IC eases risk charges for insurers’ gov’t infrastructure investments

THE INSURANCE Commission (IC) has eased rules for insurance firms’ looking to put funds in infrastructure projects, lowering risk charges for debt and equity investments.

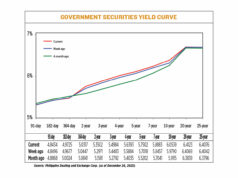

Yields on gov’t debt end flat on RRR cut

YIELDS ON government securities (GS) traded on the secondary market were flat last week amid ahead of the central bank’s decision to cut big banks’ reserve requirements in tranches.

BDO completes sale of 15% stake in rural bank unit ONB

BDO Unibank, Inc. said it completed the sale of a minority stake in its rural banking unit to a Singapore investment firm.

Peso closes at over seven-week low after RRR cuts

THE peso plunged further against the dollar on Friday to its seven-week low, as market participants responded to the 200-basis-point reduction in the reserve requirement ratio (RRR) for big banks.

Robinsons Bank to raise P10B via bonds

ROBINSONS BANK Corp. is set to raise P10 billion in peso-denominated corporate bonds to support its lending growth, eyeing to issue the first tranche within three months.

China’s wildest rates since 2014 leaving bond traders stranded

CHINA’S BOND TRADERS are throwing away the script this year as the central bank repeatedly tweaks policy to keep up with shifts in the economy.

Fed policy maker sees no strong case for hike or cut

NEW YORK — Strong US economic growth and subdued inflation mean there is no strong argument for a rate hike or cut right now, though business confidence is fragile, a Federal Reserve policy maker said on Wednesday.

Wakatabe extols benefits of loose monetary policy

TOKYO — Bank of Japan (BoJ) Deputy Governor Masazumi Wakatabe said he saw the benefits of ultra-loose monetary policy still outweighing the costs, signalling his preference for maintaining a massive stimulus program to prop up inflation to the central bank’s target.

Peso weakens ahead of RRR cut

THE PESO declined against the dollar to hit a fresh one-month low as market players awaited the central bank’s decision to trim lenders’ reserve requirement ratio (RRR).

Seven-year bonds fully awarded on strong demand after rate cut

THE GOVERNMENT fully awarded the reissued seven-year Treasury bonds (T-bond) it offered yesterday amid overwhelming demand as the market continued to react to the rate cut implemented by the central bank last week.

Term deposit yields drop

YIELDS ON term deposits continued to decline amid steady demand as the central bank placed a higher volume on the auction block, resuming its offering of the month-long tenor after several weeks.

RCBC to issue P5 billion in sustainability bonds

RIZAL COMMERCIAL Banking Corp. (RCBC) is set to issue at least P5 billion in two-year peso-denominated sustainability bonds, the first of its kind in the country, with the proceeds to fund environmental and social projects.