By Adrian H. Halili and Chloe Mari A. Hufana, Reporters

TYPHOON Fung-wong, locally known as Uwan, left at least 18 dead mainly due to landslides caused by heavy rains across Luzon and Visayas, the Office of Civil Defense (OCD) said on Tuesday.

OCD Deputy Administrator Bernardo Rafaelito R. Alejandro IV said that casualties were reported in Cagayan Valley (Region 2), Cordillera Administrative Region (CAR), Bicol Region (Region 5), Western Visayas (Region 6), and Eastern Visayas (Region 8).

“There were three in Region 2, 12 in CAR mostly because of landslides, one in Region 5 due to drowning, one in Region 6 due to electrocution, and one in Region 8,” Mr. Alejandro told a livestreamed briefing.

He added that authorities have logged 28 injuries and two missing individuals due to the effects of storm surge.

The Philippines remains under a state of calamity after the twin storms left extensive damage across several regions.

The country was still reeling from the effects of Typhoon Kalmaegi (Local name: Tino), which claimed the lives of more than 200 individuals, when Uwan struck large parts of Luzon on Sunday evening.

Uwan, the 21st storm to hit the Philippines this year, caused widespread flooding, storm surges, strong winds and landslides over 6,900 local villages. It displaced 2.4 million individuals, with about 804,000 seeking refuge in evacuation centers.

Uwan, which reached super typhoon category, has since weakened as it traversed the rest of Luzon, exiting the Philippine area of responsibility (PAR) on Tuesday, the state weather bureau reported.

In an 11 a.m. bulletin, the Philippine Atmospheric, Geophysical and Astronomical Services Administration (PAGASA) said that the typhoon weakened into a severe tropical storm as it moved outside of the PAR closer to Taiwan.

Parts of northern Luzon continue to feel the effects of Uwan, with PAGASA raising Signal No. 2 over Batanes and the western portion of Ilocos Norte; while other portions of Cagayan Valley, CAR, and Ilocos Region are under a lower wind signal.

Uwan was last seen 370 kilometers west northwest of Calayan, Cagayan and moving north northwestward at 10 kilometers per hour (kph). It had maximum sustained winds of 110 kph near the center and gusts reaching up to 135 kph.

PAGASA noted Uwan may re-enter PAR on Wednesday evening as it makes landfall over the southwestern coast of Taiwan.

The weather bureau also maintained warning for marines to avoid sea travel on northern and central Luzon seaboards, advising vessels to remain in port or seek safe harbor until conditions improve.

DISASTER RESPONSE

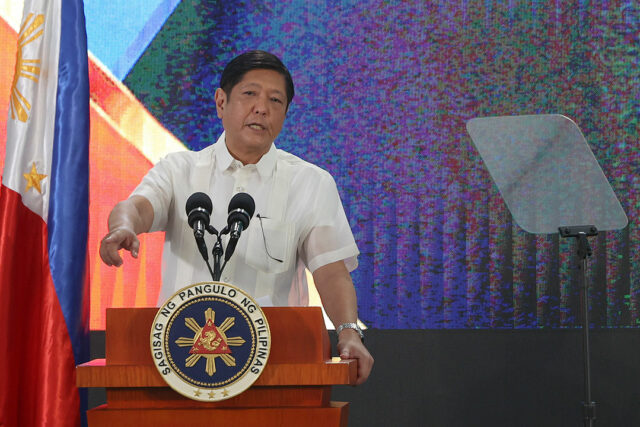

Meanwhile, electricity and communications services have been restored in more than half of the areas hit by Uwan, as Cabinet secretaries were deployed to oversee response and recovery operations across the Visayas and Bicol regions, Malacañang said on Tuesday.

Citing information from the Department of Energy (DoE), Palace Press Officer Clarissa A. Castro reported that power has been brought back to 454 of 712 storm-hit municipalities, or about 60% of affected areas.

Quoting Energy Secretary Sharon S. Garin, Ms. Castro said restoration work continues for roughly three million customers still without power, while 60 electric cooperatives remain under close monitoring.

Initial DoE estimates placed the damage to energy infrastructure at over P4 million.

Meanwhile, telecommunications services have also been gradually restored, according to the Department of Information and Communications Technology (DICT).

As of 8 a.m. on Tuesday, 82% of Smart’s network, 77% of Globe’s, 63% of DITO’s, and 79% of Converge’s connections were back online.

Ms. Castro quoted DICT Secretary Henry Rhoel R. Aguda in saying restoration crews are prioritizing areas where communications remain critical for rescue and logistics operations.

Government relief efforts continue, she noted. The National Disaster Risk Reduction and Management Council (NDRRMC) said P324.1 million in aid has been distributed to families affected by Typhoon Tino, while P48.1 million has been released for communities hit by Uwan.

Social Welfare Secretary Rexlon T. Gatchalian, currently in Catanduanes, reported that 600,000 family food packs and 21,000 ready-to-eat boxes have been distributed in the two typhoon-affected regions.

Health Secretary Teodoro J. Herbosa, who is in Leyte, said P8.2 million worth of medical supplies and nutrition commodities have been sent to five municipalities in Southern Leyte, including Silago and Sogod.

Education Secretary Juan Edgardo M. Angara has been inspecting damaged schools in Negros Occidental to assess structural safety, while Tourism Secretary Ma. Christina G. Frasco is evaluating the extent of damage to tourism sites and facilities.

The Philippines sits along the Pacific Ring of Fire, a horseshoe-shaped zone of intense seismic and volcanic activity that encircles the Pacific Ocean.

This position makes the country one of the most disaster-prone in the world, experiencing frequent earthquakes, volcanic eruptions, and tsunamis.

This geologic setting has shaped the nation’s landscape and posed persistent challenges for infrastructure, disaster preparedness, and economic stability.