Rate cuts, US tariffs, corruption mess steer markets in Q3

By Isa Jane D. Acabal

POLICY EASING by the Bangko Sentral ng Pilipinas (BSP), tariffs imposed by the United States, and the ongoing flood control corruption scandal shaped the country’s financial markets in the third quarter, analysts said.

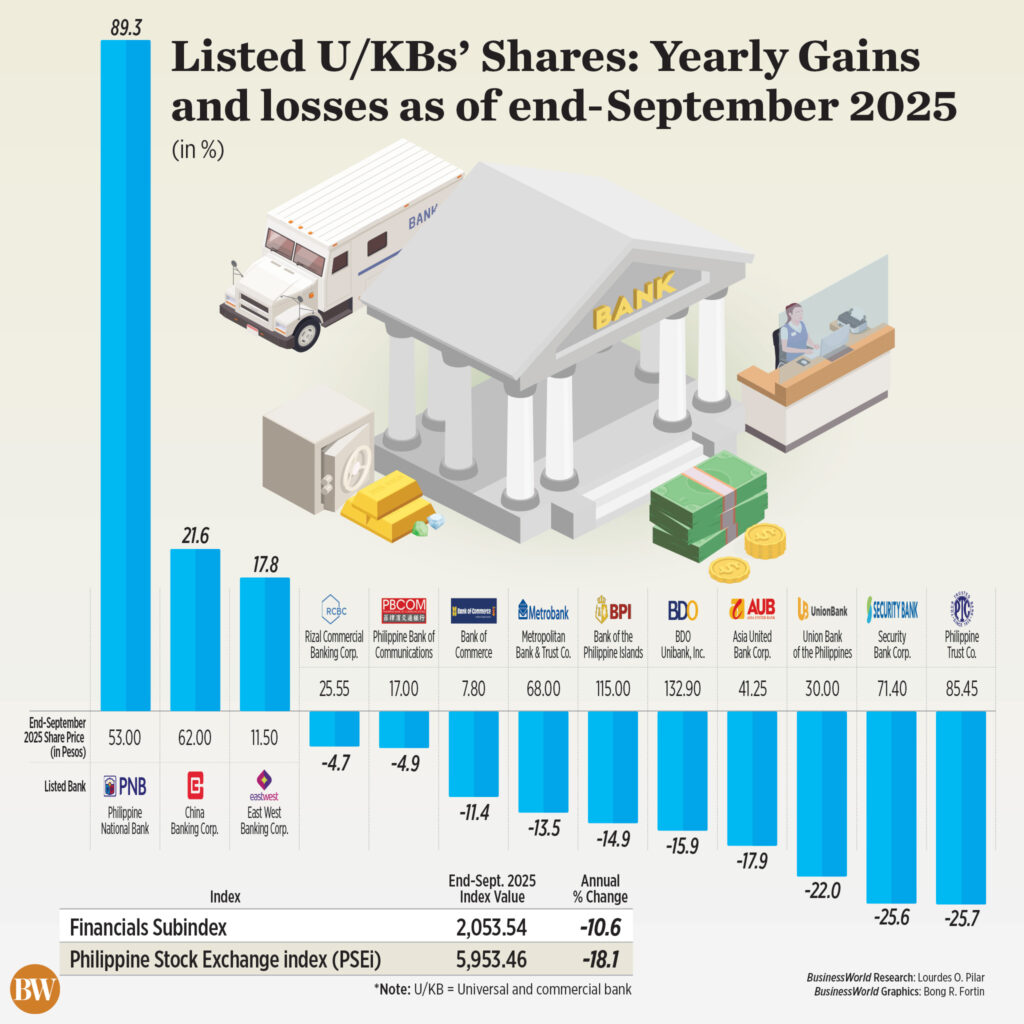

The Philippine Stock Exchange index (PSEi), the country’s barometer for the stock market, closed at 5,953.46 in the third quarter, down by 18.1% from 7,272.65 in the same quarter last year.

On the other hand, the peso appreciated by 3.9% to P58.20 against the dollar as of end-September from P56.03 a year ago, according to data from the Bankers Association of the Philippines.

Yields on government securities rose by an average of 2.59 basis points (bps) year on year, based on the PHP Bloomberg Valuation (BVAL) Service Reference Rates published on the Philippine Dealing System’s website as of Sept. 30.

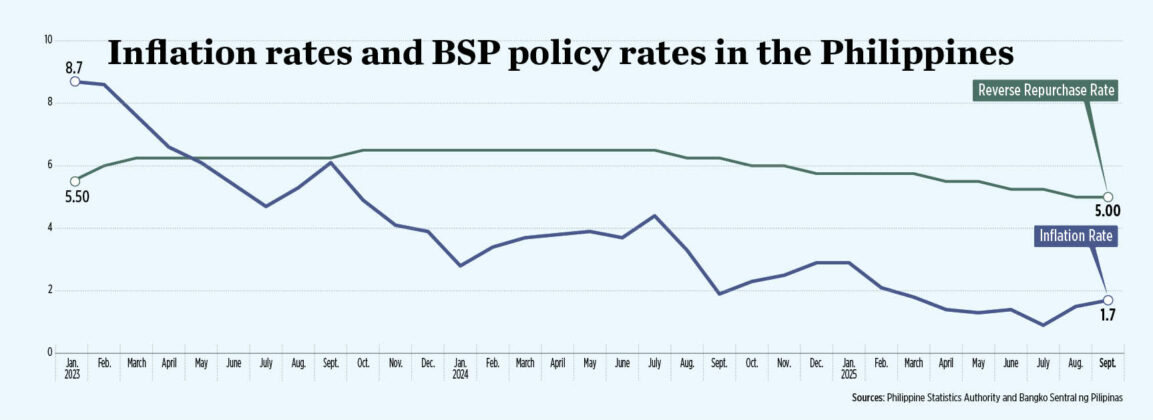

The BSP’s shift to a more dovish stance reflected in its consecutive rate cuts influenced the performance of domestic markets during the period, according to analysts.

Just last week, the central bank slashed again its policy rate by another 25 bps, bringing the key rate to over three-year low of 4.5%. It also signaled that the easing cycle nears its end.

It has so far trimmed borrowing costs by two full percentage points since it began its easing cycle in August last year.

“Reduced borrowing costs incentivized capital formation and supported investment momentum and economic activity, despite external headwinds and domestic governance concerns,” the central bank said in an e-mailed reply to questions.

According to the BSP, the present interest rate environment helped in credit expansion and in maintaining stability in the domestic financial markets.

“What we saw from this easing cycle was a ‘A Tale of Two Cities’ in Q3 — the local stock market was tepid while the bond market received much interest,” Marco Antonio C. Agonia, an economist from the University of Asia and the Pacific, said in an e-mail.

Mr. Agonia said the response in local equities was muted because market players anticipated the rate cuts, contrary to the local secondary market where “participants scrambled to lock in yields within the easing cycle.”

For economist Reinielle Matt M. Erece of Oikonomia Advisory and Research, Inc., the markets’ reaction to the key rate reduction was anticipated, with bond yields already factoring in the move, leading to their decline.

However, he said equity markets continued to move sideways due to investors’ concern about corruption, global trade tensions, and weaker currency.

Sharing the same sentiment, Nicholas Antonio T. Mapa, chief economist of Metropolitan Bank & Trust Co., said in an e-mail that the BSP’s policy easing would help support moderating growth momentum amid uncertainty.

“Almost everyone was expecting BSP to retain their dovish stance given target consistent inflation and expectations for growth momentum to stay challenged,” he said.

Despite the rate cuts, Mr. Mapa said investors remain cautious given persistent concerns about the economic and geopolitical outlook for the Philippines.

In the third quarter, the Philippine economy grew 4%, a sharp slowdown from the 5.5% growth in the second quarter and the 5.2% logged in the same period in 2024.

Government spending increased by 5.8% in the third quarter, slowing down from 8.7% in the previous quarter, but faster than the 5% growth recorded in the same period last year.

This followed after the delays and controversies surrounding flood-control infrastructure projects.

“The ongoing infrastructure spending controversy exerted downward pressure on investor sentiment and domestic market performance,” according to the BSP.

On the same note, Mr. Agonia said the ongoing flood control scandal soured investors’ mood in the stock market.

“While trade uncertainties weighed on investors’ minds in the first half of the year, governance issues became the defining brush stroke for the Q3 picture,” he said, adding that a definite action is needed to regain investors’ optimism.

He noted that the US Fed’s September rate cut boosted the PSEi, but gains were short-lived as new revelations about the flood-control scandal emerged.

US TARIFFS

The 19% US tariff imposed on most Philippine goods, effective Aug. 7, also affected markets during the period.

“The heightened uncertainty over the implementation of US tariffs weighed on domestic investor sentiment during the quarter,” the BSP said.

Based on the central bank’s Business Expectations Survey, business sentiment became less optimistic in the third quarter amid global headwinds from higher US tariffs, geopolitical tensions, and weaker external demand.

For Mr. Agonia, the tariff announcement alleviated some of the uncertainty that had weighed market players in the previous quarters concerning the implementation of US tariffs.

“Markets seemed to react positively to the definite and comparatively lenient tariff stance given to the Philippines,” Mr. Agonia said.

Meanwhile, for Pantheon Macroeconomics Chief Emerging Asia Economist Miguel Chanco, the confirmation of the US tariff midway through the quarter “was neither here nor there in terms of market impact” primarily because exports are a minor factor for the country’s economic growth.

“For the most part, the Philippines is one of the ‘winners’ in the global tariff setup so far, even though its rate ended up being slightly higher than the one first proposed in Liberation Day,” he said.

For Mr. Mapa, the ongoing US tariffs weighed on the country’s overall growth, a key concern for investors.

However, “although traders and exporters remain wary over developments on the global trade front, concern appears to be shifting to domestic growth concerns more than to US tariff policy,” Mr. Mapa added.

Mr. Agonia said other challenges for financial markets in the third quarter included the “ghost month,” bad weather, and slight peso depreciation.

Meanwhile, supportive factors included “benign domestic inflation, within-expectations Q2 gross domestic product (GDP) growth, and good Q2 corporate earnings,” he added.

KEY FACTORS TO MONITOR

Heading into the fourth quarter, Mr. Chanco sees further rate cut expectations as markets continue to face pressure based on domestic factors.

“As things stand, our base case is that the Board will cut again in December and in early-2026 by a total of 50 bps (two more 25-bps cuts),” he said.

Mr. Agonia said the country’s financial markets could see cautious gains, supported by the seasonal holiday boost and catch-up government spending.

On the same note, Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said markets expect a seasonal rise in remittances and peso conversions to fund the Christmas spending in the latter part of the fourth quarter, a pattern observed for decades.

He also anticipates further rate cuts by the US Fed and the BSP in the coming months, amid benign inflation, to remain an offsetting positive factor for the economy.

FIXED-INCOME MARKET

BSP: The bond market is expected to be supported by the low-interest rate environment, easing global monetary conditions, and robust demand from domestic investors.

Agonia: Relatively low inflation and a more dovish BSP should see the bond market flourishing into Q4 and onwards. Volatility in the US markets may encourage investors to flock to the Philippine bond market.

Erece: Expectations of continuous rate cuts can drive market rates downwards. Furthermore, concerns about economic slowdowns may also drive demand for debt securities over equities to lock in consistent profit through interest rates.

EQUITIES

BSP: Ongoing concerns over public spending on flood control projects weigh down market sentiment. However, slower global trade and the sustained strength of the US dollar are likely to influence foreign investment into equities.

Ricafort: Further improvement in ESG (environmental, social, and governance) compliance by the government and some listed companies may be needed for the PSEi to break out higher from the familiar range of 6,000-7,000 seen for more than 13 years already, particularly the government’s anti-corruption measures and further elevating governance standards.

Agonia: Local equities may continue to be lukewarm, especially as analysts scale down their Q3 GDP growth forecasts. Despite this, some factors guarding the downside may include benign inflation, healthy employment figures, potentially strong Q3 corporate earnings, and some holiday remittance relief for the peso-dollar rate.

Erece: A potential year of loss can be anticipated given disappointing economic growth, persistent external headwinds, and weak public sector credibility.

FOREIGN EXCHANGE MARKET

BSP: Concerns over US fiscal sustainability, US trade policy measures and risks to the US Fed’s stability and independence could weaken the US dollar and support the peso. However, ongoing geopolitical tensions, notably in the Middle East, may prompt safe-haven demand for the dollar and put depreciation pressure on the peso. Domestically, the peso could find support from steady macroeconomic fundamentals and resilient FX inflows from BPO revenues, tourism, and Overseas Filipino Workers’ remittances.

Ricafort: Still relatively benign local inflation data tends to fundamentally support the peso exchange rate with more purchasing power for the local currency.

Agonia: The holiday remittance wave may also provide relief for the peso-dollar rate towards the P57-P57.5 range. However, a potential BSP rate cut in December and a larger Q4 trade deficit could add to some depreciation pressure moving forward.

Erece: The recent corruption scandals can drive confidence on the country down. Thus, inducing capital outflows and less demand for the peso. These events can cause the peso to depreciate. Despite a dovish Fed, if investor sentiment overwhelms the foreign exchange effects of monetary policy, the Peso may continue to depreciate. However, I think the BSP will prevent the currency from reaching P60 levels through their own interventions.