIC AFFAIRS’ award-winning drama anthology Tadhana, hosted by Marian Rivera, is celebrating its 8th year on air and online through a special three-part episode. Titled “Banta ng Kahapon,” the episode stars veteran actress Cherry Pie Picache and GMA Sparkle Artist Althea Ablan. It offers another story of Filipinos who triumph over great challenges. It will air on Aug. 30, and Sept. 6, 3:15 p.m. on GMA Network, and also stream on GMA Public Affairs’ social media accounts.

Rich Brian releases first album in 6 years

RICH BRIAN has dropped his most personal and self-directed album, WHERE IS MY HEAD?, out now via 88rising. It marks his first full-length album since 2019 and offers a raw, introspective coming-of-age journey that captures the singer’s evolution. The album explores themes of heartbreak and healing, ambition and alienation, memory, and self-reinvention across 15 tracks, which include features collaborations with artists such as Toro y Moi on “Body High,” Charlotte Day Wilson and DAISY WORLD on “Is It?,” and redveil on “Bumpy Road.”

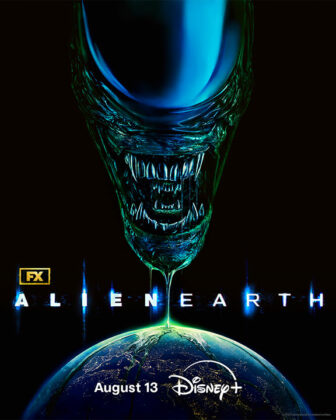

FX’s Alien: Earth now on Disney+

THE hit series from creator Noah Hawley, FX’s Alien: Earth, has released its first three episodes on the Disney+ platform. The story kicks off when the mysterious deep space research vessel, USCSS Maginot, crash-lands on Earth, and Wendy (played by Sydney Chandler) and a ragtag group of tactical soldiers come face-to-face with the planet’s greatest threat. Set in the year 2120, it dials in on the sci-fi world of the popular Alien movie franchise. It is written by Mr. Hawley and Bob DeLaurentis and directed by Dana Gonzales. Future episodes of the eight-episode season will premiere every Wednesday.

Wolf Alice’s new album out now

BRITISH band Wolf Alice has released their fourth studio album, The Clearing, via Sony Music. Highlighting the focus track “Just Two Girls,” the album was written in Seven Sisters and recorded in Los Angeles with Grammy-winning producer Greg Kurstin. It is a classic pop/rock album that nods to the 1970s while remaining rooted firmly in the present, going for the sensibilities of “what if Fleetwood Mac wrote an album today in North London?”

Genie, Make a Wish on Netflix in October

THE K-drama Genie, Make a Wish, starring Kim Woo-bin and Suzy, is coming to Netflix in October. Written by Kim Eun-sook, it tells the story of Jinn (Mr. Kim), a genie who awakens after a thousand years, and Ka-young (Suzy), his new impassive master. The show blends a romantic comedy around their conflicts over three wishes, which sets the stage for a magical twist of destiny, desire, and love. The series will launch exclusively on Netflix on Oct. 3.

Laufey drops new album

THE new album by Los Angeles-based Icelandic-Chinese artist Laufey has been released. Titled A Matter of Time, the album strips back Laufey’s polished veneer of elegance to present her at her most vulnerable and unguarded. It is accompanied by the new focus track, “Mr. Eclectic,” featuring backing vocals from Clairo. The album is now available worldwide via Vingolf Recordings and AWAL.

Jeremy Zucker returns to Asia for world tour

MULTI-PLATINUM singer, songwriter, and producer Jeremy Zucker is set to return to Asia this year for his 2025 World Tour. Kicking off this November, the tour will bring Mr. Zucker to Seoul, Singapore, Kuala Lumpur, Manila, Taipei, and Tokyo. Jeremy Zucker – World Tour 2025 in Manila will take place on Nov. 29 at the New Frontier Theater in Cubao, Quezon City. Tickets are priced starting at P2,500 and will be available via Ticketnet.

Prime Video announces Fallout season 2

THE global hit series Fallout will premiere its second season on Dec. 17, according to Prime Video, with new episodes dropping weekly until the finale on Feb. 4, 2026. The teaser trailer has unveiled key details: a new cast member, Justin Theroux as Robert House, and the appearance of the highly anticipated Deathclaw, one of the Fallout universe’s most iconic creatures. This season takes the story to the post-apocalyptic city of New Vegas, picking up where the first season’s finale left off.