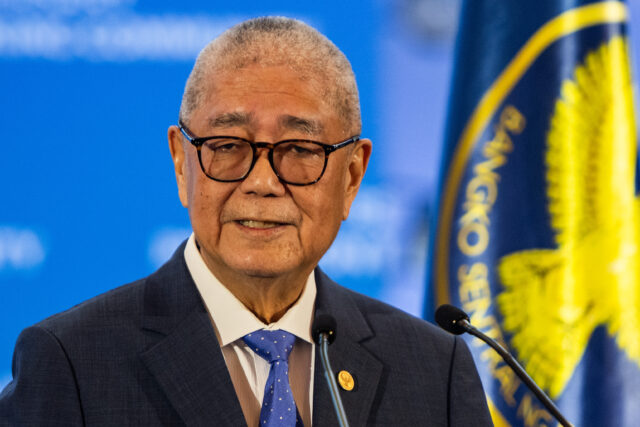

The Korean-Canadian finance chief leads the fast-growing food service group in its goal of becoming one of the top 5 restaurant companies in the world

In a historic turn for the ING-FINEX CFO of the Year Award, Richard CW Shin of Jollibee Foods Corp. (Jollibee Group) has been named the 2024 awardee, becoming the first non-Filipino to win the country’s longest-running and most prestigious honor for finance chiefs.

The seasoned Korean-Canadian finance leader has worked with various global companies across different sectors in a remarkable career that spans nearly three decades. In 2022, he was appointed Chief Finance Officer of Jollibee Group, one of the world’s fastest-growing food service companies. In only his first two years at the post, the minimum tenure required to be even nominated for the ING-FINEX CFO of the Year, Mr. Shin has exemplified the qualities of a #GameChangingDifferenceMakingCFO. The theme serves as the guidelines of this year’s ING-FINEX CFO of the Year Award, presented since 2006 through a permanent partnership between Dutch financial giant ING Bank N.V. and the Financial Executives Institute of the Philippines (FINEX), the country’s premier organization for finance and business professionals.

“Richard Shin’s exceptional leadership at Jollibee Foods Corp. exemplifies the very qualities that this award seeks to celebrate — visionary financial stewardship, strategic growth, and global impact,” said Jun Palanca, country manager of ING in the Philippines. “As the first non-Filipino recipient of this prestigious distinction, Richard’s achievement highlights the increasing international recognition of the Philippines as a hub for dynamic corporate leadership. At ING, we are committed to supporting innovation, collaboration, and excellence in finance, and we’re proud to be a partner in recognizing the outstanding contributions of finance leaders like Richard who are shaping the future of business in the Philippines and beyond.”

“Bringing global perspectives while respecting local sensitivities, this is why we chose Richard Shin to be the 2024 ING-FINEX CFO of the Year,” added Augusto D. Bengzon, president, FINEX.

Bringing Joy and Success to the Team

Under Mr. Shin’s leadership, Jollibee Group achieved record system-wide sales and revenue in back-to-back years in 2022 and 2023. The 57-year-old CFO is also one of the chief architects of the bold five-year enterprise strategy to triple the business in five years (grow NIAT three-fold by end-2028 and reach 20% enterprise ROIC) — set to bolster the company’s lofty goal of becoming one of the top 5 restaurant companies in the world.

Key to the plan were game-changing deals for Jollibee Group. This includes acquisitions of South Korean value coffee brand Compose Coffee and Hong Kong dim sum restaurant chain Tim Ho Wan, along with a significant investment in beverage tech company Botrista, to name a few. Mr. Shin’s strategic vision and risk management expertise have also been pivotal in navigating the complexities of global expansion and sustaining operational excellence.

“This is a deeply humbling honor,” Mr. Shin said of the ING-FINEX CFO of the Year Award. “While I’ve only been with Jollibee Group for about two years, this recognition affirms the collective achievements and shared vision of our entire team.”

Mr. Shin has always been a team player. He considers the ING-FINEX CFO of the Year Award “as much a recognition of the team’s hard work as it is a milestone in my career.” He also points to Jollibee Group’s leadership team, led by Dr. Tony Tan Caktiong, Founder and Chairman, and Ernesto Tanmantiong, President and Chief Executive Officer, “who have encouraged our impactful work.”

When Mr. Shin onboarded Jollibee Group, he set his eyes on one goal, fitting for an established brand looking to take on the next level: transformational and consistent growth. He laid out strategies centered on data-driven processes, brands, and, of course, people.

“I truly believe that, for great teams, the sum is much greater than its parts,” he said. “Our finance team excels because we lean on each other’s strengths. My role as their leader is to give them the right environment that allows them to collaborate and excel. It also helps to have great leaders and contributing colleagues.”

In just two short years, Mr. Shin’s impact on the team has been as immediate as it is indelible. According to Mr. Tanmantiong, Mr. Shin embodies not only exceptional financial acumen but also a deep compassion for people that aligns with their company values.

“His dedication to making people happy — his unwavering commitment to ensuring optimal employee benefits, maximizing financial opportunities for everyone — is truly admirable,” he said. “Richard’s leadership resonates with warmth and a genuine heart for the well-being of all.”

Valerie Amante, Jollibee Group Global Chief Legal, Ethics, and Compliance Officer, sings the same song. Mr. Shin is highly intelligent and skilled at what he does, she said; that “it’s a privilege to watch his brilliance in action.”

“More than that,” Ms. Amante added, “he brings a lot of himself to his work and the heart, style, and even humor that I get to experience during our work together makes it so much fun. As a colleague, he provides clarity, collaboration, and space for people to do what they do best.”

For Gilbert Villas, Jollibee Group Assistant Vice-President, Head of Corporate and Financial Planning and Analysis, Mr. Shin “brings joy by being a spark of positivity who lights up the room the moment he walks in. From personalized shout-outs to surprise treats, he finds ways to celebrate each person’s contributions, creating an environment where we’re not just coworkers, but a true community.”

Mr. Villas added that he was moved by the way Mr. Shin rallied the leaders and, ultimately, the whole organization, towards their unified goal of tripling the business in five years. “He communicated it clearly and so convincingly that at the end of the leadership session, every leader was talking about the strategic objective and embedding it into their respective BU planning sessions.”

“I am proud of how the company came together on this unified goal,” Mr. Shin said. “Equally, I am so proud to see so many individuals across the business mature, grow and unleash their talent for the benefit of the common goals set.”

Financial Success is the Result of Bringing Joy

Mr. Shin’s victory proves monumental on an organizational level as well. His win makes Jollibee Group only the third company to have multiple awardees of the ING-FINEX CFO of the Year. Mr. Shin’s predecessor, Ysmael Baysa, won the award in 2010. The other two companies with multiple winners are Ayala Land, Inc. (Jaime Ysmael in 2011 and Augusto Bengzon in 2019) and Manila Water Company, Inc. (Sherisa Nuesa in 2008 and Luis Juan Oreta in 2015).

Prior to joining Jollibee Group, Mr. Shin held senior financial and business leadership roles across diverse sectors such as Fast-Moving Consumer Goods (FMCG), Retail, Beverage, and Aquaculture. He holds a bachelor’s degree in commerce with a Double Major in Finance and Accountancy from Concordia University in Canada and a master’s degree in accountancy from McGill University, where he is a qualified Canadian Chartered Accountant.

Mr. Shin describes himself as a “solid student, but certainly not the top student — that was my wife, Heidi.” He remembers getting straight A’s in courses he enjoyed, such as finance courses, which he also tutored for pocket money. Meanwhile, he makes no bones about getting B’s for those that he found “less interesting,” which were, ironically, accounting and auditing. “But that helped get my work experience started,” he said.

On his free days, Mr. Shin loves hiking and spending time with his wife and friends, which usually involves dining out or traveling together. He also values peace and quiet to reflect, while practicing Wim Hof breathing and other forms of physical exercise. “Because my work is a big part of my life at this stage, I am absolutely OK to not have time-consuming hobbies such as golf,” he said, laughing.

Looking back on his journey, Mr. Shin considers himself blessed to have had opportunities to grow; exposures to learn from mistakes; coaching and mentorship; and complex business environments to help accelerate his professional development. He said that in his post as Jollibee Group CFO, he learns every day from Dr. Tony and the Tan family. From a non-corporate perspective, he credits his father for teaching him strength and honor, that his mother blessed him with compassion and gratitude, and his brother taught him humility. Meanwhile, Mr. Shin’s “brilliant and beautiful” wife taught him “how to be a detailed thinker and how to execute with utmost conviction and efficiency.”

These are what make Mr. Shin the game-changing and difference-making CFO that he is today. It’s the type of CFO that, according to Mr. Shin, “not only acts as a responsible steward of the company’s resources but also inspires that same sense of stewardship in others.” It’s all about that multiplying effect, leading by example, and fostering a culture where financial discipline and purpose work hand-in-hand to fuel growth and make a positive difference. It’s about choosing “courage over fear.”

The Joys of Proactive Stewardship

Aside from leading Jollibee Group from a finance perspective as CFO, Mr. Shin also serves as the corporation’s first-ever Chief Risk Officer. He created the Enterprise Risk Council to proactively identify and mitigate risks, helping the company to be better prepared for unwanted and emergency situations, which prove vital for Jollibee Group’s globalization efforts.

“I see being proactive as not only in seizing opportunities and mitigating risks, but also embedding this approach into the culture of the organization,” Mr. Shin said. “When we foster a culture where this mindset is shared across teams, we’re better positioned to navigate uncertainties and leverage our strengths. This ensures that our strategy remains resilient and forward-looking. The mantra is ‘see it, feel it, do it.’”

Mr. Shin shared that the company’s progress toward its top five vision has been very encouraging. They remain focused on further strengthening their fundamentals and accelerating their growth, led by the flagship champion Jollibee brand in the global market. To date, the flagship brand has over 1,700 stores around the world and accounts for 51% of the Jollibee Group’s organic system-wide sales.

A True, Joyful Filipino at Heart

A True, Joyful Filipino at Heart

“I consider it a privilege to be part of this journey of a Filipino company that has truly global ambition and strategic intent,” Mr. Shin said. “It’s an honor to help bring their vision to life, not only for the company but also as a source of pride for the Philippines on the global stage.”

Mr. Tanmantiong noted that while their award-winning CFO may not be Filipino by blood, he is very much Filipino at heart — “and that has manifested in the many ways he has helped our Filipino company compete with the best of the world.”

“I consider myself incredibly fortunate to be part of an organization and team that truly takes bringing joy to people to heart,” Mr. Shin said. “For us, financial success isn’t just about growth for growth’s sake. It’s about the sense of genuine joy and positive impact we bring to people’s lives. When our customers can get great-tasting food and share it with their loved ones; when we’re providing growth opportunities for our people; when we’re making an economic impact on the thousands of communities we operate in: all of this is what joy means to us. I’m proud of the work we are doing as one Jollibee Group.”

For more information about the ING-FINEX CFO of the Year Award, visit www.ingfinexcfooftheyear.com. Follow the Award on Facebook and Instagram (@ingfinexcfooftheyear) and LinkedIn.

Spotlight is BusinessWorld’s sponsored section that allows advertisers to amplify their brand and connect with BusinessWorld’s audience by publishing their stories on the BusinessWorld Web site. For more information, send an email to online@bworldonline.com.

Join us on Viber at https://bit.ly/3hv6bLA to get more updates and subscribe to BusinessWorld’s titles and get exclusive content through www.bworld-x.com.

A True, Joyful Filipino at Heart

A True, Joyful Filipino at Heart