On Easter Monday, April 21, Pope Francis passed away peacefully at 7:35 a.m. in his room at Casa Santa Marta, a Vatican guesthouse where he chose to live instead of the Apostolic Palace since his election as Pope in 2013. He had been sick for three months since February until just before Easter, when he left Rome’s Gemelli Hospital to recuperate at home.

Not only the Catholics, but most of the world was saddened by the passing of Pope Francis, who had assumed the role of unifying servant-leader to all — non-discriminatory of religion, philosophy, race or social and economic status, gender, and identity preferences — in his determination to include all in solutions for peace and harmony among peoples.

Would there be a good replacement for Pope Francis? The world was anxious.

On Wednesday, May 7, the first day of the conclave, 133 cardinals gathered in the Sistine Chapel to cast their vote to choose the 267th Roman Pontiff.

The liturgy and traditions of the Roman Catholic Church provide for the holding of a “Conclave” (cum [with]; clavis [key]), a closed-door, locked-in election of the new Pope by the College of Cardinals, those who are below 80 years old at the time of the Conclave (from the Catholic Encyclopedia, newadvent.org).

Before putting his ballot into the chalice on the altar, the Cardinal-elector swears to the truth and integrity of his vote, saying aloud in Italian: “I call as my witness Christ the Lord, who will be my judge, that my vote is given to the one whom I believe should be elected according to God.”

The votes are counted one-by-one and verified by the three-layered nine-man Committee on Elections (Comelec) appointed from among the Cardinal-electors, and read out aloud before the altar. A candidate must receive at least two-thirds of the vote in order to become the next Pope. There are four available voting sessions (lasting at least two hours each) on a Conclave Day, which may carry on for a maximum of seven days, until the attempt to get the two-thirds majority vote is achieved.

Although the voting in the Conclave is done in tight secrecy, the result after each voting session is immediately conveyed to the waiting crowds gathered at St. Peter’s Square. A failed vote would be signaled by black smoke coming out of the chimney on the roof of the Sistine Chapel. On May 8, after only four voting sessions of the Conclave, white smoke floated out of the chimney.

“Habemus Papam!” (We have a Pope!)

More than 100,000 people cheered. Cardinal Dominique Mambertì appeared on the central balcony of St. Peter’s Basilica and announced the new pope’s name in Latin — Robertum Franciscum Prevost (Robert Francis Prevost). Cardinal Prevost had chosen his name to be Pope Leo XIV.

The 69-year-old pontiff presented himself to the public, dressed in the traditional white cassock, red mozetta, and white skullcap, along with the gold cross necklace and Fisherman’s ring placed on his right ring finger. He also wore a burgundy stole with ornate gold embroidery draped over his shoulders — restoring the tradition for a new Pope’s first appearance that Pope Francis dispensed with in 2013 (National Catholic Register, May 9, 2025).

“La pace sia con tutti voi.” Peace be with you all.

Pope Leo XIV delivered his first “Urbi et Orbi” (To the city and to the world) address and blessing, recalling his predecessor, the late Pope Francis, who delivered his last “Urbi et Orbi” on that same balcony to bless all on Easter Sunday just hours before his death. “Allow me,” Leo said, “to follow that same blessing.”

The Pope’s election prompted an outpouring of congratulations from world leaders, who expressed eagerness to work with the pontiff on global issues. US President Donald Trump called the historic selection a great honor for the country (cnn.com, May 9). Pope Leo XIV is the first citizen of the USA to be elected Pope.

Cardinal Robert Francis Prevost was a dark horse at the Conclave, and not known by most Catholics. Not even the American clergy thought that he might be Pope — it was just in 2023 that he had been made Cardinal by Pope Francis, for his long missionary work in Peru, and after that, his assignment at the Dicastery for Bishops (the Pope’s advisory group in Rome that recommends the elevation of priests to the bishopric in dioceses).

The Catholic Bishop’s Conference of the Philippines (CBCP) held a presscon on May 9, presenting as resource speakers, the three Filipino Cardinal-electors at the Conclave that elected Pope Leo XIV: Luis Antonio Tagle, Pro-Prefect Emeritus of the Dicastery for Evangelization in Rome; Jose Advincula, current Archbishop of Manila; and Pablo Virgilio “Ambo” David, current Bishop of Kalookan.

Cardinals Advincula, Tagle, and David thanked God for giving us Pope Leo XIV — for truly, he was the choice of the Holy Spirit to guide and guard the faithful in synodality and inclusion of the Least, the Last, and the Lost in the peripheries of society.

Cardinal David set the tone by focusing on “the chimney”— the white smoke from the Conclave that signaled the strictly conscience-based selection of the new Pope by the Cardinal-electors, guided by the Holy Spirit. Yet the all-too similar questions and comments from the VIP mainstream journalists at the presscon seemed to insinuate apprehensions on the election of a “dark horse,” Cardinal Prevost, and anxieties of whether the new Pope Leo XIV can follow-through on the achievements of the late Pope Francis on peace and harmony in the world.

Were there politics in the Conclave? Cardinal David already warned against politicking and horse-betting both within the clergy and the laity (even the world leaders and interested other-faith observers). “Any participating cardinal, including those not considered papabile or front-runners, can emerge as the next pope,” said David. He played down the social media posts that had gone viral since Francis’ death about the list of his possible successors (globalnation.inquirer.net, April 24).

Cardinal Tagle was indeed played up by both mainstream and social media (and individual private speculations) as a strong, if not the strongest possible papabile, almost surely the next Pope. At the presscon, Cardinal Tagle decried the weight brought on by this unwanted over-exposure in media. In all humility, he knew he could not be Pope, for lack of capability and strength of mind and body, he said. It was also very embarrassing. He related that he was also used for AI-created advertising of medicine, food, services, and other things totally unrelated to his persona as a man of God.

There may have been politicking, maybe influencing public opinion, among interested parties to the outcome of the Conclave — some wanted the new pope to be liberal like Pope Francis was, and to continue what he had started; some wanted the new pope to be traditionalist, and temper or reverse the radical changes Pope Francis made in his dealing with issues in society that touched Canon Law and traditions. Cardinal David warned, “Don’t expect a photocopy of Pope Francis. Continuity is needed, but the direction is what is good for the world.”

Cardinal Tagle pointed out the learning points from the Conclave: the internal discipline gained from adherence to the strict rules of secrecy and isolation, and the safeguarding of the integrity of the vote. The identifying and selecting of candidates are a responsibility more than the right of the voter.

Cardinal Advincula admonished candidates (like even the papabile) to be mindful not of the honor, but of the responsibility of the position (of Pope).

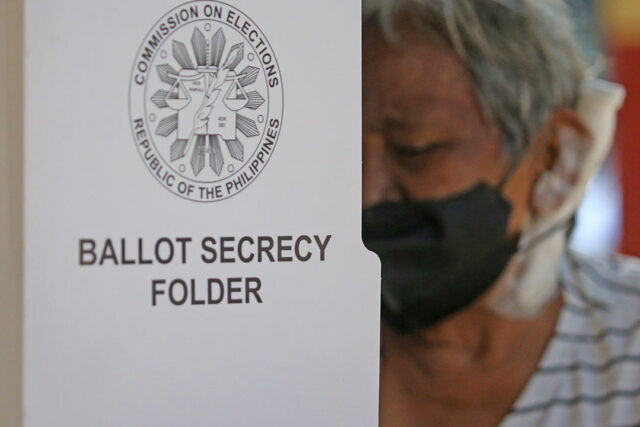

“The elections in the Catholic Church are far from the elections we know in the Philippines, where there is noisy fanfare, many candidates going around to campaign, tarpaulins are being posted everywhere, and financial aid being handed out. There’s nothing like that in the papal election,” David said in an interview on GMA’s Unang Balita.

Today, May 12, mid-term elections will be held for a total of 18,320 positions in government (Philstar.com, June 26, 2024). Filipinos will vote for 12 senators who will serve for a term of six years in the 24-member Senate until 2031. All 317 seats in the House of Representatives are open, with representatives elected for a term of three years; these include the 254 seats representing geographic congressional districts and 63 seats to be apportioned among party-lists.

Local elections above the barangay level will also be held, with the following positions being contested, excluding sectoral and ex officio seats: all 82 governors and vice-governors, and 792 out of 1,038 provincial board members; all 149 city mayors and vice-mayors, and 1,690 out of 1,988 city councilors; all 1,493 municipal mayors and vice-mayors, and 11,948 out of 14,934 municipal councilors.

The Philippine National Police has officially recorded 35 election-related incidents since January, with 13 deaths occurring as a result (ABS-CBN, April 29). As of April 28, the Comelec has summoned 213 candidates due to various complaints, mostly regarding vote-buying and abuse of state resources (GMA News, April 29).

May the Holy Spirit guide the Filipino people in voting for honest and capable leaders of the country.

Amelia H. C. Ylagan is a doctor of Business Administration from the University of the Philippines.

ahcylagan@yahoo.com