From navigating vast oceans to steering a groundbreaking company, Capt. Roy Rivera has always been guided by vision and purpose. Once a Ship Captain, Capt. Rivera is now at the helm of Nano ProTech, a company redefining how science and technology can protect and enhance everyday living. Alongside two of his most trusted officers — Arjean Reyes, COO and VP for Administration and Finance; and Jit Enano, EVP for Business Development & Marketing — Capt. Rivera leads a dynamic team determined to bring innovation closer to every Filipino home and community, empowering lives through nature-inspired innovation, advanced technology, and science-driven solutions.

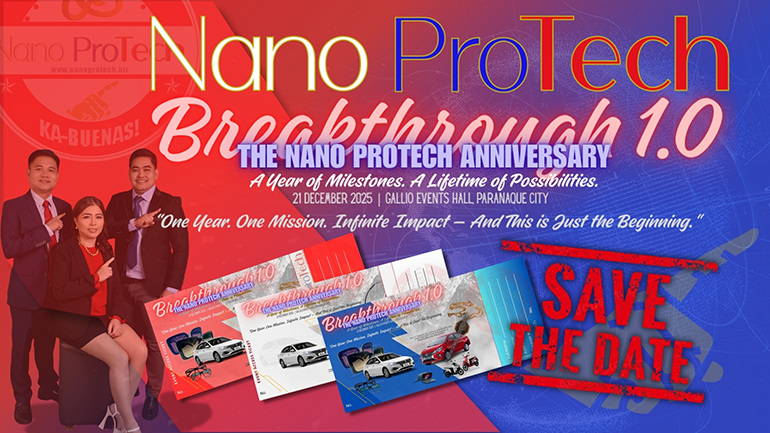

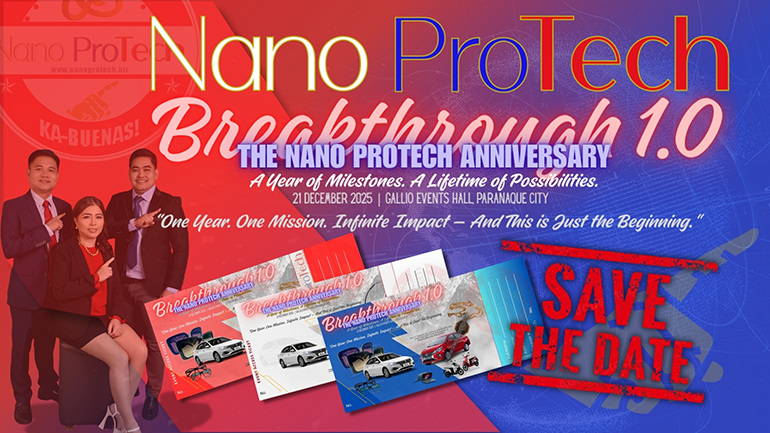

This shared leadership was on full display during the special media event themed “See the World in Style, Shielded by Science” held at Nano ProTech’s headquarters in Mandaluyong City. The event unveiled the company’s latest innovation, the Nano ProTech Eyewear Line, and gave a glimpse of its first anniversary celebration this December, aptly titled “Breakthrough 1.0: The Nano ProTech Anniversary.”

Designed for today’s fast-paced and visually demanding world, the Nano ProTech Eyewear Line showcases how science and style can seamlessly come together. Each pair fuses advanced nanotechnology and natural components embedded in the frame — including Germanium Stones, Negative Ions, Far Infrared (FIR), Silver Ions, and Multi-Minerals. Working in synergy, these elements create a subtle natural interaction that promotes balance, comfort, and a relaxing wearing experience.

“We believe innovation should empower everyday living,” said Capt. Rivera, CEO and president for Sales and Product Management. “Our mission has always been to make advanced science accessible and meaningful — integrating protective technology into the products people use every day.”

“We believe innovation should empower everyday living,” said Capt. Rivera, CEO and president for Sales and Product Management. “Our mission has always been to make advanced science accessible and meaningful — integrating protective technology into the products people use every day.”

Much like a well-coordinated crew, Capt. Rivera, Ms. Reyes and Mr. Enano each play vital roles in navigating Nano ProTech toward growth and excellence. Ms. Reyes oversees the company’s operations, ensuring its systems run efficiently and sustainably, while Mr. Enano drives business expansion and nurtures strategic partnerships. Together, they steer Nano ProTech toward a future where protection is not only smart but also stylish, practical, and people-centered.

The eyewear line is just one of the many innovations in Nano ProTech’s expanding portfolio. Since its founding, the company has been pioneering products that embody its philosophy of smart protection through science. Beyond eyewear, its proprietary Nano ProTech technology powers an ecosystem of solutions designed to protect, preserve, and perform. Each product reflects the brand’s dedication to research, innovation, and its goal of enhancing modern living through technology.

As Nano ProTech celebrates Breakthrough 1.0, the company marks a year of milestones, partnerships, and achievements that have established it as a trusted name in nano-protection. The celebration kicked off with “Beats of Hope: Music for a Cause” held last Nov.7, 2025, at their Mandaluyong headquarters. The company turned passion into compassion by directing proceeds from the concert to fund its corporate social responsibility initiatives.

As Nano ProTech celebrates Breakthrough 1.0, the company marks a year of milestones, partnerships, and achievements that have established it as a trusted name in nano-protection. The celebration kicked off with “Beats of Hope: Music for a Cause” held last Nov.7, 2025, at their Mandaluyong headquarters. The company turned passion into compassion by directing proceeds from the concert to fund its corporate social responsibility initiatives.

“With Breakthrough 1.0, we want to highlight not just how far we’ve come, but how much further innovation can take us,” said Mr. Enano. “This is just the beginning of our journey to make protection smarter, sleeker, and more sustainable.”

Guided by Capt. Rivera’s steady leadership, Ms. Reyes’ strategic management, and Mr. Enano’s forward-thinking vision, Nano ProTech continues to chart new territories in protection technology — proving that with science, style, and synergy, every breakthrough brings us closer to a safer, smarter world.

Spotlight is BusinessWorld’s sponsored section that allows advertisers to amplify their brand and connect with BusinessWorld’s audience by publishing their stories on the BusinessWorld Web site. For more information, send an email to online@bworldonline.com.

Join us on Viber at https://bit.ly/3hv6bLA to get more updates and subscribe to BusinessWorld’s titles and get exclusive content through www.bworld-x.com.

“We believe innovation should empower everyday living,” said Capt. Rivera, CEO and president for Sales and Product Management. “Our mission has always been to make advanced science accessible and meaningful — integrating protective technology into the products people use every day.”

“We believe innovation should empower everyday living,” said Capt. Rivera, CEO and president for Sales and Product Management. “Our mission has always been to make advanced science accessible and meaningful — integrating protective technology into the products people use every day.” As Nano

As Nano