Winning GEA-3 bidders to be revealed next week

WINNING BIDDERS of the third round of green energy auction (GEA-3), which attracted over 7,500 megawatts (MW) worth of bids, are set to be announced next week, the Department of Energy (DoE) said.

“Hopefully, by Monday,” Energy Secretary Rowena Cristina L. Guevara said on the sidelines of the ADB Asia Clean Energy Forum on Tuesday.

Ms. Guevara did not disclose the number of winning bidders.

In February, the DoE announced that GEA-3 exceeded the auction goal of 4,650 MW after receiving offers totaling 6,950 MW for pumped storage hydropower projects and 550 MW for impounding hydro projects.

Meanwhile, geothermal attracted bids for 30.887 MW, well below the 100 MW target.

Overall, the auction round received offers for 14 projects, with delivery periods of between 2025 and 2035.

The GEA program promotes renewable energy (RE) as a primary source of energy, with bidders undergoing competitive selection. The government is hoping to increase the share of RE in the power mix to 35% by 2030 and to 50% by 2040.

“The GEA underscores the department’s commitment to creating a fair and competitive environment for RE development, ensuring transparency, innovation, and deployment of cost-effective RE technologies across the country,” the DoE said.

This year, the government is staging two more auctions focusing on integrated renewable energy and energy storage systems and offshore wind power. — Sheldeen Joy Talavera

Lazada investing P2 billion to grow in Mindanao

By Justine Irish D. Tabile, Reporter

E-COMMERCE platform Lazada Philippines plans to invest at least P2 billion to expand its footprint in Mindanao, with the goal of making goods cheaper for consumers and enabling inclusive digital growth.

“Lazada has been steadily investing in the region over the years. We continue to build our logistics capabilities, drive new buyer engagement, and support local sellers as they establish and grow their businesses online,” Lazada Philippines Chief Executive Officer Carlos Barrera said on Monday.

“Looking ahead, we see strong potential in the region and are exploring the possibility of investing over PHP 2 to 3 billion over the next few years. Any such investment will be guided by market performance and aligned with our strategic roadmap,” he added.

He said that Mindanao has the lowest e-commerce penetration, which is in the single digits.

“When we look at opportunity, it is not so much about what it accounts for today, but we believe that over time it should be a sizable portion of our business at 20-25%,” he said.

“We are investing today to build that future growth and to help bridge that e-commerce development gap,” he added.

He said the investment will be geared towards making buying online cheaper in the region through promotions and vouchers.

“Historically, the cost of delivering items to Mindanao was the highest in the country. So, we have been investing a lot, and we have been able to lower the cost of shipping by more than P40 per order,” he said.

“That’s one of the big investments, and we’re also investing more in online marketing and installation campaigns, trying to get more of the users to test out e-commerce,” he added.

Meanwhile, a portion of the investment will help sellers in Mindanao gain more traction and reduce their cost of doing business.

“We set up an office, we have dedicated account managers, a dedicated team there, and we are incubating a lot of sellers. So we give them different packages to help them grow,” he said.

“We have onboarded more than 500 sellers over the past few months, and we’re also investing a lot to help them grow. So, for example, what we will do is co-funded vouchers and commission waivers,” he added.

Lazada will also be investing in logistics and financing in Mindanao.

“We are opening more hubs. We are growing our own logistics ecosystem there. We are also helping with financing options; together with our partners, we are giving more buy now, pay later options for the users in the area and even seller financing,” Mr. Barrera said.

The company also identified the Philippines as among the targets for a $100-million investment in the creator economy.

Asked how much will be allocated for the Philippines, he said that “it will depend on the performance of the influencers. So we earmark an amount, and then we spend based on performance.”

“The Philippines is one of the biggest countries for influencers,” he said. “We have very strong beauty bloggers, so the Philippines will probably be one of the top two countries in terms of influencers.”

The other leading countries are Thailand and Indonesia, he said.

On Monday, Lazada announced its mid-year sale, known as the “6.6 Super Wow Sale,” during which shoppers can tap vouchers for up to P2,000 off and LazFlash deals of up to 90% off between June 5 and 8.

“Beyond the discounts, Lazada is redefining online shopping through AI-powered experiences and our Authenticity Guarantee, delivering the best prices on quality assortment and a more personalized shopping experience through tools like LazzieChat,” according to Mishie de la Cruz, commercial director for electronics at Lazada Philippines.

“Shoppers can also look forward to a worry-free experience this 6.6, with Lazada’s easy and convenient returns process, including the Change of Mind option that’s available for most product categories,” Joey Bienvenida, commercial director for fashion at Lazada Philippines, said.

May spot power prices decline 11.2% vs April

POWER prices on the Wholesale Electricity Spot Market (WESM) fell in May as supply growth outpaced that of demand, the Independent Electricity Market Operator of the Philippines (IEMOP) said.

IEMOP reported that WESM rates system-wide declined 11.2% month on month in May to P4.01 per kilowatt-hour (kWh).

Between April 26 and May 25, the available supply increased 4.1% to 22,218 megawatts (MW). Demand rose 2.9% to 15,169 MW.

“This supply-demand level resulted in an increased margin of 4,945 MW, up from 4,585 MW in April 2025,” Arjon B. Valencia, manager for corporate planning and communication at IEMOP, said via Viber.

For Luzon, spot prices dipped 7.9% month on month to P4.23 per kWh, with supply rising 4.1% to 15,620 MW while demand grew 3.6% to 10,993 MW.

WESM rates in the Visayas surged 17.9% month on month to P3.71 per kWh as supply rose 4% to 2,664 MW. Demand grew 3.5% to 2,078 MW.

Spot power prices in Mindanao slipped 24.3% month on month to P3.11 per kWh. During the period, the available supply rose 4% to 3,934 MW. Demand, on the other hand, decreased 0.9% to 2,098 MW.

Coal remained the top power generation source on the WESM, accounting for 59.9%, Mr. Valencia said. This is followed by renewable energy (22%) and natural gas (17%).

IEMOP operates the WESM, where energy companies can buy power when their long-term contracted power supply is insufficient for customer needs. — Sheldeen Joy Talavera

Geothermal de-risking project may tap $100M

THE PHILIPPINES is looking to access an initial $100 million for the first tranche of the Geothermal Resource De-Risking Facility managed by the Asian Development Bank (ADB), the Department of Energy (DoE) said.

The loan is worth $250 million overall, to be drawn down in two or three tranches.

“It’s possible that our first tranche is $100 million. That’s what we’re looking at. We want to make sure that the private sector can absorb the facility offering,” Energy Undersecretary Rowena Cristina L. Guevara told reporters on the sidelines of the ADB Asia Clean Energy Forum on Tuesday.

According to the ADB website, the project will be funded by $190 million from ADB’s ordinary capital resources and $60 million from Association of Southeast Asian Nations Catalytic Green Finance concessional funds.

The project seeks to address the risks faced by prospective geothermal power investors.

Ms. Guevara said the preparation of the geothermal de-risking facility is in the “final stages and we hope that next year it will be in place with the Land Bank of the Philippines (LANDBANK).”

The DoE is in talks with the state-run bank to be the possible facility manager.

Energy Assistant Secretary Mylene C. Capongcol said the project awaits the approval of the Investment Coordination Committee of the Department of Economy, Planning, and Development.

As of 2023, the Philippines had installed geothermal energy capacity of 1,952 megawatts (MW), making it the third-biggest geothermal producer behind Indonesia and the US.

In February, the third green energy auction, which covers geothermal, attracted bids for 30.887 MW, well below the 100 MW target. — Aubrey Rose A. Inosante

DSWD to receive 490,000 sacks of rice from NFA

THE Department of Agriculture (DA) said on Tuesday it will supply the Department of Social Welfare and Development (DSWD) with 490,000 sacks of rice for its feeding program and relief operations.

The rice will be provided to the DSWD between June and December, the DA said in a statement.

It said the drawdowns from the National Food Authority (NFA) will allow the grains agency to buy more palay (unmilled rice) from farmers.

“This clears space in our warehouses and allows us to buy more palay at fair prices,” it said.

Social Welfare Secretary Rexlon T. Gatchalian said his agency requires 35,000 sacks of rice monthly to keep its repacking hubs in Pasay and Cebu operational.

NFA stocks currently exceed 8 million sacks — “pushing storage to near capacity,” the DA said.

The DA recently expanded its P20-per-kilo rice program to include minimum-wage earners as beneficiaries.

The DSWD on Monday said it has integrated the initiative into its food stamp program and was in the process of compiling the list of approved retailers such as Kadiwa outlets and small agricultural cooperatives. — Kyle Aristophere T. Atienza

PHL rice inventory rises 1.3% month on month in early June

THE national rice inventory rose 1.3% month on month to 2.37 million metric tons (MMT) as of June 1, as the government built up its grain holdings.

Year on year, inventory rose 14.2%.

As of June 1, 49.4% of the rice stocks was held by households, 33.9% by the commercial sector, and 16.8% by the National Food Authority (NFA).

Month on month, rice stocks held by the NFA rose by 14.7%. Rice held by the commercial sector fell 2.1%, and by households fell 0.3%.

Stocks held by NFA warehouses and the commercial sector rose 472.8% and 35.5% year on year, respectively, it added. Household stocks fell 29.7%.

The NFA’s reserves hit 400,000 metric tons as of May 31.

Department of Agriculture spokesman Arnel V. de Mesa has said that the inventory levels in December were “enough until the harvest.”

Supply is considered “sufficient” to bridge the lean months between mid-July and mid-August, he added. — Kyle Aristophere T. Atienza

PHL wholesale price growth accelerates to 4%

GROWTH in wholesale prices accelerated to a 16-month high of 4% in April, the Philippine Statistics Authority (PSA) said in a report.

Citing preliminary data, the PSA said the general wholesale price index (GWPI) accelerated from 2.6% a year earlier and 3.6% in March.

The April reading was the strongest in 16 months, or since the 4.3% posted in December 2023.

In the four months to April, GWPI growth averaged 3.3%, against 2.9% a year earlier.

“The pickup in prices can reflect the sustained pickup in economic activity with a particular increase in crude materials cost outside fuels. Fuel costs are likely keeping a lid on overall GWPI growth,” Nicholas Antonio T. Mapa, a senior economist at the Metropolitan Bank & Trust Co., said via e-mail.

He added that the GWPI reading for the Visayas reflects modest gains in food prices as food production in 2025 improved compared to last year’s El Niño-affected output.

The PSA said the uptrend was driven by growth in the index of chemicals, including animal and vegetable oils and fats, which accelerated to 15.3% in April from 12.4% in March.

Also accelerating were sub-indices for crude materials, inedible except fuels (94.6% from 77.9%), beverages and tobacco (3.7% from 3.4%), machinery and transport equipment (1.4% from 1.3%), and miscellaneous manufactured articles (0.1% from 0%).

Prices for food (2.9%) and manufactured goods classified chiefly by materials (1.3%) were steady year on year in April.

Meanwhile, mineral fuels, lubricants, and related materials prices declined 4.2%, steeper than the 1.9% dip recorded in March.

Luzon wholesale price growth outpaced the national GWPI, accelerating 4.3% from the 3.9% logged in March, the strongest reading since the 4.4% posted in October 2023.

Wholesale price growth in the Visayas slowed to 0.7% from 0.8% a month earlier, the weakest reading since the 0.4% booked in September 2021.

The Mindanao GWPI picked up to 1.1%, from 0.8% in March, the strongest reading since the 1.2% posted in October 2024. — John Phoebus G. Villanueva

Deadline for applications to import seafood extended

THE Department of Agriculture (DA) said it extended the deadline to apply for permits to bring in imported seafood to the end of June, with few takers among importers because of the tight shipping deadlines.

Only about a quarter of the 25,000 metric tons of seafood approved for import has been landed so far, the DA said in a statement.

The imports were primarily intended for the use of the food service, tourism and hospitality industries.

The DA said the low uptake was due to overly tight import timelines and sourcing constraints.

“It’s more of a systemic issue than low demand,” it said.

“The timeframes we set were too short, and many of the approved products were out of season in their countries of origin,” it added.

The DA said it was challenging for some importers to meet requirements tied to larger volume allocations.

The approved list of imports includes salmon, cod, and tuna by-products, squid, scallops, octopus, and lobster, “none of which is locally sourced in sufficient quantities.”

The DA said it allowed sardine imports “because it was the offseason in some of our fishing grounds.”

It also said sardines are deemed affordable and expanding the supply will “help address inflation concerns.”

The DA said extending the deadline for issuing import permits will help ease food inflation and improve allocation efficiency.

It cited a directive from Malacañang to rationalize fish imports to “stabilize supply and prices for the tourism and high-end food sectors, with the goal of generating more jobs and attracting investment.” — Kyle Aristophere T. Atienza

OECD expects PHL to miss gov’t growth target

THE ECONOMY is likely to fail to hit even the lower end of the government’s 6-8% target this year, the Organisation for Economic Co-operation and Development (OECD) said.

In its Economic Outlook, the OECD projected gross domestic product (GDP) growth of 5.6% this year, against the revised 5.7% growth posted a year earlier.

It also expect Philippine GDP growth to pick up to 6% in 2026, well within the target band.

In the first quarter, the economy grew by a weaker-than-expected 5.4%.

“Private consumption will be bolstered by a strong labor market and low inflation, while investment is projected to pick up modestly on the back of easing financial conditions and increased public infrastructure spending,” the OECD said.

The OECD also sees inflation settling at 2% this year and 3.1% in 2026 “amid balanced domestic demand and currency stability.”

Headline inflation eased to 1.4% in April, the lowest in over five years, amid lower food and fuel prices. This brought average inflation in the first four months to 2%.

The OECD said the risks are “broadly balanced.”

“On the downside, a larger-than-expected slowdown in major economies, including the US or China, could reduce demand for Philippine exports and affect remittance inflows, impacting domestic consumption and investment,” it said.

On the upside, recent reforms to reduce barriers to foreign direct investment could boost investment, the OECD said.

It added that the “sharper-than-expected” global economic slowdown, particularly in the US and China, could cause subdued demand for exports and dent remittances, threatening to dampen consumption and investment.

Private consumption, which accounts for 70% of the economy, is projected to grow 5.7% this year and 6.5% in 2026.

The OECD said below-trend GDP growth and stable inflation expectations gives the Bangko Sentral ng Pilipinas room to continue its easing cycle and eventually lower the policy rate to “a more neutral level” of around 4.75-5% in late 2026.

“Fiscal policy will be slightly restrictive over 2025-26, as the authorities are expected to continue gradual fiscal consolidation to put public debt — currently at around 60% of GDP — on a declining path,” it said. — Aubrey Rose A. Inosante

Peso slips as markets eye US-China talks

THE PESO slipped against the dollar on Tuesday as markets monitored developments in the trade war between the United States and China.

The local unit closed at P55.721 per dollar, weakening by 2.1 centavos from its P55.70 finish on Monday, Bankers Association of the Philippines data showed.

The peso opened Tuesday’s session stronger at P55.62 against the dollar. Its worst showing was at P55.745, while its intraday best was at P55.60 versus the greenback.

Dollars exchanged rose to $1.64 billion on Tuesday from $1.38 billion on Monday.

“The peso weakened slightly after the US accused China of violating their agreed trade deal in Geneva,” a trader said in an e-mail.

The local unit dropped as the dollar corrected slightly but remained weak amid soft US manufacturing data and renewed trade tensions between the US and China, Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said in a Viber message.

For Wednesday, the trader expects the peso to move between P55.60 and P55.85 per dollar, while Mr. Ricafort sees it ranging from P55.60 to P55.80.

On Tuesday, the dollar fell to a six-week low as erratic US trade policies clouded market sentiment and investors turned defensive ahead of key developments later in the week, Reuters reported.

US President Donald J. Trump and Chinese leader Xi Jinping will probably speak this week, White House Press Secretary Karoline Leavitt said on Monday, days after Mr. Trump accused Beijing of violating an agreement to roll back tariffs and trade restrictions.

The call between the two leaders will be closely watched by markets, which have been roiled by tariff-induced trade tensions between the world’s two largest economies that continue to simmer.

Data on Monday showed US manufacturing contracted for a third straight month in May and suppliers took the longest time in nearly three years to deliver inputs amid tariffs.

The dollar fell to a six-week low against a basket of currencies early on Tuesday, ahead of Friday’s US nonfarm payrolls data, which will offer a timely reading on the health of the world’s largest economy.

A rise in unemployment is one of the few developments that could get the US Federal Reserve to start thinking of easing policy again, with investors having largely given up on a cut this month or next.

The dollar index was last marginally higher at 98.86, trimming some of its losses from earlier in the session.

Against the yen, the dollar rose 0.2% to 142.92. — A.M.C. Sy with Reuters

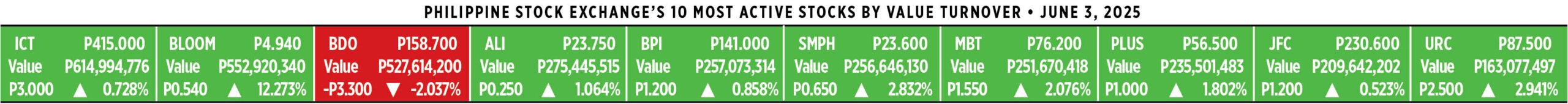

PSEi climbs to 6,400 level before inflation data

PHILIPPINE SHARES climbed for a second straight day on Tuesday as expectations of cooling inflation boosted investor sentiment.

The bellwether Philippine Stock Exchange index (PSEi) rose by 0.94% or 60.20 points to close at 6,412.86, while the broader all shares index went up by 0.73% or 27.54 points to 3,770.95.

“The local market extended its rise as investors continued to draw optimism from the expectation that inflation remained below the government’s target last May, giving the Bangko Sentral ng Pilipinas (BSP) more leeway to cut rates,” Philstocks Financial, Inc. Senior Research Analyst Japhet Louis O. Tantiangco said in a Viber message.

“Philippine shares broke past the 6,400 market once again, driven by broad market optimism ahead of Thursday’s inflation report from last month,” Regina Capital Development Corp. Head of Sales Luis A. Limlingan likewise said in a Viber message.

The Philippine Statistics Authority will release May inflation data on Thursday (June 5).

A BusinessWorld poll of 17 analysts yielded a median estimate of 1.3% for the May consumer price index, slower than the 1.4% in April and 3.9% in the same month a year ago. This is within the central bank’s 0.9%-1.7% forecast for the month.

If realized, this would be the lowest headline inflation print in more than five years or since the 1.2% in November 2019.

“Hopes that the leaders of the US and China would have a productive talk this week also helped the market,” Mr. Tantiangco added.

US President Donald J. Trump and Chinese leader Xi Jinping will probably speak this week, White House Press Secretary Karoline Leavitt said on Monday, days after Mr. Trump accused Beijing of violating an agreement to roll back tariffs and trade restrictions, Reuters reported.

The call between the two leaders will be closely watched by markets, which have been roiled by tariff-induced trade tensions between the world’s two largest economies that continue to simmer.

Almost all sectoral indices ended higher on Tuesday. Property climbed by 1.63% or 36.80 points to 2,282.32; holding firms increased by 1.48% or 79.30 points to 5,411.01; industrials rose by 1.2% or 107.19 points to 8,996.76; mining and oil went up by 0.8% or 79.51 points to 9,969.59; and services added 0.74% or 16.08 points to end at 2,182.38.

Meanwhile, financials inched down by 0.06% or 1.53 points to 2,398.57.

“Bloomberry Resorts Corp. was the day’s index leader, surging 12.27% to P4.94. BDO Unibank, Inc. was at the tail end, falling 2.04% to P158.70,” Mr. Tantiangco said.

Value turnover fell to P5.99 billion on Tuesday with 739.36 million shares traded from the P7.08 billion with 617.85 million issues exchanged on Monday.

Advancers narrowly beat decliners, 103 versus 102, while 52 names were unchanged.

Net foreign buying went down to P168.63 million on Tuesday from P418.29 million on Monday. — Revin Mikhael D. Ochave